Post content & earn content mining yield

placeholder

Midnight128

Loss of the desire to express oneself\nToo lazy to argue even with idiots\nSilent during my wife's arguments\n\nNo reaction when seeing porn\nNo complaints in the face of difficulties\n\nOnly the calmness of life remains\nAnd the helplessness towards things and people that cannot be changed\nEventually accepting my mediocrity and flaws

View Original- Reward

- like

- Comment

- Repost

- Share

Gate Annual Report is out! Let's take a look at my yearly performance

Click the link to view your exclusive #2025Gate年度账单 and receive a 20 USDT position experience voucher https://www.gate.com/zh/competition/your-year-in-review-2025?ref=VVRCVFsN&ref_type=126&shareUid=VVVAXF5fBwO0O0OO0O0O

View OriginalClick the link to view your exclusive #2025Gate年度账单 and receive a 20 USDT position experience voucher https://www.gate.com/zh/competition/your-year-in-review-2025?ref=VVRCVFsN&ref_type=126&shareUid=VVVAXF5fBwO0O0OO0O0O

- Reward

- 1

- Comment

- Repost

- Share

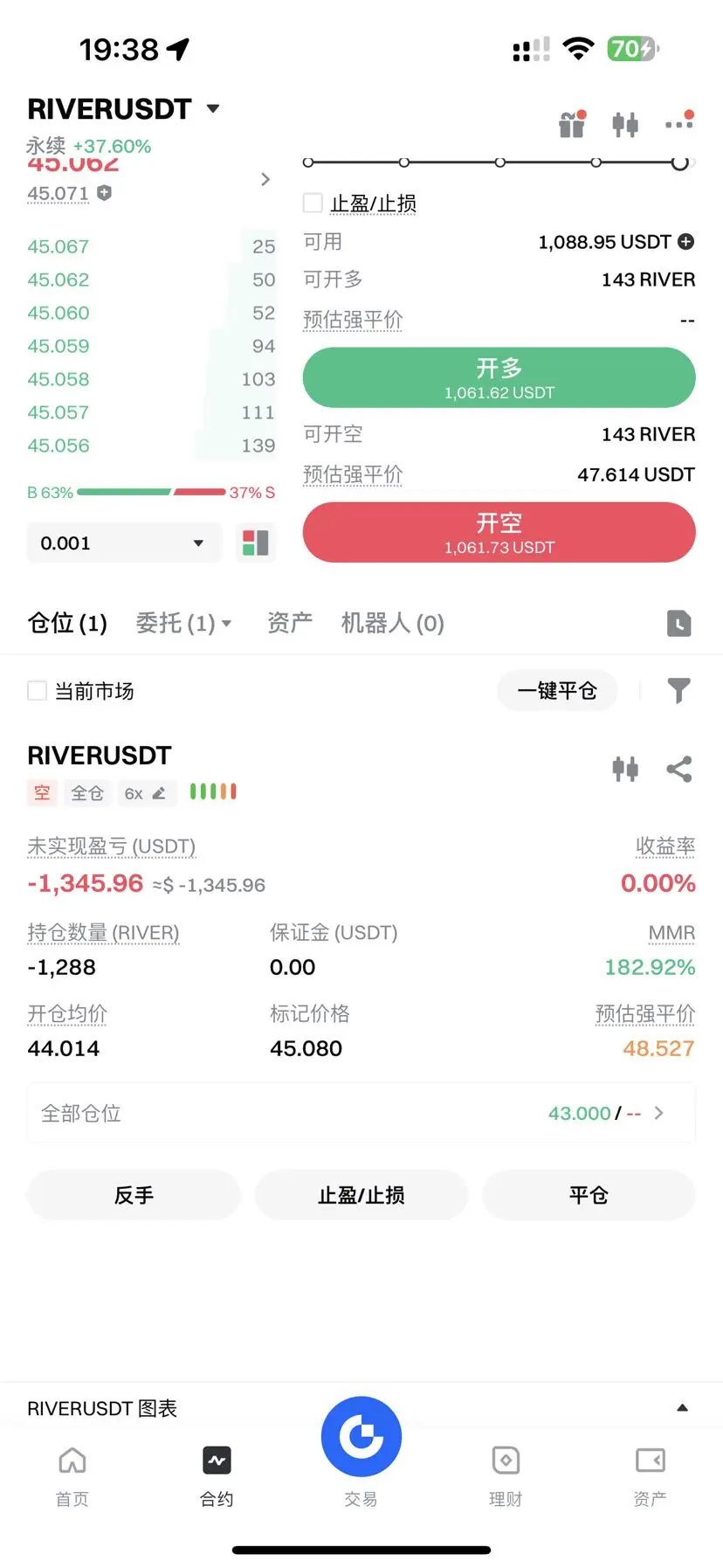

#RIVER #社区成长值抽奖十六期 just over ten thousand U came straight at me, satellite positioning😂😂😂😂😂😂😂😂😂😂

View Original

- Reward

- 2

- 13

- Repost

- Share

mochedan :

:

Come on, come on, everyone come and claim the gold. Anyway, I didn't get any. I don't know if you guys received yours?View More

和平精英

和平精英

Created By@LINA1

Listing Progress

0.29%

MC:

$3.45K

Create My Token

Today, a giant whale from the Satoshi Nakamoto era sold all of their over 10,000 BTC after holding for 12 years, worth $1.2 billion. No wonder Bitcoin has dropped so much; it turns out this whale was dumping the market.

BTC-2.58%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Rebound is weak, bears are in control, firmly bearish! The evening trend perfectly aligns with the prediction, with Bitcoin's first target basically reached, already hitting 2000 points; Ethereum's first target was met as expected, gaining 100 points of space! The strength of the results has already proven it!$BTC $ETH #加密市场回调

View Original

- Reward

- like

- Comment

- Repost

- Share

#GateTradFi1gGoldGiveaway Traditional finance and digital innovation are coming together in an exciting way ✨

Gate.io continues to build powerful bridges between trusted value systems and modern trading experiences.

Gold has always symbolized stability, strength, and long-term confidence. Combining that legacy with today’s fast-moving financial world creates a unique opportunity for users who believe in balanced growth and smart participation.

This giveaway reflects how classic assets and next-generation platforms can coexist, offering users more ways to explore, learn, and engage with the mar

Gate.io continues to build powerful bridges between trusted value systems and modern trading experiences.

Gold has always symbolized stability, strength, and long-term confidence. Combining that legacy with today’s fast-moving financial world creates a unique opportunity for users who believe in balanced growth and smart participation.

This giveaway reflects how classic assets and next-generation platforms can coexist, offering users more ways to explore, learn, and engage with the mar

- Reward

- 1

- 1

- Repost

- Share

MarketAdvicer :

:

2026 GOGOGO 👊Check in to Stream, Sprint for VIP+1 and Monthly Bonus https://www.gate.com/campaigns/3899?ref=VGJMUWPYBW&ref_type=132

- Reward

- 1

- 1

- Repost

- Share

MrFlower_XingChen :

:

2026 GOGOGO 👊Thank you all for your support of Gate Live. We are excited to launch the "Comment and Win Rewards Challenge." Users only need to watch the live broadcast and actively comment and interact in the chat room to have a chance to win exquisite merchandise daily, while staying updated with industry hot topics and gaining the latest industry trends and in-depth analysis.

#币圈洞察 #币圈洞察工资条

View Original#币圈洞察 #币圈洞察工资条

- Reward

- like

- Comment

- Repost

- Share

Gate Live Creator Incentive Program — Now Upgraded

Live-to-Earn | Livestream Check-in · Round 1

💰 Monthly Rewards × Traffic Boosts × VIP Upgrades — Get Them All

Stream consistently, rewards paid bi-weekly

📈 The more you stream, the more exposure you get

Climb the leaderboard and break into the Monthly TOP 10 Streamers

Earn bonus rewards, platform traffic, and official support

👉 Sign up and start streaming

https://www.gate.com/campaigns/3899

Not a streamer yet? Turn your voice and knowledge into rewards — join now:

https://www.gate.com/live

Live-to-Earn | Livestream Check-in · Round 1

💰 Monthly Rewards × Traffic Boosts × VIP Upgrades — Get Them All

Stream consistently, rewards paid bi-weekly

📈 The more you stream, the more exposure you get

Climb the leaderboard and break into the Monthly TOP 10 Streamers

Earn bonus rewards, platform traffic, and official support

👉 Sign up and start streaming

https://www.gate.com/campaigns/3899

Not a streamer yet? Turn your voice and knowledge into rewards — join now:

https://www.gate.com/live

- Reward

- 6

- 8

- Repost

- Share

ybaser :

:

2026 GOGOGO 👊View More

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 1

- 1

- Repost

- Share

IAmHaifeng :

:

Community Growth Points Lottery Carnival Invite friends to participate in the growth points lottery and win generous prizes!

https://www.gate.com/activities/pointprize/?now_period=16&refUid=5720533

cctv

CCTV

Created By@sawahtonin

Listing Progress

0.00%

MC:

$3.36K

Create My Token

JUST IN: Donald Trump earned $1.4 billion from #crypto in one year, according to report. #crypto

- Reward

- like

- Comment

- Repost

- Share

#AIBT Keep an eye on it, a promising project. Believe in it, so I choose to follow closely. AIBT soars to the sky, went all in.

View Original

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

What is the current long BTC condition today? Is it crashing? Let's catch it again for the next month. Can the market buy again within the next week?

BTC-2.58%

- Reward

- 2

- 1

- Repost

- Share

GateUser-2b88c4a2 :

:

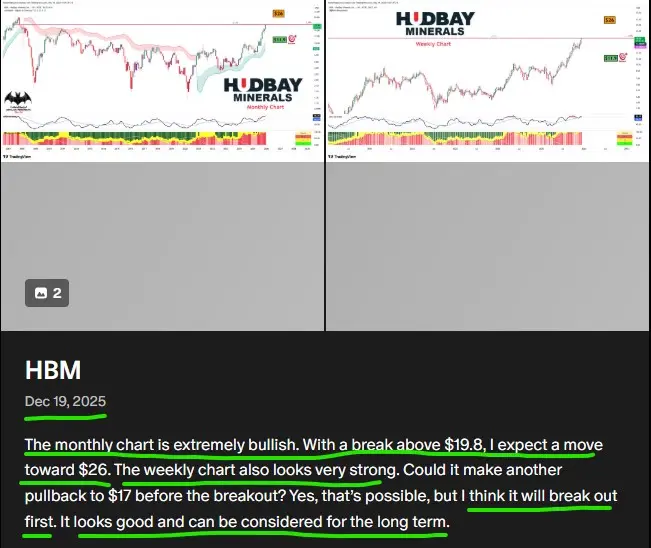

ygcxgtxfugkjfytfyfyficucxyyztstddyyfghhvhvhcyftfryyuhutfrdsrRtzuxcuciivcocociiciciccicicicicivi$HBM Long term call 💰 🎯💯👇\n

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

🚨1.21 US Cryptocurrency Morning Report: BTC drops back to 89K! Trump calls for tariffs + buying Greenland, $800 million+ liquidated across the network, bulls collectively ascend to heaven 😭

Gold hits a new high celebration, BTC: I’m just taking a break, will carry on soon! 🤡

Institutions ETF aggressively吸收 $2 billion retail investors: Thank you, President, for making us all winners (wallets emptied) 😂

Is this still a bear market or a major reversal with institutions bottoming out?

Paper hands have run, can diamond hands still hold? Cry/laugh in the comments! 👇

#比特币 #特朗普 #加密货币 #爆仓

View OriginalGold hits a new high celebration, BTC: I’m just taking a break, will carry on soon! 🤡

Institutions ETF aggressively吸收 $2 billion retail investors: Thank you, President, for making us all winners (wallets emptied) 😂

Is this still a bear market or a major reversal with institutions bottoming out?

Paper hands have run, can diamond hands still hold? Cry/laugh in the comments! 👇

#比特币 #特朗普 #加密货币 #爆仓

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More28.8K Popularity

14.97K Popularity

3.5K Popularity

49.09K Popularity

342.17K Popularity

Hot Gate Fun

View More- MC:$3.43KHolders:20.19%

- MC:$3.36KHolders:10.00%

- MC:$3.36KHolders:10.00%

- MC:$3.36KHolders:10.00%

- MC:$3.47KHolders:20.05%

News

View MoreThe US Dollar Index drops to the intraday low of 98.384 due to Trump's speech

1 m

Bank of Italy Governor: The "anchor" of digital currencies remains with banks, and stablecoins are only supplementary

6 m

Bank of Italy Governor: Stablecoins can only play a supplementary role in the monetary system

10 m

Trump: Expected US Q4 2025 economic growth rate to be 5.4%

15 m

Trump: U.S. inflation has been defeated

17 m

Pin

Strike Gold by Sharing Your TradFi Orders and Pictures!

Post on Gate Square and split $10,000 in rewards!

The TradFi Gold Lucky Bag is now live—1g of real gold every 10 minutes. Trade nonstop, win nonstop!

👉 https://www.gate.com/announcements/article/49357

🎁 50 lucky winners × $200 Position Vouchers ($10 × 20 leverage)

How to Join:

1️⃣ Post your order on Square with #GateTradFi1gGoldGiveaway, including:

A trade or draw screenshot

A brief experience sharing

2️⃣ Or create a related image (AI creation allowed) with a short promo line, such as:

Get gold on Gate App — 1g every 10 minutes!

⏰ Jan 2Gate Square New & Returning Creator Rewards are ongoing!

Your ideas may be more valuable than you think!

Make your first post or come back post to share a $20,000 monthly prize pool!

Post with #MyFirstPostOnSquare to receive a $50 Position Voucher each

Monthly Top Posters and Top Engagers will each earn an extra $50 reward

Your crypto insights could inspire many—start creating today!

👉 https://www.gate.com/postGate Square “Creator Certification Incentive Program” — Recruiting Outstanding Creators!

Join now, share quality content, and compete for over $10,000 in monthly rewards.

How to Apply:

1️⃣ Open the App → Tap [Square] at the bottom → Click your [avatar] in the top right.

2️⃣ Tap [Get Certified], submit your application, and wait for approval.

Apply Now: https://www.gate.com/questionnaire/7159

Token rewards, exclusive Gate merch, and traffic exposure await you!

Details: https://www.gate.com/announcements/article/47889