Is Allora (ALLO) a good investment?: A comprehensive analysis of tokenomics, technology, and market potential

Introduction: Allora (ALLO) Investment Position and Market Prospects

Allora is an open intelligence platform designed to make artificial intelligence systems more adaptive, collaborative, and efficient. As an emerging asset in the cryptocurrency sector, ALLO has garnered increasing attention from investors and developers seeking exposure to decentralized AI infrastructure. As of December 20, 2025, ALLO maintains a market capitalization of approximately $109.7 million USD with a circulating supply of 200.5 million tokens out of a total supply of 1 billion. The token currently trades at $0.1097, representing a 24-hour price increase of 6.37 percent. With 593 active holders and trading across 28 exchanges on multiple blockchain networks including Ethereum, Base, and Binance Smart Chain, ALLO has established a presence within the decentralized finance ecosystem. This comprehensive analysis examines ALLO's investment potential, historical price movements, future price forecasts, and associated investment risks to provide investors with an informed perspective on this artificial intelligence-focused cryptocurrency asset.

Allora (ALLO) Crypto Asset Research Report

I. ALLO Price History Review and Current Investment Status

ALLO Historical Price Performance and Investment Returns

Based on available data, the following price milestones have been recorded:

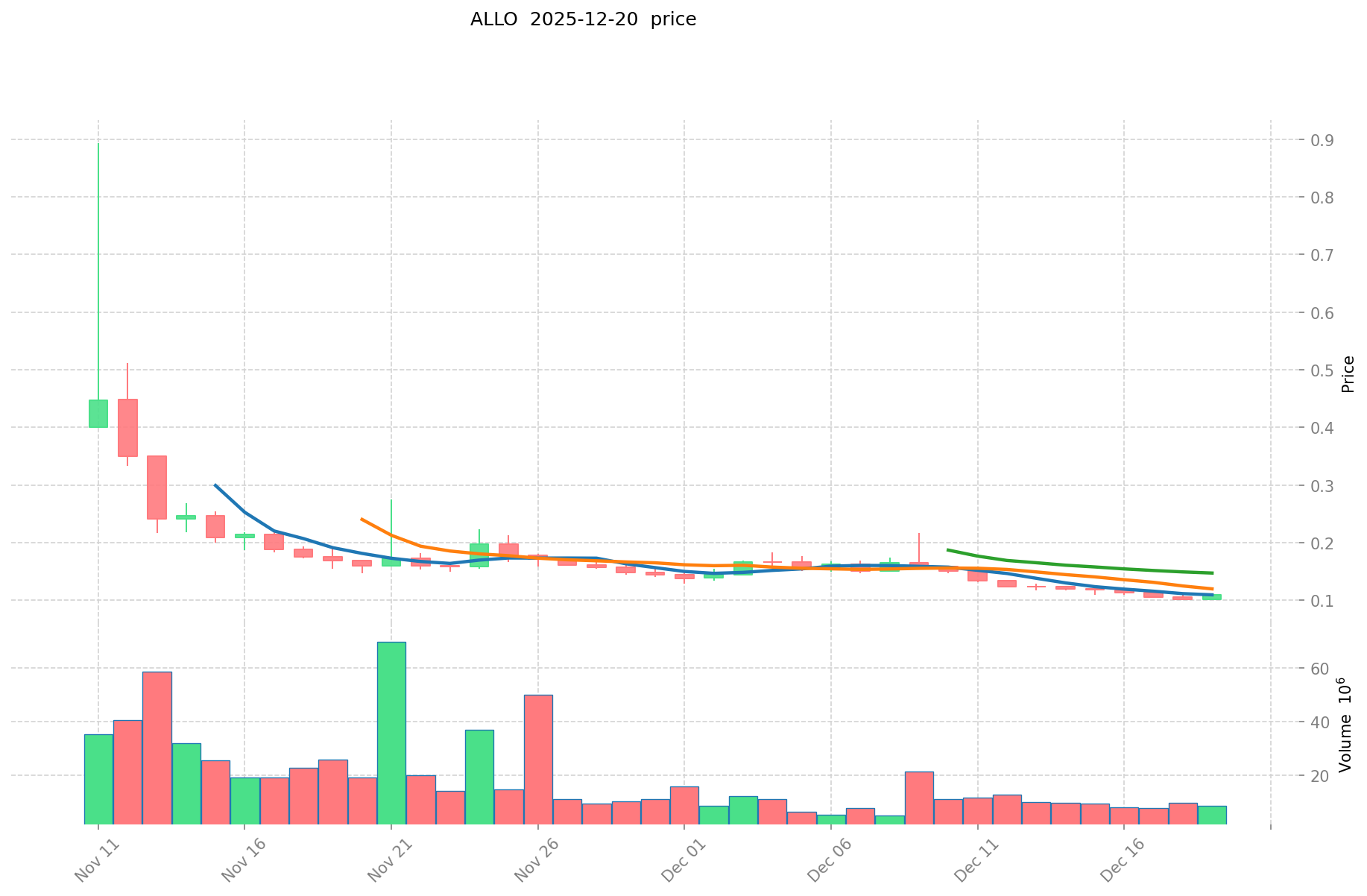

- All-Time High (ATH): $0.8937, reached on November 11, 2025

- All-Time Low (ATL): $0.0998, reached on December 18, 2025

- Year-to-Date Performance: -92.38% decline over one year

The token has experienced significant volatility, with a peak-to-current decline representing substantial losses for investors who purchased near the all-time high.

Current ALLO Market Status (December 20, 2025)

Price and Market Metrics:

- Current Price: $0.1097 USD

- Market Capitalization: $21,994,850 USD

- Fully Diluted Valuation: $109,700,000 USD

- 24-Hour Trading Volume: $883,655.16 USD

- Circulating Supply: 200,500,000 ALLO (20.05% of total supply)

- Total Supply: 1,000,000,000 ALLO

Price Movement Analysis:

- 1-Hour Change: +0.64%

- 24-Hour Change: +6.37%

- 7-Day Change: -10.11%

- 30-Day Change: -34.68%

- Market Dominance: 0.0034%

Market Emotion Indicator: Positive (Score: 1)

For real-time ALLO market pricing, visit Allora Price

II. Project Overview

Platform Description

Allora is an open intelligence platform designed to make artificial intelligence systems more adaptive, collaborative, and efficient. The network enables users and developers to access and contribute to a collective layer of intelligence where multiple AI models are combined, compared, and refined in real time.

Token Distribution

- Total Holdings: 593 token holders

- Circulating Ratio: 20.05%

- Exchange Listings: 28 exchanges

III. Network Architecture and Technical Specifications

Blockchain Compatibility

ALLO token operates across multiple blockchain networks:

| Chain | Contract Address | Network Type |

|---|---|---|

| Ethereum | 0x8408d45b61f5823298f19a09b53b7339c0280489 | ERC-20 |

| Base | 0x032d86656db142138ac97d2c5c4e3766e8c0482d | Base EVM |

| BSC | 0xcce5f304fd043d6a4e8ccb5376a4a4fb583b98d5 | BEP-20 |

Network Standards

The token implements ERC-20, BEP-20, Mainnet, and BASE protocol standards.

IV. Market Information and Resources

Official Channels

- Website: https://www.allora.network/

- Twitter/X: https://x.com/AlloraNetwork

- Discord: https://discord.com/invite/allora

- Whitepaper: https://research.assets.allora.network/allora.0x10001.pdf

Block Explorers

- Allora Mainnet Explorer: https://explorer.mainnet.allora.network

- Ethereum Etherscan: https://etherscan.io/token/0x8408d45b61f5823298f19a09b53b7339c0280489

- Base Scan: https://basescan.org/token/0x032d86656db142138ac97d2c5c4e3766e8c0482d

- BSC Scan: https://bscscan.com/token/0xcce5f304fd043d6a4e8ccb5376a4a4fb583b98d5

Report Generated: December 20, 2025

Data Last Updated: 2025-12-20 10:20:33 UTC

Allora (ALLO) Investment Analysis Report

Report Date: December 20, 2025

Data Source: Gate Crypto Asset Database

Research Focus: Comprehensive assessment of Allora as an investment asset

I. Executive Summary

Allora (ALLO) is a decentralized artificial intelligence platform built on a Cosmos-based blockchain, designed to enable collaborative, self-improving AI predictions for DeFi and Web3 applications. As of December 20, 2025, ALLO is trading at $0.1097 with a market capitalization of approximately $109.7 million USD, ranking 828th among cryptocurrencies. The token experienced its all-time high of $0.8937 on November 11, 2025, followed by significant price volatility, reflecting the inherent risks associated with newly launched VC-backed projects.

II. Core Factors Affecting Whether Allora (ALLO) Is a Good Investment

Supply Mechanism and Scarcity (ALLO Investment Scarcity)

Token Distribution:

- Total Supply: 1,000,000,000 ALLO tokens

- Circulating Supply: 200,500,000 ALLO tokens

- Circulating Ratio: 20.05% of total supply

- Current Holders: 593 addresses

Supply Impact Assessment: The relatively low circulating supply ratio (20.05%) indicates significant inflationary pressure ahead as vesting schedules release additional tokens to the market. Industry analysis notes that "Allora's price likely hinges on whether AI product traction outpaces vesting-related sell pressure." This supply-demand dynamic represents a critical risk factor for short-term price stability, though it also suggests potential scarcity benefits if adoption accelerates.

Institutional Investment and Mainstream Adoption (Institutional Investment in Allora)

Venture Capital Backing: Allora benefits from support by leading venture capital firms, which historically provides liquidity and credibility to early-stage blockchain projects. This institutional backing has facilitated the project's progression to mainnet launch and listing on 28 cryptocurrency exchanges.

Network Launch Milestone:

- Mainnet Launch (November 2025): The Allora decentralized intelligence network officially went live, marking a critical development milestone that transformed ALLO from a speculative asset to an operational network token.

Adoption Trajectory: Post-launch adoption indicators remain in early stages. The network's incentive-driven architecture rewards participants based on the quality of AI contributions and uses a pay-what-you-want model for accessing predictions. Community and developer interest is building, though mainstream institutional adoption has not yet materialized.

Macro-Economic Environment Impact on Allora Investment

AI Sector Momentum: The broader AI token market demonstrates cyclical behavior. Reference data indicates "the broader crypto market showing signs of recovery in November 2025, ALLO's price has climbed about 15% in the past week, fueled by growing interest in AI tokens." Similar AI-focused assets like Fetch.ai (FET) experienced comparable volatility, suggesting sector-wide sensitivity to macro trends and regulatory sentiment.

Interest Rate and Risk Environment: As a speculative, high-volatility asset, ALLO's performance inversely correlates with periods of monetary tightening and risk-off market sentiment. Conversely, periods of increased appetite for alternative assets and emerging technologies may enhance investment demand.

Technology and Ecosystem Development (Technology & Ecosystem for Allora Investment)

Blockchain Infrastructure: Allora operates on multiple blockchain networks:

- Ethereum (ETH) network

- Binance Smart Chain (BSC)

- Base (BASEEVM)

- Native Allora Mainnet

This multi-chain deployment strategy expands accessibility and reduces network congestion risks.

Core Technology Innovation: Allora's differentiating feature is its "collective intelligence" architecture where multiple AI models combine outputs to deliver more accurate, self-improving predictions. The platform enables:

- Real-time combination and comparison of multiple AI models

- Collaborative refinement of prediction accuracy

- Decentralized intelligence layer accessible to users and developers

- Context-aware, on-chain predictions for DeFi and Web3 applications

Ecosystem Applications: The network targets decentralized finance (DeFi) prediction services and Web3 applications. As convergence between Web3 infrastructure and artificial intelligence accelerates, Allora positions itself as foundational infrastructure rather than a consumer-facing application, potentially supporting long-term value accrual.

III. Price Performance and Market Dynamics

Historical Price Movement

| Time Period | Price Change | Amount |

|---|---|---|

| 1 Hour | +0.64% | +$0.000698 |

| 24 Hours | +6.37% | +$0.006569 |

| 7 Days | -10.11% | -$0.012338 |

| 30 Days | -34.68% | -$0.058242 |

| 1 Year | -92.38% | -$1.329933 |

Key Price Levels:

- All-Time High: $0.8937 (November 11, 2025)

- All-Time Low: $0.0998 (December 18, 2025)

- 24-Hour High: $0.111

- 24-Hour Low: $0.1023

- Current Price: $0.1097 (as of December 20, 2025)

Post-Launch Volatility: Market data indicates "Allora crypto just launched and, no surprise here, the price tanked more than 65% right after going live," which is characteristic of VC-backed airdrop projects experiencing initial sell-pressure from token recipients and early speculators.

Market Capitalization and Dominance

- Market Capitalization: $21,994,850 USD (based on circulating supply)

- Fully Diluted Valuation: $109,700,000 USD

- Market Dominance: 0.0034% of total cryptocurrency market

- 24-Hour Trading Volume: $883,655.16 USD

The modest trading volume relative to market capitalization suggests limited liquidity and potential price impact from significant buy or sell orders.

IV. Risk Assessment and Cautionary Factors

Technical and Execution Risks

High Volatility: ALLO's 92.38% decline over one year and 34.68% decline over 30 days demonstrate extreme price instability. Technical analysis from multiple sources indicates a "bearish" short-term outlook, with multiple analysts advising "it is unadvisable to invest in this coin in the short-term" despite acknowledging "strong fundamentals."

Adoption Execution Risk: Allora's investment thesis depends on successful adoption of its AI coordination platform. The company faces execution risks including:

- Achieving developer adoption for AI model deployment

- Building a sustainable ecosystem of AI providers

- Competing with centralized AI services and other decentralized intelligence platforms

- Monetizing through the pay-what-you-want pricing model

Vesting and Supply Dilution

The significant gap between circulating supply (20.05%) and total supply indicates ongoing token inflation ahead. Large vesting releases could exert downward pressure on price, particularly if product adoption does not accelerate proportionally.

Competitive Positioning

While Allora differentiates itself through collective intelligence architecture rather than payment or identity solutions, competitive pressure exists from other decentralized AI platforms and established centralized AI service providers.

V. Staking and Yield Opportunities

Staking Yield: Reference materials indicate a "12% staking yield," which provides a potential return mechanism for token holders willing to lock capital. This yield structure may function as a price floor during periods of weakness by incentivizing holding behavior.

VI. Institutional and Community Resources

Official Channels:

- Website: https://www.allora.network/

- Twitter/X: https://x.com/AlloraNetwork

- Discord: https://discord.com/invite/allora

- Mainnet Explorer: https://explorer.mainnet.allora.network

- Whitepaper: https://research.assets.allora.network/allora.0x10001.pdf

Exchange Availability: ALLO is listed on 28 cryptocurrency exchanges, providing reasonable liquidity access across multiple trading platforms.

VII. Conclusion

Allora presents a technically novel approach to decentralized artificial intelligence with potentially significant long-term infrastructure value as Web3 and AI technologies converge. However, current market conditions present substantial short-term risks:

Long-Term Potential:

- Innovative collective intelligence architecture

- Timing alignment with AI adoption trends

- Institutional VC backing and multi-chain deployment

- Potential to become foundational AI infrastructure

Short-Term Risks:

- Bearish technical indicators and recent 92.38% annual decline

- Significant vesting-related sell pressure ahead

- Early-stage adoption with unproven user demand

- Extreme price volatility typical of new VC-backed projects

- Limited trading liquidity relative to market cap

Assessment Summary: Market consensus suggests ALLO offers "strong long-term value through its AI collaboration platform, potentially soaring as Web3 and AI converge, but short-term risks from market dips and regulations demand caution." Current technical indicators recommend avoiding aggressive positioning until clearer evidence of product-market fit and adoption acceleration emerges.

Disclaimer: This report presents factual data and market analysis without offering investment recommendations. Cryptocurrency investments carry substantial risk of loss. Conduct thorough independent research and consult qualified financial advisors before making investment decisions.

III. ALLO Future Investment Forecast and Price Outlook (Is Allora(ALLO) worth investing in 2025-2030)

Short-term Investment Forecast (2025, short-term ALLO investment outlook)

- Conservative forecast: $0.0859 - $0.1101

- Neutral forecast: $0.1101 - $0.1321

- Optimistic forecast: $0.1321 - $0.1371

Mid-term Investment Outlook (2026-2028, mid-term Allora(ALLO) investment forecast)

-

Market stage expectation: ALLO is experiencing volatility recovery phase following significant price declines. The token shows potential for consolidation and gradual adoption as the artificial intelligence and collaborative intelligence sectors mature within the blockchain ecosystem.

-

Investment return forecast:

- 2026: $0.0690 - $0.1720

- 2027: $0.0923 - $0.2183

-

Key catalysts: Expansion of AI model collaboration features, increased developer participation, enterprise adoption of the Allora network, regulatory clarity for AI-based blockchain applications, and integration partnerships with major platforms.

Long-term Investment Outlook (Is Allora a good long-term investment?)

-

Base scenario: $0.1267 - $0.2030 USD (Assuming steady ecosystem development, moderate market adoption, and stable regulatory environment)

-

Optimistic scenario: $0.1880 - $0.2750 USD (Assuming mainstream adoption of collaborative AI systems, significant developer community growth, and positive macroeconomic conditions)

-

Risk scenario: $0.0500 - $0.0900 USD (Assuming regulatory headwinds, slower than expected adoption, or competitive pressures from alternative platforms)

Visit long-term price forecast for ALLO: Price Prediction

2025-12-20 - 2030 Long-term Outlook

-

Base scenario: $0.1267 - $0.2019 USD (Corresponding to stable advancement and steady mainstream application development)

-

Optimistic scenario: $0.1880 - $0.2750 USD (Corresponding to large-scale adoption and favorable market conditions)

-

Transformative scenario: $0.35 USD and above (Should the ecosystem achieve breakthrough progress and mainstream adoption)

-

2030-12-31 Price High Forecast: $0.2192 USD (Based on optimistic development assumptions)

Disclaimer

This analysis is provided for informational purposes only and should not be construed as investment advice. Cryptocurrency markets carry substantial risks including high volatility, regulatory uncertainty, and potential loss of capital. Past performance does not guarantee future results. Investors should conduct independent research and consult with qualified financial advisors before making investment decisions.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.13212 | 0.1101 | 0.085878 | 0 |

| 2026 | 0.1719762 | 0.12111 | 0.0690327 | 10 |

| 2027 | 0.218349219 | 0.1465431 | 0.092322153 | 33 |

| 2028 | 0.206164160235 | 0.1824461595 | 0.1459569276 | 66 |

| 2029 | 0.207906521058225 | 0.1943051598675 | 0.188476005071475 | 77 |

| 2030 | 0.21920536610452 | 0.201105840462862 | 0.126696679491603 | 83 |

Allora (ALLO) Investment Analysis Report

I. Project Overview

Basic Information

Allora is an open intelligence platform designed to make artificial intelligence systems more adaptive, collaborative, and efficient. The network enables users and developers to access and contribute to a collective layer of intelligence where multiple AI models are combined, compared, and refined in real time.

Token Specifications

| Metric | Value |

|---|---|

| Token Symbol | ALLO |

| Current Price | $0.1097 |

| Market Cap | $21,994,850.00 |

| Fully Diluted Valuation | $109,700,000.00 |

| Circulating Supply | 200,500,000 ALLO |

| Total Supply | 1,000,000,000 ALLO |

| Circulation Ratio | 20.05% |

| Market Ranking | 828 |

| Holders | 593 |

| Listed Exchanges | 28 |

Network Distribution

ALLO token operates across multiple blockchain networks:

- Ethereum (ETH): 0x8408d45b61f5823298f19a09b53b7339c0280489

- Base (BASEEVM): 0x032d86656db142138ac97d2c5c4e3766e8c0482d

- Binance Smart Chain (BSC): 0xcce5f304fd043d6a4e8ccb5376a4a4fb583b98d5

II. Market Performance Analysis

Price Performance

| Time Period | Change | Price Range |

|---|---|---|

| 1 Hour | +0.64% | - |

| 24 Hours | +6.37% | $0.1023 - $0.111 |

| 7 Days | -10.11% | - |

| 30 Days | -34.68% | - |

| 1 Year | -92.38% | - |

Historical Price Points

- All-Time High (ATH): $0.8937 (November 11, 2025)

- All-Time Low (ATL): $0.0998 (December 18, 2025)

- 24-Hour Volume: $883,655.16

Market Metrics

- Market Dominance: 0.0034%

- Market Cap to FDV Ratio: 20.05%

- Trading Volume (24h): $883,655.16

III. Investment Strategy and Risk Management

Investment Methodology

Long-term Holding (HODL ALLO): Suited for conservative investors who believe in the long-term potential of AI-powered intelligence platforms and are willing to weather short-term volatility.

Active Trading: Requires technical analysis expertise and careful market timing given the significant price fluctuations observed in the asset's price history.

Risk Management

Asset Allocation Considerations:

- Conservative investors: Minimal allocation due to high volatility and early-stage project status

- Aggressive investors: Small-cap positions with strict stop-loss protocols

- Institutional investors: Limited strategic allocation with thorough due diligence

Risk Mitigation Strategies:

- Diversified portfolio approach across multiple asset classes

- Position sizing appropriate to risk tolerance

- Regular portfolio rebalancing

Secure Storage:

- Hot wallets for active trading

- Cold storage for long-term holdings

- Hardware wallets recommended for significant positions

IV. Investment Risks and Challenges

Market Risk

- Extreme volatility: ALLO has experienced a 92.38% decline over one year, indicating significant price instability

- Low trading volume relative to market cap may result in wider bid-ask spreads

- Potential for rapid liquidations given the asset's price sensitivity

Regulatory Risk

- Cryptocurrency regulatory frameworks remain uncertain across jurisdictions

- Changes in AI-related regulations could impact project viability

- Compliance requirements may vary significantly by geography

Technical Risk

- Platform security and smart contract vulnerability risks inherent in blockchain systems

- Dependency on network adoption and developer ecosystem growth

- Execution risk on protocol upgrades and feature implementations

Market Structure Risk

- Limited holder base (593 holders) suggests concentration risk

- Relatively low circulating-to-total supply ratio (20.05%) indicates significant future dilution potential

V. Conclusion: Is Allora a Good Investment?

Investment Value Assessment

Allora represents a speculative play on AI infrastructure and collective intelligence platforms. The project demonstrates innovation potential in combining multiple AI models on-chain; however, the extreme price decline (-92.38% annually) coupled with low market cap penetration indicates early-stage risk profiles typical of emerging blockchain projects.

Investor Guidance

For Beginners:

- Allocate only what you can afford to lose completely

- Use secure wallet storage solutions

- Dollar-cost averaging may reduce timing risk

For Experienced Traders:

- Identify technical support and resistance levels

- Implement strict risk management with position sizing

- Monitor development milestones and ecosystem growth

For Institutional Investors:

- Conduct thorough technical and fundamental due diligence

- Evaluate team credentials and development roadmap

- Consider this as a high-risk allocation within alternative asset portfolios

⚠️ Disclaimer: Cryptocurrency investments carry substantial risk including total capital loss. This report is for informational purposes only and does not constitute investment advice. Conduct independent research and consult with qualified financial advisors before making investment decisions.

Report Generated: December 20, 2025

Allora (ALLO) Frequently Asked Questions (FAQ)

I. What is Allora (ALLO) and how does it work?

Answer: Allora is an open intelligence platform designed to make artificial intelligence systems more adaptive, collaborative, and efficient. The network operates as a decentralized infrastructure layer built on a Cosmos-based blockchain that enables multiple AI models to be combined, compared, and refined in real time. Users and developers can access and contribute to a collective layer of intelligence where AI predictions are combined collaboratively, creating a self-improving ecosystem for DeFi and Web3 applications. The platform utilizes a pay-what-you-want model for accessing predictions while rewarding participants based on the quality of their AI contributions.

II. What is the current price and market position of ALLO?

Answer: As of December 20, 2025, ALLO trades at $0.1097 USD with a market capitalization of approximately $21.99 million USD (based on circulating supply) and a fully diluted valuation of $109.7 million USD. The token ranks 828th among cryptocurrencies globally. ALLO maintains a circulating supply of 200.5 million tokens out of a total supply of 1 billion tokens (20.05% circulation ratio). The token has experienced significant volatility, with an all-time high of $0.8937 reached on November 11, 2025, followed by an all-time low of $0.0998 on December 18, 2025, representing a 92.38% decline over the past year.

III. Is ALLO a good short-term investment?

Answer: Short-term investment in ALLO carries substantial risk. The token displays bearish technical indicators with a 34.68% decline over the past 30 days and extreme volatility characteristics. Market analysts generally advise caution for short-term positions, noting that while the token has strong long-term fundamentals, short-term risks include vesting-related sell pressure, limited trading liquidity ($883,655.16 USD 24-hour volume), and unproven product-market fit. Conservative short-term forecast suggests a price range of $0.0859 to $0.1101 USD, while optimistic scenarios project $0.1321 to $0.1371 USD. Only investors with high risk tolerance and active trading expertise should consider short-term positions.

IV. What are the long-term price forecasts for ALLO?

Answer: Long-term price forecasts for ALLO through 2030 vary based on adoption scenarios. The base scenario projects a price range of $0.1267 to $0.2030 USD assuming steady ecosystem development and moderate market adoption. The optimistic scenario forecasts $0.1880 to $0.2750 USD with mainstream adoption of collaborative AI systems and significant developer community growth. A transformative scenario suggests prices could exceed $0.35 USD should the ecosystem achieve breakthrough progress. The conservative risk scenario projects $0.0500 to $0.0900 USD in cases of regulatory headwinds or slower adoption. By December 31, 2030, the optimistic high forecast reaches $0.2192 USD under favorable development assumptions.

V. What are the main risks associated with investing in ALLO?

Answer: ALLO investments face several significant risk categories. Market risk includes extreme price volatility (92.38% annual decline), low trading volume relative to market cap, and potential rapid liquidations. Supply dilution risk stems from the 20.05% circulating-to-total supply ratio, indicating substantial future token inflation from vesting schedules. Adoption execution risk depends on achieving developer participation and sustainable ecosystem growth with unproven demand. Regulatory risk reflects uncertainty surrounding AI-based blockchain applications across different jurisdictions. Technical risks include smart contract vulnerabilities and platform security concerns. Additionally, the small holder base (593 addresses) suggests concentration risk, and competitive pressure exists from other decentralized AI platforms and centralized AI service providers.

VI. On which blockchain networks is ALLO available?

Answer: ALLO operates across multiple blockchain networks to maximize accessibility and reduce network congestion risks. The token is deployed on: Ethereum (ERC-20 standard) with contract address 0x8408d45b61f5823298f19a09b53b7339c0280489; Base (Base EVM standard) with contract address 0x032d86656db142138ac97d2c5c4e3766e8c0482d; Binance Smart Chain (BEP-20 standard) with contract address 0xcce5f304fd043d6a4e8ccb5376a4a4fb583b98d5; and the native Allora Mainnet which launched in November 2025. ALLO is listed on 28 cryptocurrency exchanges providing trading access across these multiple networks.

VII. Does ALLO offer staking or yield opportunities?

Answer: Yes, ALLO provides staking yield opportunities for token holders willing to lock their capital. The platform offers a 12 percent staking yield mechanism, which provides a potential return component for participants. This yield structure may function as a price floor during periods of market weakness by incentivizing holding behavior rather than selling. Staking participants receive rewards based on their locked token amounts, creating an additional income stream beyond potential price appreciation. However, stakers should consider that locked tokens cannot be traded during the staking period, and yield opportunities exist within the broader context of ongoing price volatility and token inflation from vesting schedules.

VIII. Where can I find official information and resources about Allora?

Answer: Official Allora resources include the main website at https://www.allora.network/, social media presence on Twitter/X at https://x.com/AlloraNetwork, and the community Discord server at https://discord.com/invite/allora. The technical whitepaper is available at https://research.assets.allora.network/allora.0x10001.pdf. For blockchain verification and transaction monitoring, users can access the Allora Mainnet Explorer at https://explorer.mainnet.allora.network. For token tracking on other networks, Ethereum transactions can be verified on Etherscan, Base transactions on BaseScan, and Binance Smart Chain transactions on BSCScan using the respective contract addresses. These resources provide comprehensive information for conducting independent research and due diligence.

Report Generated: December 20, 2025

Disclaimer: This FAQ is provided for informational purposes only and does not constitute investment advice. Cryptocurrency investments carry substantial risk of total capital loss. Investors should conduct independent research and consult qualified financial advisors before making investment decisions.

Is Hey Anon (ANON) a Good Investment?: Analyzing the Potential Returns and Risks of This Emerging Cryptocurrency

Is Hive AI (BUZZ) a good investment?: Analyzing the Potential and Risks of this Emerging Cryptocurrency

2025 GIZA Price Prediction: Analyzing Market Trends and Potential Growth Factors in the Cryptocurrency Landscape

2025 ALCH Price Prediction: Bullish Outlook as DeFi Adoption Surges

Is Velvet (VELVET) a good investment? : Analyzing the potential and risks of this new cryptocurrency

2025 UNO Price Prediction: Analyzing Market Trends and Potential Growth Factors

How do futures open interest and funding rates signal crypto derivatives market shifts?

Essential Guide to Meme Coin Investments: What Every Crypto Enthusiast Must Know

How Will Regulatory Risks Impact NXPC Compliance in 2025: SEC Scrutiny and KYC/AML Requirements

Discover the Top 5 Fastest Growing Cryptocurrencies of 2024

What is TEXITcoin (TXC) market overview: price, trading volume, and market cap rankings?