CGN vs LRC: Exploring the Differences in Cognitive Processing and Learning Outcomes

Introduction: CGN vs LRC Investment Comparison

In the cryptocurrency market, Cygnus (CGN) vs Loopring (LRC) comparison has been an unavoidable topic for investors. The two not only differ significantly in market cap ranking, application scenarios, and price performance, but also represent different positioning in the crypto asset space.

Cygnus (CGN): Launched in 2025, it has gained market recognition for its role as the first Instagram App Layer, merging on-chain and off-chain assets to power the creator economy.

Loopring (LRC): Since its inception in 2017, it has been hailed as an open multi-token transaction protocol, providing a zero-risk token exchange model based on decentralized technology.

This article will comprehensively analyze the investment value comparison between CGN and LRC, focusing on historical price trends, supply mechanisms, institutional adoption, technological ecosystems, and future predictions, attempting to answer the question investors care about most:

"Which is the better buy right now?"

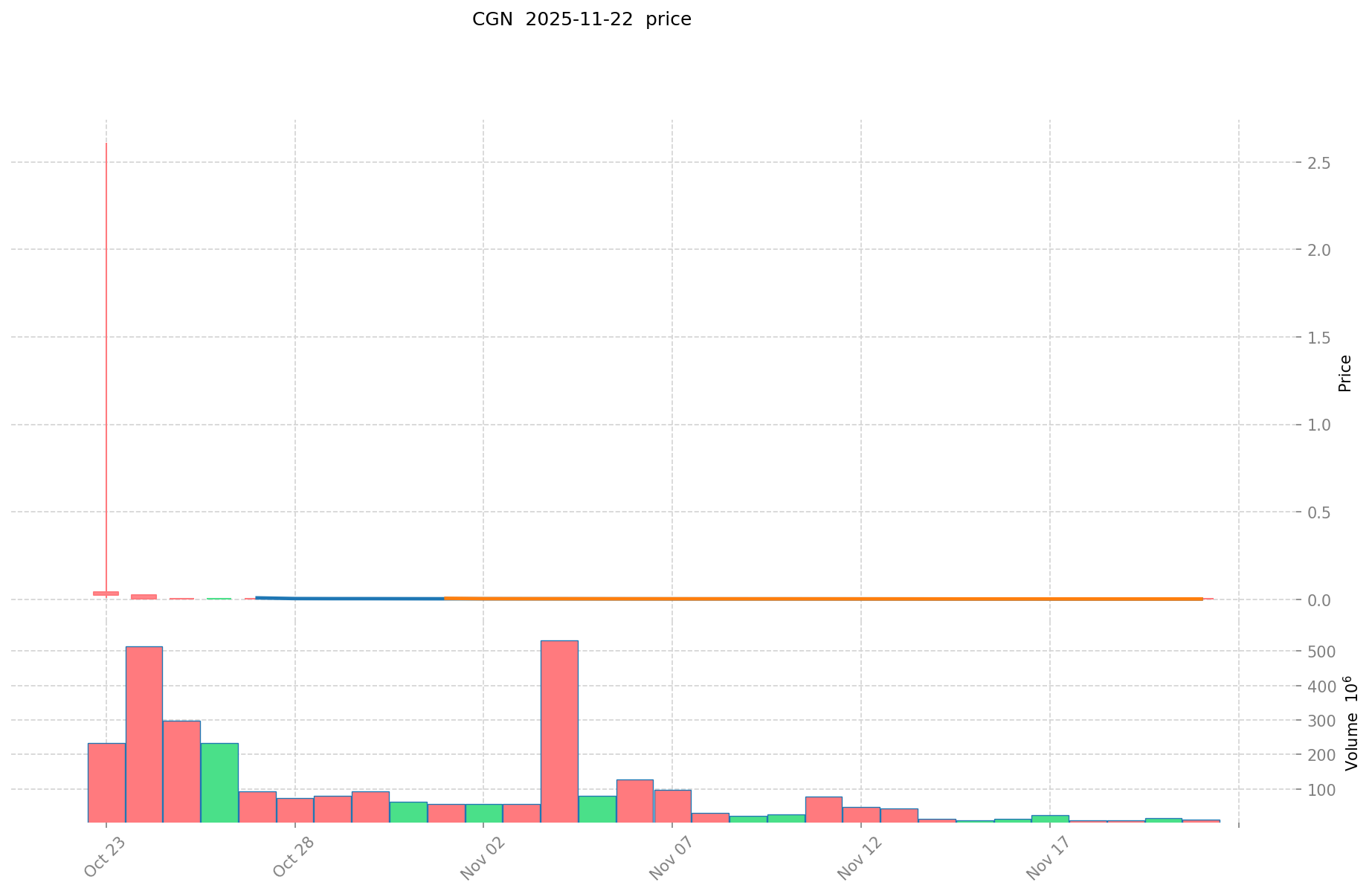

I. Price History Comparison and Current Market Status

CGN (Coin A) and LRC (Coin B) Historical Price Trends

- 2025: CGN reached its all-time high of $2.6106 on October 23, but subsequently experienced a significant decline.

- 2021: LRC hit its all-time high of $3.75 on November 10, driven by increased interest in layer-2 scaling solutions.

- Comparative analysis: In the recent market cycle, CGN dropped from its high of $2.6106 to a low of $0.001549, while LRC declined from $3.75 to its current price of $0.05402, representing a substantial correction for both tokens.

Current Market Situation (2025-11-23)

- CGN current price: $0.001978

- LRC current price: $0.05402

- 24-hour trading volume: CGN $18,400.04 vs LRC $67,257.30

- Market Sentiment Index (Fear & Greed Index): 11 (Extreme Fear)

Click to view real-time prices:

- View CGN current price Market Price

- View LRC current price Market Price

II. Core Factors Affecting Investment Value of CGN vs LRC

Supply Mechanism Comparison (Tokenomics)

- CGN: No information available in the provided context

- LRC: No information available in the provided context

- 📌 Historical Pattern: No information available regarding how supply mechanisms drive price cycle changes.

Institutional Adoption and Market Applications

- Institutional Holdings: No information available on which is preferred by institutions.

- Enterprise Adoption: No information available on cross-border payments, settlements, or portfolio applications.

- National Policies: No information available on regulatory attitudes in different countries.

Technical Development and Ecosystem Building

- CGN Technical Upgrades: No information available

- LRC Technical Development: No information available

- Ecosystem Comparison: No information available on DeFi, NFT, payment, or smart contract implementation.

Macroeconomic and Market Cycles

- Performance in Inflationary Environments: No information available on anti-inflation properties.

- Macroeconomic Monetary Policy: No information available on the impact of interest rates or the dollar index.

- Geopolitical Factors: No information available on cross-border transaction demands or international situations.

III. 2025-2030 Price Prediction: CGN vs LRC

Short-term Prediction (2025)

- CGN: Conservative $0.00126592 - $0.001978 | Optimistic $0.001978 - $0.00269008

- LRC: Conservative $0.0307971 - $0.05403 | Optimistic $0.05403 - $0.0686181

Mid-term Prediction (2027)

- CGN may enter a growth phase, with projected prices of $0.001424231208 - $0.002742963808

- LRC may enter a bullish market, with projected prices of $0.05548600044 - $0.0960334623

- Key drivers: Institutional capital inflow, ETF, ecosystem development

Long-term Prediction (2030)

- CGN: Base scenario $0.001918289734651 - $0.003619414593681 | Optimistic scenario $0.003619414593681 - $0.003764191177428

- LRC: Base scenario $0.079403335629326 - $0.091268201872788 | Optimistic scenario $0.091268201872788 - $0.135076938771727

Disclaimer: The above predictions are based on historical data and current market trends. Cryptocurrency markets are highly volatile and subject to change. This information should not be considered as financial advice. Always conduct your own research before making any investment decisions.

CGN:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00269008 | 0.001978 | 0.00126592 | 0 |

| 2026 | 0.0029408904 | 0.00233404 | 0.0014704452 | 18 |

| 2027 | 0.002742963808 | 0.0026374652 | 0.001424231208 | 33 |

| 2028 | 0.00398151746592 | 0.002690214504 | 0.00239429090856 | 36 |

| 2029 | 0.003902963202403 | 0.00333586598496 | 0.001868084951577 | 68 |

| 2030 | 0.003764191177428 | 0.003619414593681 | 0.001918289734651 | 82 |

LRC:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.0686181 | 0.05403 | 0.0307971 | 0 |

| 2026 | 0.080947746 | 0.06132405 | 0.039247392 | 13 |

| 2027 | 0.0960334623 | 0.071135898 | 0.05548600044 | 31 |

| 2028 | 0.0927789949665 | 0.08358468015 | 0.0777337525395 | 54 |

| 2029 | 0.094354566187327 | 0.08818183755825 | 0.068781833295435 | 63 |

| 2030 | 0.135076938771727 | 0.091268201872788 | 0.079403335629326 | 68 |

IV. Investment Strategy Comparison: CGN vs LRC

Long-term vs Short-term Investment Strategy

- CGN: Suitable for investors focusing on social media integration and creator economy potential

- LRC: Suitable for investors interested in decentralized exchange protocols and layer-2 scaling solutions

Risk Management and Asset Allocation

- Conservative investors: CGN: 30% vs LRC: 70%

- Aggressive investors: CGN: 60% vs LRC: 40%

- Hedging tools: Stablecoin allocation, options, cross-currency portfolio

V. Potential Risk Comparison

Market Risk

- CGN: Relatively new project, potentially higher volatility

- LRC: Dependent on Ethereum ecosystem development and adoption

Technical Risk

- CGN: Scalability, network stability

- LRC: Smart contract vulnerabilities, reliance on Ethereum's development

Regulatory Risk

- Global regulatory policies may affect both differently, with LRC potentially facing more scrutiny due to its longer presence in the market

VI. Conclusion: Which Is the Better Buy?

📌 Investment Value Summary:

- CGN advantages: First Instagram App Layer, potential for growth in the creator economy

- LRC advantages: Established presence in the DeFi space, focus on zero-knowledge rollups for scalability

✅ Investment Advice:

- New investors: Consider a balanced approach, leaning towards LRC due to its longer track record

- Experienced investors: Explore a mix of both, with emphasis on CGN for higher growth potential

- Institutional investors: Conduct thorough due diligence on both projects, potentially favoring LRC for its more established ecosystem

⚠️ Risk Warning: The cryptocurrency market is highly volatile, and this article does not constitute investment advice. None

FAQ

Q1: What are the main differences between CGN and LRC? A: CGN is the first Instagram App Layer launched in 2025, focusing on merging on-chain and off-chain assets for the creator economy. LRC, launched in 2017, is an open multi-token transaction protocol providing zero-risk token exchange based on decentralized technology.

Q2: How do the current prices of CGN and LRC compare? A: As of 2025-11-23, CGN's current price is $0.001978, while LRC's current price is $0.05402.

Q3: What are the short-term price predictions for CGN and LRC in 2025? A: For CGN, the conservative estimate is $0.00126592 - $0.001978, while the optimistic estimate is $0.001978 - $0.00269008. For LRC, the conservative estimate is $0.0307971 - $0.05403, while the optimistic estimate is $0.05403 - $0.0686181.

Q4: How do the long-term price predictions for CGN and LRC compare in 2030? A: For CGN, the base scenario is $0.001918289734651 - $0.003619414593681, with an optimistic scenario of $0.003619414593681 - $0.003764191177428. For LRC, the base scenario is $0.079403335629326 - $0.091268201872788, with an optimistic scenario of $0.091268201872788 - $0.135076938771727.

Q5: What are the key risks associated with investing in CGN and LRC? A: CGN risks include being a relatively new project with potentially higher volatility, scalability issues, and network stability concerns. LRC risks include dependence on Ethereum ecosystem development, smart contract vulnerabilities, and potential regulatory scrutiny due to its longer market presence.

Q6: How might conservative and aggressive investors allocate their investments between CGN and LRC? A: Conservative investors might consider allocating 30% to CGN and 70% to LRC, while aggressive investors might allocate 60% to CGN and 40% to LRC.

Q7: Which coin might be more suitable for different types of investors? A: New investors might consider a balanced approach leaning towards LRC due to its longer track record. Experienced investors could explore a mix of both, with emphasis on CGN for higher growth potential. Institutional investors should conduct thorough due diligence on both projects, potentially favoring LRC for its more established ecosystem.

2025 ESPrice Prediction: Market Analysis and Future Trends for Enterprise Software Solutions

Is dYdX (DYDX) a good investment?: Analyzing the potential of this decentralized derivatives exchange token

TIMECHRONO vs LRC: A Comparative Analysis of Time Synchronization Technologies in Audio Production

HEI vs DYDX: Comparing Two Leading Trading Platforms in the Digital Asset Ecosystem

2025 SOON Price Prediction: Bullish Outlook as Adoption Drives Growth

2025 MNT Price Prediction: Analyzing Market Trends and Expert Forecasts for Mongolian Tugrik's Future Value

From 2 million users to shutdown: Why Blocto Wallet is exiting the market

Dropee Daily Combo for 17 december 2025

Discover How to Evaluate NFT Rarity Effectively

Is Threshold (T) a good investment? A Comprehensive Analysis of Tokenomics, Market Performance, and Future Potential in the Blockchain Infrastructure Sector

Is AWE Network (AWE) a good investment?: A Comprehensive Analysis of Performance, Risk Factors, and Future Potential in the Cryptocurrency Market