- Trending TopicsView More

1.4K Popularity

4.7M Popularity

119.4K Popularity

77.5K Popularity

162.8K Popularity

- Pin

- 🍁 Golden Autumn, Big Prizes Await!

Gate Square Growth Points Lucky Draw Carnival Round 1️⃣ 3️⃣ Is Now Live!

🎁 Prize pool over $15,000+, iPhone 17 Pro Max, Gate exclusive Merch and more awaits you!

👉 Draw now: https://www.gate.com/activities/pointprize/?now_period=13&refUid=13129053

💡 How to earn more Growth Points for extra chances?

1️⃣ Go to [Square], tap the icon next to your avatar to enter [Community Center]

2️⃣ Complete daily tasks like posting, commenting, liking, and chatting to rack up points!

🍀 100% win rate — you’ll never walk away empty-handed. Try your luck today!

Details: ht - 💥 Gate Square Event: #Post0GWinUSDT# 💥

Post original content on Gate Square related to 0G or the ongoing campaigns (Earn, CandyDrop, or Contract Trading Competition) for a chance to share 200 USDT rewards!

📅 Event Period: Sept 25, 2025, 18:00 – Oct 2, 2025, 16:00 UTC

📌 Related Campaigns:

Earn: Enjoy stable earnings

👉 https://www.gate.com/announcements/article/47290

CandyDrop: Claim 0G rewards

👉 https://www.gate.com/announcements/article/47286

Contract Trading Competition: Trade to win prizes

👉 https://www.gate.com/announcements/article/47221

📌 How to Participate:

1️⃣ Post original cont - 🚀 #GateNewbieVillageEpisode2# ✖️ @独领风骚必暴富

💰 Share your first profit on Gate | 🎉 Recall your most unexpected gain | 🤝 Grow with the community

⏰ Event Date:Sept 24 04:00 – Sept 30 16:00 UTC+8

How to Join:

1️⃣ Follow Gate_Square + @独领风骚必暴富

2️⃣ Post on Gate Square with the hashtag #GateNewbieVillageEpisode2#

3️⃣ Share your first pot of gold or your most surprising profit on Gate—more detailed and interesting posts have a higher chance to win!

🎁 Rewards

3 lucky winners → Gate X RedBull Tumbler + $20 Futures Trial Voucher

If merchandise cannot be shipped, it will be replaced with a $30 Futures - 🚗 #GateSquareCommunityChallenge# Round 2 — Which coin is not listed on Gate Launchpad❓

Time to prove if you’re a true Gate veteran!

💰 Join the challenge — 5 lucky winners will share $50 in GT!

👉 How to participate:

1️⃣ Follow Gate_Square

2️⃣ Like this post

3️⃣ Comment with your answer

🗓️ Deadline: October 8, 2025, 24:00 (UTC+8) - 🥊 You’ve entered the Trading PK Arena, matching your opponent now...

One click to place an order and jump into the battle! Who will climb the leaderboard and claim the 👑?

Gate’s brand-new Indicators Radar feature is live! Here you can:

📈 Share your trades on the live candlestick chart to [Square] 👉️ https://www.gate.com/post

👀 Watch others’ trading moves in real time;

💬 Go head-to-head with fellow traders in the community!

Don’t just read—follow the tutorial below and get started 👇

📌 Note: This feature is available only on app version 7.20.5 or above.

Days Calculator: Count from Any Date

###Cryptocurrency Market Cycle Analysis: Potential Peak Approaching

As of September 20, 2025, the cryptocurrency market cycle has progressed significantly since the November 2022 low. With 1,244 days elapsed, we are approaching the historical peak window of 1,060-1,100 days observed in previous cycles. This positions the potential cycle peak in the coming weeks.

###Halving Event and Market Dynamics

The last halving event occurred 891 days ago in April 2024. Historical data suggests market peaks typically arrive 518-580 days post-halving. We are currently well within this timeframe, indicating a critical phase in the market cycle.

###Current Market Conditions

The market is experiencing a typical third-quarter consolidation period. September has historically been the weakest month, with an average decline of 6.17%. However, this often precedes strength in October and November.

###Technical Analysis

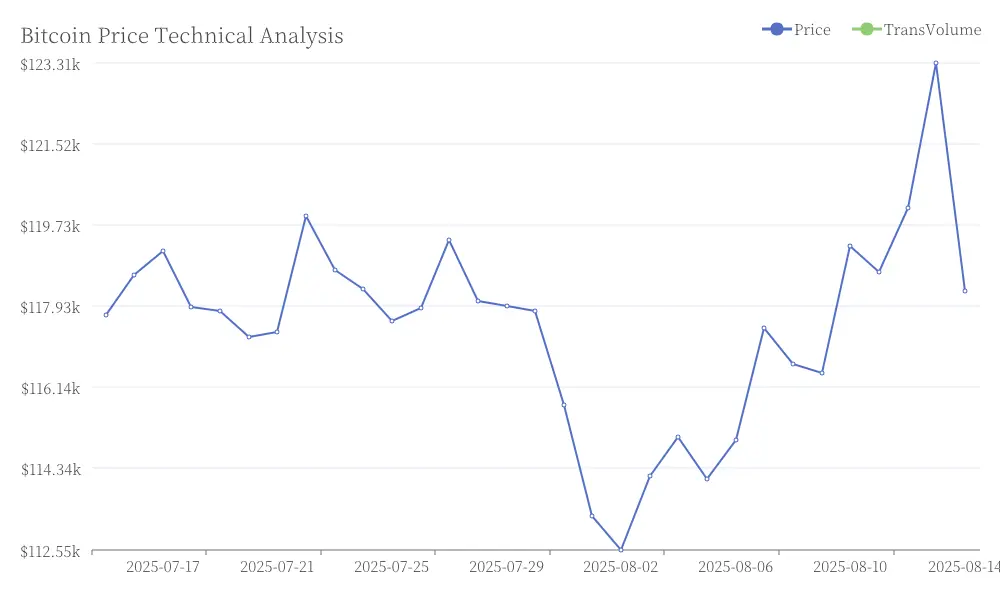

|Metric|Value| |---|---| |Current Price|$109,800| |All-Time High|$124,100 (August 14, 2025)| |50-week Simple Moving Average|$95,900| |200-week Simple Moving Average|$52,300| |7-week Correlation with S&P 500|-0.25| Bitcoin Price Technical Analysis

Bitcoin Price Technical Analysis

The negative correlation with traditional markets suggests a potential decoupling, often indicative of significant market movements.

###Short-Term Market Indicators

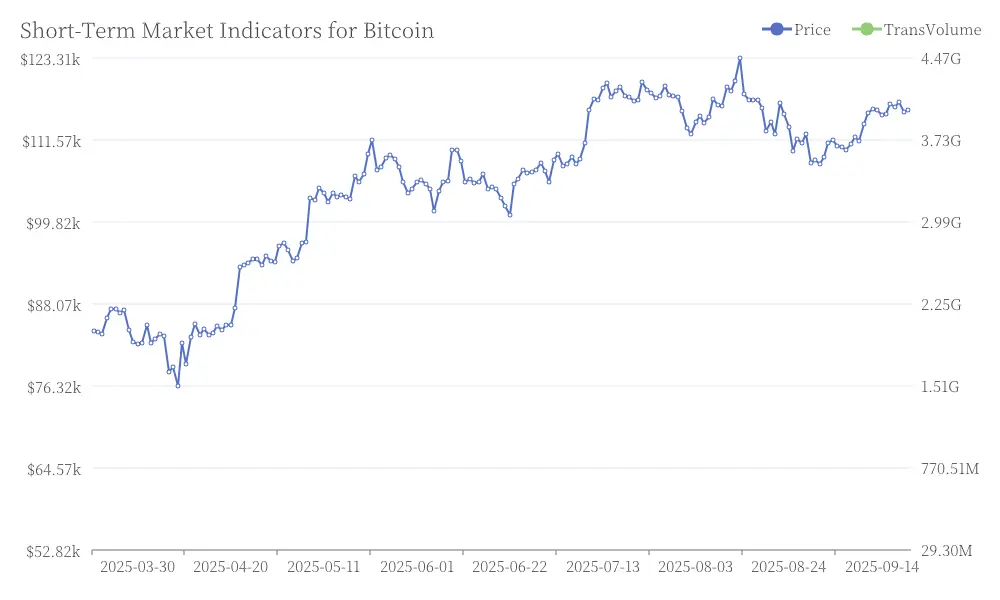

|Indicator|Value| |---|---| |200-day Breakout Pro|$111,000| |200-day Simple Moving Average|$101,500| |Relative Strength Index|43| |Average True Range|3,000| |50-day Volatility|2,940| |Local Support Range|$107,700 - $108,700| |Local Resistance Range|$113,000 - $114,100| Short-Term Market Indicators for Bitcoin

Short-Term Market Indicators for Bitcoin

###Market Direction and Risk Assessment

The market structure remains bearish below $112,758, with increased downside risk if prices fall below the $107,000-$108,000 range. Secondary corrections typically result in 20-30% dips.

###On-Chain Metrics and Mining Activity

|Metric|Value| |---|---| |Mining Cost|$95,400| |Cost to Price Ratio|0.86| |Net Unrealized Profit/Loss|0.527| |Market Value to Realized Value|2.20| |Percentage of Supply in Profit|>90%|

These metrics suggest a healthy mining ecosystem with low capitulation risk.

###Institutional Involvement

Recent data shows a 24-hour spot volume of $630.94 million for cryptocurrency investment products. After August outflows, September 3rd saw a positive net flow of $332.8 million. Total assets under management for these products stand at $155.8 billion, with spot products representing 93.54% of market share.

###Market Outlook

The cryptocurrency market appears to be in the final stages of its current cycle, with approximately 50 days remaining until the historical peak window. Key support levels have held, and on-chain metrics remain resilient. However, caution is advised as volatility may increase in the coming weeks.

Investors should be prepared for potential significant price movements in October and November, which could mark the cycle peak and possibly lead to an altcoin season. As always, thorough research and risk management are crucial when participating in the cryptocurrency market.