Tether's Compliance Adventure

In August, Bo Hines resigned from the White House Crypto Council and swiftly assumed the role of CEO of Tether’s new US division. His mission is to launch USAT, a stablecoin designed to comply with the GENIUS Act. USAT will undergo monthly audits, maintain reserves exclusively in cash and short-term US Treasuries, and operate under full federal banking supervision.

Meanwhile, USDT continues to process over $1 trillion in monthly transactions with reserves comprising Bitcoin, gold, and secured loans. These assets are managed through offshore entities that have never been subjected to a comprehensive audit.

Same company. Two completely different approaches to the same product.

Tether earned $13.7 billion in profit last year by perfecting the “ask for forgiveness, not permission” model. In contrast, Circle went public at a $7 billion valuation by doing their due diligence and asking the right questions before moving forward.

The announcement should have been a celebration.

After years of regulatory battles, concerns about transparency, and persistent questions about reserve backing, Tether was finally offering the American market what critics had long demanded: full compliance, independent audits, regulated custodians, and reserves held exclusively in cash and short-term US Treasuries.

Instead, we find ourselves discussing regulatory arbitrage, competitive moats, and those delightfully awkward moments when revolutionary technology clashes with the established order, leaving everyone pretending this was part of the plan all along.

It turns out, with enough creativity in corporate structure, it’s possible to serve two masters simultaneously.

TOKEN2049 Happy Bird Ends Today!

In less than two weeks, the global crypto community converges at Marina Bay Sands for the world’s largest crypto event: TOKEN2049 Singapore. You can still save US$400 off your tickets.

The unmatchable speaker lineup includes Eric Trump and Donald Trump Jr. (World Liberty Financial), Tom Lee (Fundstrat CIO), Vlad Tenev (Robinhood Chairman & CEO), Paolo Ardoino (Tether CEO), and Arthur Hayes (CIO, Maelstrom), with many more to be announced.

Join 25,000+ attendees, 500+ exhibitors, and 300 speakers as the entire venue transforms into a festival-style pop-up city, featuring a rock-climbing wall, zipline, pickleball courts, live performances, wellness sessions, and more.

Don’t miss your chance to be part of the defining crypto event of the year.

Before diving into USAT, let’s take a moment to appreciate the sheer scale of what Tether has accomplished with USDT. We’re talking about $172 billion in circulating tokens that process over $1 trillion in monthly transactions across crypto markets. If Tether were a country, it would rank as the 18th-largest holder of US Treasury debt, having accumulated $127 billion in government bonds.

The company made $13.7 billion in profit last year – not revenue, but profit – placing it among the most profitable companies, surpassing many Fortune 500 companies.

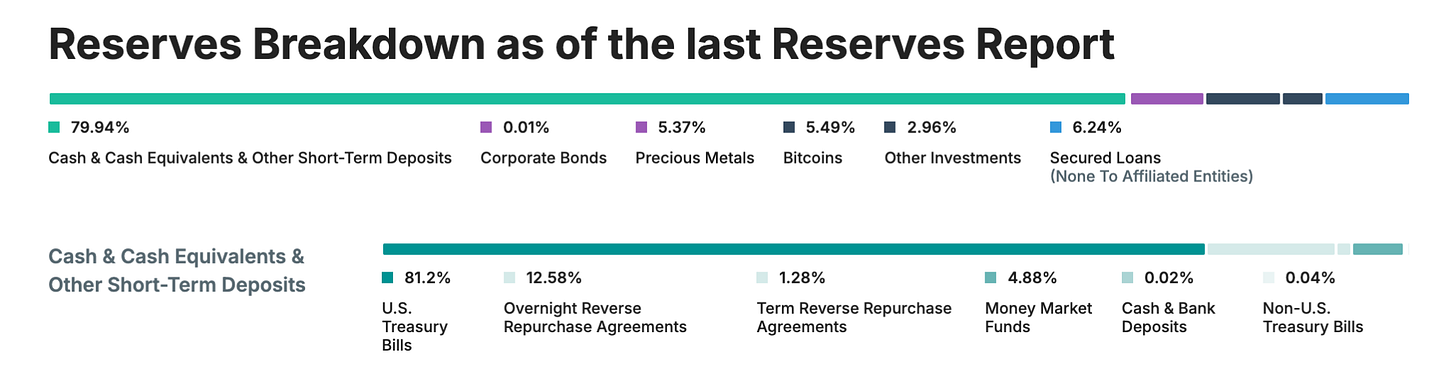

All of this was built without full audits, comprehensive regulatory oversight, or the kind of transparency that traditional financial institutions take for granted. Instead, Tether has relied on quarterly attestations, not full audits, and has included assets like gold, Bitcoin, and secured loans in its reserves–assets that wouldn’t be allowed under strict stablecoin regulations. Additionally, it has largely operated through offshore entities in Hong Kong and the British Virgin Islands.

This has been the ultimate example of how, sometimes, you can build something enormous by doing exactly the opposite of what regulators would prefer.

Enter the GENIUS Act (And The Problem)

Then came the GENIUS Act in July 2015, the first comprehensive stablecoin regulation in the United States. Suddenly, the US market – the world’s most lucrative and influential crypto market – had new strict rules.

- 100% reserves in cash and short-term US Treasuries (no Bitcoin, no gold, no secured loans)

- Monthly independent audits with CEO and CFO attestations

- US-licensed issuers with US-supervised custodians

- Full AML/KYC compliance with freezing capabilities

- No interest payments to holders

- Complete transparency in reserve composition

Looking at this list and then at USDT’s current structure, the challenge becomes clear. The law effectively drew a bright line between “foreign” and US-domiciled stablecoins. USDT, issued by Tether entities in the British Virgin Islands and Hong Kong, couldn’t simply flip a switch to become compliant. It would require a complete overhaul of its corporate structure, reserve composition, and operational framework.

Even more problematically for Tether, true compliance with the GENIUS Act would demand the kind of transparency the company has historically avoided. As of 2025, Tether still provides quarterly “attestations” instead of full audits. Its reserves include approximately 16% in assets explicitly prohibited by the GENIUS Act requirements: gold (3.5%), Bitcoin (5.4%), secured loans, and corporate bonds.

Then why not just fix USDT?

Why launch an entirely new token rather than simply bringing USDT into compliance?

The simple answer is that retrofitting USDT would be akin to trying to turn a speedboat into an aircraft carrier while it’s still racing. USDT currently serves 500 million global users who specifically chose it because it wasn’t subject to strict US regulatory oversight. Many of these users are in emerging markets, where USDT provides access to dollars when local banking systems are unreliable or prohibitively expensive.

If Tether suddenly imposed US-level KYC requirements, freezing capabilities, and audit protocols on all USDT users globally, it would fundamentally change the very product that made USDT successful. A Brazilian small business owner using USDT to avoid currency volatility doesn’t want to deal with US regulatory compliance and a crypto trader in Southeast Asia doesn’t need monthly CEO attestations.

But there’s a deeper strategic reason: market segmentation. By creating USAT, Tether can offer a “premium” regulated product for US institutions while keeping USDT as the “global standard” for everyone else. It’s like having both a luxury brand and a mass market brand – the same company, different products for different customers.

The USAT Value Proposition (Such As It Is)

So what exactly is USAT offering that USDC doesn’t already provide? This is where Tether’s pitch gets a bit fuzzy?

The technical architecture supports this dual approach. Both tokens leverage Tether’s Hadron platform, allowing seamless integration with existing infrastructure while maintaining regulatory separation. Liquidity can flow between the systems where legally permissible, but compliance “firewalls” ensure each token operates within its jurisdictional constraints.

USAT will be issued by Anchorage Digital Bank (a federally chartered crypto bank) with reserves custodied by Cantor Fitzgerald. It will be fully GENIUS Act compliant, with monthly audits, transparent reserves, and all the regulatory bells and whistles that institutional users supposedly want. With former White House crypto advisor Bo Hines at the helm, USAT benefits from strong political backing and Washington relationships.

However, Circle’s USDC already ticks all of these boxes and has been doing so for years. USDC boasts deep liquidity, established exchange integrations, institutional partnerships, and a clean regulatory track record. It’s already the preferred stablecoin for US institutions.

Tether’s main advantage is… well, it’s Tether. The company has built the world’s largest stablecoin distribution network, with a huge existing market share and it generates $13.7 billion in annual profits to fund its growth. As CEO Paolo Ardoino stated: “Unlike our competitors, we don’t need to rent out distribution channels. We own them.”

Tether will need to bootstrap liquidity for USAT from essentially nothing. That means convincing exchanges to list USAT, market makers to provide liquidity, and institutional customers to actually use it. Even with Tether’s deep pockets and vast distribution network, this won’t be easy.

USDC controls about 25% of the global stablecoin market but dominates regulated US flows. USDT holds 58% globally but remains largely excluded from the US-compliant US sector.

The company is betting that institutional users want alternatives to avoid concentration risk. If something goes wrong with Circle or USDC, institutions may seek another fully regulated option. Plus, Tether can leverage its existing relationships – such as the partnership with Cantor Fitzgerald – to potentially offer better terms or services.

Circle’s recent moves highlight the competitive stakes. In June 2025, Circle completed a successful IPO, launched its own blockchain called Arc specifically for stablecoin finance, and continues to expand global payment corridors. Circle’s regulatory-first approach has clearly paid dividends in terms of institutional adoption.

But USAT has certain advantages that USDC lacks. Tether’s global distribution network includes “hundreds of thousands of physical distribution points,” according to CEO Paolo Ardoino, along with digital partnerships like the $775 million investment in Rumble. This infrastructure took over a decade to build and can’t be easily replicated.

Tether’s strength lies in its global relationships and financial firepower. The company generated $5.7 billion in profit during the first half of 2025, providing substantial resources for market-making, liquidity incentives, and partnership development. Unlike its competitors that must “rent” distribution channels, Tether owns much of its infrastructure.

USAT’s biggest advantage could be compatibility. If it works with existing USDT infrastructure, users won’t need to overhaul their systems. For developers who’ve spent months integrating USDT, switching to another Tether token beats starting over with a completely different provider.

Some institutions or risk-minded users may simply want exposure to multiple regulated stablecoins for diversification, hedging counterparty risk between Circle (USDC) and Tether (USAT).

The timeline here is crucial. USAT is targeting a year-end 2025 launch, giving Tether limited time to build liquidity, secure exchange listings, and establish market-maker relationships. In financial markets, first-mover advantages can be decisive—and users typically gravitate towards established, liquid options rather than newcomers.

Critics argue that USAT is essentially “compliance theater” – a way for Tether to gain access to the US market without addressing the transparency and operational issues at the heart of its core business.

There’s some validity to this criticism. Tether’s decision to launch USAT rather than bring USDT into full compliance does suggest that the company values its current operational flexibility more than it wants comprehensive regulatory legitimacy.

On the flip side, one could argue that this is exactly how markets should function. Different customer segments have different needs and risk appetites. US institutions require regulatory compliance and transparency, while emerging market users prioritise accessibility and low fees. Why shouldn’t one company cater to both segments with different products?

The Verdict

Tether’s dual-stablecoin strategy reflects broader tensions within the crypto industry regarding regulation, decentralisation, and institutional adoption. The industry is increasingly faced with the challenge of balancing crypto’s original permissionless ethos with the need to embrace regulatory frameworks that facilitate mainstream adoption.

USAT represents Tether’s bet that they can achieve both: Securing regulatory legitimacy for institutional users while maintaining flexibility for global retail adoption. Whether this strategy succeeds will depend on execution, market acceptance, and the stability of evolving regulatory frameworks.

The regulatory environment is still in flux. While the GENIUS Act offers some clarity, the specifics of its implementation and enforcement remain uncertain. Changes in administration or shifts in regulatory priorities could significantly stablecoin issuers’ strategies.

More fundamentally, USAT raises crucial questions about the nature of Tether’s original success. Was USDT’s dominance built on regulatory arbitrage, which may no longer be sustainable? Or does it reflect genuine innovation in global financial infrastructure, one that regulatory compliance could enhance rather than constrain?

The answer to this question may ultimately determine whether USAT represents Tether’s evolution into a mature financial institution or an admission that their original model had fundamental limitations. Either way, the launch of USAT marks a new chapter in the competition and regulation of stablecoins.

The king is building a second kingdom. Whether he can rule both remains to be seen.

That’s it about today’s deep dive. See you next week with another one.

Disclaimer:

- This article is reprinted from [TOKEN DISPATCH]. All copyrights belong to the original author [Thejaswini M A]. If there are objections to this reprint, please contact the Gate Learn team, and they will handle it promptly.

- Liability Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute any investment advice.

- Translations of the article into other languages are done by the Gate Learn team. Unless mentioned, copying, distributing, or plagiarizing the translated articles is prohibited.

Related Articles

In-depth Explanation of Yala: Building a Modular DeFi Yield Aggregator with $YU Stablecoin as a Medium

What is Stablecoin?

Top 15 Stablecoins

A Complete Overview of Stablecoin Yield Strategies

Stripe’s $1.1 Billion Acquisition of Bridge.xyz: The Strategic Reasoning Behind the Industry’s Biggest Deal.