- Trending TopicsView More

13.1K Popularity

4.7M Popularity

123.6K Popularity

79.3K Popularity

164.7K Popularity

- Pin

- 🍁 Golden Autumn, Big Prizes Await!

Gate Square Growth Points Lucky Draw Carnival Round 1️⃣ 3️⃣ Is Now Live!

🎁 Prize pool over $15,000+, iPhone 17 Pro Max, Gate exclusive Merch and more awaits you!

👉 Draw now: https://www.gate.com/activities/pointprize/?now_period=13&refUid=13129053

💡 How to earn more Growth Points for extra chances?

1️⃣ Go to [Square], tap the icon next to your avatar to enter [Community Center]

2️⃣ Complete daily tasks like posting, commenting, liking, and chatting to rack up points!

🍀 100% win rate — you’ll never walk away empty-handed. Try your luck today!

Details: ht - 💥 Gate Square Event: #Post0GWinUSDT# 💥

Post original content on Gate Square related to 0G or the ongoing campaigns (Earn, CandyDrop, or Contract Trading Competition) for a chance to share 200 USDT rewards!

📅 Event Period: Sept 25, 2025, 18:00 – Oct 2, 2025, 16:00 UTC

📌 Related Campaigns:

Earn: Enjoy stable earnings

👉 https://www.gate.com/announcements/article/47290

CandyDrop: Claim 0G rewards

👉 https://www.gate.com/announcements/article/47286

Contract Trading Competition: Trade to win prizes

👉 https://www.gate.com/announcements/article/47221

📌 How to Participate:

1️⃣ Post original cont - 🚀 #GateNewbieVillageEpisode2# ✖️ @独领风骚必暴富

💰 Share your first profit on Gate | 🎉 Recall your most unexpected gain | 🤝 Grow with the community

⏰ Event Date:Sept 24 04:00 – Sept 30 16:00 UTC+8

How to Join:

1️⃣ Follow Gate_Square + @独领风骚必暴富

2️⃣ Post on Gate Square with the hashtag #GateNewbieVillageEpisode2#

3️⃣ Share your first pot of gold or your most surprising profit on Gate—more detailed and interesting posts have a higher chance to win!

🎁 Rewards

3 lucky winners → Gate X RedBull Tumbler + $20 Futures Trial Voucher

If merchandise cannot be shipped, it will be replaced with a $30 Futures - 🚗 #GateSquareCommunityChallenge# Round 2 — Which coin is not listed on Gate Launchpad❓

Time to prove if you’re a true Gate veteran!

💰 Join the challenge — 5 lucky winners will share $50 in GT!

👉 How to participate:

1️⃣ Follow Gate_Square

2️⃣ Like this post

3️⃣ Comment with your answer

🗓️ Deadline: October 8, 2025, 24:00 (UTC+8) - 🥊 You’ve entered the Trading PK Arena, matching your opponent now...

One click to place an order and jump into the battle! Who will climb the leaderboard and claim the 👑?

Gate’s brand-new Indicators Radar feature is live! Here you can:

📈 Share your trades on the live candlestick chart to [Square] 👉️ https://www.gate.com/post

👀 Watch others’ trading moves in real time;

💬 Go head-to-head with fellow traders in the community!

Don’t just read—follow the tutorial below and get started 👇

📌 Note: This feature is available only on app version 7.20.5 or above.

The Impact of Large Investors on the Bitcoin Market

What are Bitcoin whales?

Bitcoin whales are individuals or organizations with large amounts of Bitcoin (BTC) capable of influencing the market through their trading strategies. This term is colloquially used to refer to holders with a significant stake compared to smaller participants, often referred to as "small fish" in the market. The owner of the wallet or group of wallets controlled by an entity can be an individual or a group that pools funds to make large investments.

Their vast holdings have been accumulated through mining, early investments, and other methods. Whales have access to substantial amounts of Bitcoin, giving them the power to manipulate the market by making significant purchases or sales of assets that result in price fluctuations. The abundance of whales and extreme volatility are frequently linked in the cryptocurrency space.

How much money turns a cryptocurrency fork into a Bitcoin whale?

A person or organization is considered a "Bitcoin whale" if they hold a significant amount of Bitcoin, although the threshold for this classification is not established. The widely accepted benchmark is set at 1,000 BTC, a threshold commonly cited by cryptocurrency analysis firms when identifying network entities with this minimum amount.

Currently, there are 3 addresses that hold between 100,000 and 1,000,000 BTC ( totaling 577,502 BTC ) and 108 addresses that have between 10,000 and 100,000 BTC ( accumulating 2,437,765 BTC ). These 111 richest addresses represent approximately 15.34% of the total Bitcoin supply.

Why do Bitcoin whales influence the market?

Whales exert a significant influence on market dynamics due to their enormous holdings, which grant them power to influence the supply and demand of Bitcoin. When they increase their reserves, prices tend to rise, while selling parts of their holdings can lead to declines. By maintaining substantial amounts, they create scarcity, increasing the demand and value of the asset.

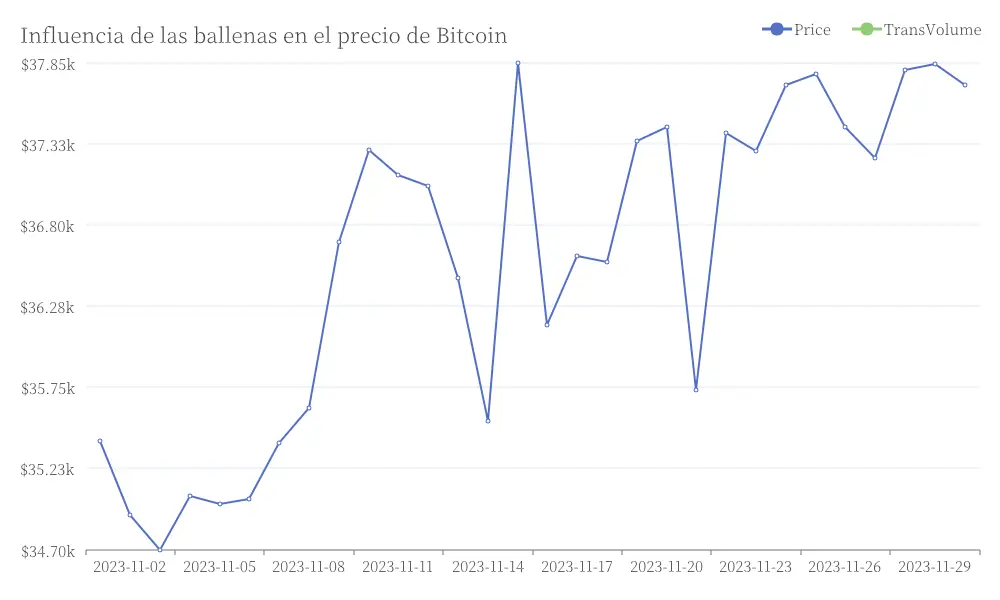

Their large transactions can trigger significant changes in prices, guiding the actions of other traders. Influence of whales on the price of Bitcoin

By frequently operating in public view, with wallets tracked by the trading community, your decisions or anticipated movements can cause significant price changes due to the following behavior of other traders.

Influence of whales on the price of Bitcoin

By frequently operating in public view, with wallets tracked by the trading community, your decisions or anticipated movements can cause significant price changes due to the following behavior of other traders.

Some whales choose over-the-counter trading (OTC) to minimize their impact on prices, while others take advantage of exchanges to manipulate the markets by signaling large buys or sells.

Trading strategies used by Bitcoin whales

Cryptocurrency whales are distinguished from ordinary investors by their long-term vision and the use of advanced investment tactics. They occasionally engage in pump-and-dump schemes to manipulate the market, make calculated purchases at low prices or during dips to accumulate assets, and hold long-term investments as protection against inflation.

They also diversify their portfolios by investing in other digital assets to spread the risk. Among their more sophisticated strategies is hunting for short and long positions through strategic sales or purchases to influence the market direction, as well as the deliberate manipulation of the price to trigger stop-loss orders from other traders.

How to detect a Bitcoin whale

Although whales often move funds secretly using innovative methods to hide their identities and holdings, the transparency of the blockchain and various Whale Alert platforms facilitate their identification. This process, known as on-chain analysis, requires a deep exploration of the blockchain and vigilant monitoring.

Traders and investors can gain valuable insights through "whale watching," closely monitoring the actions of large Bitcoin holders to make more informed decisions. The large trades made by these entities often cause abrupt movements in the asset's price. Bitcoin's public ledger allows access to all these transactions and identifies large amounts of Bitcoin in motion, providing potential signals about the future direction of the market.