Bitcoin: O Comércio Depois do Comércio

Este artigo analisa a correlação entre os preços do Bitcoin e fatores como liquidez global, mercado de ações dos EUA e déficits fiscais. Também argumenta que a correlação entre Bitcoin e o mercado de ações dos EUA pode ser espúria. O artigo explora ainda o impacto das políticas comerciais da administração Trump nos fluxos de capital globais e as implicações potenciais para os preços do Bitcoin.TL;DR

Quero anotar alguns pensamentos que venho ponderando ultimamente, principalmente sobre como o Bitcoin pode se sair durante uma grande mudança de regime nos fluxos de capital globais, algo que nunca experimentou verdadeiramente antes. Acredito que, uma vez que a fase de descarte termine, isso poderia ser uma negociação incrível. Neste artigo, eu dissecarei meu pensamento. Vamos mergulhar.

Quais foram os principais impulsionadores do preço do Bitcoin historicamente?

Estou construindo sobre o trabalho de Michael Howell em relação aos drivers históricos dos movimentos de preço do Bitcoin, e usando essa base para entender melhor como essas correntes cruzadas podem evoluir no futuro próximo.

Conforme mostrado no gráfico acima, os fatores impulsionadores do BTC incluem:

Apetite dos investidores por ativos beta de alto risco

Correlação com ouro

liquidez global

Desde 2021, o simples framework que tenho usado para avaliar o apetite ao risco, o desempenho do ouro e a liquidez global se concentra na porcentagem do déficit fiscal em relação ao PIB. Esta métrica oferece uma rápida visão sobre o impulso fiscal que tem dominado os mercados globais desde 2021.

Um déficit fiscal mais alto (como uma porcentagem do PIB) leva mecanicamente a uma inflação mais alta, um PIB nominal mais alto e, subsequentemente, maiores receitas corporativas totais - uma vez que a receita é uma figura nominal. Para empresas capazes de alavancar economias de escala, isso representa boas notícias para o crescimento dos lucros.

Em grande medida, a política monetária tem desempenhado um papel secundário em comparação com o estímulo fiscal, que tem sido o principal impulsionador por trás da atividade de ativos de risco. A partir do gráfico atualizado regularmente por@BickerinBrattle, é evidente que o impulso monetário nos EUA é tão contido em relação à política fiscal que vou deixá-lo de lado por enquanto.

Conforme mostrado no gráfico abaixo, podemos observar a partir dos dados das principais economias desenvolvidas do Ocidente que o déficit fiscal dos EUA como percentual do PIB é significativamente maior do que o de qualquer outro país.

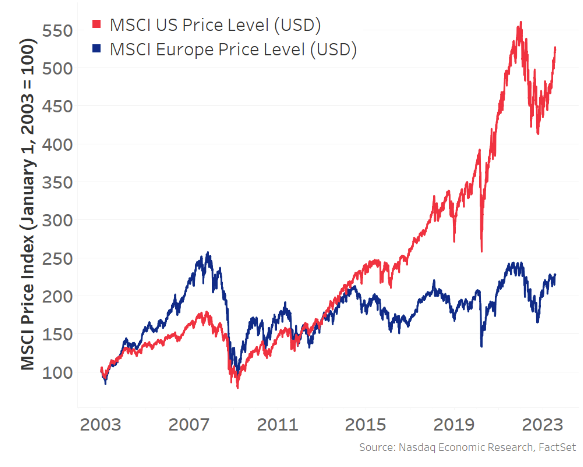

Devido a um déficit tão grande nos EUA, o crescimento da renda tem permanecido dominante, levando o mercado de ações dos EUA a superar significativamente outras economias modernas:

Essa dinâmica tornou o mercado de ações dos EUA um dos principais impulsionadores marginais do crescimento de ativos de risco, do efeito riqueza e da liquidez global. Como resultado, os Estados Unidos se tornaram o destino mais favorecido para os fluxos de capital globais. Essa dinâmica de entrada de capital, combinada com um enorme déficit comercial, significa que os EUA recebem bens em troca de estrangeiros recebendo dólares, que são então reinvestidos em ativos denominados em dólares (pense em Tesouros e no MAG7). Assim, os EUA se tornaram o principal impulsionador do apetite por risco global:

Agora, voltando ao trabalho de Michael Howell. Por mais de uma década, o apetite ao risco e a liquidez global têm sido impulsionados principalmente pelos Estados Unidos, e essa tendência acelerou-se desde a pandemia de COVID-19 devido aos relativamente massivos déficits fiscais da América.

Portanto, enquanto o Bitcoin é um ativo de liquidez global (não limitado aos EUA), ele mostrou uma correlação positiva com o mercado de ações dos EUA, e essa relação tem se tornado cada vez mais evidente desde 2021:c

Agora, acredito que essa correlação com o mercado de ações dos EUA é espúria. Quando uso o termo “correlação espúria” aqui, quero dizer no sentido estatístico, pois acredito que exista uma terceira variável causal que não é mostrada na análise de correlação, mas é na verdade a força motriz. Argumento que essa variável é a liquidez global, que, como estabelecemos acima, tem sido dominada pelos EUA ao longo da última década.

À medida que mergulhamos mais fundo na toca do coelho estatístico, também devemos estabelecer a causalidade, não apenas a correlação. Felizmente, Michael Howell também fez um excelente trabalho aqui, usando testes de causalidade de Granger para estabelecer uma relação causal entre a liquidez global e o Bitcoin.

Isso pode servir como nosso ponto de referência inicial?

Bitcoin é principalmente impulsionado pela liquidez global, e como os Estados Unidos têm consistentemente sido o principal motor por trás do aumento da liquidez global, uma correlação espúria surgiu.

Agora, no último mês, enquanto todos nós estávamos especulando sobre as políticas comerciais de Trump e os objetivos do capital global e reestruturação ordenada da liquidez, algumas narrativas dominantes surgiram. Eu as categorizo da seguinte forma:

A administração Trump quer reduzir os déficits comerciais com outros países. Mecanicamente, isso significa menos dólares fluindo para o exterior, e esses dólares não seriam mais reinvestidos em ativos dos EUA. Sem essa redução, o déficit comercial não pode diminuir.

A administração Trump acredita que as moedas estrangeiras estão sendo enfraquecidas artificialmente, fortalecendo assim artificialmente o dólar. Eles pretendem reequilibrar isso. Em resumo, um dólar mais fraco e moedas estrangeiras mais fortes resultariam em taxas de juros crescentes no exterior, levando o capital a voltar para casa em busca de taxas melhores e de ações domésticas que se beneficiam de ajustes favoráveis no câmbio.

A abordagem de "atirar primeiro, perguntar depois" de Trump nas negociações comerciais está levando o resto do mundo - cujos déficits fiscais são pequenos em comparação com os dos EUA - a intensificar o investimento governamental em defesa, infraestrutura e protecionismo amplo, buscando maior autossuficiência. Independentemente de as negociações tarifárias se acalmarem (com exceção da China), acredito que o gênio está fora da garrafa e os países continuarão seguindo esse caminho.

Trump quer que outros países aumentem seus gastos com defesa como uma porcentagem do PIB e contribuam mais para a OTAN, uma vez que os EUA têm carregado um fardo desproporcional. Isso também contribui para os déficits fiscais.

Vou deixar de lado minhas opiniões pessoais sobre essas ideias — muitas já foram compartilhadas — e, em vez disso, focar nas consequências lógicas dessas narrativas se continuarem a se desenrolar:

Capital deixará ativos denominados em dólares e voltará para casa. Isso significa desempenho inferior das ações dos EUA em relação ao resto do mundo, maiores rendimentos de títulos e um dólar mais fraco.

Este capital está retornando para lugares onde os déficits fiscais não serão mais limitados. Outras economias modernas começarão a gastar e imprimir para financiar esses déficits expandidos.

À medida que os EUA continuam a passar de um parceiro de capital global para uma postura mais protecionista, os detentores de ativos em dólares terão de começar a precificar prêmios de risco mais altos associados a esses ativos anteriormente "seguros" e atribuir-lhes margens de segurança maiores. Quando isso acontece, os rendimentos dos títulos subirão e os bancos centrais estrangeiros buscarão a diversificação do balanço patrimonial, afastando-se das puras Treasuries dos EUA em direção a outras commodities neutras como o ouro. Da mesma forma, os fundos soberanos e os fundos de pensão no exterior também podem buscar uma maior diversificação da carteira.

A contra narrativa é que os EUA permanecem o centro de inovação e crescimento impulsionado pela tecnologia, e nenhum país provavelmente o destronará. A Europa, sendo muito burocrática e socialista, não pode seguir o capitalismo da mesma forma que os EUA fazem. Eu simpatizo com essa visão. Isso sugere que isso pode não ser uma tendência de vários anos, mas sim um ajuste de médio prazo, uma vez que a valoração desses nomes de tecnologia poderia limitar seu potencial de valorização ao longo de um certo período.

Voltando ao título deste artigo, O Negócio Após o Negócio, o primeiro negócio é vender os ativos em dólares excessivamente detidos pelos quais o mundo inteiro está sobrecarregado, evitando a desvalorização contínua. Como esses ativos são tão favorecidos globalmente, este desenrolar pode se tornar desordenado, à medida que grandes gestores de fundos e jogadores especulativos como fundos de hedge multiestratégia com stop-loss apertados atingem seus limites de risco. Quando isso acontece, chega o dia da chamada de margem — tudo é vendido para levantar dinheiro. A indústria está atualmente passando por este processo, preparando o seu pó seco.

No entanto, à medida que essa tendência de queda se estabiliza, o próximo comércio começa - um que apresenta uma carteira mais diversificada: ações estrangeiras, títulos estrangeiros, ouro, commodities e até Bitcoin.

Durante esses dias de mercado de rotação e dias sem chamada de margem, já começamos a ver essa dinâmica se formar. O índice do dólar está em baixa, as ações dos EUA estão subperformando, o ouro está disparando e o Bitcoin tem mostrado um desempenho relativo surpreendentemente forte em comparação com as ações de tecnologia tradicionais dos EUA.

Eu acredito que quando essa mudança ocorrer, o crescimento marginal na liquidez global se transformará em uma dinâmica completamente oposta ao que estamos acostumados. O resto do mundo assumirá a responsabilidade de impulsionar a liquidez global e o apetite por risco.

Ao considerar os riscos diversificados neste ambiente de guerra comercial global, preocupo-me com os riscos de mergulhar profundamente em ativos de risco estrangeiros, dada a possibilidade de manchetes tarifárias desagradáveis que poderiam impactar severamente esses ativos. Por isso, nesta transição, vejo o ouro e o Bitcoin como as ferramentas mais limpas para a diversificação global.

O ouro tem estado em modo de ruptura absoluta, atingindo novas máximas históricas diariamente, refletindo essa mudança de regime. No entanto, embora o Bitcoin tenha tido um desempenho surpreendentemente bom ao longo dessa mudança, sua correlação beta com o apetite pelo risco até agora limitou seu potencial - não acompanhou o desempenho excepcional do ouro.

Portanto, à medida que avançamos para o reequilíbrio do capital global, acredito que o “comércio após o comércio” seja o Bitcoin.

Quando comparo este framework com o trabalho relacionado de Howell, vejo as peças se encaixando juntas:

O mercado de ações dos EUA não é influenciado pela liquidez global em si, mas pela liquidez medida através do impulso fiscal e de alguns influxos de capital (que acabamos de estabelecer que podem parar ou até reverter). No entanto, o Bitcoin é um ativo global e reflete uma visão mais ampla da liquidez global.

À medida que essa narrativa se torna mais definida e os alocadores de risco continuam a reequilibrar, acredito que o apetite pelo risco será impulsionado pelo resto do mundo, não pelos EUA.

O ouro já teve um desempenho excepcional, então, para o aspecto correlacionado ao ouro do BTC, essa caixa está marcada.

Com tudo isso no lugar, vejo pela primeira vez o potencial do Bitcoin se desvincular das ações de tecnologia dos EUA nos mercados financeiros. Eu sei - é uma chamada de alto risco e muitas vezes marca os topos locais do Bitcoin. Mas desta vez, há um potencial real para uma mudança significativa nos fluxos de capital, o que poderia torná-lo sustentável.

Então, para mim, como trader macro em busca de riscos, o Bitcoin parece o trade mais limpo depois do trade. Você não pode tarifar o Bitcoin. Ele não se importa com fronteiras. Oferece alta exposição beta para uma carteira sem os riscos extremos atualmente associados à tecnologia dos EUA. Não preciso apostar na UE se acertar. E oferece exposição pura à liquidez global, não apenas à liquidez dos EUA.

Este é precisamente o tipo de mecanismo de mercado para o qual o Bitcoin nasceu para servir. Uma vez que a poeira baixar, ele será o cavalo mais rápido. Acelere.

Aviso Legal:

Este artigo é reproduzido a partir de [ X]. Todos os direitos autorais pertencem ao autor original [@fejau_inc]. Se houver objeções a esta reimpressão, entre em contato com o Gate Learnequipe, e eles vão lidar com isso prontamente.

Isenção de Responsabilidade: As opiniões expressas neste artigo são exclusivamente do autor e não constituem qualquer conselho de investimento.

As traduções do artigo para outros idiomas são feitas pela equipe Gate Learn. A menos que mencionado, copiar, distribuir ou plagiar os artigos traduzidos é proibido.

Artigos Relacionados

O que é Bitcoin?

Tudo o que você precisa saber sobre negociação de estratégia quantitativa

O que é mineração BTC?

Da emissão de ativos à escalabilidade do BTC: evolução e desafios

Inscrições na cadeia: O renascimento do BTC