- Trending TopicsView More

12.4K Popularity

4.7M Popularity

123.4K Popularity

79.3K Popularity

164.7K Popularity

- Pin

- 🍁 Golden Autumn, Big Prizes Await!

Gate Square Growth Points Lucky Draw Carnival Round 1️⃣ 3️⃣ Is Now Live!

🎁 Prize pool over $15,000+, iPhone 17 Pro Max, Gate exclusive Merch and more awaits you!

👉 Draw now: https://www.gate.com/activities/pointprize/?now_period=13&refUid=13129053

💡 How to earn more Growth Points for extra chances?

1️⃣ Go to [Square], tap the icon next to your avatar to enter [Community Center]

2️⃣ Complete daily tasks like posting, commenting, liking, and chatting to rack up points!

🍀 100% win rate — you’ll never walk away empty-handed. Try your luck today!

Details: ht - 💥 Gate Square Event: #Post0GWinUSDT# 💥

Post original content on Gate Square related to 0G or the ongoing campaigns (Earn, CandyDrop, or Contract Trading Competition) for a chance to share 200 USDT rewards!

📅 Event Period: Sept 25, 2025, 18:00 – Oct 2, 2025, 16:00 UTC

📌 Related Campaigns:

Earn: Enjoy stable earnings

👉 https://www.gate.com/announcements/article/47290

CandyDrop: Claim 0G rewards

👉 https://www.gate.com/announcements/article/47286

Contract Trading Competition: Trade to win prizes

👉 https://www.gate.com/announcements/article/47221

📌 How to Participate:

1️⃣ Post original cont - 🚀 #GateNewbieVillageEpisode2# ✖️ @独领风骚必暴富

💰 Share your first profit on Gate | 🎉 Recall your most unexpected gain | 🤝 Grow with the community

⏰ Event Date:Sept 24 04:00 – Sept 30 16:00 UTC+8

How to Join:

1️⃣ Follow Gate_Square + @独领风骚必暴富

2️⃣ Post on Gate Square with the hashtag #GateNewbieVillageEpisode2#

3️⃣ Share your first pot of gold or your most surprising profit on Gate—more detailed and interesting posts have a higher chance to win!

🎁 Rewards

3 lucky winners → Gate X RedBull Tumbler + $20 Futures Trial Voucher

If merchandise cannot be shipped, it will be replaced with a $30 Futures - 🚗 #GateSquareCommunityChallenge# Round 2 — Which coin is not listed on Gate Launchpad❓

Time to prove if you’re a true Gate veteran!

💰 Join the challenge — 5 lucky winners will share $50 in GT!

👉 How to participate:

1️⃣ Follow Gate_Square

2️⃣ Like this post

3️⃣ Comment with your answer

🗓️ Deadline: October 8, 2025, 24:00 (UTC+8) - 🥊 You’ve entered the Trading PK Arena, matching your opponent now...

One click to place an order and jump into the battle! Who will climb the leaderboard and claim the 👑?

Gate’s brand-new Indicators Radar feature is live! Here you can:

📈 Share your trades on the live candlestick chart to [Square] 👉️ https://www.gate.com/post

👀 Watch others’ trading moves in real time;

💬 Go head-to-head with fellow traders in the community!

Don’t just read—follow the tutorial below and get started 👇

📌 Note: This feature is available only on app version 7.20.5 or above.

Expert Insights on Cryptocurrency Market Analysis

Bitcoin's Potential Support Level and Double Top Pattern

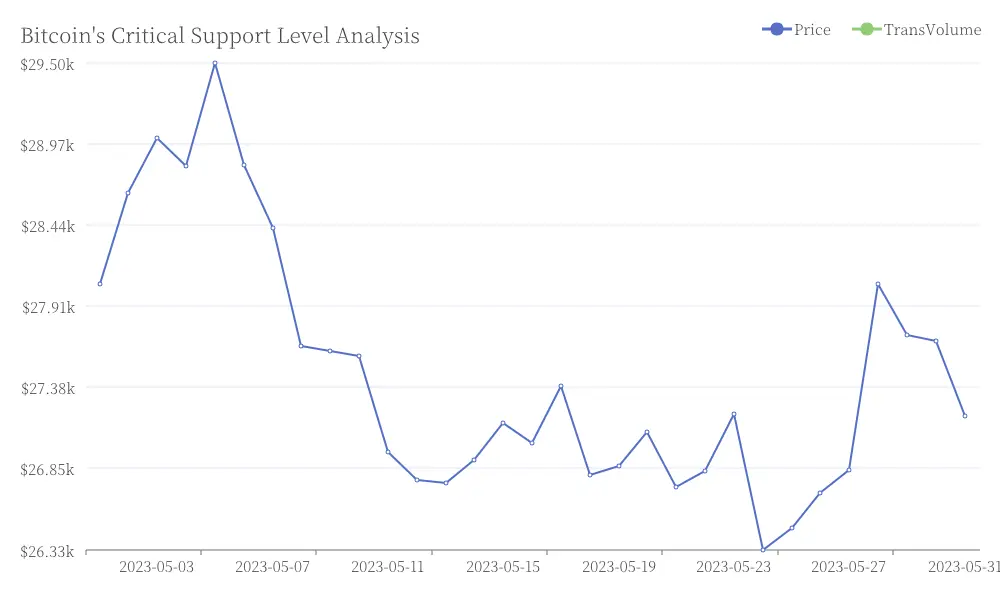

In the ever-evolving cryptocurrency market, Bitcoin (BTC) continues to capture the attention of traders and investors alike. Recent market analysis suggests that BTC may be approaching a critical support level. If this support breaks, we could see BTC retest the $52,000 mark, presenting a potential buying opportunity for those looking to enter the market. Bitcoin's Critical Support Level Analysis

Bitcoin's Critical Support Level Analysis

Technical Analysis and Market Sentiment

Market observers have noted the formation of a double top pattern in BTC's price chart. This technical formation often signals a possible trend reversal, indicating that a price decline may be on the horizon. The convergence of this pattern with the potential break of support adds weight to the bearish short-term outlook. Bitcoin Double Top Pattern and Potential Price Decline

Bitcoin Double Top Pattern and Potential Price Decline

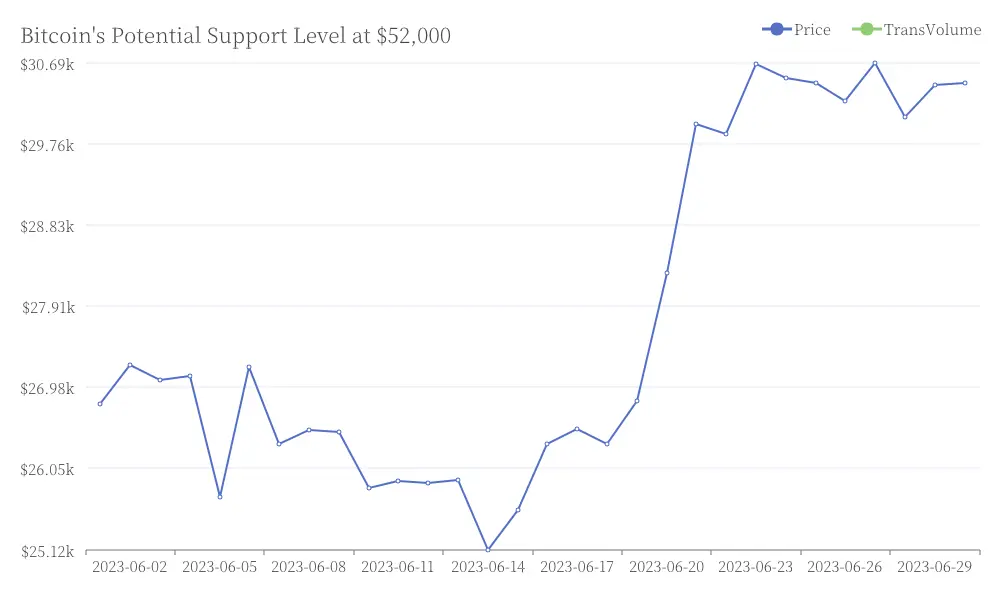

Strategic Approach to Bitcoin Investment

For those considering a BTC investment, patience may be key. Waiting for a clear entry point, such as a potential dip to the $52,000 level, could provide a more favorable risk-reward ratio. It's crucial to remember that market timing is challenging, and thorough research should always precede any investment decision. Bitcoin's Potential Support Level at $52,000

Bitcoin's Potential Support Level at $52,000

Broader Cryptocurrency Market Dynamics

While BTC remains the flagship cryptocurrency, other digital assets are also making waves in the market. Projects focusing on decentralized finance (DeFi) and blockchain interoperability continue to gain traction, diversifying the crypto ecosystem.

Long-term Outlook and Market Cycles

Despite short-term fluctuations, many analysts maintain a bullish long-term outlook for Bitcoin and the broader cryptocurrency market. The cyclical nature of the crypto market often sees periods of consolidation followed by significant price movements.

Risk Management in Cryptocurrency Trading

Given the volatile nature of cryptocurrency markets, implementing robust risk management strategies is essential. This includes establishing clear entry and exit points, implementing stop-loss orders to limit potential losses, and maintaining reasonable leverage levels to avoid unnecessary exposure.

Staying Informed in the Crypto Space

To navigate the complex world of cryptocurrency trading and investment, continuous education about market trends, regulatory changes, and technological innovations is vital. Relying on credible information sources and detailed market analysis empowers investors to make more educated decisions in this dynamic environment.