# BTC

37.66M

Crypto_Exper

0

0

Core Takeaway

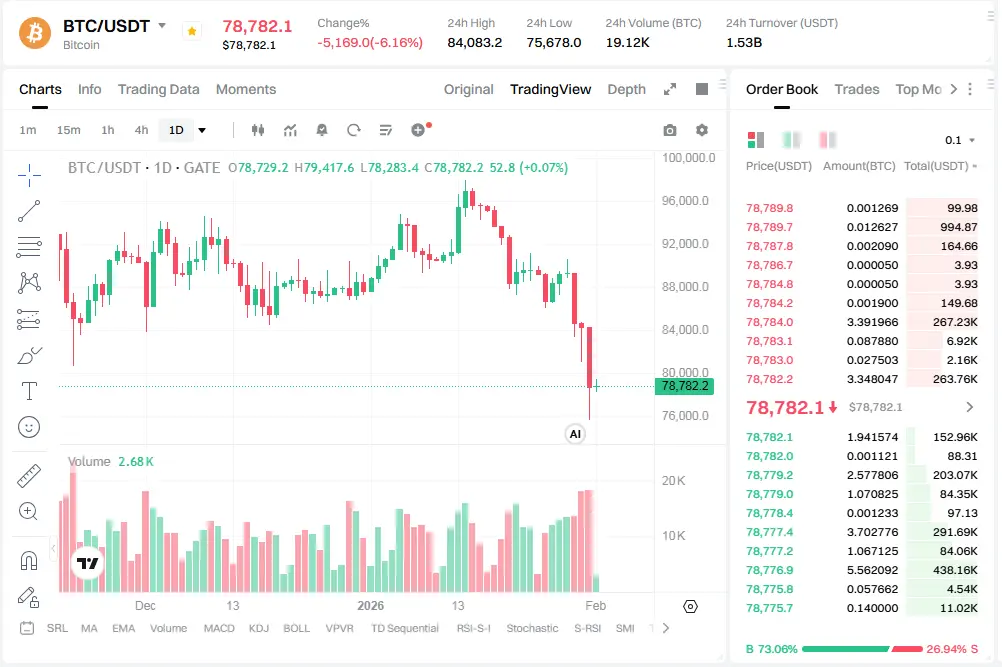

BTC has been under significant pressure lately, showing a clear downward trend with signs of heavy selling and extremely bearish sentiment. Technical signals are flashing "oversold," hinting a rebound may be near—but caution is key as trend strength is still negative.

Key Data

- Latest price: $82,652.80 (quoted in USDT for the BTC_USDT pair)

- 24h change: -0.32%

- 24h high/low: $84,631.50 / $81,881.20

- Fear & Greed Index: Extreme Fear (score: 20)

- Technicals: RSI deeply oversold on multiple timeframes (as low as 12.3), MA lines in bearish alignment, price pressing on short-term

BTC has been under significant pressure lately, showing a clear downward trend with signs of heavy selling and extremely bearish sentiment. Technical signals are flashing "oversold," hinting a rebound may be near—but caution is key as trend strength is still negative.

Key Data

- Latest price: $82,652.80 (quoted in USDT for the BTC_USDT pair)

- 24h change: -0.32%

- 24h high/low: $84,631.50 / $81,881.20

- Fear & Greed Index: Extreme Fear (score: 20)

- Technicals: RSI deeply oversold on multiple timeframes (as low as 12.3), MA lines in bearish alignment, price pressing on short-term

BTC-5.47%

MC:$3.18KHolders:8

0.00%

- Reward

- 1

- Comment

- Repost

- Share

#FedKeepsRatesUnchanged 📈 Rates on hold, “higher for longer” priced in — what’s your move?

Markets are at a crossroads:

BTC remains the core defensive asset, drawing institutional flows and ETF interest.

Altcoins need selective positioning — only strong narratives, clear catalysts, and solid metrics are seeing rotation.

💡 My approach:

Core BTC holds the fort

Tactical exposure to high-potential alts

Cash ready for volatility-driven opportunities

This isn’t broad risk-on… it’s a stock-picker’s market.

Are you staying defensive or slowly rotating into risk? 👀

#Bitcoin #Altcoins #CryptoMarkets

Markets are at a crossroads:

BTC remains the core defensive asset, drawing institutional flows and ETF interest.

Altcoins need selective positioning — only strong narratives, clear catalysts, and solid metrics are seeing rotation.

💡 My approach:

Core BTC holds the fort

Tactical exposure to high-potential alts

Cash ready for volatility-driven opportunities

This isn’t broad risk-on… it’s a stock-picker’s market.

Are you staying defensive or slowly rotating into risk? 👀

#Bitcoin #Altcoins #CryptoMarkets

BTC-5.47%

- Reward

- 3

- 2

- Repost

- Share

Yusfirah :

:

Buy To Earn 💎View More

- Reward

- 2

- Comment

- Repost

- Share

Core Takeaway

BTC has been under significant pressure lately, showing a clear downward trend with signs of heavy selling and extremely bearish sentiment. Technical signals are flashing "oversold," hinting a rebound may be near—but caution is key as trend strength is still negative.

Key Data

- Latest price: $82,652.80 (quoted in USDT for the BTC_USDT pair)

- 24h change: -0.32%

- 24h high/low: $84,631.50 / $81,881.20

- Fear & Greed Index: Extreme Fear (score: 20)

- Technicals: RSI deeply oversold on multiple timeframes (as low as 12.3), MA lines in bearish alignment, price pressing on short-term

BTC has been under significant pressure lately, showing a clear downward trend with signs of heavy selling and extremely bearish sentiment. Technical signals are flashing "oversold," hinting a rebound may be near—but caution is key as trend strength is still negative.

Key Data

- Latest price: $82,652.80 (quoted in USDT for the BTC_USDT pair)

- 24h change: -0.32%

- 24h high/low: $84,631.50 / $81,881.20

- Fear & Greed Index: Extreme Fear (score: 20)

- Technicals: RSI deeply oversold on multiple timeframes (as low as 12.3), MA lines in bearish alignment, price pressing on short-term

BTC-5.47%

- Reward

- 2

- 1

- Repost

- Share

HeavenSlayerSupporter :

:

2026 Go Go Go 👊Core Takeaway

BTC has been under significant pressure lately, showing a clear downward trend with signs of heavy selling and extremely bearish sentiment. Technical signals are flashing "oversold," hinting a rebound may be near—but caution is key as trend strength is still negative.

Key Data

- Latest price: $82,652.80 (quoted in USDT for the BTC_USDT pair)

- 24h change: -0.32%

- 24h high/low: $84,631.50 / $81,881.20

- Fear & Greed Index: Extreme Fear (score: 20)

- Technicals: RSI deeply oversold on multiple timeframes (as low as 12.3), MA lines in bearish alignment, price pressing on short-term

BTC has been under significant pressure lately, showing a clear downward trend with signs of heavy selling and extremely bearish sentiment. Technical signals are flashing "oversold," hinting a rebound may be near—but caution is key as trend strength is still negative.

Key Data

- Latest price: $82,652.80 (quoted in USDT for the BTC_USDT pair)

- 24h change: -0.32%

- 24h high/low: $84,631.50 / $81,881.20

- Fear & Greed Index: Extreme Fear (score: 20)

- Technicals: RSI deeply oversold on multiple timeframes (as low as 12.3), MA lines in bearish alignment, price pressing on short-term

BTC-5.47%

- Reward

- 1

- Comment

- Repost

- Share

📊 Amid the correction, Bitcoin's True Market Mean indicator fell below the market price for the first time in two and a half years. The metric shows the average price at which investors purchased coins, excluding miners.

Analyst Keith Alan predicted a double bottom could be forming at around $74,000. This zone coincides with the April 2025 support line—the very levels Bitcoin fell to during the current sell-off.

However, MN Trading founder Michael van de Poppe noted that the RSI on the weekly chart of the leading cryptocurrency against gold fell below 30.

"[...] this is a signal [of a trend r

Analyst Keith Alan predicted a double bottom could be forming at around $74,000. This zone coincides with the April 2025 support line—the very levels Bitcoin fell to during the current sell-off.

However, MN Trading founder Michael van de Poppe noted that the RSI on the weekly chart of the leading cryptocurrency against gold fell below 30.

"[...] this is a signal [of a trend r

- Reward

- 1

- 1

- Repost

- Share

deltapro :

:

Bitcoin Plunges Below $76,000: Hello, Bear Market Bitcoin's price fell to $75,555 on Bitstamp, marking a 40% drop from its all-time high on October 6, 2025. In the two days since January 29, the world's leading cryptocurrency has lost 15% of its value.

#MarketUpdate

Over 430,000 liquidations have triggered a massive wave of panic, unexpectedly pushing the market into full high-speed turnover.

At the moment, except for HYPE, all top-10 trading volumes have surged by 50%–100%, clearly showing that liquidity and market participation are strong.

This level of volatility is exactly what market makers thrive on — they are actively using these sharp moves to accumulate positions and absorb chips.

While this zone may not be the absolute bottom, it strongly represents a setup for future profit opportunities.

If the market sees another 1–2 aggressive

Over 430,000 liquidations have triggered a massive wave of panic, unexpectedly pushing the market into full high-speed turnover.

At the moment, except for HYPE, all top-10 trading volumes have surged by 50%–100%, clearly showing that liquidity and market participation are strong.

This level of volatility is exactly what market makers thrive on — they are actively using these sharp moves to accumulate positions and absorb chips.

While this zone may not be the absolute bottom, it strongly represents a setup for future profit opportunities.

If the market sees another 1–2 aggressive

- Reward

- 1

- 2

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

The digital financial market on the morning of February 1st, 2026, recorded significant fluctuations on the first day of the new month.

🌪️ Crypto Market: Extreme Volatility at the Beginning of February

The market just experienced a turbulent trading session with extremely wide price swings for Bitcoin, creating conflicting signals for investors.

1. Bitcoin (BTC): A Giant Candlestick Pattern

24-hour developments: Bitcoin had an extremely exciting trading day, at one point reaching $84,200, but also retreating to the $75,600 region several times. The price swing of nearly $9,000 in just 24 hour

🌪️ Crypto Market: Extreme Volatility at the Beginning of February

The market just experienced a turbulent trading session with extremely wide price swings for Bitcoin, creating conflicting signals for investors.

1. Bitcoin (BTC): A Giant Candlestick Pattern

24-hour developments: Bitcoin had an extremely exciting trading day, at one point reaching $84,200, but also retreating to the $75,600 region several times. The price swing of nearly $9,000 in just 24 hour

- Reward

- like

- Comment

- Repost

- Share

#MyWeekendTradingPlan

Weekend markets move differently—slower liquidity, sudden spikes, and lots of traps. So this weekend, the plan is simple: trade smart, not fast.

📌 Step 1: Read the Bigger Picture

Before touching any trade, I’m analyzing daily and 4H charts to understand the trend. If the market is ranging, I trade the range. If it’s unclear, I wait.

📌 Step 2: Respect the Levels

Support and resistance are my best friends. I’m only interested in trades where price reacts with confirmation—no FOMO, no impulse entries.

📌 Step 3: Choose Quality Over Quantity

Not every coin deserves attentio

Weekend markets move differently—slower liquidity, sudden spikes, and lots of traps. So this weekend, the plan is simple: trade smart, not fast.

📌 Step 1: Read the Bigger Picture

Before touching any trade, I’m analyzing daily and 4H charts to understand the trend. If the market is ranging, I trade the range. If it’s unclear, I wait.

📌 Step 2: Respect the Levels

Support and resistance are my best friends. I’m only interested in trades where price reacts with confirmation—no FOMO, no impulse entries.

📌 Step 3: Choose Quality Over Quantity

Not every coin deserves attentio

- Reward

- 4

- 4

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

26.59K Popularity

63.3K Popularity

367.87K Popularity

46.23K Popularity

65.56K Popularity

18.66K Popularity

26.29K Popularity

19.69K Popularity

92.71K Popularity

37.71K Popularity

32.85K Popularity

28.88K Popularity

17.23K Popularity

23.91K Popularity

214.82K Popularity

News

View MoreData: If BTC breaks through $82,861, the total liquidation strength of mainstream CEX short positions will reach $2.053 billion.

15 m

Data: If ETH breaks through $2,548, the total liquidation strength of long positions on mainstream CEXs will reach $910 million.

15 m

Jupiter will integrate Polymarket, enabling users to directly access Polymarket through Jupiter.

34 m

Jensen Huang: OpenAI has invited us to invest up to $100 billion

40 m

A whale holding a Bitcoin long position for 112 days is facing liquidation, with an estimated loss of $6.84 million.

1 h

Pin