Trending Topics

View More7.5K Popularity

11.34K Popularity

27.27K Popularity

12.31K Popularity

148.49K Popularity

Hot Gate Fun

View More- MC:$3.52KHolders:10.00%

- MC:$3.52KHolders:10.00%

- MC:$3.52KHolders:10.00%

- MC:$3.52KHolders:10.00%

- MC:$3.57KHolders:20.09%

Pin

Gate Square New & Returning Creator Rewards are ongoing!

Your ideas may be more valuable than you think!

Make your first post or come back post to share a $20,000 monthly prize pool!

Post with #MyFirstPostOnSquare to receive a $50 Position Voucher each

Monthly Top Posters and Top Engagers will each earn an extra $50 reward

Your crypto insights could inspire many—start creating today!

👉 https://www.gate.com/postGate Square “Creator Certification Incentive Program” — Recruiting Outstanding Creators!

Join now, share quality content, and compete for over $10,000 in monthly rewards.

How to Apply:

1️⃣ Open the App → Tap [Square] at the bottom → Click your [avatar] in the top right.

2️⃣ Tap [Get Certified], submit your application, and wait for approval.

Apply Now: https://www.gate.com/questionnaire/7159

Token rewards, exclusive Gate merch, and traffic exposure await you!

Details: https://www.gate.com/announcements/article/47889Your First Words Matter!

Share your first post on and split $10,000 in New Year rewards.

Post with #My2026FirstPost to share your New Year wish

2026U Position Voucher, Gate New Year boxes, F1 Red Bull merch await you!

Ends on Jan 15, 2026, 16:00 UTC

2026 starts with this post!Gate 2025 Year-End Gala Square TOP50 List Announced!

The final ranking phase is now live.

Earn Votes by watching live streams and posting.

30 Votes = 1 chance — support your favorite creators now!

👉 https://www.gate.com/activities/community-vote-2025

iPhone 17 Pro Max, JD gift cards, Mi Band, Gate merch await you!

Creators are welcome to rally fans to climb the rankings and win rewards!

Voting ends: Jan 20, 02:00 UTC

Details: https://www.gate.com/announcements/article/48693

A new wave of explosion is about to begin

Hot News |

1. On January 8th at 21:30, the US initial jobless claims for the week ending January 3rd will be announced( ten thousand)

2. On January 9th at 21:30, the US non-farm payrolls for December (seasonally adjusted) will be announced( ten thousand)

Recap: Bitcoin has been consolidating sideways for nearly two weeks, and in the Year of the Horse 2026, it has also delivered a good start rally. Bitcoin rose from 87,800 to a high of 94,700, gaining 7,500 points in a week, an 8.6% increase. The market also saw the “Mrs. Ethereum” rise from 2,930 to around the target level of 3,310 we mentioned before the holiday. Currently, although the first week of 2026 has shown impressive performance, the overall consolidation pattern indicates that the market still lacks sustained liquidity supply. The supply and demand are still relatively imbalanced. Plus, the US Senate is scheduled to review the Crypto Market Structure Act on January 15. This could trigger a real breakout. This legislation will determine Bitcoin’s status; it will no longer be seen as an alternative asset by most, but as a core component of the global financial system. Passing this legislation could make Bitcoin a truly sovereign-level asset, stepping onto the global stage as a mainstream asset. In the second week of 2026, our main focus will be on monitoring data releases while keeping a close eye on political changes in the US. Don’t just blindly chase the few K-line patterns on the chart for quick gains and losses.

BTC: The 12H chart is currently facing strong resistance. After three attempts to surge and fall back in the last two weeks of 2025, and a half-month of accumulation, the effort to break through the 94,700 resistance level still shows weakness. Currently, it’s in a high-level oscillation rather than a one-way trend. The direction will depend on the data released in the next two days. Once the key support below is confirmed, the new trend will be determined. Bitcoin is now at 90,800. We need to watch whether the support at 88,000 can hold. The key position above is the bullish testing platform at 92,500. If it stabilizes, a new breakout could be even more vigorous. The strong resistance at 94,700 will turn into the next major support. If 89,000 cannot be effectively supported, late January will likely be a wide-range shakeout and consolidation. To sum up, the focus is on breaking through the key resistance level, rather than blindly accumulating at support levels. Yesterday’s movement was very typical: prices pushed up but lacked sustainability, then retraced for short-term trades, with some buyers stepping in. This indicates that the main force is not in a hurry to make a statement and won’t give retail traders a quick profit. It’s more about testing retail traders’ patience—if they can hold, they win; if not, they will be forced out.

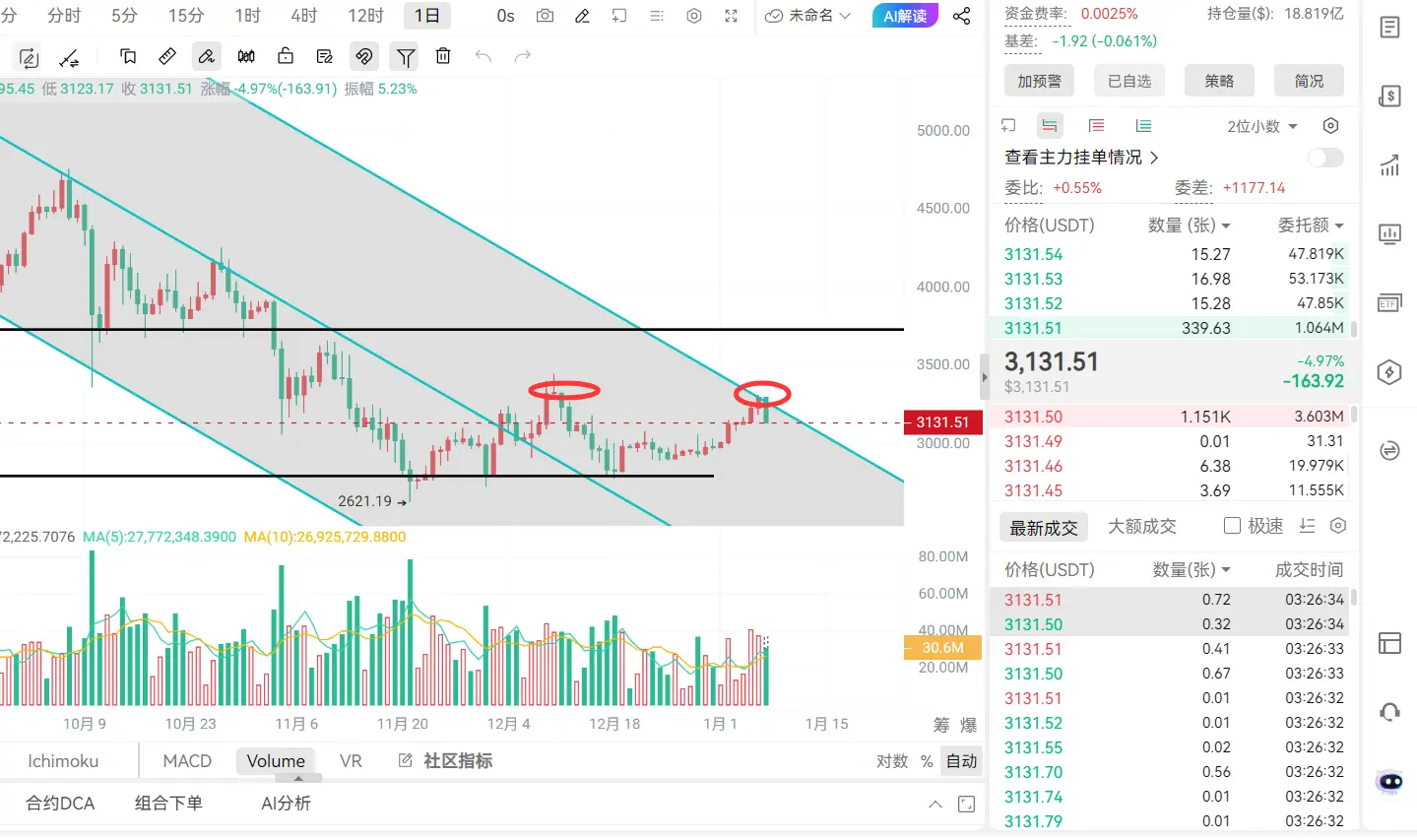

ETH: The 12-hour structure is clearer than Bitcoin’s. The resistance at 3,310 and support between 3,030-2,930. From a structural perspective, this rally shows obvious lagging. In summary, Mrs. Ethereum is waiting for Bitcoin to give a signal. Tonight, we should pay more attention to the changes in the Dow Jones and Nasdaq before choosing entry points.#BTC#ETH

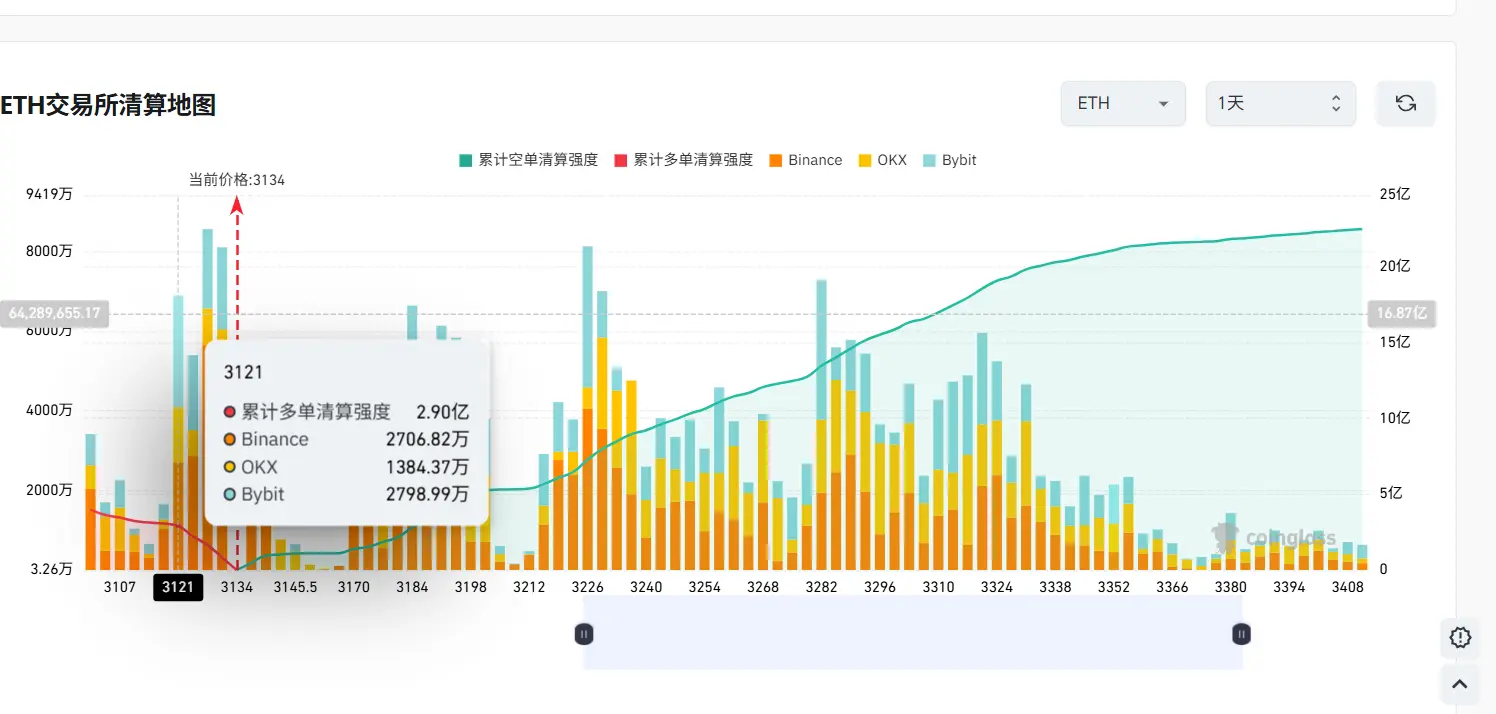

Latest Liquidation Map:

The recent market movements are quite volatile, and it’s also a good time to practice basic skills, learn more technical analysis, and build patience. Waiting for a real breakout will help you hold steady without panic. I am Tommy, a trader who is also on a journey of self-improvement in the B circle; if you want real-time key entry points and personalized strategies, click on my homepage and join the community. We have professional trading instructors available around the clock to help you stay calm and avoid going solo in tough times.