Diogo_bitcoin

Bonjour, je suis Diogo Bitcoin ! Je travaille avec des cryptomonnaies depuis 2015 et j'ai toujours cru au potentiel du Bitcoin. Mon parcours a commencé lorsque je me suis plongé dans l'étude de ce marché,

Diogo_bitcoin

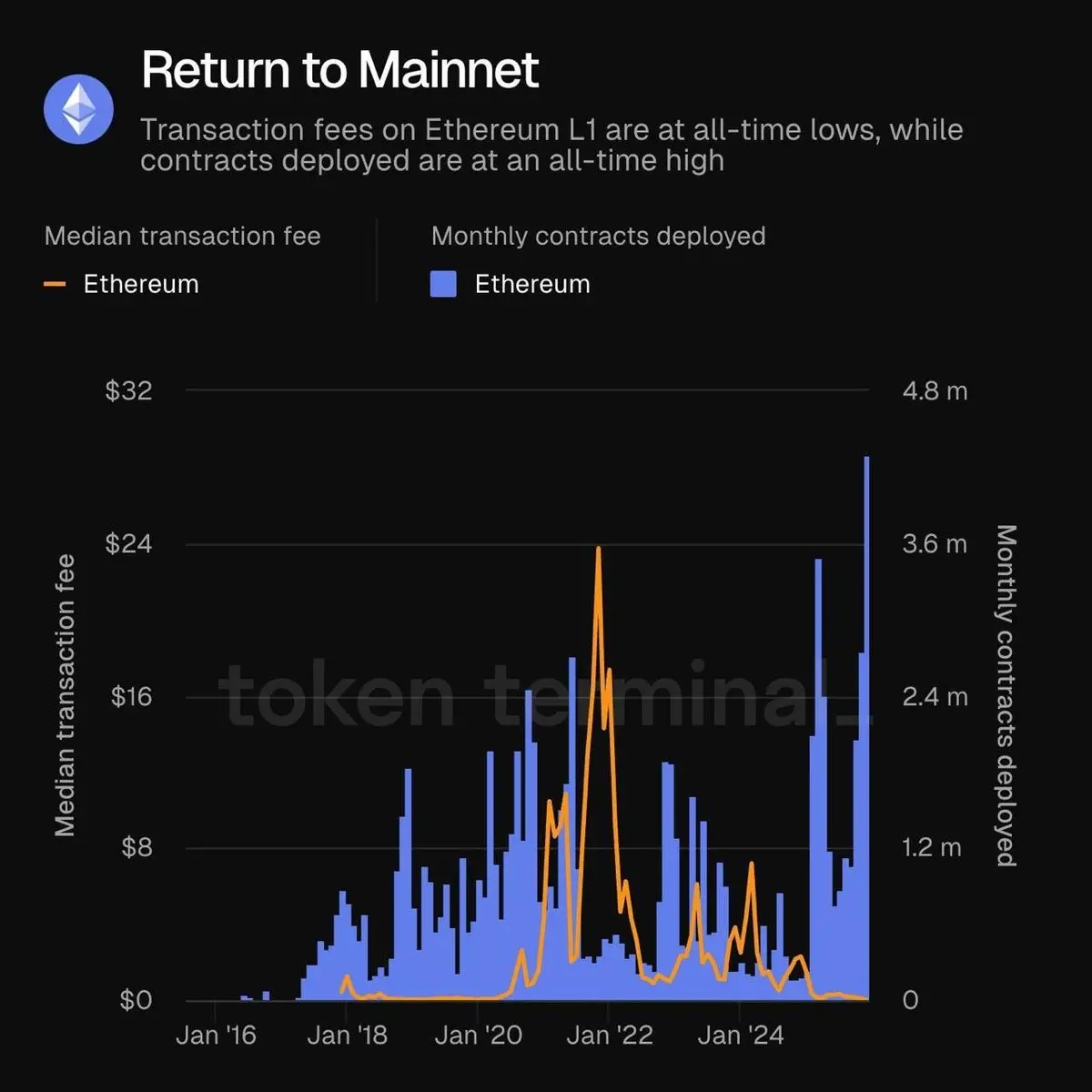

🚨 Les frais de transaction du #Ethereum atteignent des niveaux historiques, tandis que les déploiements de contrats atteignent des records historiques, selon Token Terminal.

ETH-0,67%

- Récompense

- J'aime

- 1

- Reposter

- Partager

feryzalil :

:

Oh d'accord, je vois.- Récompense

- J'aime

- Commentaire

- Reposter

- Partager

🗣 #RWA Le PDG de BlackRock, Larry Fink, affirme que la tokenisation est inévitable et que l'avenir se dirige vers une blockchain commune.

Voir l'original

- Récompense

- J'aime

- Commentaire

- Reposter

- Partager

- Récompense

- J'aime

- Commentaire

- Reposter

- Partager

- Récompense

- J'aime

- Commentaire

- Reposter

- Partager

- Récompense

- J'aime

- Commentaire

- Reposter

- Partager

- Récompense

- J'aime

- Commentaire

- Reposter

- Partager

- Récompense

- J'aime

- Commentaire

- Reposter

- Partager

- Récompense

- J'aime

- Commentaire

- Reposter

- Partager

- Récompense

- J'aime

- Commentaire

- Reposter

- Partager

Vanar est une blockchain L1 conçue dès le départ pour avoir du sens pour l'adoption dans le monde réel. L'équipe Vanar a une expérience dans le domaine des jeux, du divertissement et des marques ; son approche technologique est axée sur l'apport des prochains 3 milliards de consommateurs au Web3. Vanar intègre une série de produits qui traversent plusieurs secteurs clés, notamment les jeux, le métavers, l'IA, les solutions écologiques et de marques. Les produits connus de Vanar incluent Virtua Metaverse et le réseau de jeux VGN. Vanar est alimentée par le token VANRY.

VANRY-6,56%

- Récompense

- J'aime

- Commentaire

- Reposter

- Partager

📉 Signal de VENTE pour PUFFERUSDT

📊 RSI : 38.90

📈 Intérêt Ouvert : 13290837.00

🔄 Ratio L/S : 3.1494

💰 Prix : 0.0600

🔽 Minimum : 0.0602

📊 Volume : 39332.0

🔹 Volume Moyen(20) : 37072.3

Inscrivez-vous sur #Bybit #btc #bitcoin #xrp

📊 RSI : 38.90

📈 Intérêt Ouvert : 13290837.00

🔄 Ratio L/S : 3.1494

💰 Prix : 0.0600

🔽 Minimum : 0.0602

📊 Volume : 39332.0

🔹 Volume Moyen(20) : 37072.3

Inscrivez-vous sur #Bybit #btc #bitcoin #xrp

SIGN1,73%

- Récompense

- J'aime

- Commentaire

- Reposter

- Partager

🚀 1000CATUSDT - 30m 🚀

📊 Stratégie : Dave Landry SHORT

💰 Entrée : 0.003139

🛑 Stop Loss : 0.003168

🎯 Prise de profit : 0.003081

📈 ADX : 45.65

📊 Taux de réussite : 28.57% ✅

⚖️ Effet de levier : 32x ↓

⚠️ Risque : -0.92%

⏰ Horaires : 14/01/2026, 19:39:48

Inscrivez-vous sur #Bybit #btc #bitcoin #xrp

Voir l'original📊 Stratégie : Dave Landry SHORT

💰 Entrée : 0.003139

🛑 Stop Loss : 0.003168

🎯 Prise de profit : 0.003081

📈 ADX : 45.65

📊 Taux de réussite : 28.57% ✅

⚖️ Effet de levier : 32x ↓

⚠️ Risque : -0.92%

⏰ Horaires : 14/01/2026, 19:39:48

Inscrivez-vous sur #Bybit #btc #bitcoin #xrp

- Récompense

- J'aime

- Commentaire

- Reposter

- Partager

🚀 TRUMPUSDT - 30m 🚀

📊 Stratégie : Dave Landry SHORT

💰 Entrée : 5.571000

🛑 Stop Loss : 5.607000

🎯 Take Profit : 5.499000

📈 ADX : 46.85

📊 Taux de réussite : 21.79% ✅

⚖️ Effet de levier : 46x ↓

⚠️ Risque : -0.65%

⏰ Horaires : 14/01/2026, 19:35:56

📊 Stratégie : Dave Landry SHORT

💰 Entrée : 5.571000

🛑 Stop Loss : 5.607000

🎯 Take Profit : 5.499000

📈 ADX : 46.85

📊 Taux de réussite : 21.79% ✅

⚖️ Effet de levier : 46x ↓

⚠️ Risque : -0.65%

⏰ Horaires : 14/01/2026, 19:35:56

ADX-0,32%

- Récompense

- J'aime

- Commentaire

- Reposter

- Partager

🔥 ALTA : La capitalisation boursière des #cryptomonnaies atteint 3,32 billions de dollars, gagnant environ 103 milliards de dollars en valeur au cours des dernières 24 heures.

Voir l'original

- Récompense

- J'aime

- Commentaire

- Reposter

- Partager

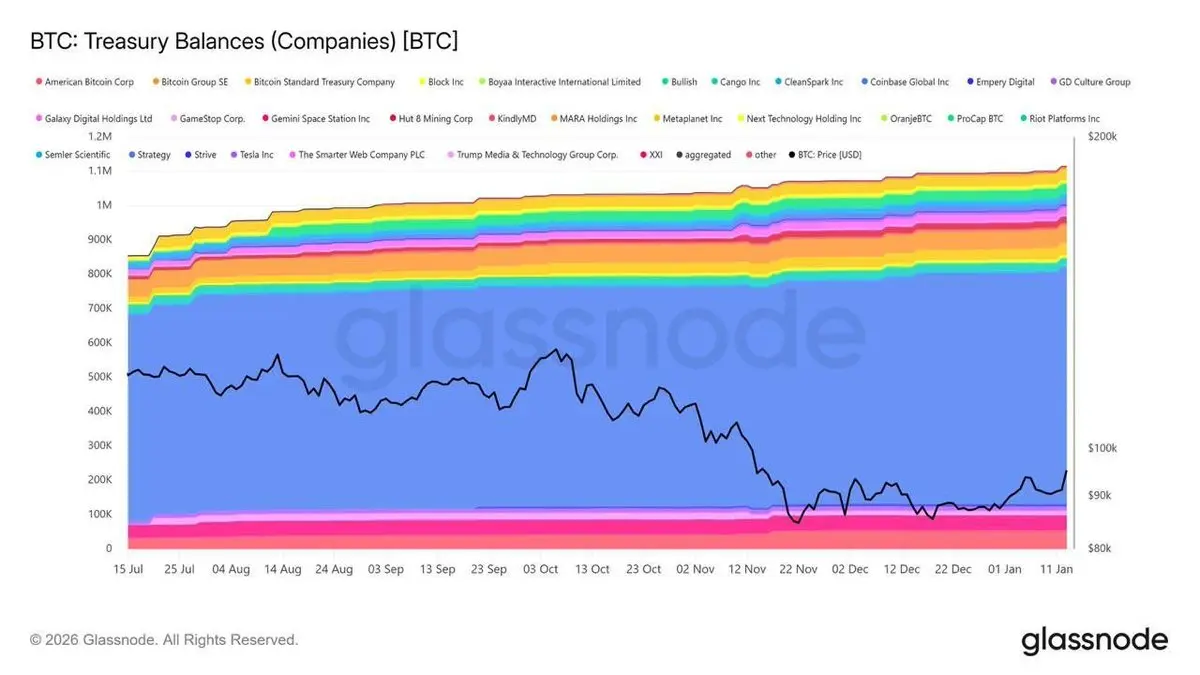

🧑💻 Les trésoreries d'entreprise en Bitcoin ont acquis 260 000 #BTC en six mois, soit trois fois l'offre minée durant cette période.

BTC-0,8%

- Récompense

- J'aime

- Commentaire

- Reposter

- Partager

L'intérêt ouvert (Open Interest) du Bitcoin a chuté de 31 %, avec les traders réduisant drastiquement leur levier, selon CryptoQuant.

Ce type de baisse de l'Open Interest se produit généralement lorsque les investisseurs les plus faibles sont éliminés. Historiquement, des conditions similaires apparaissent souvent près des fonds de marché, et non des sommets 🤔

Moins de levier = structure plus propre.

Maintenant, observons la réaction du prix et du volume pour confirmation.

Ce type de baisse de l'Open Interest se produit généralement lorsque les investisseurs les plus faibles sont éliminés. Historiquement, des conditions similaires apparaissent souvent près des fonds de marché, et non des sommets 🤔

Moins de levier = structure plus propre.

Maintenant, observons la réaction du prix et du volume pour confirmation.

BTC-0,8%

- Récompense

- 2

- 1

- Reposter

- Partager

GateUser-1391e233 :

:

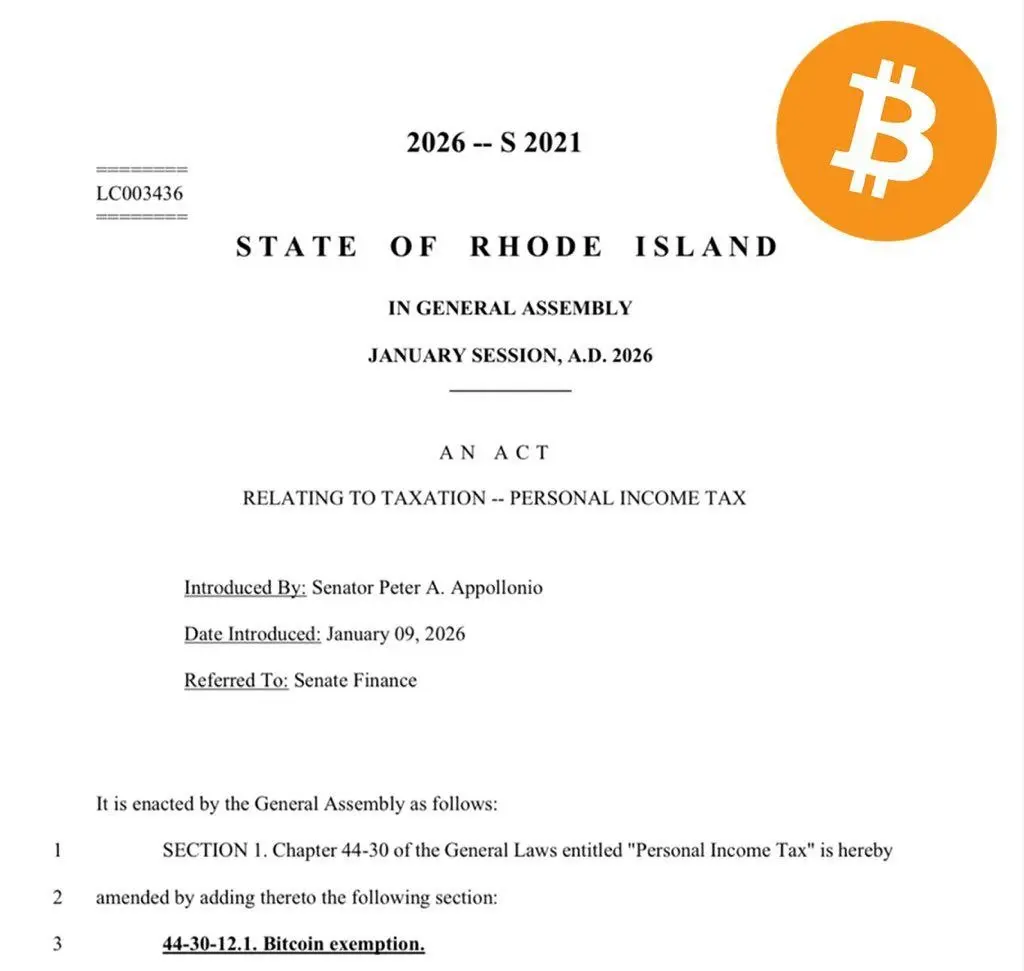

Merci pour les informations fournies 👋🕵️ #BTC Rhode Island a présenté un projet de loi d'exonération de l'impôt sur le revenu de l'État pour les transactions Bitcoin à petite échelle.

Gagnez de l'argent tous les jours avec Bitcoin.

Gagnez de l'argent tous les jours avec Bitcoin.

BTC-0,8%

- Récompense

- J'aime

- Commentaire

- Reposter

- Partager

Sujets populaires

Afficher plus67.97K Popularité

42.53K Popularité

35.56K Popularité

13.54K Popularité

28.69K Popularité

Hot Gate Fun

Afficher plus- MC:$3.49KDétenteurs:20.37%

- MC:$3.43KDétenteurs:20.05%

- MC:$3.38KDétenteurs:10.00%

- MC:$3.45KDétenteurs:20.00%

- MC:$3.44KDétenteurs:20.09%

Épingler