- Topic1/3

38k Popularity

39k Popularity

41k Popularity

57k Popularity

22k Popularity

- Pin

- 📢 Gate Square #Creator Campaign Phase 2# is officially live!

Join the ZKWASM event series, share your insights, and win a share of 4,000 $ZKWASM!

As a pioneer in zk-based public chains, ZKWASM is now being prominently promoted on the Gate platform!

Three major campaigns are launching simultaneously: Launchpool subscription, CandyDrop airdrop, and Alpha exclusive trading — don’t miss out!

🎨 Campaign 1: Post on Gate Square and win content rewards

📅 Time: July 25, 22:00 – July 29, 22:00 (UTC+8)

📌 How to participate:

Post original content (at least 100 words) on Gate Square related to

- 📢 Gate Square #MBG Posting Challenge# is Live— Post for MBG Rewards!

Want a share of 1,000 MBG? Get involved now—show your insights and real participation to become an MBG promoter!

💰 20 top posts will each win 50 MBG!

How to Participate:

1️⃣ Research the MBG project

Share your in-depth views on MBG’s fundamentals, community governance, development goals, and tokenomics, etc.

2️⃣ Join and share your real experience

Take part in MBG activities (CandyDrop, Launchpool, or spot trading), and post your screenshots, earnings, or step-by-step tutorials. Content can include profits, beginner-friendl

[US Stocks: Stock Discovery] New S&P 500 Constituent: TKO Group Holdings [TKO], which boasts impressive combat sports content | US stocks, industry trends, and stock commentary | Moneyクリ Money Forward Securities' investment information and media useful for finances.

The S&P 500 is a stock market index composed of 500 companies that represent major industries in the United States. To be included in the constituent stocks, a company must be a U.S. company, which is determined by its sales, fixed assets, and headquarters location in the U.S.

Other requirements include

The total net profit for the past four quarters is positive, and the net profit for the most recent quarter is positive.

The industry balance based on the Global Industry Classification Standard (GICS) is appropriate.

There are various factors to consider. Additionally, the market capitalization standard will rise to "over $20.5 billion" in January 2025, increasing the hurdle from the previous "over $18 billion."

This time, I would like to introduce five stocks: TKO Group Holdings [TKO], DoorDash [DASH], Williams-Sonoma [WSM], Expand Energy [EXE], which will be officially added to the S&P 500 on March 24, 2025, along with Workday [WDAY], which was adopted in December 2024.

TKO Group Holdings [TKO] is born from the merger of martial arts organizations

The parent companies of UFC and WWE merged in 2023.

TKO Group Holdings [TKO] is a company engaged in the sports and entertainment business. It was formed in 2023 through the merger of the Ultimate Fighting Championship (UFC) and the world's largest professional wrestling organization, World Wrestling Entertainment (WWE). It has overwhelming content in the combat sports sector.

UFC is known as the organization that hosts the world's premier mixed martial arts events. Fighters participating in the UFC compete against each other inside an octagonal cage called the Octagon, using striking and grappling techniques to aim for championship titles in their respective weight classes. The matches are broadcast to approximately 950 million households across over 170 countries and regions, with a fan base exceeding 700 million and about 300 million followers on social media.

WWE has over 700 million fans, with approximately 380 million followers on social media. It has over 100 million subscribers on YouTube and is considered one of the most-viewed YouTube channels in the world.

UFC and WWE hold approximately 300 live events each year, attracting over 2 million attendees. These live events form the foundation of their content and serve as intellectual property that generates revenue.

Generate revenue through content provision and event projects.

The main source of revenue comes from providing content to media companies such as television stations and video streaming services. This includes ABC, which holds a corner among the three major U.S. network television stations under the umbrella of Walt Disney [DIS], ESPN, a sports channel also under Walt Disney, Netflix [NFLX], the largest video streaming service, and NBC, one of the three major networks under Comcast [CMCSA], thereby generating revenue.

Live events generate revenue from ticket sales and viewing tour fees. Sponsorship income is also an important source of revenue, with companies like sports betting operator DraftKings [DKNG], energy drink Monster Beverage [MNST], IT giant IBM [IBM], consumer goods company Procter & Gamble [PG], and Coca-Cola [KO] among the sponsors.

They also generate revenue by licensing consumer products. They grant licenses to game companies and sports equipment manufacturers.

For the fiscal year ending December 2024, the segment performance shows that UFC's revenue increased by 8.8% year-on-year to $1.406 billion, with adjusted EBITDA (earnings before interest, taxes, depreciation, and amortization) rising by 6.0% to $810 million. WWE's revenue surged to $1.398 billion, which is 3.7 times that of the previous year, with adjusted EBITDA increasing 4.2 times to $681 million.

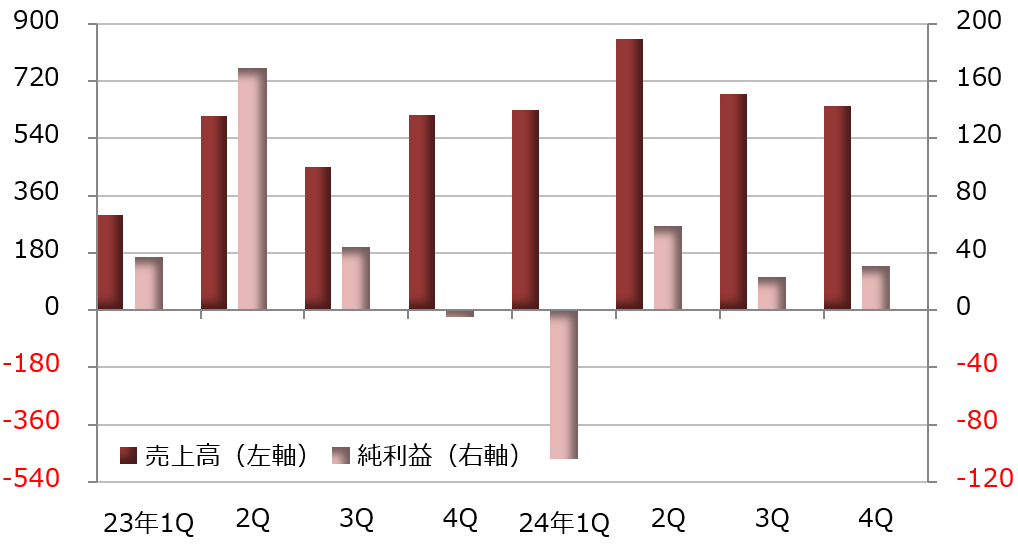

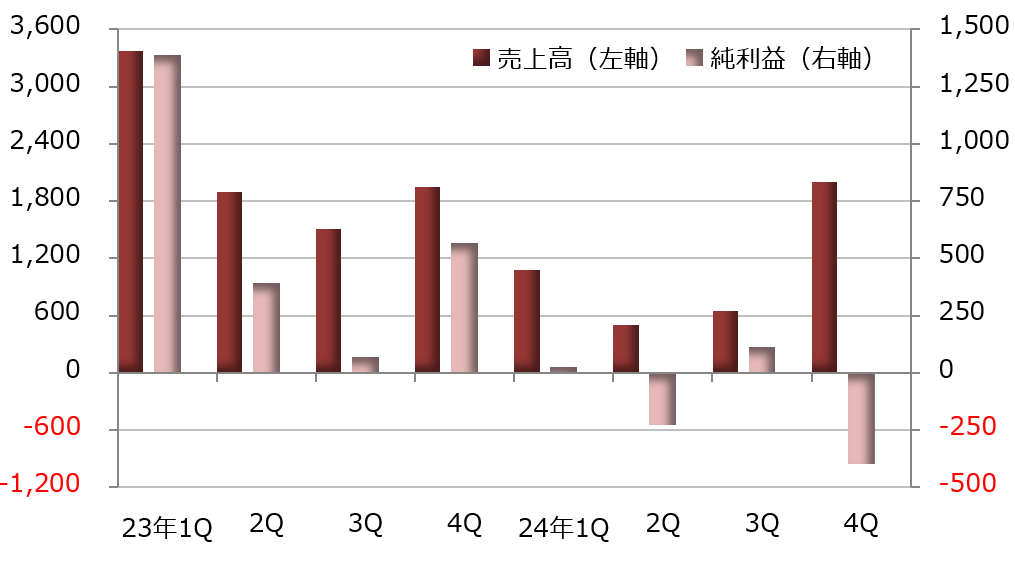

[Table 1] TKO Group Holdings [TKO]: Performance Trends (Unit: Million Dollars) Source: Created by DZH Financial Research from LSEG

*The end of the term is in December.

Source: Created by DZH Financial Research from LSEG

*The end of the term is in December.

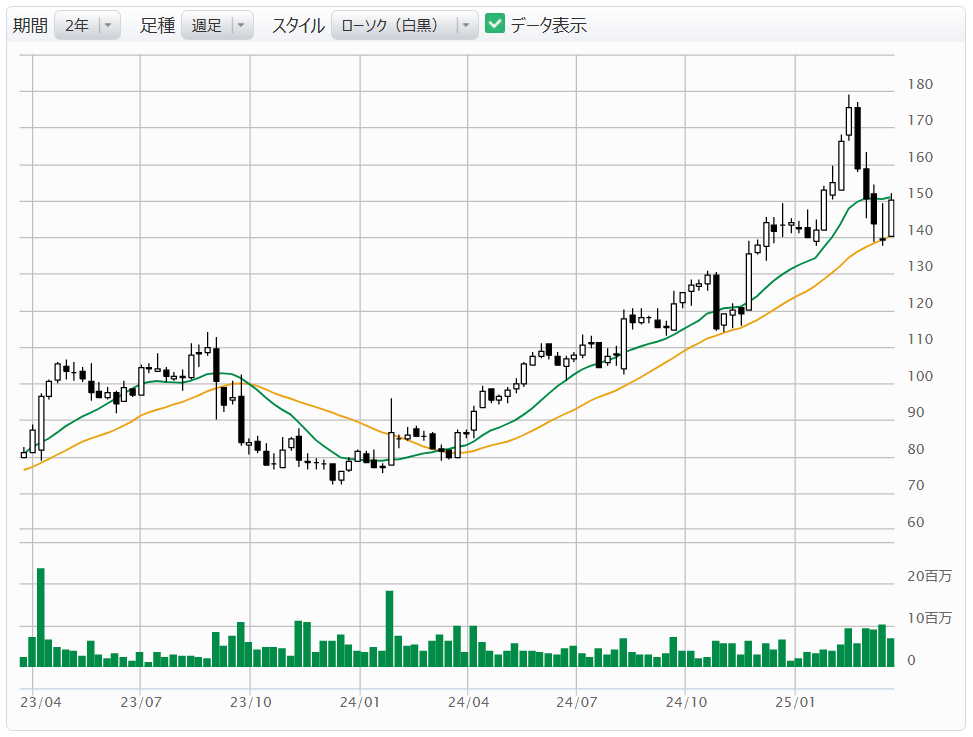

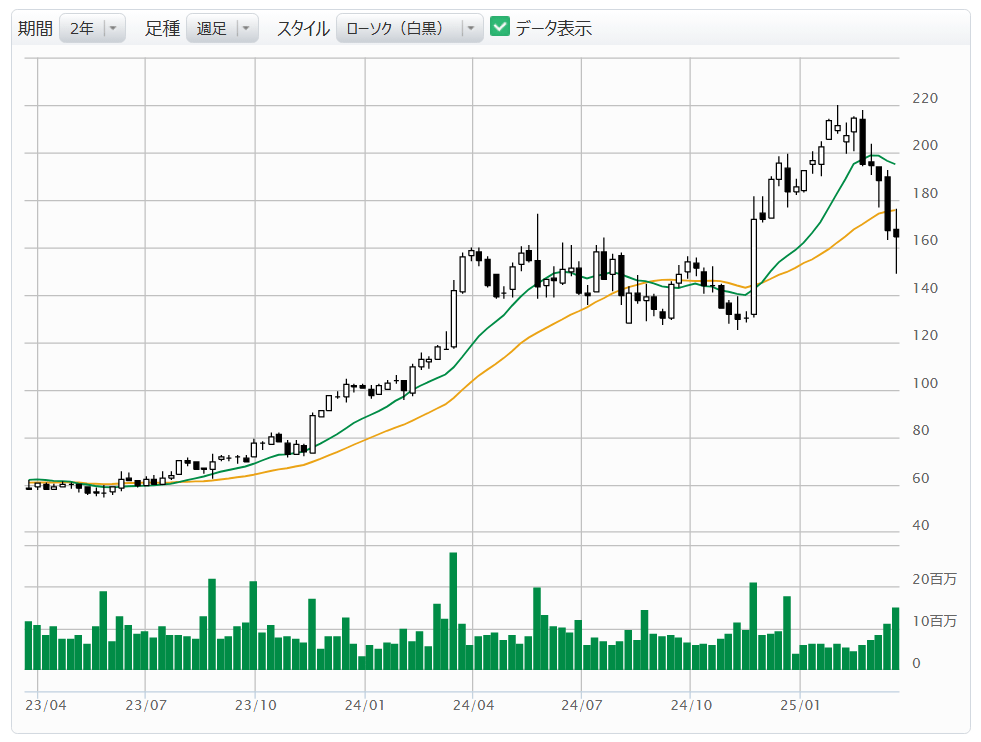

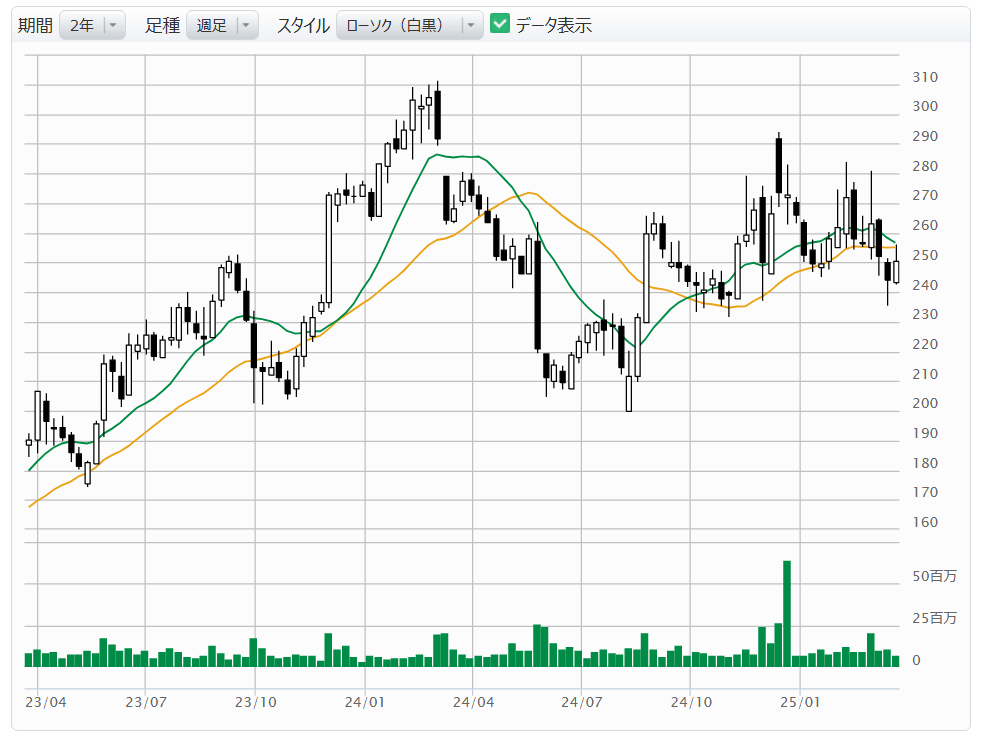

[Chart 2] TKO Group Holdings [TKO]: Weekly Chart (Moving Averages Green: 13 Weeks, Orange: 26 Weeks) Source: Monex Securities website (as of March 21, 2025)

Source: Monex Securities website (as of March 21, 2025)

DoorDash [DASH], the largest food delivery service

DoorDash [DASH] is engaged in the food delivery business. It holds an overwhelming market share of over 60% in the United States, significantly outpacing the second-place Uber Eats, which is operated by Uber Technologies [UBER].

When consumers order food or daily necessities from a marketplace on an app or website, the store prepares the food or products. A delivery person called a Dasher picks them up at the store and delivers them.

Fees are collected from both consumers and stores. A portion of the fee is paid to Dashers, and the remainder becomes DoorDash's actual revenue. The number of monthly active users in December 2024 is approximately 42 million, and the membership count for programs called "DashPass" and "Wolt Plus" reaches 22 million.

The business operates in over 30 countries, primarily in the United States. The "DoorDash" brand is the core, and in 2022, it expanded its operations by acquiring Walt, a competitor based in Finland.

DoorDash also operates a commerce platform business that supports retailers. White-label delivery, which handles deliveries under the retailer's brand, is the main source of revenue for this business.

They are also proactive in mergers and acquisitions (M&A). Following the acquisition of Walt in 2022, in January 2025, Walt acquired the Romanian competitor Tazz, further strengthening its foothold in the European market.

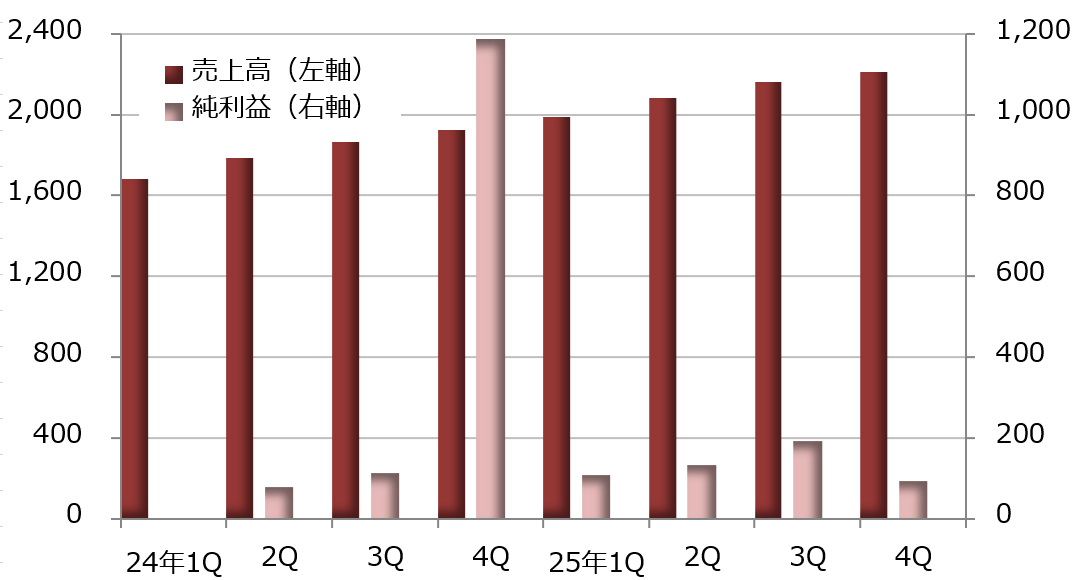

[Figure 3] DoorDash [DASH]: Performance Trends (Unit: Million Dollars) ! Source: Created by DZH Financial Research from LSEG *The end of the term is in December.

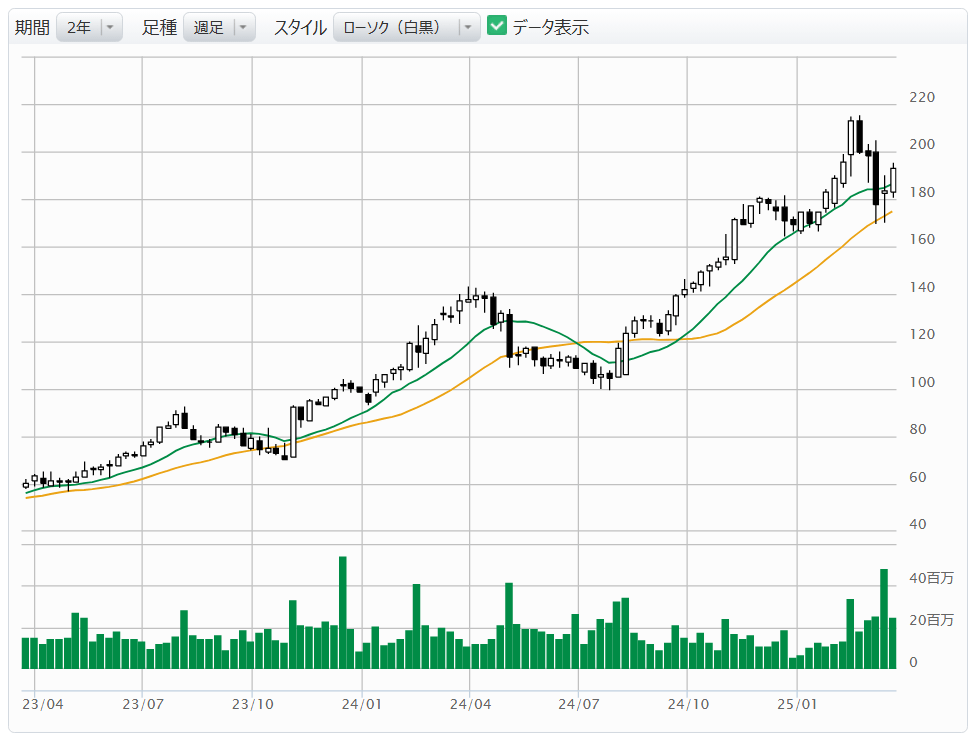

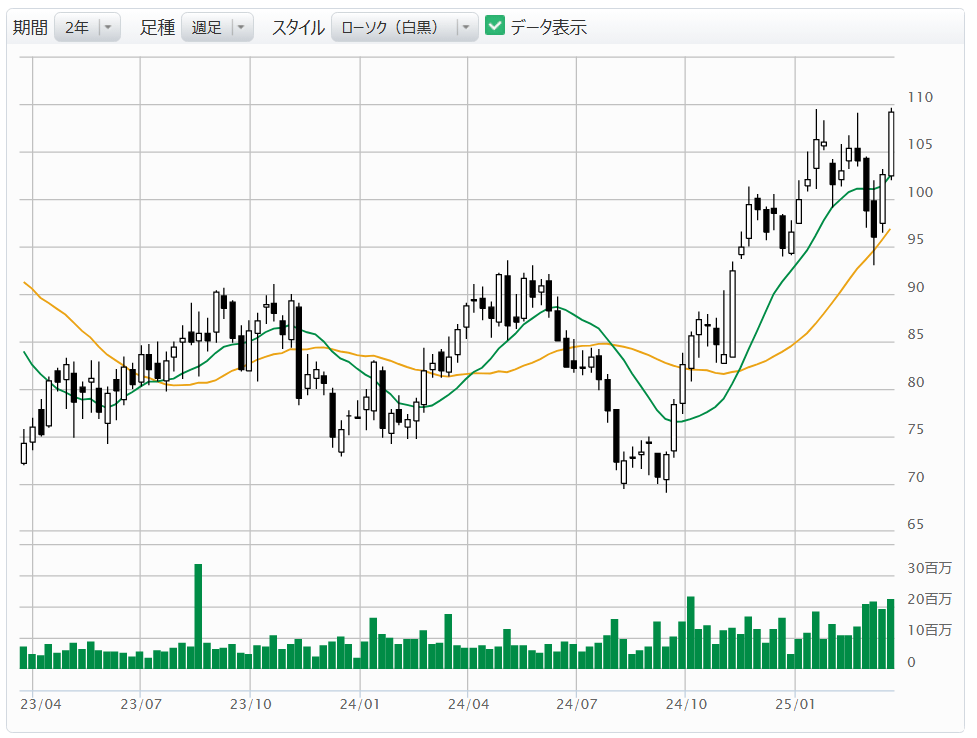

[Chart 4] DoorDash [DASH]: Weekly Chart (Moving Average Green: 13 Weeks, Orange: 26 Weeks) Source: Monex Securities website (as of March 21, 2025)

Source: Monex Securities website (as of March 21, 2025)

Williams-Sonoma [WSM], a specialty retailer of premium home goods

Williams Sonoma [WSM] operates a retail chain for home goods. It is well-known for its high-quality and aesthetically pleasing interior and kitchen products, and it sells its products not only in physical stores but also through online shopping and catalog sales.

As of the end of January 2024, there are 518 directly operated stores. The breakdown of the store count includes 184 "Pottery Barn" interior shops, 156 "Williams Sonoma", 121 "West Elm", 46 "Pottery Barn Kids", and 11 "Rejuvenation". There are stores in the United States as well as in Canada, the United Kingdom, and Australia. There are a total of 138 franchise stores operating in Mexico, the Middle East, India, the Philippines, and South Korea.

"Pottery Barn" is a furniture retailer founded in 1949, which was acquired by Williams-Sonoma in 1986 and became part of its subsidiary. Its main products include beds, lighting, rugs, and decorative items.

"Williams Sonoma" is a brand that is also used as the company name, dealing in cookware, tableware, furniture, and cookbooks. On the other hand, "West Elm" is a store that originated in the Brooklyn area of New York in 2002 and is popular for its unique decor items.

The products are sourced from Asia and Europe, as well as manufactured in our own factories located in North Carolina, Oregon, and Mississippi. The main production items include upholstered sofas and lighting fixtures.

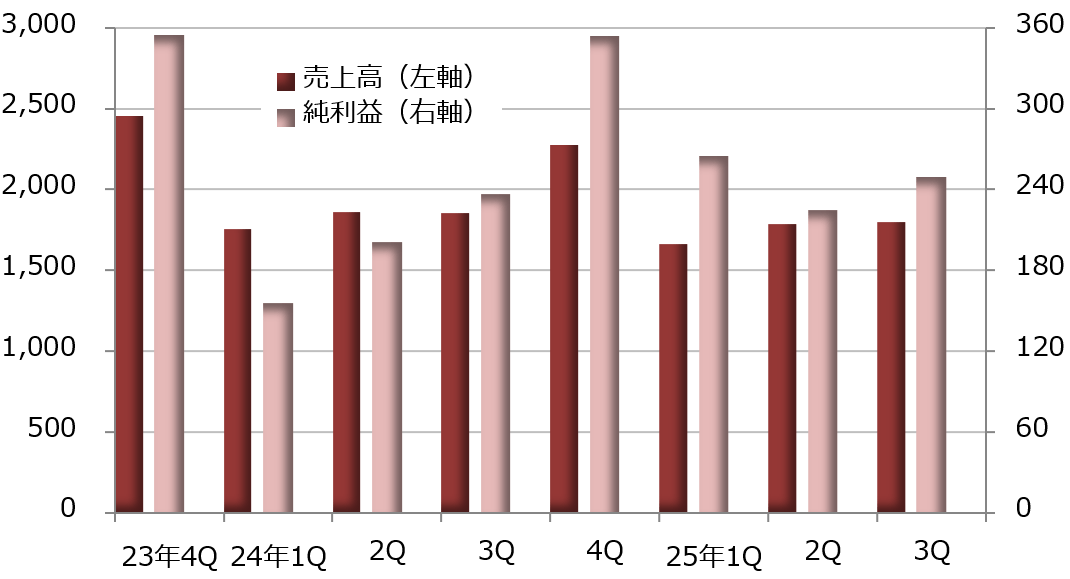

[Figure 5] Williams Sonoma [WSM]: Performance Trends (Unit: Million Dollars) Source: Created by DZH Financial Research from LSEG

*The end of the term is in January.

Source: Created by DZH Financial Research from LSEG

*The end of the term is in January.

[Chart 6] Williams Sonoma [WSM]: Weekly Chart (Moving Averages Green: 13 Weeks, Orange: 26 Weeks) Source: Monex Securities website (as of March 21, 2025)

Source: Monex Securities website (as of March 21, 2025)

Expanded Energy [EXE], strengths in shale gas development

Expand Energy [EXE] is engaged in the exploration and production of natural gas, oil, and natural gas liquids (liquefied hydrocarbons). The original company name was Chesapeake Energy, and it changed to its current name in October 2024 following the completion of the merger with Southwestern Energy.

As an independent company, it is the largest producer of natural gas in the country, particularly strong in shale gas development. The focus is on acquisitions, exploration, development, and production.

Haynesville and Bossier Shale in Louisiana

Marcellus Shale in Pennsylvania

Marcellus and Utica Shale formations in Ohio and West Virginia

--- at three locations.

The number of gas and oil wells under exploration and production will reach approximately 8,000 by the end of 2024. Among these, 6,200 wells have working interests that allow our company to take the lead in development and production activities as an operator, and almost all of them are gas wells. In reality, we are operating in 5,500 gas wells as an operator for development and production.

As of the end of 2024, the estimated reserves are 16.924 trillion cubic feet of natural gas, 67.9 million barrels of oil, and 578.1 million barrels of natural gas liquids. This is equivalent to 20.8 trillion cubic feet in natural gas terms.

[Figure 7] Expand Energy [EXE]: Performance Trends (Unit: Million Dollars) Source: Created by DZH Financial Research from LSEG

*The end of the term is December.

Source: Created by DZH Financial Research from LSEG

*The end of the term is December.

[Figure 8] Expand Energy [EXE]: Weekly Chart (Moving Averages Green: 13 weeks, Orange: 26 weeks) Source: Monex Securities website (as of March 21, 2025)

Source: Monex Securities website (as of March 21, 2025)

Workday [WDAY], a platform for talent and capital management

Workday [WDAY] provides a cloud-based platform for managing personnel and capital for corporations. Through a platform equipped with AI called "Workday Artificial Intelligence (AI)", it supports initiatives aimed at improving labor productivity and strengthening financial management.

The main applications integrated into the platform include "financial management," "expense management," "human resource management," and "business planning," each with its own unique functions. In "financial management," it monitors major transactions such as accounts receivable and accounts payable and provides real-time insights into the financial status, while "expense management" manages expenditures related to procurement and ordering.

"Talent management" is a tool that manages the lifecycle of employees from onboarding to offboarding. The "business plan" utilizes data from finance, human resources, sales, and operations to support the formulation of business plans.

Workday provides services to over 11,000 organizations. It particularly excels in serving mid-sized and large enterprises, with more than 60% of the Fortune 500 companies in the United States utilizing Workday's services.

[Figure 9] Workday [WDAY]: Performance Trends (Unit: Million Dollars) Source: Created by DZH Financial Research from LSEG

*The end of the term is in January.

Source: Created by DZH Financial Research from LSEG

*The end of the term is in January.

[Chart 10] Workday [WDAY]: Weekly Chart (Moving Averages Green: 13 Weeks, Orange: 26 Weeks) Source: Monex Securities website (as of March 21, 2025)

Source: Monex Securities website (as of March 21, 2025)