2025 ZYRA Price Prediction: Analyzing Market Trends and Potential Growth Factors for the Cryptocurrency

Introduction: ZYRA's Market Position and Investment Value

Bitcoin ZK (ZYRA), as a Layer 2 scaling network for Bitcoin built on zero-knowledge proof technology, has been making significant strides since its inception. As of 2025, ZYRA's market capitalization has reached $63,640,000, with a circulating supply of approximately 1,000,000,000 tokens, and a price hovering around $0.06364. This asset, known as the "Bitcoin Layer 2 Governance Token," is playing an increasingly crucial role in expanding Bitcoin's mainnet capabilities and enabling low-cost, high-throughput smart contracts and transactions.

This article will comprehensively analyze ZYRA's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and the macroeconomic environment to provide investors with professional price predictions and practical investment strategies.

I. ZYRA Price History Review and Current Market Status

ZYRA Historical Price Evolution

- 2025: ZYRA launched, reaching its all-time high of $0.17 on September 11

- 2025: Market volatility, price dropped to its all-time low of $0.056 on October 21

ZYRA Current Market Situation

ZYRA is currently trading at $0.06364, experiencing a significant 36.83% decline in the past 24 hours. The token has seen a sharp downturn over the past week, with a 60.46% decrease in value. This downward trend extends to the monthly performance, showing a 59.86% drop over the last 30 days. The current price is 62.56% below its all-time high of $0.17, recorded on September 11, 2025. However, it's 13.64% above its all-time low of $0.056, which occurred just yesterday, on October 21, 2025.

The market capitalization of ZYRA stands at $63,640,000, with a fully diluted valuation matching this figure due to its total supply being in circulation. The 24-hour trading volume is $111,318.08, indicating moderate market activity. ZYRA's market dominance is currently at 0.0016%, reflecting its relatively small position in the overall cryptocurrency market.

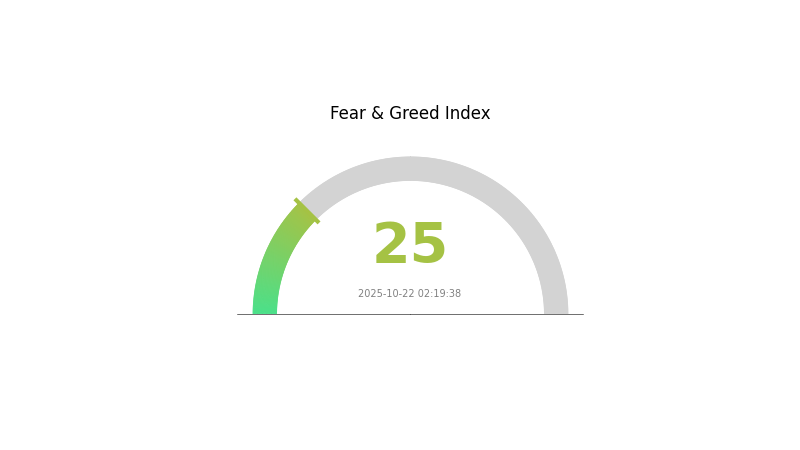

The token's supply metrics show a circulating supply of 1,000,000,000 ZYRA, which is also the maximum supply, indicating no future inflation through additional token issuance. The current market sentiment for cryptocurrencies is characterized as "Extreme Fear," with a VIX (Volatility Index) score of 25, suggesting a highly risk-averse environment in the crypto market.

Click to view the current ZYRA market price

ZYRA Market Sentiment Indicator

2025-10-22 Fear and Greed Index: 25 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is gripped by extreme fear, with the sentiment index plummeting to 25. This level of pessimism often presents unique opportunities for savvy investors. While many are selling in panic, experienced traders may see this as a potential buying opportunity. However, it's crucial to exercise caution and conduct thorough research before making any investment decisions. Remember, market sentiment can shift rapidly, and diversification remains key in navigating these turbulent waters.

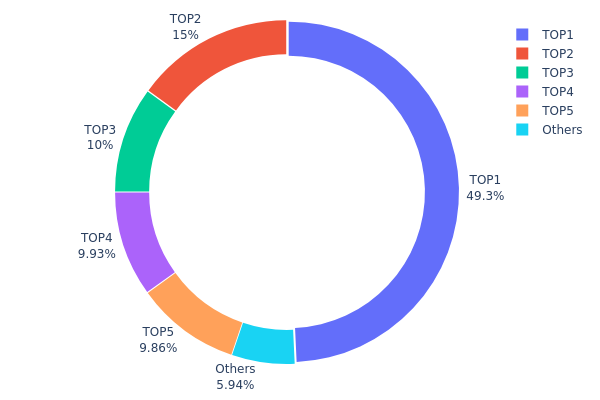

ZYRA Holdings Distribution

The address holdings distribution data for ZYRA reveals a highly concentrated ownership structure. The top address holds a substantial 49.25% of the total supply, with the top five addresses collectively controlling 94.04% of ZYRA tokens. This level of concentration raises concerns about centralization and potential market manipulation.

Such a concentrated distribution can significantly impact market dynamics. The large holdings by a few addresses may lead to increased price volatility, as any substantial movement from these wallets could cause significant price swings. Moreover, this concentration of power potentially undermines the principles of decentralization often associated with cryptocurrency projects.

From a market structure perspective, this distribution suggests a relatively illiquid and potentially unstable on-chain environment for ZYRA. The high concentration in few hands could lead to reduced trading volume and less diverse market participation, potentially affecting price discovery and overall market health.

Click to view current ZYRA Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x7fcc...a3433c | 492580.84K | 49.25% |

| 2 | 0x15e1...44b427 | 150000.00K | 15.00% |

| 3 | 0x6e73...1ad5d9 | 100000.00K | 10.00% |

| 4 | 0x21d0...6e52cb | 99338.60K | 9.93% |

| 5 | 0xa8dd...673a5e | 98636.54K | 9.86% |

| - | Others | 59444.01K | 5.96% |

II. Key Factors Affecting ZYRA's Future Price

Institutional and Whale Dynamics

- National Policies: The SEC's final decision on at least 16 spot crypto ETFs in October will significantly impact cryptocurrency price trends and set the stage for subsequent altcoin ETFs.

Macroeconomic Environment

- Monetary Policy Impact: Positive economic indicators and potential interest rate cuts by the Federal Reserve could boost demand and liquidity in the crypto market.

- Geopolitical Factors: Historical data shows that government shutdowns have varying effects on Bitcoin, potentially increasing short-term volatility.

Technical Development and Ecosystem Building

- Layer 1 Market: Overall decline observed in the Layer 1 market as of August 2024.

- Bitcoin Layer 2: Significant expansion noted in the Bitcoin Layer 2 sector.

- Ethereum Layer 2: Facing challenges in development and adoption.

III. ZYRA Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.05142 - $0.06348

- Neutral prediction: $0.06348 - $0.07649

- Optimistic prediction: $0.07649 - $0.08951 (requires favorable market conditions)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increasing volatility

- Price range forecast:

- 2027: $0.05076 - $0.13325

- 2028: $0.07724 - $0.12202

- Key catalysts: Technological advancements, wider adoption, and overall crypto market trends

2029-2030 Long-term Outlook

- Base scenario: $0.11698 - $0.13629 (assuming steady market growth)

- Optimistic scenario: $0.13629 - $0.15559 (assuming strong market performance)

- Transformative scenario: $0.15559 - $0.16354 (assuming breakthrough developments and mass adoption)

- 2030-12-31: ZYRA $0.16354 (potential peak price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.08951 | 0.06348 | 0.05142 | 0 |

| 2026 | 0.1048 | 0.07649 | 0.04743 | 20 |

| 2027 | 0.13325 | 0.09064 | 0.05076 | 42 |

| 2028 | 0.12202 | 0.11195 | 0.07724 | 75 |

| 2029 | 0.15559 | 0.11698 | 0.07604 | 83 |

| 2030 | 0.16354 | 0.13629 | 0.12538 | 114 |

IV. ZYRA Professional Investment Strategies and Risk Management

ZYRA Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors focused on Bitcoin ecosystem growth

- Operation suggestions:

- Accumulate ZYRA tokens during market dips

- Participate in network governance to contribute to ecosystem development

- Store tokens in secure non-custodial wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Monitor short-term and long-term trends

- RSI (Relative Strength Index): Identify overbought/oversold conditions

- Key points for swing trading:

- Set clear entry and exit points based on technical indicators

- Monitor Bitcoin price movements as they may influence ZYRA

ZYRA Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Balance ZYRA holdings with other crypto assets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate web3 wallet

- Cold storage solution: Hardware wallets for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. ZYRA Potential Risks and Challenges

ZYRA Market Risks

- High volatility: ZYRA price may experience significant fluctuations

- Liquidity risk: Limited trading volume may affect price stability

- Correlation with Bitcoin: ZYRA performance may be influenced by BTC price movements

ZYRA Regulatory Risks

- Uncertain regulatory landscape: Potential changes in crypto regulations

- Cross-border compliance: Varying regulatory approaches in different jurisdictions

- Tax implications: Evolving tax policies for crypto assets

ZYRA Technical Risks

- Smart contract vulnerabilities: Potential security issues in the protocol

- Scalability challenges: Ability to handle increased network activity

- Interoperability concerns: Integration with other blockchain networks

VI. Conclusion and Action Recommendations

ZYRA Investment Value Assessment

ZYRA presents a unique opportunity in the Bitcoin Layer 2 scaling space, offering potential long-term value for those invested in Bitcoin's ecosystem growth. However, short-term price volatility and regulatory uncertainties pose significant risks.

ZYRA Investment Recommendations

✅ Beginners: Start with small positions, focus on learning about Layer 2 technologies ✅ Experienced investors: Consider allocating a portion of Bitcoin holdings to ZYRA for diversification ✅ Institutional investors: Conduct thorough due diligence and consider ZYRA as part of a broader crypto portfolio strategy

ZYRA Trading Participation Methods

- Spot trading: Purchase ZYRA tokens on Gate.com

- Staking: Participate in governance and earn rewards (if available)

- DeFi integration: Explore DeFi opportunities within the BitcoinZK ecosystem (when launched)

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Would hamster kombat coin reach $1?

Hamster Kombat coin has potential to reach $1, following trends of similar meme coins. However, market conditions and investor sentiment will ultimately determine its future price.

What crypto has the highest price prediction?

Bitcoin (BTC) has the highest price prediction for 2025, followed closely by Ethereum (ETH) and Solana (SOL). Predictions vary, but BTC leads.

What is the price prediction for Zil in 2025?

Based on analytical forecasts, Zil is predicted to reach $0.00464667 by the end of 2025.

Does ZRX have a future?

Yes, ZRX has a promising future. It supports Ethereum-based projects and decentralized exchanges, positioning itself well for ongoing blockchain advancements and growth in the DeFi sector.

GOAT Network (GOATED): Bitcoin ZK-Rollup With Native Yield

What is B2: Understanding the Business-to-Business Marketing Model

What is B2: Understanding the Business-to-Business Marketing Model and Its Strategic Importance

What Makes GOAT Network GOATED

2025 MERL Price Prediction: Analyzing Market Trends and Potential Growth Factors for Merlin Protocol

How Active is the Bitcoin Layer 2 Ecosystem in 2025?

Understanding Cosmos: Exploring Blockchain Interoperability and the Interchain Ecosystem

Beginner's Guide to Shorting Cryptocurrency

Exploring Distributed Ledgers: A Non-Block Approach

Guide to Profiting from Cryptocurrency Hard Forks

Understanding DeFi Insurance: A Comprehensive Guide to Decentralized Coverage Solutions