Predicción del precio de ZRX en 2025: análisis de tendencias de mercado y factores potenciales de crecimiento para el protocolo 0x

Introducción: Posición de mercado y valor de inversión de ZRX

0xProject (ZRX), como protocolo de código abierto para exchanges descentralizados sobre la blockchain Ethereum, ha avanzado notablemente desde su creación en 2017. A fecha de 2025, la capitalización bursátil de 0xProject se sitúa en 203 615 175 $, con un suministro circulante cercano a 848 396 562 tokens y un precio que oscila en torno a 0,24 $. Este activo, apodado “habilitador de DEX”, tiene una importancia creciente en la facilitación del intercambio peer-to-peer de tokens ERC20.

En este artículo se aborda un análisis detallado de la evolución del precio de 0xProject entre 2025 y 2030, combinando patrones históricos, oferta y demanda del mercado, el desarrollo del ecosistema y factores macroeconómicos para ofrecer previsiones profesionales de precio y estrategias de inversión aplicables.

I. Revisión histórica de precios y situación actual de mercado de ZRX

Evolución histórica del precio de ZRX

- 2017: ZRX se lanza con un precio de ICO de 0,05 $, marcando el comienzo de su trayectoria.

- 2018: Alcanza su máximo histórico de 2,5 $ el 13 de enero de 2018 durante el ciclo alcista del mercado cripto.

- 2020: Toca su mínimo histórico de 0,120667 $ el 13 de marzo de 2020 en plena caída global de mercados.

Situación actual de mercado de ZRX

A 24 de septiembre de 2025, ZRX cotiza en 0,24 $, ubicándose en el puesto 294 del mercado de criptomonedas. El token ha subido un 0,96 % en las últimas 24 horas, con un volumen negociado de 159 761,11 $. Su capitalización de mercado es de 203 615 175 $ y el suministro circulante es de 848 396 562,91 tokens. El precio actual representa una caída notable desde el máximo histórico, situándose un 90,4 % por debajo de aquel pico. Sin embargo, mantiene un 98,89 % por encima de su mínimo histórico. El rendimiento en diferentes horizontes es mixto: un repunte del 1,05 % en la última hora, una bajada del 9,5 % en la semana y un descenso del 28,13 % en el último año.

Haz clic para ver el precio actual de ZRX

Indicador de sentimiento de mercado de ZRX

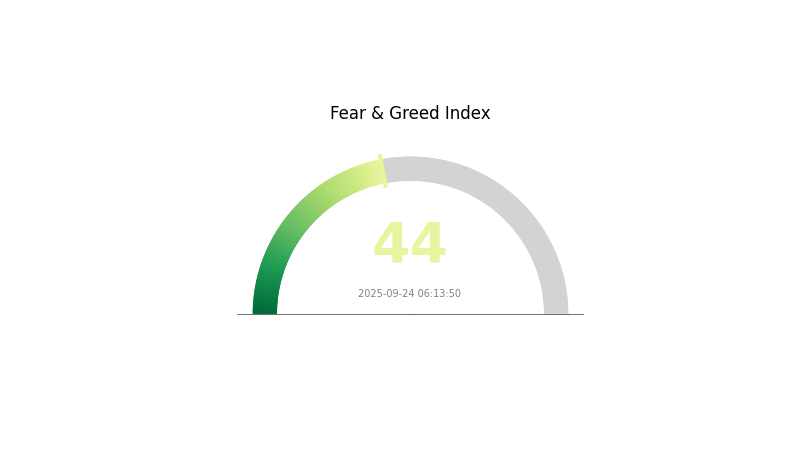

24 de septiembre de 2025 Índice de Miedo y Codicia: 44 (Miedo)

Haz clic para visualizar el Índice de Miedo y Codicia en tiempo real

El mercado cripto atraviesa actualmente una fase de miedo, con el índice situado en 44. Esto indica que los inversores muestran más cautela y aversión al riesgo. El sentimiento actual suele generar presión vendedora y, al mismo tiempo, oportunidades de compra para inversores contrarios. Recuerda que el ánimo de mercado puede cambiar rápidamente. Mantente atento, realiza análisis exhaustivos y utiliza las herramientas avanzadas de trading de Gate.com para operar de forma eficaz en estas condiciones.

Distribución de tenencias de ZRX

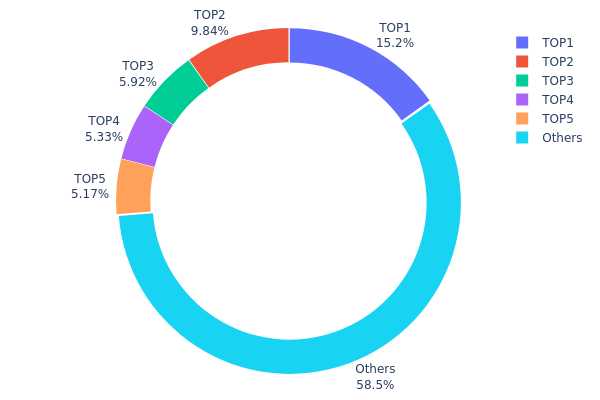

Los datos de distribución de direcciones de ZRX muestran un nivel medio de concentración en los principales tenedores. La dirección con mayor tenencia controla el 15,20 % del suministro, y las cuatro siguientes ostentan entre el 5 % y el 10 % cada una. Las cinco primeras direcciones concentran el 41,42 % de los tokens ZRX; otros titulares poseen el 58,58 % restante.

Este reparto refleja una estructura de propiedad bastante equilibrada. Aunque hay cierta concentración en la cúspide, no existe una centralización excesiva. La diversidad en los grandes tenedores, en vez de predominio de uno solo, puede contribuir a la estabilidad del mercado. Sin embargo, las acciones coordinadas de los principales tenedores podrían influir sustancialmente en el precio.

La actual distribución evidencia un grado moderado de descentralización, coherente con la filosofía blockchain de ZRX. El reparto entre múltiples direcciones incrementa la resiliencia del token ante movimientos bruscos de mercado o intentos de manipulación, aunque sigue siendo imprescindible la vigilancia dada la relevancia de los grandes tenedores.

Haz clic para conocer la distribución de tenencias de ZRX en tiempo real

| Posición | Dirección | Cantidad | Participación (%) |

|---|---|---|---|

| 1 | 0x1743...f27440 | 152 076,07 K | 15,20 % |

| 2 | 0x2063...e0fd43 | 98 350,94 K | 9,83 % |

| 3 | 0xf977...41acec | 59 191,09 K | 5,91 % |

| 4 | 0xdb63...d97303 | 53 252,50 K | 5,32 % |

| 5 | 0xba7f...7a5eaf | 51 664,21 K | 5,16 % |

| - | Otros | 585 465,19 K | 58,58 % |

II. Factores determinantes para el precio futuro de ZRX

Mecanismo de suministro

- Suministro máximo: ZRX cuenta con un límite máximo de tokens, lo que puede incidir en su precio y valor por la escasez.

- Patrón histórico: La restricción del suministro favoreció la estabilidad del precio y la apreciación del valor en el pasado.

- Impacto actual: Cuando el suministro circulante se aproxima al máximo, puede surgir presión alcista sobre el precio de ZRX.

Dinámica institucional y de grandes tenedores

- Tenencia institucional: Los desarrolladores y creadores de mercado necesitan ZRX para crear y operar exchanges descentralizados, generando liquidez y obteniendo comisiones de trading.

- Adopción empresarial: Proyectos de Ethereum como Augur, Aragon, Maker y Melonport han integrado 0x directamente en sus plataformas.

- Participación en gobernanza: Los tenedores de ZRX pueden intervenir en decisiones sobre el protocolo, influyendo en su desarrollo futuro.

Desarrollo técnico y expansión ecosistémica

- Innovación del protocolo: Las mejoras e innovaciones continuas del protocolo 0x inciden de forma significativa en el valor de ZRX.

- Expansión del ecosistema: El crecimiento de los DEX y del ecosistema DeFi aumenta la demanda de ZRX como token utilitario.

- Aplicaciones ecosistémicas: Proyectos como dYdX, Dharma y Market desarrollan derivados y productos financieros sobre el protocolo 0x, ampliando sus usos.

III. Proyección de precio de ZRX para 2025–2030

Escenario 2025

- Proyección conservadora: 0,19705 $ – 0,24030 $

- Proyección neutral: 0,24030 $ – 0,28000 $

- Proyección optimista: 0,28000 $ – 0,31479 $ (si el sentimiento de mercado y desarrollo del proyecto son positivos)

Escenario 2027–2028

- Fase de mercado prevista: Crecimiento con mayor adopción

- Rango de precio esperado:

- 2027: 0,18154 $ – 0,36309 $

- 2028: 0,30499 $ – 0,45913 $

- Catalizadores: Nuevos casos de uso, avances tecnológicos y expansión general del mercado cripto

Perspectivas a largo plazo 2029–2030

- Escenario base: 0,39354 $ – 0,48208 $ (crecimiento y adopción continuados)

- Escenario optimista: 0,48208 $ – 0,57063 $ (rendimiento de mercado sólido, avances de proyecto)

- Escenario transformador: 0,57063 $ – 0,70000 $ (gran innovación y adopción masiva)

- 31 de diciembre de 2030: ZRX 0,48208 $ (subida potencial del 100 % respecto a valores de 2025)

| Año | Máximo estimado | Precio medio | Mínimo estimado | Variación (%) |

|---|---|---|---|---|

| 2025 | 0,31479 | 0,2403 | 0,19705 | 0 |

| 2026 | 0,30808 | 0,27755 | 0,21926 | 15 |

| 2027 | 0,36309 | 0,29281 | 0,18154 | 21 |

| 2028 | 0,45913 | 0,32795 | 0,30499 | 36 |

| 2029 | 0,57063 | 0,39354 | 0,29515 | 63 |

| 2030 | 0,52547 | 0,48208 | 0,33746 | 100 |

IV. Estrategias profesionales de inversión y gestión de riesgos para ZRX

Metodología de inversión en ZRX

(1) Estrategia holding a largo plazo

- Indicado para: Inversores de valor y entusiastas de la tecnología blockchain

- Recomendaciones operativas:

- Acumula ZRX en correcciones de mercado

- Define objetivos de precio para toma parcial de beneficios

- Almacena los tokens en carteras hardware seguras

(2) Estrategia de trading activo

- Herramientas de análisis técnico:

- Medias móviles: identificar tendencias y posibles cambios de ciclo

- Índice de fuerza relativa (RSI): valorar zonas de sobrecompra/sobreventa

- Puntos clave para operativa swing trading:

- Analiza el volumen negociado para confirmar movimientos

- Establece órdenes de stop-loss para gestionar el riesgo bajista

Marco de gestión de riesgos para ZRX

(1) Principios de asignación de activos

- Perfil conservador: 1–3 % de la cartera cripto

- Perfil agresivo: 5–8 %

- Perfil profesional: 10–15 %

(2) Soluciones de cobertura de riesgo

- Diversificación: reparte la inversión entre varios criptoactivos

- Órdenes de stop-loss: limita las pérdidas potenciales

(3) Soluciones de custodia segura

- Billetera caliente recomendada: Gate Web3 wallet

- Custodia en frío: billeteras hardware para posiciones a largo plazo

- Precauciones: activa la autenticación en dos factores y emplea contraseñas robustas

V. Riesgos y retos potenciales de ZRX

Riesgos de mercado de ZRX

- Volatilidad: oscilaciones intensas de precio propias del cripto

- Liquidez: posibles dificultades en momentos de tensión

- Competencia: la aparición de nuevos protocolos DEX puede reducir cuota de mercado de ZRX

Riesgos regulatorios de ZRX

- Incertidumbre regulatoria: la normativa global en constante cambio puede afectar a los DEX

- Desafíos de cumplimiento: adaptación a exigencias KYC/AML

- Situación legal: potencial clasificación como valor negociable en determinadas jurisdicciones

Riesgos técnicos de ZRX

- Vulnerabilidad de contratos inteligentes: posible exposición a exploits

- Problemas de escalabilidad: congestión en Ethereum que afecta al usuario

- Desafíos de actualización: introducir mejoras sin interrupciones en el protocolo

VI. Conclusión y recomendaciones de actuación

Evaluación del valor de inversión en ZRX

ZRX constituye una infraestructura clave para la operativa en DEX, con un potencial robusto a largo plazo, aunque expuesto a riesgos de corto plazo por la volatilidad y mayor competencia.

Recomendaciones de inversión en ZRX

✅ Principiantes: opta por posiciones modestas a largo plazo en una cartera diversificada ✅ Inversores con experiencia: utiliza estrategias DCA y monitoriza la evolución en el entorno DEX ✅ Institucionales: valora ZRX dentro de una estrategia DeFi amplia y sigue de cerca los cambios regulatorios

Formas de participar en el trading de ZRX

- Spot trading: compra ZRX en Gate.com

- Participa en staking DeFi o como proveedor de liquidez en exchanges descentralizados compatibles

- Derivados: opera futuros de ZRX para exposición apalancada (solo operadores avanzados)

Las inversiones en criptoactivos conllevan riesgos muy elevados y este texto no constituye asesoramiento financiero. Decide cuidadosamente en función de tu tolerancia a riesgo y consulta siempre con profesionales. No inviertas más de lo que puedas permitirte perder.

FAQ

¿Hasta dónde puede llegar ZRX?

ZRX podría alcanzar los 1,5790 $ al final de 2025, según el análisis y las proyecciones actuales del mercado.

¿Es recomendable invertir en ZRX?

ZRX apunta buenas perspectivas. La subida reciente y el objetivo de 0,55 $ sugieren potencial de crecimiento. Su integración con 0x Protocol puede reforzar su valor y convertirlo en una opción atractiva en el mercado actual.

¿Es 0x una buena criptomoneda?

0x tiene potencial de apreciación, y las previsiones para 2028 son favorables. Sin embargo, como ocurre en todo el sector cripto, el futuro es incierto. Los precios actuales son bajos, lo que puede ser una buena oportunidad de entrada para inversores interesados.

¿Quién es el dueño de ZRX?

ZRX pertenece a inversores y traders individuales; no hay ninguna entidad que lo posea en exclusiva. Es una criptomoneda descentralizada.

cuando una moneda criptográfica recibe un ETF..

Mejor Cripto para Comprar Ahora Mismo: Guía 2025 para Inversores Inteligentes

Predicción del precio de UNI en 2025: análisis de los factores clave que determinarán la valoración del token de Uniswap en la etapa posterior al mercado alcista

Predicción del precio de COMP en 2025: ¿Llegará el token de Compound Finance a nuevos máximos en el mercado DeFi?

Predicción del precio de UNI en 2025: análisis del potencial de crecimiento y los desafíos para el token nativo de Uniswap