- Trending TopicsView More

10.7K Popularity

4.7M Popularity

123K Popularity

79.2K Popularity

164.7K Popularity

- Pin

- 🍁 Golden Autumn, Big Prizes Await!

Gate Square Growth Points Lucky Draw Carnival Round 1️⃣ 3️⃣ Is Now Live!

🎁 Prize pool over $15,000+, iPhone 17 Pro Max, Gate exclusive Merch and more awaits you!

👉 Draw now: https://www.gate.com/activities/pointprize/?now_period=13&refUid=13129053

💡 How to earn more Growth Points for extra chances?

1️⃣ Go to [Square], tap the icon next to your avatar to enter [Community Center]

2️⃣ Complete daily tasks like posting, commenting, liking, and chatting to rack up points!

🍀 100% win rate — you’ll never walk away empty-handed. Try your luck today!

Details: ht - 💥 Gate Square Event: #Post0GWinUSDT# 💥

Post original content on Gate Square related to 0G or the ongoing campaigns (Earn, CandyDrop, or Contract Trading Competition) for a chance to share 200 USDT rewards!

📅 Event Period: Sept 25, 2025, 18:00 – Oct 2, 2025, 16:00 UTC

📌 Related Campaigns:

Earn: Enjoy stable earnings

👉 https://www.gate.com/announcements/article/47290

CandyDrop: Claim 0G rewards

👉 https://www.gate.com/announcements/article/47286

Contract Trading Competition: Trade to win prizes

👉 https://www.gate.com/announcements/article/47221

📌 How to Participate:

1️⃣ Post original cont - 🚀 #GateNewbieVillageEpisode2# ✖️ @独领风骚必暴富

💰 Share your first profit on Gate | 🎉 Recall your most unexpected gain | 🤝 Grow with the community

⏰ Event Date:Sept 24 04:00 – Sept 30 16:00 UTC+8

How to Join:

1️⃣ Follow Gate_Square + @独领风骚必暴富

2️⃣ Post on Gate Square with the hashtag #GateNewbieVillageEpisode2#

3️⃣ Share your first pot of gold or your most surprising profit on Gate—more detailed and interesting posts have a higher chance to win!

🎁 Rewards

3 lucky winners → Gate X RedBull Tumbler + $20 Futures Trial Voucher

If merchandise cannot be shipped, it will be replaced with a $30 Futures - 🚗 #GateSquareCommunityChallenge# Round 2 — Which coin is not listed on Gate Launchpad❓

Time to prove if you’re a true Gate veteran!

💰 Join the challenge — 5 lucky winners will share $50 in GT!

👉 How to participate:

1️⃣ Follow Gate_Square

2️⃣ Like this post

3️⃣ Comment with your answer

🗓️ Deadline: October 8, 2025, 24:00 (UTC+8) - 🥊 You’ve entered the Trading PK Arena, matching your opponent now...

One click to place an order and jump into the battle! Who will climb the leaderboard and claim the 👑?

Gate’s brand-new Indicators Radar feature is live! Here you can:

📈 Share your trades on the live candlestick chart to [Square] 👉️ https://www.gate.com/post

👀 Watch others’ trading moves in real time;

💬 Go head-to-head with fellow traders in the community!

Don’t just read—follow the tutorial below and get started 👇

📌 Note: This feature is available only on app version 7.20.5 or above.

Mindset When the Cryptocurrency Market Experiences Downward Movement

Last Night's Plummet: A Textbook Case of Technical Analysis

Last night's movement of Ethereum was truly a textbook example of technical analysis. After a brief adjustment in the afternoon, it rose to $4,340 before the opening of the U.S. stock market, and then plummeted down to $4,064. This was not just a "whim of the market," as important technical indicators had issued warnings in advance. The 30-minute RSI reached an oversold level of 22.7, suggesting the possibility of a short-term rebound. However, the 4-hour MACD still showed a bearish trend, indicating that downward pressure remained.

Movements of Institutional Investors: The Underlying Trends Behind the Plummet

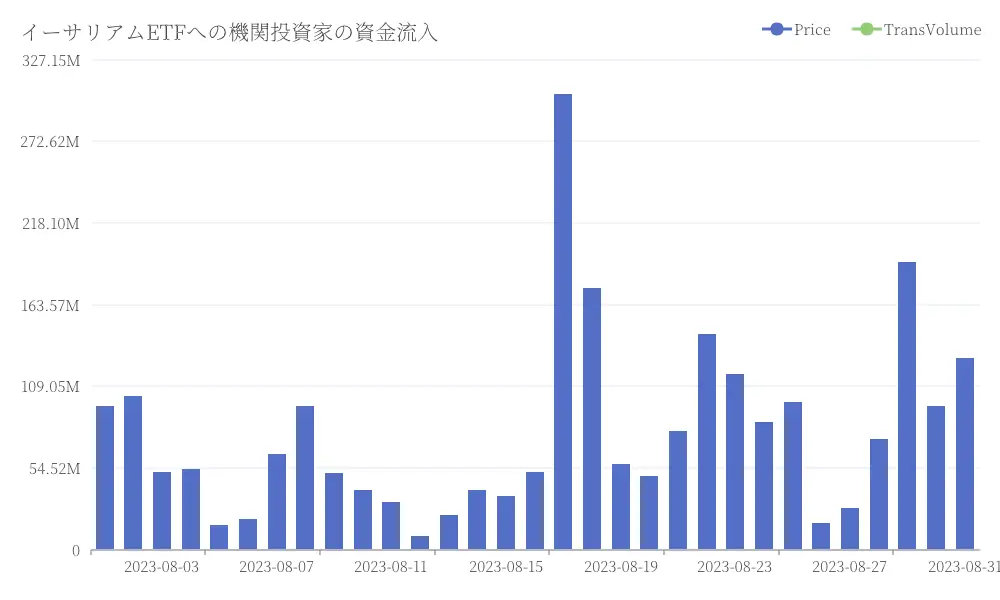

In contrast to the plummet in prices, it seems that institutional investors were quietly engaging in "bottom fishing." According to data, the weekly net inflow into Ethereum ETFs reached $2.9 billion, accounting for 80% of the total inflow into cryptocurrency ETFs. The cumulative inflow for August surpassed $11 billion. This means that approximately $160 million of "smart money" is buying Ethereum each day. Institutional investor inflow into Ethereum ETFs

Institutional investor inflow into Ethereum ETFs

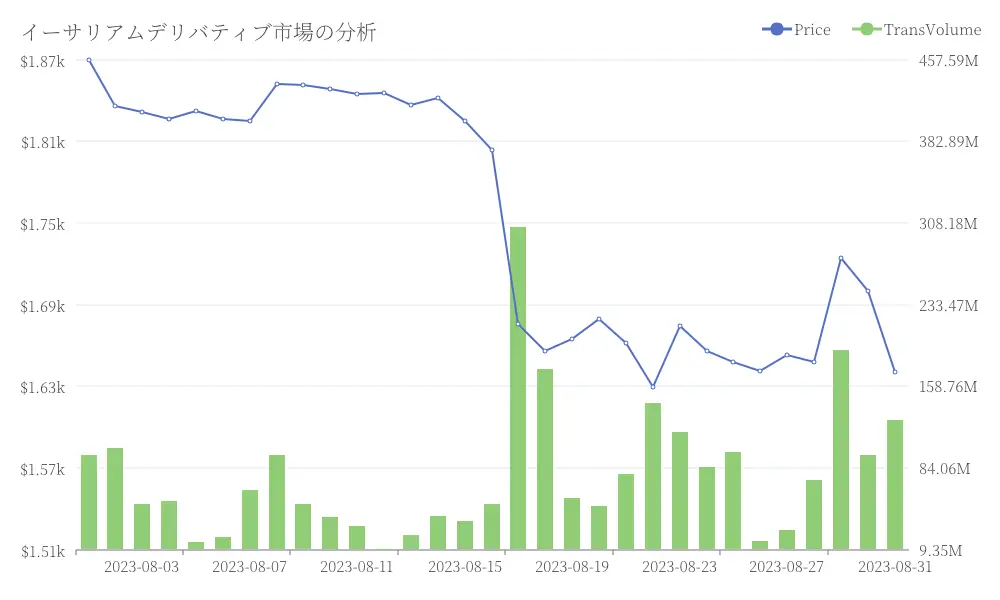

However, the reason the price continues to plummet is in the derivatives market. The open contracts for futures have reached a new record of $60.8 billion, with long position liquidations accounting for nearly 90% of the total. This indicates that traders using leverage have suffered significant losses. Institutional investors are taking this opportunity to accumulate assets at low prices, absorbing funds from individual investors. Analysis of the Ethereum Derivatives Market

Analysis of the Ethereum Derivatives Market

Today's Market Outlook: Stability During the Day, Significant Movements at Night

Based on technical analysis and market sentiment, today's market may rebound to around $4,150-4,180 during the day. Alternatively, it may first decline to around $4,064 before rebounding. $4,064 is an important support line, and if it is broken, there is a possibility of a decline to $3,995-3,800. In the evening, the movement after the start of the U.S. stock market will be key; if $4,064 is maintained and $4,200 is recovered, there is a possibility of a rebound to $4,350-4,400, while there is also a possibility of testing the demand zone around $3,800.

Trading Strategy: Be agile in the short term, invest at low prices in the long term.

There are two strategies for short-term traders. As a short-selling strategy, consider taking a short position if there is a rebound in the range of $4,150 to $4,200, with a stop-loss line set at $4,250 and a target set below $4,050. As a buying strategy, consider taking a long position if it stabilizes in the range of $4,064 to $4,080, with a stop-loss line at $3,990 and a target set above $4,180. Risk management is crucial, and do not take more than 2-3% of your capital at risk in a single trade. Pay attention to the increased volatility at the start of the U.S. stock market and keep an eye on the Federal Reserve's policy outlook and the movements of the dollar index.

The cryptocurrency market is not a gambling place where you can "become a millionaire overnight," but rather a battlefield where "knowledge is monetized." Last night's plummet of Ethereum was a "market correction" by institutional investors and an opportunity for wise investors to "build positions." As analyst James Seyffart points out, "The continued inflow of funds into Ethereum ETFs indicates that institutional investors are strategically allocating Ethereum as a 'core digital asset.'"

Currently, Ethereum is struggling around $4,100, but the real battle is just beginning. After the U.S. stock market opens tonight, the flow of funds from institutional investors and macroeconomic trends will determine the next important direction. It's essential to stay calm, analyze without being swayed by market sentiment, and seize opportunities.