# RiskManagement

9.76K

MissCrypto

#CryptoMarketPullback — Understanding the Move, Not Fearing It

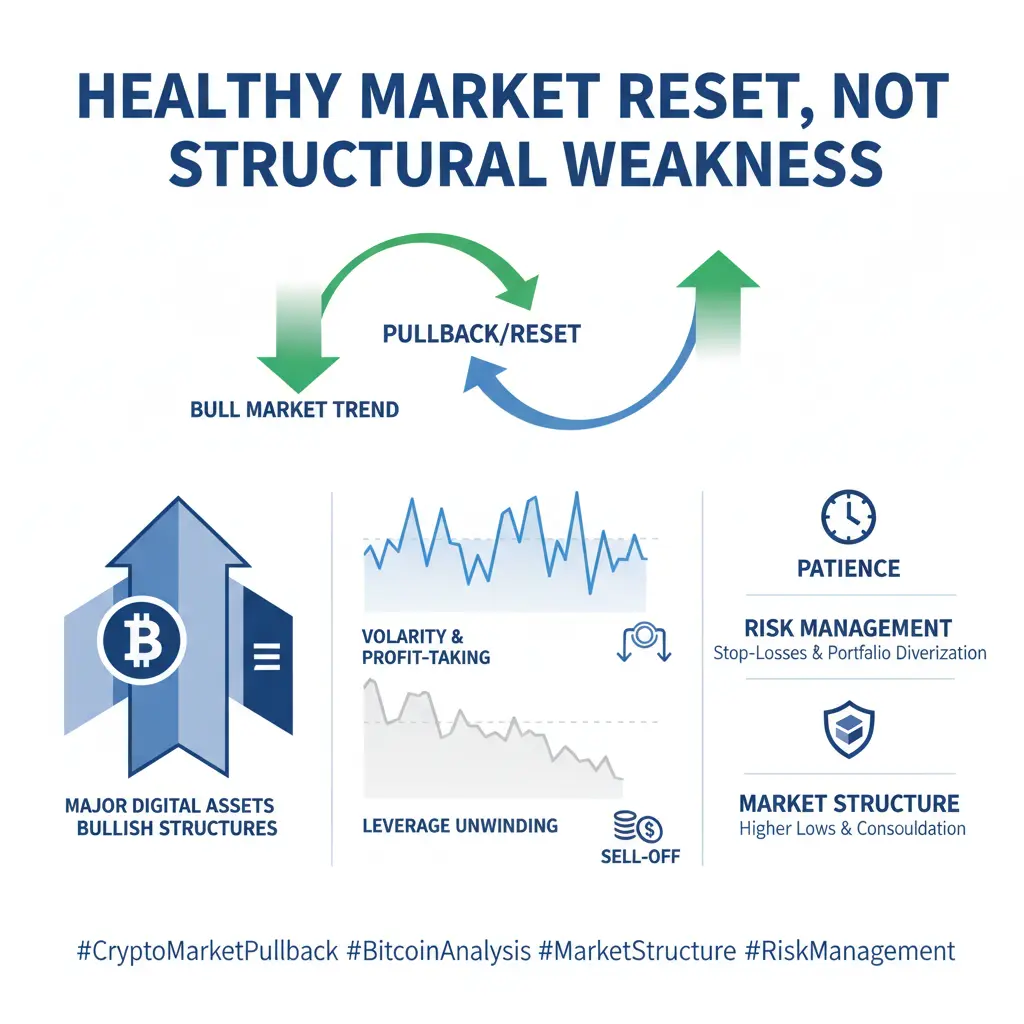

The recent crypto market pullback has unsettled many participants, but viewed through a professional lens, this phase reflects a healthy market reset rather than structural weakness. After an extended period of strong upside and elevated leverage, cooling-off periods are both normal and necessary. Short-term volatility is being driven by macro uncertainty, profit-taking from recent highs, and the unwinding of overleveraged positions — not a breakdown of long-term fundamentals.

Bitcoin and major digital assets continue to trade with

The recent crypto market pullback has unsettled many participants, but viewed through a professional lens, this phase reflects a healthy market reset rather than structural weakness. After an extended period of strong upside and elevated leverage, cooling-off periods are both normal and necessary. Short-term volatility is being driven by macro uncertainty, profit-taking from recent highs, and the unwinding of overleveraged positions — not a breakdown of long-term fundamentals.

Bitcoin and major digital assets continue to trade with

BTC2,79%

- Reward

- 4

- 9

- Repost

- Share

repanzal :

:

2026 GOGOGO 👊View More

#BuyTheDipOrWaitNow?

Markets are once again testing investor conviction. After a sharp pullback, emotions are running high—some see opportunity, others see risk. The key question isn’t just whether prices have fallen, but why they have fallen. If the dip is driven by short-term fear, leverage unwinding, or macro uncertainty without structural damage, it often presents selective buying opportunities for long-term investors. However, if liquidity is tightening, momentum is breaking, and higher time-frame trends are turning lower, patience can be a powerful strategy.

Buying the dip works best whe

Markets are once again testing investor conviction. After a sharp pullback, emotions are running high—some see opportunity, others see risk. The key question isn’t just whether prices have fallen, but why they have fallen. If the dip is driven by short-term fear, leverage unwinding, or macro uncertainty without structural damage, it often presents selective buying opportunities for long-term investors. However, if liquidity is tightening, momentum is breaking, and higher time-frame trends are turning lower, patience can be a powerful strategy.

Buying the dip works best whe

- Reward

- 1

- Comment

- Repost

- Share

#Is It Time to Buy the Dip or Stay on the Sidelines?|Market Depth Analysis

The crypto market has once again reached a critical crossroads. Amid high volatility, investors repeatedly face the same dilemma: is this the right opportunity to buy the dip, or is it wiser to wait patiently? In an environment of increasing uncertainty, emotions can easily dominate decision-making, making rationality and discipline especially important.

Logic of Buying the Dip

From a long-term perspective, the core fundamentals of crypto assets have not disappeared. Institutional participation continues to grow, on-cha

The crypto market has once again reached a critical crossroads. Amid high volatility, investors repeatedly face the same dilemma: is this the right opportunity to buy the dip, or is it wiser to wait patiently? In an environment of increasing uncertainty, emotions can easily dominate decision-making, making rationality and discipline especially important.

Logic of Buying the Dip

From a long-term perspective, the core fundamentals of crypto assets have not disappeared. Institutional participation continues to grow, on-cha

- Reward

- 6

- 6

- Repost

- Share

MrFlower_ :

:

2026 GOGOGO 👊View More

#BuyTheDipOrWaitNow? | Gate Plaza Market Update – Feb 6

Bitcoin below $60K, metals plunging, equities under pressure — markets have entered a clear risk-off phase.

A sharp, synchronized selloff across crypto, stocks, and precious metals signals that this move is driven less by fundamentals and more by leverage unwinding and macro uncertainty.

Market Snapshot

Bitcoin: Briefly dipped below $60,000, down ~30% over the past month, with volatility remaining elevated. Key support lies in the $56K–$58K zone.

U.S. Equities: Nasdaq, S&P, and Dow continue to slide as risk appetite fades amid tech and ma

Bitcoin below $60K, metals plunging, equities under pressure — markets have entered a clear risk-off phase.

A sharp, synchronized selloff across crypto, stocks, and precious metals signals that this move is driven less by fundamentals and more by leverage unwinding and macro uncertainty.

Market Snapshot

Bitcoin: Briefly dipped below $60,000, down ~30% over the past month, with volatility remaining elevated. Key support lies in the $56K–$58K zone.

U.S. Equities: Nasdaq, S&P, and Dow continue to slide as risk appetite fades amid tech and ma

BTC2,79%

- Reward

- 1

- 1

- Repost

- Share

ybaser :

:

Happy New Year! 🤑#StrategyBitcoinPositionTurnsRed

#StrategyBitcoinPositionTurnsRed

Bitcoin positions are turning red for many traders after the recent pullback, but this phase is more about strategy than panic.

When BTC retraces sharply, weak hands exit — while disciplined traders reassess risk, size, and key levels.

Historically, red positions during high-volatility phases often become opportunities if risk management is respected.

Key strategic points right now:

• Avoid over-leveraging during unstable momentum

• Focus on strong support zones instead of chasing rebounds

• Red positions don’t mean wrong posit

#StrategyBitcoinPositionTurnsRed

Bitcoin positions are turning red for many traders after the recent pullback, but this phase is more about strategy than panic.

When BTC retraces sharply, weak hands exit — while disciplined traders reassess risk, size, and key levels.

Historically, red positions during high-volatility phases often become opportunities if risk management is respected.

Key strategic points right now:

• Avoid over-leveraging during unstable momentum

• Focus on strong support zones instead of chasing rebounds

• Red positions don’t mean wrong posit

BTC2,79%

- Reward

- 2

- 3

- Repost

- Share

AYATTAC :

:

Buy To Earn 💎View More

#FedLeadershipImpact 🌍 Macro Expectations Are Back in Focus

Inflation data, interest rate signals, and liquidity trends are once again shaping market sentiment — and crypto is feeling it.

At this stage, macro doesn’t decide every trade for me, but it clearly sets the context: • Liquidity tells me when to be aggressive or defensive

• Rates & dollar strength influence risk appetite

• Macro trends help separate short-term noise from structural moves

📊 My approach:

I let macro guide position sizing & patience, while price action and structure decide entries.

💬 How much weight do you give macro

Inflation data, interest rate signals, and liquidity trends are once again shaping market sentiment — and crypto is feeling it.

At this stage, macro doesn’t decide every trade for me, but it clearly sets the context: • Liquidity tells me when to be aggressive or defensive

• Rates & dollar strength influence risk appetite

• Macro trends help separate short-term noise from structural moves

📊 My approach:

I let macro guide position sizing & patience, while price action and structure decide entries.

💬 How much weight do you give macro

- Reward

- 5

- 3

- Repost

- Share

MrFlower_ :

:

2026 GOGOGO 👊View More

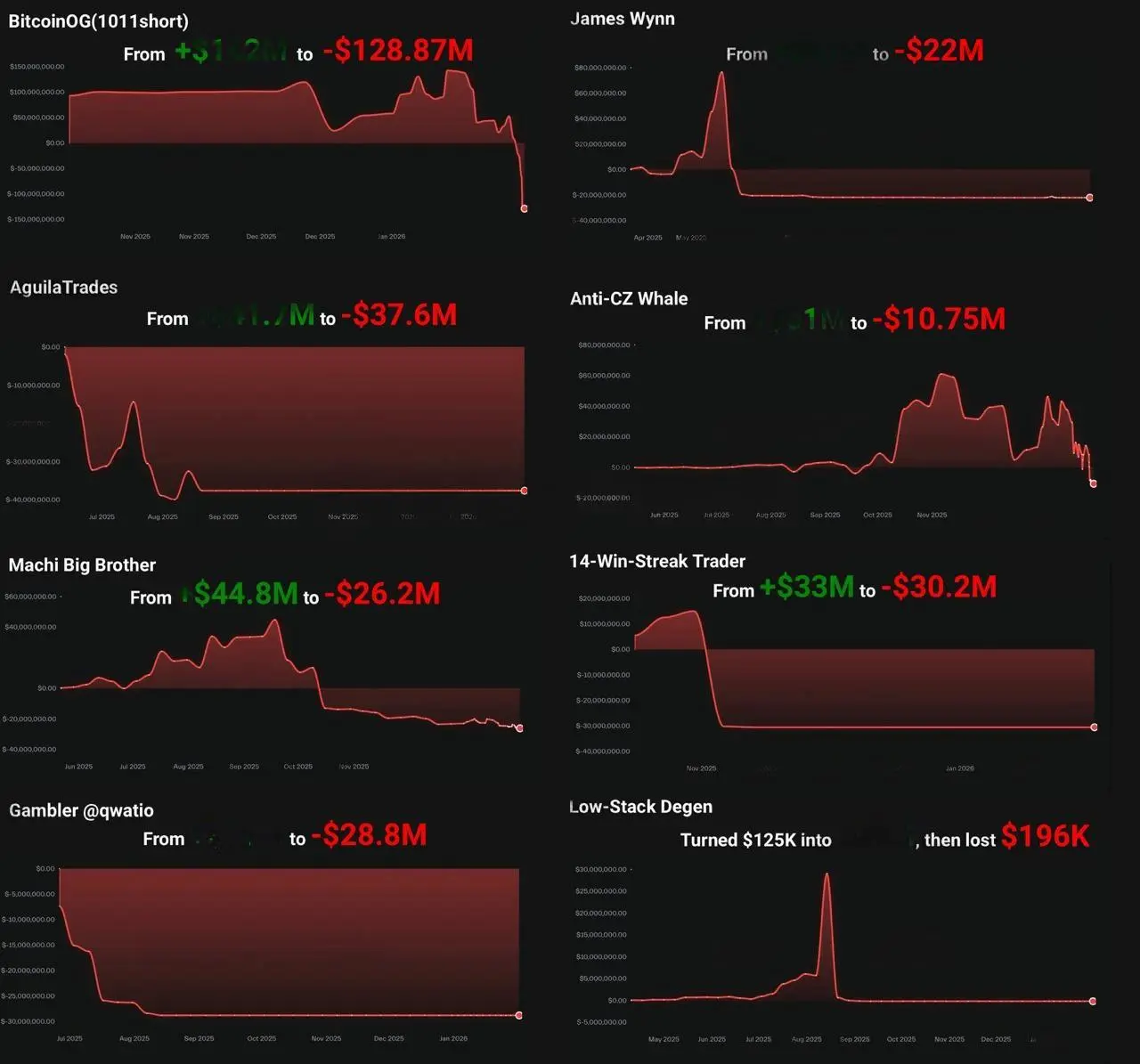

The market doesn't care about your past wins. 📉💀

This image is a brutal reminder that in crypto, your "streak" means nothing if you don't manage risk. From BitcoinOG losing $128M to a 14-win-streak trader ending up -$30M in the hole.

The Lesson:

Realized profits > Paper gains.

Leverage is a double-edged sword that eventually cuts deep.

The market can stay irrational longer than you can stay solvent.

Don't become a chart in someone else's "Rekt" compilation. Stay humble or the market will do it for you. 🏛️💸

#Crypto #TradingTips #Rekt #RiskManagement #Bitcoin

This image is a brutal reminder that in crypto, your "streak" means nothing if you don't manage risk. From BitcoinOG losing $128M to a 14-win-streak trader ending up -$30M in the hole.

The Lesson:

Realized profits > Paper gains.

Leverage is a double-edged sword that eventually cuts deep.

The market can stay irrational longer than you can stay solvent.

Don't become a chart in someone else's "Rekt" compilation. Stay humble or the market will do it for you. 🏛️💸

#Crypto #TradingTips #Rekt #RiskManagement #Bitcoin

BTC2,79%

- Reward

- 2

- 2

- Repost

- Share

BitcoinEyes :

:

2026 GOGOGO 👊View More

$SOL BUY / LONG 🎯

Entry: 99 – 103

Take Profit: 107 – 108

Stop: Risk 3–5% of portfolio

Simple. Clean. No noise.

Defined risk, clear invalidation, solid R:R.

Manage your own position size.

Stick to your plan.

Over and out 🫡

#SOL #CryptoTrade #LongSetup #RiskManagement

Entry: 99 – 103

Take Profit: 107 – 108

Stop: Risk 3–5% of portfolio

Simple. Clean. No noise.

Defined risk, clear invalidation, solid R:R.

Manage your own position size.

Stick to your plan.

Over and out 🫡

#SOL #CryptoTrade #LongSetup #RiskManagement

SOL4,42%

- Reward

- 3

- Comment

- Repost

- Share

#CryptoMarketPullback #MarketVolatility ⚡

The crypto market is facing one of its toughest stress tests of early 2026.

Bitcoin has slipped below $80K, briefly touching the $75K–$78K zone — its weakest structure since mid-2025. Ethereum followed, sliding toward $2,400 as leveraged positions were aggressively flushed. Billions in liquidations erased over the weekend.

This isn’t just a random dip.

Macro pressure is building:

• Geopolitical instability

• Stronger U.S. dollar

• Fed uncertainty

• Risk-off capital rotation

Bitcoin is behaving like a high-beta tech asset — not digital gold — in this en

The crypto market is facing one of its toughest stress tests of early 2026.

Bitcoin has slipped below $80K, briefly touching the $75K–$78K zone — its weakest structure since mid-2025. Ethereum followed, sliding toward $2,400 as leveraged positions were aggressively flushed. Billions in liquidations erased over the weekend.

This isn’t just a random dip.

Macro pressure is building:

• Geopolitical instability

• Stronger U.S. dollar

• Fed uncertainty

• Risk-off capital rotation

Bitcoin is behaving like a high-beta tech asset — not digital gold — in this en

ETH5,07%

- Reward

- 10

- 14

- Repost

- Share

ybaser :

:

2026 GOGOGO 👊View More

#GT $BTC BTC $ETH我的周末交易计划#RiskManagement

One of the largest single-day liquidation events in crypto history has just been recorded, ranking inside the top ten of all time.

This level of destruction hasn’t been seen since the brutal cycles of 2021, when billions were wiped out in a matter of hours and hundreds of thousands of traders were forced out of the market.

If we review historical liquidation data, it becomes clear that bull markets are not gentle.

In fact, most of the top liquidation events happened during so-called bull runs, where leverage, greed, and overconfidence peaked at the sam

One of the largest single-day liquidation events in crypto history has just been recorded, ranking inside the top ten of all time.

This level of destruction hasn’t been seen since the brutal cycles of 2021, when billions were wiped out in a matter of hours and hundreds of thousands of traders were forced out of the market.

If we review historical liquidation data, it becomes clear that bull markets are not gentle.

In fact, most of the top liquidation events happened during so-called bull runs, where leverage, greed, and overconfidence peaked at the sam

- Reward

- 1

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

135.57K Popularity

29.55K Popularity

391.35K Popularity

11.98K Popularity

10.9K Popularity

9.47K Popularity

8.89K Popularity

9.07K Popularity

6.17K Popularity

3.47K Popularity

17.84K Popularity

11.56K Popularity

23.96K Popularity

31.63K Popularity

27.14K Popularity

News

View MoreSolana's first AI-driven MEME launch platform AixFun officially launches, with its first target "Horse" surpassing a market value of $4 million

6 m

EY: Wallets are upgrading from crypto tools to financial gateways, replacing bank accounts in managing customer relationships

18 m

Ethereum treasury company Bit Digital disclosed that at the end of January, ETH holdings exceeded 155,000, valued at over $380 million.

29 m

Opinion: This round of the crypto bear market was not caused by a single factor; instead, a combination of 15 major factors collectively drove the market downturn.

33 m

Whale 0x3952 Shifts from Profit to Loss, Deposits $50M ETH to Exchanges

59 m

Pin