- Trending TopicsView More

15.5K Popularity

4.7M Popularity

124.7K Popularity

79.4K Popularity

164.7K Popularity

- Pin

- 🍁 Golden Autumn, Big Prizes Await!

Gate Square Growth Points Lucky Draw Carnival Round 1️⃣ 3️⃣ Is Now Live!

🎁 Prize pool over $15,000+, iPhone 17 Pro Max, Gate exclusive Merch and more awaits you!

👉 Draw now: https://www.gate.com/activities/pointprize/?now_period=13&refUid=13129053

💡 How to earn more Growth Points for extra chances?

1️⃣ Go to [Square], tap the icon next to your avatar to enter [Community Center]

2️⃣ Complete daily tasks like posting, commenting, liking, and chatting to rack up points!

🍀 100% win rate — you’ll never walk away empty-handed. Try your luck today!

Details: ht - 💥 Gate Square Event: #Post0GWinUSDT# 💥

Post original content on Gate Square related to 0G or the ongoing campaigns (Earn, CandyDrop, or Contract Trading Competition) for a chance to share 200 USDT rewards!

📅 Event Period: Sept 25, 2025, 18:00 – Oct 2, 2025, 16:00 UTC

📌 Related Campaigns:

Earn: Enjoy stable earnings

👉 https://www.gate.com/announcements/article/47290

CandyDrop: Claim 0G rewards

👉 https://www.gate.com/announcements/article/47286

Contract Trading Competition: Trade to win prizes

👉 https://www.gate.com/announcements/article/47221

📌 How to Participate:

1️⃣ Post original cont - 🚀 #GateNewbieVillageEpisode2# ✖️ @独领风骚必暴富

💰 Share your first profit on Gate | 🎉 Recall your most unexpected gain | 🤝 Grow with the community

⏰ Event Date:Sept 24 04:00 – Sept 30 16:00 UTC+8

How to Join:

1️⃣ Follow Gate_Square + @独领风骚必暴富

2️⃣ Post on Gate Square with the hashtag #GateNewbieVillageEpisode2#

3️⃣ Share your first pot of gold or your most surprising profit on Gate—more detailed and interesting posts have a higher chance to win!

🎁 Rewards

3 lucky winners → Gate X RedBull Tumbler + $20 Futures Trial Voucher

If merchandise cannot be shipped, it will be replaced with a $30 Futures - 🚗 #GateSquareCommunityChallenge# Round 2 — Which coin is not listed on Gate Launchpad❓

Time to prove if you’re a true Gate veteran!

💰 Join the challenge — 5 lucky winners will share $50 in GT!

👉 How to participate:

1️⃣ Follow Gate_Square

2️⃣ Like this post

3️⃣ Comment with your answer

🗓️ Deadline: October 8, 2025, 24:00 (UTC+8) - 🥊 You’ve entered the Trading PK Arena, matching your opponent now...

One click to place an order and jump into the battle! Who will climb the leaderboard and claim the 👑?

Gate’s brand-new Indicators Radar feature is live! Here you can:

📈 Share your trades on the live candlestick chart to [Square] 👉️ https://www.gate.com/post

👀 Watch others’ trading moves in real time;

💬 Go head-to-head with fellow traders in the community!

Don’t just read—follow the tutorial below and get started 👇

📌 Note: This feature is available only on app version 7.20.5 or above.

Effective Strategies for Token Burning in Meme Coin Markets

Market and Cycle Insights

The current bull market cycle differs from 2021, with corporate liquidity driving a flywheel effect that can withstand seasonal factors and macroeconomic noise. Historical patterns suggest potential market rises following September rate cuts, though Crypto Asset Treasury (DAT) presents both risks and bullish factors.

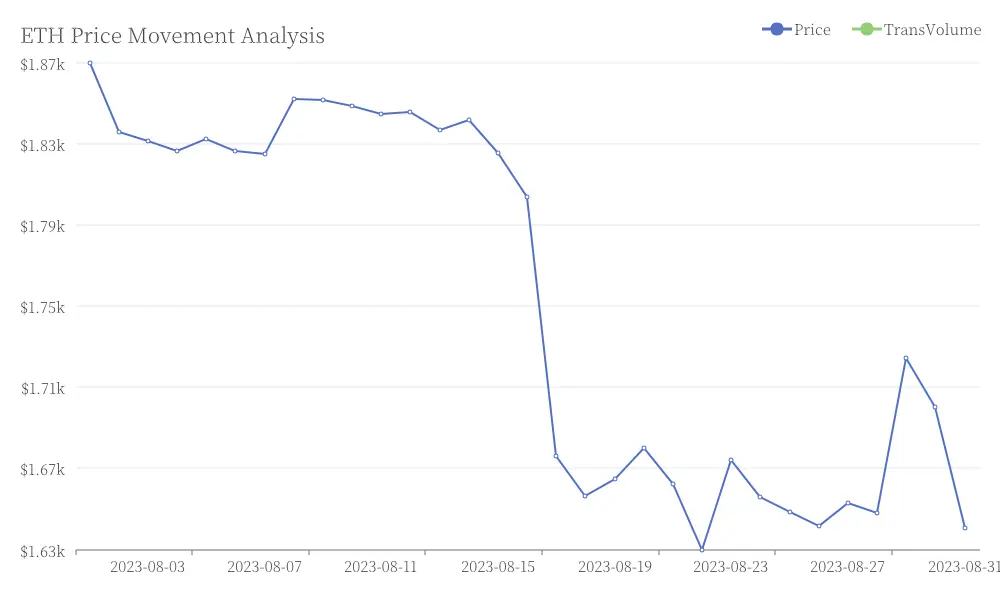

Recent market movements saw ETH falling below $4,100, with whale positions reducing and ETF fund outflows. ETH Price Movement Analysis

Institutional investors' influence may extend this cycle to 2026, altering market structure and dynamics.

ETH Price Movement Analysis

Institutional investors' influence may extend this cycle to 2026, altering market structure and dynamics.

For strategic positioning, consider bottom-fishing in late September if significant drops occur, gradually clearing positions in Q4 to capture the bull market's final gains.

Macro Perspective and Global Developments

Cathie Wood's investment philosophy reveals Ark Invest's cryptocurrency asset allocation methodology, emphasizing strategic operation logic amidst regulatory challenges.

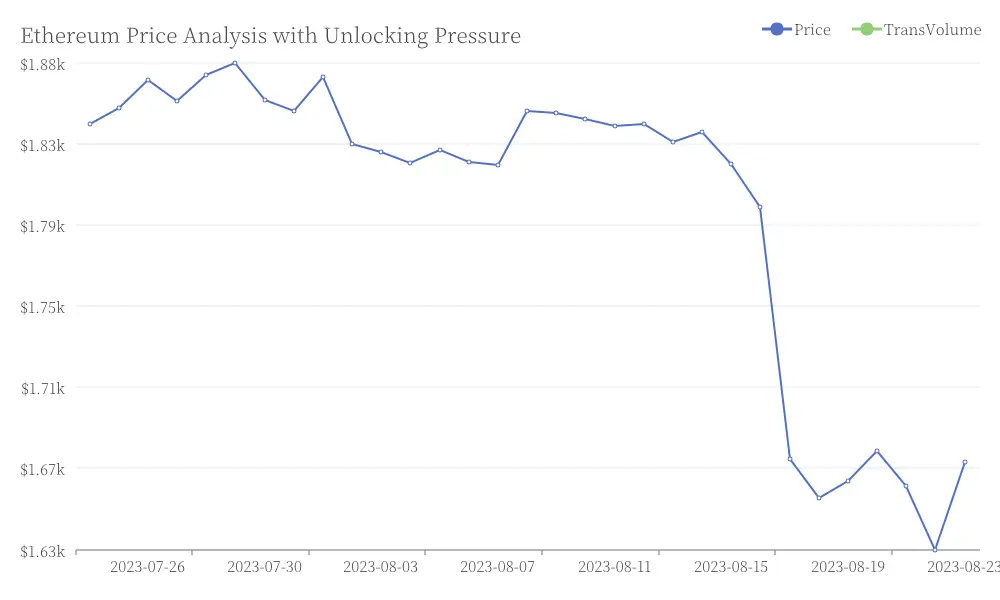

Hong Kong's cryptocurrency scene is evolving through phases of confrontation and integration. Meanwhile, Ethereum faces potential selling pressure with over $3.7 billion worth of ETH awaiting unlocking, though institutional accumulation may provide support. Ethereum Price Analysis with Unlocking Pressure

Ethereum Price Analysis with Unlocking Pressure

The A-share market is poised for a new bull cycle after a decade of consolidation, coinciding with anticipated joint fiscal and monetary easing between China and the U.S.

Bitcoin's quantum resistance upgrades are setting the stage for decentralized AGI's future, while the Latin American stablecoin market showcases utility-driven growth, with Brazil and Mexico leading localized ecosystems.

AI and Meme Coin Dynamics

A notable meme coin launch by a high-profile figure garnered significant attention, achieving a market value exceeding $3.4 billion. However, concerns arose regarding insider control and trading profits, with the token model drawing comparisons to controversial projects.

Generative video technology is leveraging memes to create potential windfalls, transitioning from viral content to enterprise-level applications. The DeFAI sector is expanding rapidly, with projects like FLock securing real-world use cases and technical validations.

Market Opportunities and Project Highlights

The stablecoin landscape is evolving, with new entrants aiming to dominate mainstream payment markets. Ethereum's resurgence has spotlighted multiple ecosystem projects, while three major crypto narratives - DeFi, DeFAI, and DeSci - are vying to ignite the next bull run.

Innovative concepts like machine collateral are emerging, with protocols like USD.AI enabling AI enterprises to finance GPUs using hardware as collateral. The ETHGlobal NYC hackathon showcased award-winning projects across gaming, payments, DeFi, and development tools.

Web3 Developments and Industry Shifts

LayerZero's acquisition of Stargate, supported by over 97% of stakeholders, marks a significant industry move. The U.S. banking sector's resistance to stablecoin legislation highlights the ongoing power struggle between traditional and emerging financial systems.

Grayscale's cryptocurrency trust fund performance reveals a strategic shift towards AI, ecosystem-specific products, and meme culture. The success of platforms like Hyperliquid demonstrates the potential of self-funded, user-driven growth models in the crypto space.

Network security remains a focal point, with Dogecoin potentially facing 51% attack attempts following Monero's challenges. Solana's theoretical 100,000 TPS capability under ideal conditions sparks debates on scalability and future upgrades.

Key Market Information

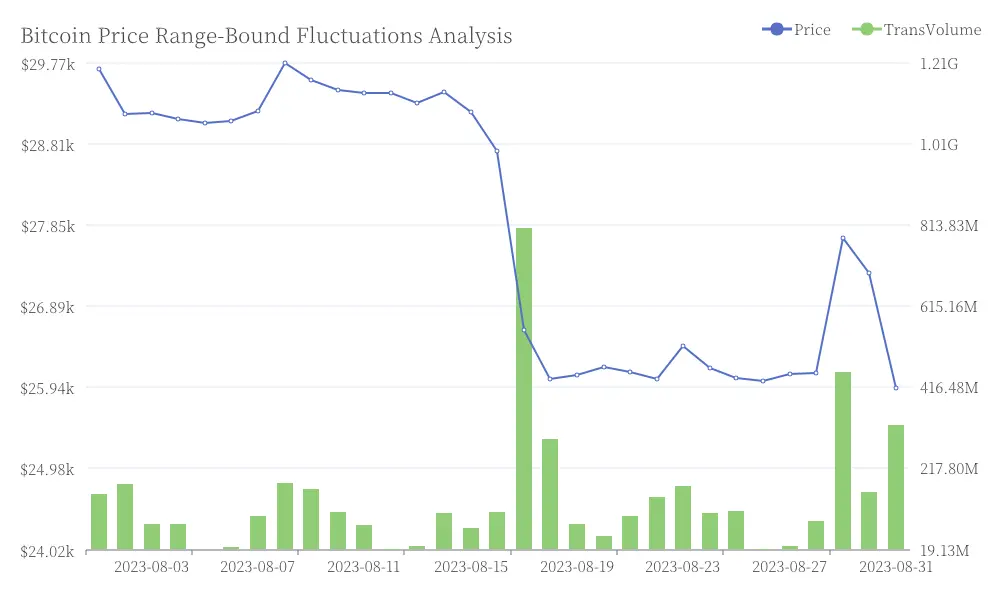

Recent developments include Circle's acquisition promoting the Arc blockchain testnet launch, DeepSeek's V3.1 model upgrade, and ongoing market analysis suggesting range-bound BTC fluctuations pending strong catalysts. Bitcoin Price Range-Bound Fluctuations Analysis

The total market value of Shanghai and Shenzhen stock markets surpassed 100 trillion yuan, while U.S. 401(k) plans may drive Bitcoin to new heights by 2025. Federal Reserve officials maintain a focus on inflation, with Powell's upcoming speech at the Jackson Hole meeting eagerly anticipated by market participants.

Bitcoin Price Range-Bound Fluctuations Analysis

The total market value of Shanghai and Shenzhen stock markets surpassed 100 trillion yuan, while U.S. 401(k) plans may drive Bitcoin to new heights by 2025. Federal Reserve officials maintain a focus on inflation, with Powell's upcoming speech at the Jackson Hole meeting eagerly anticipated by market participants.