Trending Topics

View More15.22K Popularity

20.76K Popularity

57.62K Popularity

16.19K Popularity

97.02K Popularity

Pin

Gate Square New & Returning Creator Rewards are ongoing!

Your ideas may be more valuable than you think!

Make your first post or come back post to share a $20,000 monthly prize pool!

Post with #MyFirstPostOnSquare to receive a $50 Position Voucher each

Monthly Top Posters and Top Engagers will each earn an extra $50 reward

Your crypto insights could inspire many—start creating today!

👉 https://www.gate.com/postGate Square “Creator Certification Incentive Program” — Recruiting Outstanding Creators!

Join now, share quality content, and compete for over $10,000 in monthly rewards.

How to Apply:

1️⃣ Open the App → Tap [Square] at the bottom → Click your [avatar] in the top right.

2️⃣ Tap [Get Certified], submit your application, and wait for approval.

Apply Now: https://www.gate.com/questionnaire/7159

Token rewards, exclusive Gate merch, and traffic exposure await you!

Details: https://www.gate.com/announcements/article/47889Your First Words Matter!

Share your first post on and split $10,000 in New Year rewards.

Post with #My2026FirstPost to share your New Year wish

2026U Position Voucher, Gate New Year boxes, F1 Red Bull merch await you!

Ends on Jan 15, 2026, 16:00 UTC

2026 starts with this post!Gate 2025 Year-End Gala Square TOP50 List Announced!

The final ranking phase is now live.

Earn Votes by watching live streams and posting.

30 Votes = 1 chance — support your favorite creators now!

👉 https://www.gate.com/activities/community-vote-2025

iPhone 17 Pro Max, JD gift cards, Mi Band, Gate merch await you!

Creators are welcome to rally fans to climb the rankings and win rewards!

Voting ends: Jan 20, 02:00 UTC

Details: https://www.gate.com/announcements/article/48693

December 30 | ETH Price Trend Analysis

Core Viewpoints

Current Price: $2,935 (as of 10:00 December 30)

Short-term Outlook: Neutral to slightly bearish. ETH is currently consolidating within $2,890-$2,950, trading below multiple key moving averages, indicating a neutral to weak technical posture. The RSI across multiple timeframes is in the 40-47 neutral zone, and MACD on 1-hour and 4-hour charts shows weak momentum. Despite large-scale institutional staking locking circulating supply, short-term technical structure and market sentiment have yet to produce a clear breakout signal. Expecting range-bound movement within the next 24-48 hours, with a 55-65% probability of testing support at $2,890 downward.

Key Supports:

Key Resistances:

Technical Analysis

Multi-timeframe Technical Indicators

ETH’s current price remains below key moving averages across multiple timeframes, indicating a neutral to weak technical bias:

Derivatives Market Dynamics

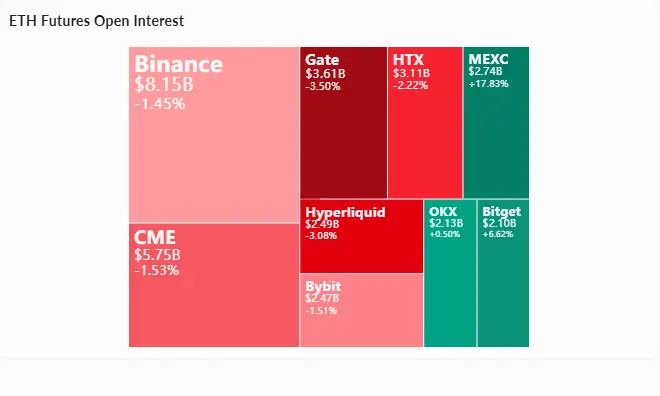

Futures open interest totals $38.4B, up +1.09% in 24h, indicating increased market participation. Binance funding rate at -0.0006% suggests shorts pay longs, reflecting slight bullish sentiment.

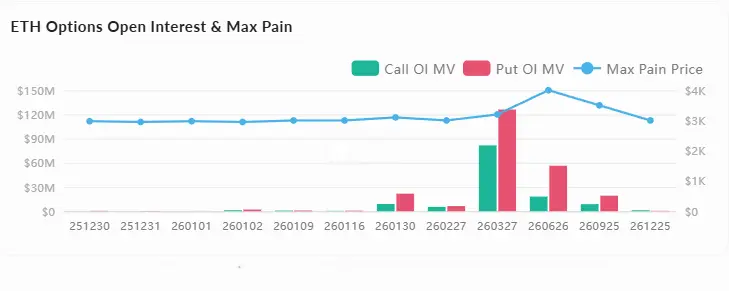

Options open interest is $6.5B, up +9.4% in 24h, with max pain near $2,950-$3,000. This zone overlaps heavily with current resistance, exerting a magnetic effect on short-term price.

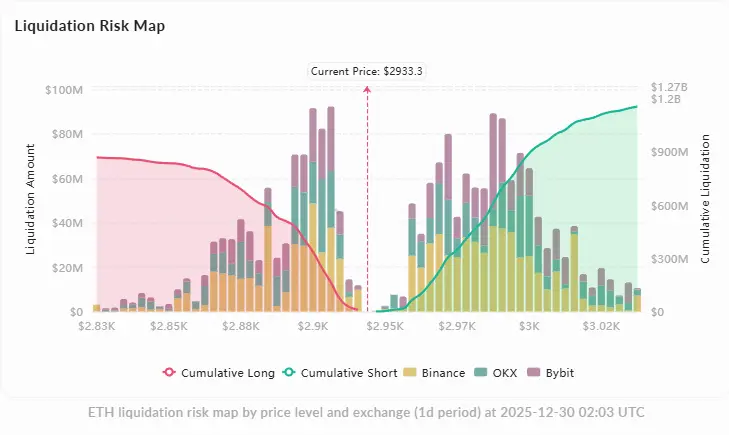

24-hour liquidation data shows $67M total, with $34.6M (51%) longs and $32.4M (49%) shorts liquidated, indicating balanced liquidation pressure. Risk map shows an $11.9M long cluster below $2,917, and over $80M in high-density long liquidation zone between $2,860-$2,870—break below could trigger cascade liquidations. Above, $2,995-$3,001 sees $89M+ in short liquidations, forming a clear resistance band.

Market Sentiment Analysis

Trader Sentiment

Short-term traders are cautious about ETH’s price action. Some interpret recent dips as a retest of support within a bullish channel, expecting higher lows and higher highs. Others point to microstructure weakness, warning that if support fails, prices could fall to lower support zones. Institutional staking activity fuels some optimistic expectations, believing supply lock-up may positively influence market rotation.

Key Narratives & Discussions

BitMine’s large ETH acquisitions and staking have become dominant market narratives. The institution holds 4.11 million ETH (3.41% of total supply), valued at a portion of its $13.2 billion total assets. On Dec 28-29, it staked 342,560 ETH (~$7.8-10B), demonstrating long-term commitment to Ethereum infrastructure.

Validator queue on Ethereum exceeds exit queue for the first time in 6 months. Entry queue: 734k-745k ETH (waiting ~13-14 days); exit queue: 343k-360k ETH (waiting ~6-8 days). This shift is attributed to DeFi deleveraging, improved staking experience post-Petra upgrade, and potential ETF institutional positioning.

Tokenized real-world assets (RWA) on Ethereum continue to ferment, with discussions focusing on their role in financial evolution and yield generation through staking.

Analyst Opinions

On-Chain Dynamics

Recent Major Events

Dec 25-27: Market in holiday lull, price oscillates narrowly between $2,900-$2,950. Vitalik Buterin tweets about Grok Twitter integration and European online polarization risks, but no direct price impact.

Dec 28-29: BitMine updates ETH holdings to 4.11 million and begins large-scale staking. On Dec 29, daily purchase of $130M ETH, total staked exceeds $1B, becoming a dominant narrative. Validator queue shows first bullish reversal in 6 months.

Dec 30: Overall crypto market cap drops by $100B, no major ETH-specific event.

On-Chain Indicators

Active Addresses: 24h active addresses at 628,857, with 64,793 new addresses, maintaining normal range of 50-60K. Mid-December data shows 551,938 active addresses, +9% YoY, +32% WoW.

Gas Usage: $326k in fees (24h), $44k revenue, average Gas ~0.03 Gwei, network utilization 64.18%. Low fees and compressed transaction volume reflect steady market activity.

TVL Trends: Stablecoins TVL $165.5B (-0.29% 7d), DEX volume $816M (-32% 7d), perpetual futures volume $1.49B (-27% 7d). Bridge TVL $442.6B, native TVL $118.2B, slight weekly decline.

Exchange Flows

7-day net inflow: +246k ETH, indicating slight accumulation pressure. Latest data (Dec 29) shows net outflow of -82.6k ETH, a bullish sign. Exchange reserves stable at 16.58M ETH (~$48.9B), showing minor accumulation.

Future Catalysts

Tech Upgrades: Petra upgrade implemented, increasing validator max balance from 32 to 2,048 ETH, improving staking UX. Hegota (Verkle Trees) upgrade planned for H2 2026 after Glamsterdam.

ETF Flows: 2025 spot ETH ETF inflows total $9.9B, with ETHA contributing $9.1B. A net outflow of -$644M occurred Dec 15-19, but overall remains positive. ETHA accounts for 57% of AUM, with concentration risk. Specific flow data for Dec 25-30 is unavailable.

Staking Dynamics: Validator exit queue may clear before Jan 3, 2026, reducing sell pressure. BitMine aims to hold 5% of total supply; ongoing accumulation and staking will tighten circulating supply further.

Summary

ETH is at a critical technical and sentiment balance point. Price consolidates around $2,935, with multi-timeframe indicators showing neutral to weak bias. Resistance at $2,942-$2,958 (moving averages and options max pain), support at $2,889-$2,917 (relatively fragile). Institutional staking lock-up supports medium-long-term bullishness, but short-term breakout signals are absent. Derivatives open interest rising, funding rates slightly bullish, but liquidation maps show significant long clusters below $2,917—break below could trigger cascade liquidations.

In the next 24-48 hours, ETH is expected to remain within $2,890-$2,950, with a slightly higher probability of testing support downward. A break above $2,958 and stabilization could open room towards $2,995-$3,001; a drop below $2,889 warrants caution for a move towards $2,860 support.