2025 ZRCPrice Prediction: Strategic Outlook and Market Analysis for ZRC Token in a Volatile Crypto Landscape

Introduction: Market Position and Investment Value of ZRC

Zircuit (ZRC), as a fully EVM-compatible zero-knowledge rollup, has been making strides in the L2 technology space since its inception. As of 2025, Zircuit's market capitalization has reached $44,161,859.97, with a circulating supply of approximately 2,194,923,458 tokens, and a price hovering around $0.02012. This asset, known for its cutting-edge Layer 2 solutions, is playing an increasingly crucial role in enhancing blockchain scalability and efficiency.

This article will provide a comprehensive analysis of Zircuit's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. ZRC Price History Review and Current Market Status

ZRC Historical Price Evolution Trajectory

- 2024: Project launch, price reached all-time high of $0.14844 on November 16

- 2025: Market downturn, price dropped to all-time low of $0.01944 on June 27

- 2025: Price recovery, current price at $0.02012 as of October 1

ZRC Current Market Situation

As of October 1, 2025, ZRC is trading at $0.02012, with a market cap of $44,161,859.97. The token has experienced a 3.92% decrease in the last 24 hours and a significant 85.39% decline over the past year. ZRC's circulating supply stands at 2,194,923,458 tokens, representing 21.95% of its total supply of 10 billion tokens. The fully diluted valuation is $201,200,000. Trading volume in the last 24 hours reached $358,512.64, indicating moderate market activity. ZRC currently ranks 741st in the cryptocurrency market, with a market dominance of 0.0048%.

Click to view the current ZRC market price

ZRC Market Sentiment Indicator

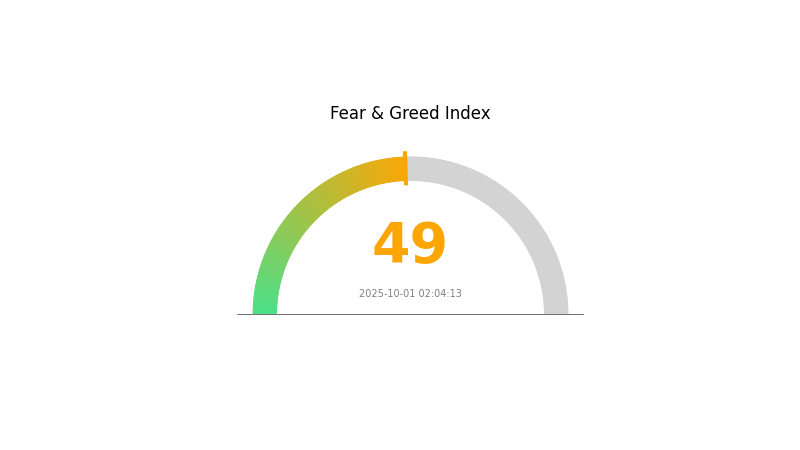

2025-10-01 Fear and Greed Index: 49 (Neutral)

Click to view the current Fear & Greed Index

The cryptocurrency market sentiment remains neutral as we enter October 2025, with the Fear and Greed Index hovering at 49. This balanced sentiment suggests investors are neither overly fearful nor excessively optimistic. While caution persists, there's a sense of stability in the market. Traders should remain vigilant, as this equilibrium could shift quickly based on emerging news or market trends. As always, it's crucial to conduct thorough research and manage risks appropriately when making investment decisions in the volatile crypto space.

ZRC Holdings Distribution

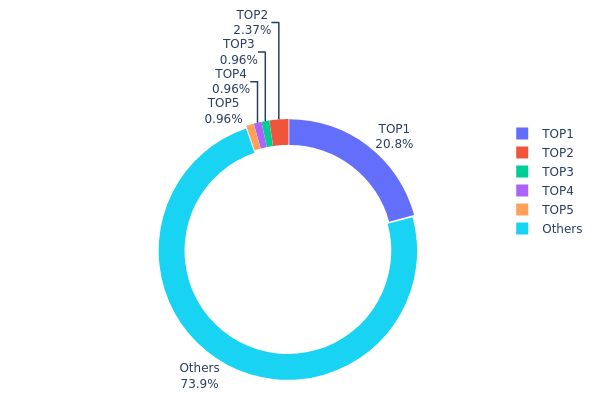

The address holdings distribution data provides crucial insights into the concentration of ZRC tokens. The top address holds a significant 20.82% of the total supply, indicating a high level of centralization. The subsequent top 4 addresses each hold approximately 0.96% of the supply, with the remaining 73.94% distributed among other addresses.

This distribution pattern suggests a moderate level of concentration, with the top address wielding substantial influence over the token's supply. While not excessively centralized, this structure could potentially impact market dynamics and price volatility. The presence of a dominant holder may introduce risks of market manipulation or sudden price fluctuations if large amounts of tokens are moved.

Despite the concentration at the top, the fact that nearly 74% of the supply is held by other addresses indicates a degree of distribution among the broader user base. This balance between centralization and distribution reflects a market structure that maintains some level of decentralization while potentially benefiting from the stability provided by larger stakeholders.

Click to view the current ZRC Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x386b...b26dd8 | 2082605.07K | 20.82% |

| 2 | 0x6522...837e90 | 236512.44K | 2.36% |

| 3 | 0xfb0f...5e8595 | 96000.10K | 0.96% |

| 4 | 0x8033...0a9e6b | 96000.00K | 0.96% |

| 5 | 0xcbd4...c04a8e | 96000.00K | 0.96% |

| - | Others | 7392882.39K | 73.94% |

II. Key Factors Influencing ZRC's Future Price

Supply Mechanism

- Supply and Demand: The fundamental basis for interpreting price trends is the supply and demand relationship.

- Historical Patterns: Price patterns such as head and shoulders, double bottoms, and triple bottoms are common formations in the market that can be used to predict future price movements.

Technical Development and Ecosystem Building

- Zero-Knowledge Rollup: Zircuit represents a significant advancement in Ethereum's scalability and security, operating as a zero-knowledge rollup. This technology aims to provide a solution fully compatible with the Ethereum Virtual Machine (EVM).

III. ZRC Price Prediction for 2025-2030

2025 Outlook

- Conservative estimate: $0.01586 - $0.02008

- Neutral estimate: $0.02008 - $0.02430

- Optimistic estimate: $0.02430 - $0.02851 (requires positive market sentiment and increased adoption)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increasing adoption

- Price range forecast:

- 2027: $0.01793 - $0.03969

- 2028: $0.03109 - $0.04525

- Key catalysts: Technological advancements, wider market recognition, and possible partnerships

2029-2030 Long-term Outlook

- Base scenario: $0.03990 - $0.04728 (assuming steady market growth and adoption)

- Optimistic scenario: $0.05466 - $0.06761 (assuming rapid adoption and favorable market conditions)

- Transformative scenario: $0.06761+ (assuming breakthrough use cases and mainstream integration)

- 2030-12-31: ZRC $0.06761 (potential peak based on optimistic projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.02851 | 0.02008 | 0.01586 | 0 |

| 2026 | 0.0345 | 0.0243 | 0.02211 | 20 |

| 2027 | 0.03969 | 0.0294 | 0.01793 | 46 |

| 2028 | 0.04525 | 0.03454 | 0.03109 | 71 |

| 2029 | 0.05466 | 0.0399 | 0.02633 | 98 |

| 2030 | 0.06761 | 0.04728 | 0.04539 | 134 |

IV. ZRC Professional Investment Strategies and Risk Management

ZRC Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors and believers in Layer 2 technology

- Operational suggestions:

- Accumulate ZRC during market dips

- Set price targets for partial profit-taking

- Store tokens securely in hardware wallets or reputable custodial services

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- RSI (Relative Strength Index): Helps in identifying overbought or oversold conditions

- Key points for swing trading:

- Monitor ZRC's correlation with the broader crypto market

- Pay attention to Zircuit's development updates and partnerships

ZRC Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Moderate investors: 3-7% of crypto portfolio

- Aggressive investors: 7-15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across different L2 projects

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate web3 wallet

- Cold storage solution: Hardware wallets for long-term holdings

- Security precautions: Enable two-factor authentication, use unique strong passwords

V. Potential Risks and Challenges for ZRC

ZRC Market Risks

- High volatility: ZRC price may experience significant fluctuations

- Competition: Other L2 solutions may gain market share

- Market sentiment: Negative news in the crypto space can impact ZRC's price

ZRC Regulatory Risks

- Uncertain regulations: Potential changes in crypto regulations could affect ZRC

- Cross-border restrictions: Varying regulations across jurisdictions may limit adoption

- Tax implications: Evolving tax laws may impact ZRC holders

ZRC Technical Risks

- Smart contract vulnerabilities: Potential bugs or exploits in the protocol

- Scalability challenges: Unforeseen issues in handling increased transaction volume

- Interoperability concerns: Difficulties in integrating with other blockchain networks

VI. Conclusion and Action Recommendations

ZRC Investment Value Assessment

ZRC presents a high-risk, high-potential investment in the L2 scaling solutions space. While it offers promising technology, investors should be aware of the volatile nature of the crypto market and the specific risks associated with emerging blockchain projects.

ZRC Investment Recommendations

✅ Beginners: Start with small positions and focus on education about L2 technologies ✅ Experienced investors: Consider a balanced approach, allocating based on risk tolerance ✅ Institutional investors: Conduct thorough due diligence and consider ZRC as part of a diversified crypto portfolio

ZRC Participation Methods

- Spot trading: Purchase ZRC on Gate.com

- Staking: Participate in staking programs if available

- DeFi integration: Explore DeFi protocols built on Zircuit, if any emerge

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is ZRC a good coin?

ZRC shows potential for long-term growth. Forecasts suggest possible value increase by 2030, despite current mixed signals. Consider it for diversifying your crypto portfolio.

How high can Zircuit go?

Zircuit could potentially reach $0.039761 by 2029, showing a moderate upward trend over the next few years.

What crypto will 1000x prediction?

Tapzi (TAPZI) and Echelon Prime (PRIME) are predicted to 1000x. They focus on skill-based gaming and interoperability, offering innovative solutions in the Web3 space.

How much is ZRC coin worth today?

As of October 1, 2025, ZRC coin is worth $0.020342. The price has decreased by 5.24% in the last 24 hours, with a trading volume of $8,725,826.

2025 ZKPrice Prediction: Analyzing Market Trends and Growth Potential for Zero-Knowledge Protocols

2025 ZKCPrice Prediction: Market Analysis and Growth Potential of ZKC in the Zero-Knowledge Cryptography Ecosystem

What Is Fundamental Analysis and How Can It Evaluate Crypto Projects in 2025?

2025 ZKC Price Prediction: Analyzing Market Trends and Potential Growth Factors

How Does Fundamental Analysis Evaluate Crypto Projects in 2025?

2025 ZK Price Prediction: Analyzing the Potential Growth of Zero-Knowledge Protocols in the Crypto Market

Understanding Bullish Flag Patterns in Cryptocurrency Trading

2025 CHILLGUY Price Prediction: Will This Viral Meme Coin Reach New Highs or Face a Market Correction?

Unlocking the Potential of Automated Crypto Trading Strategies

2025 STORJ Price Prediction: Expert Analysis and Market Forecast for Decentralized Storage Token

Comprehensive Insight into Block Trades in Cryptocurrency