2025 TLM Price Prediction: Expert Analysis and Market Forecast for Alien Worlds Token

Introduction: TLM's Market Position and Investment Value

Alien Worlds (TLM), a native functional token powering the NFT DeFi metaverse, has established itself as a unique player in the gaming and decentralized autonomous organization (DAO) sector since its launch in April 2021. As of December 2025, TLM boasts a market capitalization of approximately $12.9 million with a circulating supply of 6.24 billion tokens, currently trading at $0.002067. This innovative asset, recognized for its multi-utility framework encompassing planetary governance, in-game currency functionality, and NFT mining incentives, continues to play an increasingly vital role in the metaverse gaming ecosystem.

This article will provide a comprehensive analysis of TLM's price trajectory through 2030, integrating historical performance patterns, market supply-demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and actionable investment strategies for crypto asset enthusiasts and investors seeking exposure to the gaming and metaverse sectors.

Alien Worlds (TLM) Market Analysis Report

I. TLM Price History Review and Current Market Status

TLM Historical Price Evolution Trajectory

-

May 2021: Project launch with initial price of $0.4, reaching all-time high of $0.739714 on May 3, 2021, representing a significant early-stage appreciation as the NFT DeFi metaverse gained market attention.

-

2021-2024: Prolonged bear market cycle, with prices experiencing substantial depreciation from peak levels as the broader cryptocurrency market contracted and NFT gaming sector faced headwinds.

-

December 2025: Price declined to all-time low of $0.00191353 on December 19, 2025, reflecting a cumulative decline of approximately 99.74% from historical highs over the past four years.

TLM Current Market Performance

As of December 21, 2025, TLM is trading at $0.002067, representing a marginal recovery of 0.44% in the past hour but down 0.86% over the last 24 hours. The token exhibits continued downward pressure with a 7-day decline of 10.17% and a 30-day loss of 15.6%. Over the past year, TLM has depreciated by 85.15%.

Market Capitalization and Supply Metrics:

- Current market capitalization: $12,907,924.58

- Fully diluted valuation: $14,212,030.43

- Circulating supply: 6,244,762,735.87 TLM (62.45% of total supply)

- Total supply: 6,875,679,937.12 TLM

- Maximum supply: 10,000,000,000 TLM

- 24-hour trading volume: $12,145.88

- Market dominance: 0.00044%

- Number of holders: 6,126

- Trading on 27 exchanges

The token's 24-hour trading range spans from $0.002037 to $0.002101, with circulating supply representing approximately 62.45% of the fully diluted valuation.

Click to view current TLM market price

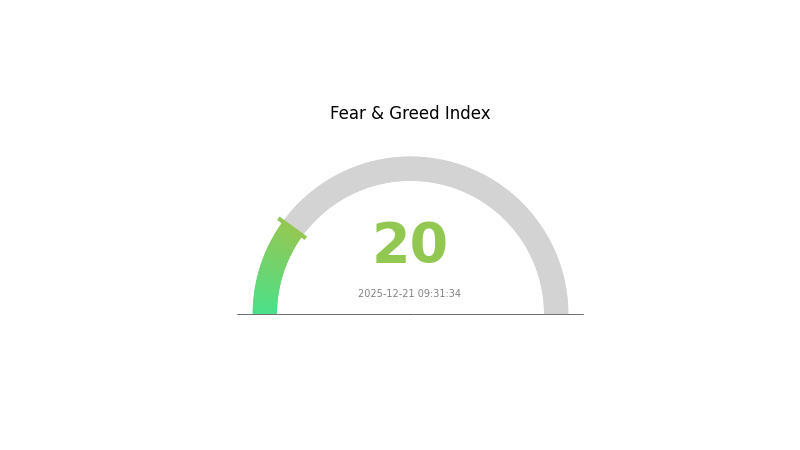

TLM 市场情绪指标

2025-12-21 恐惧与贪婪指数:20(Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is currently experiencing extreme fear with a fear and greed index of 20, indicating severe market pessimism. Such conditions often present contrarian opportunities for long-term investors, as excessive fear can signal potential bottoms. However, traders should exercise caution and conduct thorough research before making investment decisions. Consider dollar-cost averaging strategies and avoid panic selling during these periods. Monitor market sentiment closely on Gate.com's sentiment analysis tools to track potential reversals and identify entry points.

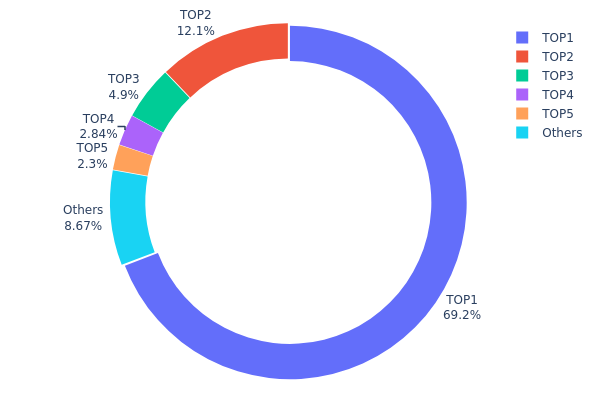

TLM Holding Distribution

The address holding distribution map illustrates how TLM tokens are allocated across different blockchain addresses, serving as a critical indicator of token concentration and decentralization. By examining the top holders and their respective percentages of total supply, analysts can assess market structure, identify potential concentration risks, and evaluate the overall health of the token's ecosystem.

Current data reveals a significant concentration of TLM tokens among a limited number of addresses. The top address commands 69.17% of the total supply, indicating an exceptionally high degree of centralization. When combined with the second-largest holder at 12.11%, these two addresses alone control over 81% of all circulating TLM tokens. The remaining top five addresses account for an additional 10.30%, collectively representing approximately 91% of the token supply. This distribution pattern demonstrates pronounced concentration risk, as decision-making power and market influence are heavily skewed toward a small number of entities.

Such extreme concentration poses notable implications for market dynamics and stability. The dominant holder's substantial stake creates asymmetric leverage that could potentially influence price movements through concentrated selling or strategic accumulation. The narrow distribution limits genuine market decentralization and raises concerns regarding token utility adoption and community-driven governance. Additionally, this structure may increase volatility susceptibility and reduce market resilience during adverse conditions. From a long-term perspective, the current holding distribution reflects a market structure dominated by centralized entities rather than distributed community participation, suggesting that broader adoption and more balanced token distribution would be necessary for achieving sustainable, decentralized network maturity.

Click to view current TLM holding distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x0000...000000 | 6851334.05K | 69.17% |

| 2 | 0xf977...41acec | 1200000.00K | 12.11% |

| 3 | 0x5a52...70efcb | 484963.28K | 4.89% |

| 4 | 0xc368...816880 | 281069.18K | 2.83% |

| 5 | 0x28c6...f21d60 | 227555.38K | 2.29% |

| - | Others | 858815.02K | 8.71% |

II. Core Factors Affecting TLM's Future Price

Supply Mechanism

-

Token Staking Requirement: Users must stake TLM tokens to participate in the Alien Worlds ecosystem, which creates consistent demand pressure on the token supply and incentivizes player engagement.

-

Current Impact: The staking mechanism directly ties token utility to active participation, meaning increased game adoption drives higher demand for TLM, while declining engagement reduces buy pressure on the token.

Ecosystem and Game Dynamics

-

Game Participation: TLM is a utility token within Alien Worlds that serves as the primary incentive mechanism for player participation. Land ownership represents the most stable and accessible way to earn TLM within the game economy.

-

Community Activity: Investor focus should center on game updates, player growth, and community engagement levels, as these metrics directly correlate with token demand and utility value.

-

Market Sentiment: Token price movements are significantly influenced by overall market sentiment and the health of the Web3 gaming sector, particularly regarding concerns about sustainable game economics and long-term project viability.

III. 2025-2030 TLM Price Forecast

2025 Outlook

- Conservative Forecast: $0.00163-$0.00206

- Neutral Forecast: $0.00206

- Bullish Forecast: $0.00293 (requires sustained ecosystem development and increased adoption)

2026-2028 Medium-term Outlook

- Market Stage Expectation: Gradual recovery phase with accumulating positive catalysts and expanding use cases within the Alien Worlds ecosystem

- Price Range Forecast:

- 2026: $0.0024-$0.0031 (21% upside potential)

- 2027: $0.00201-$0.00414 (35% upside potential)

- 2028: $0.00243-$0.00423 (68% upside potential)

- Key Catalysts: Enhanced gameplay mechanics, increased in-game utility, growing player base engagement, strategic partnerships, and improved market liquidity on platforms like Gate.com

2029-2030 Long-term Outlook

- Base Case: $0.00231-$0.00527 with 86% appreciation by 2029 (assuming steady ecosystem expansion and mainstream adoption trends)

- Bullish Case: $0.00269-$0.0067 with 121% appreciation by 2030 (assuming accelerated metaverse adoption and significant institutional interest)

- Transformative Case: $0.00269+ by 2030 (contingent on breakthrough innovations in play-to-earn mechanics, cross-chain integration, and substantial growth in the gaming and metaverse sectors)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00293 | 0.00206 | 0.00163 | 0 |

| 2026 | 0.0031 | 0.0025 | 0.0024 | 21 |

| 2027 | 0.00414 | 0.0028 | 0.00201 | 35 |

| 2028 | 0.00423 | 0.00347 | 0.00243 | 68 |

| 2029 | 0.00527 | 0.00385 | 0.00231 | 86 |

| 2030 | 0.0067 | 0.00456 | 0.00269 | 121 |

Alien Worlds (TLM) Professional Investment Strategy and Risk Management Report

IV. TLM Professional Investment Strategy and Risk Management

TLM Investment Methodology

(1) Long-Term Holding Strategy

Target Audience: Investors with strong belief in metaverse gaming ecosystems and NFT-based DeFi mechanics who can tolerate significant volatility over extended periods.

Operational Recommendations:

- Accumulation Phase: Build positions during market downturns when TLM demonstrates support levels. The token's current price of $0.002067 represents a significant discount from its all-time high of $0.739714, presenting potential entry opportunities for long-term believers.

- Staking and Governance Participation: Leverage TLM's dual functionality by staking tokens on selected planets to participate in TLM and NFT mining while simultaneously earning governance rewards through Planet DAO participation.

- Storage Solution: Utilize Gate.com's secure wallet infrastructure for extended holding periods, ensuring private keys remain under personal control while maintaining access to staking and governance features.

(2) Active Trading Strategy

Technical Analysis Considerations:

- Price Action Levels: Monitor the 24-hour trading range ($0.002037 - $0.002101) and established support at the recent all-time low of $0.00191353 (December 19, 2025). Resistance exists near $0.0021-$0.0025 based on recent price consolidation.

- Volume Analysis: Current 24-hour volume of approximately 12,145.88 TLM provides baseline liquidity assessment; traders should confirm adequate volume before executing large positions to minimize slippage.

Swing Trading Key Points:

- Short-Term Sentiment: The 24-hour price change of -0.86% indicates bearish short-term momentum; however, the 1-hour change of +0.44% suggests potential intraday recovery signals. Trade countertrends cautiously and await confirmation through multiple timeframes.

- Market Structure: The token trades across 27 exchanges globally, providing multiple venue options for entry and exit. The 62.45% market cap-to-FDV ratio indicates that approximately 37.55% of total supply remains unvested or unairclaimed, representing potential selling pressure as these tokens enter circulation.

TLM Risk Management Framework

(1) Asset Allocation Principles

Conservative Investors: 0.5%-2% portfolio allocation

- Minimal exposure appropriate for speculative gaming tokens with established user bases but unproven long-term economic models.

Active Investors: 2%-5% portfolio allocation

- Moderate allocation reflecting higher risk tolerance while maintaining diversification across multiple asset categories.

Professional Investors: 5%-10% portfolio allocation

- Substantial allocation only justified through sophisticated analysis of gaming metrics, user retention data, and DAO governance effectiveness.

(2) Risk Hedging Strategies

Dollar-Cost Averaging (DCA): Execute purchases across extended timeframes rather than lump-sum investments. The extreme 85.15% one-year decline demonstrates the necessity of gradual position building to reduce average entry price exposure.

Profit-Taking Protocol: Establish predetermined exit targets at 50%, 100%, and 200% gains above entry prices. Given TLM's historical volatility, capturing profits systematically prevents emotional decision-making during market rallies.

(3) Secure Storage Solutions

Hot Wallet Option: Gate.com Web3 Wallet provides optimal balance of accessibility and security for active traders and stakers. This solution enables seamless participation in Planet DAO governance and NFT mining while maintaining non-custodial control.

Security Considerations:

- Never store wallet recovery phrases in digital formats or cloud storage services

- Enable multi-signature transaction requirements for holdings exceeding personal daily spending limits

- Verify contract addresses directly through official Alien Worlds channels before interacting with smart contracts

- Maintain separate wallets for active trading and long-term holdings

V. TLM Potential Risks and Challenges

TLM Market Risks

Extreme Volatility and Price Drawdown: TLM has experienced an 85.15% decline over one year and trades significantly below its ICO price of $0.40, indicating severe market skepticism. This magnitude of drawdown reflects gaming token sensitivity to sentiment shifts and user engagement metrics.

Liquidity and Market Depth Constraints: With total market capitalization of only $14.21 million and relatively dispersed holdings across 6,126 holders, TLM exhibits significant liquidity risk. Large withdrawals from any individual exchange may create substantial slippage and price impact.

Competitive Metaverse Saturation: The metaverse gaming sector has experienced significant consolidation and user migration, with many projects failing to sustain player engagement beyond initial launch periods. TLM's viability depends on maintaining differentiated gameplay mechanics and economic sustainability.

TLM Regulatory Risks

Securities Classification Uncertainty: Staking mechanisms that generate returns, combined with governance participation through Planet DAO, may attract regulatory scrutiny regarding whether TLM constitutes a security rather than a utility token in certain jurisdictions.

Gaming and Gambling Regulations: As Alien Worlds incorporates competitive gaming elements with potential monetary rewards, certain jurisdictions may impose gaming license requirements, restrictions on player eligibility, or taxation frameworks that impact token economics.

International Compliance Variability: Different regulatory approaches across major markets (North America, European Union, Asia-Pacific) create uncertainty for global token operations, particularly regarding remittance of in-game earnings and NFT trading taxation.

TLM Technology Risks

Smart Contract Vulnerabilities: As a multi-chain NFT gaming protocol, Alien Worlds faces ongoing security challenges across different blockchain implementations. Historical vulnerabilities in gaming contracts can result in permanent user fund loss.

Blockchain Platform Dependency: TLM's multi-chain deployment model creates operational risk tied to underlying blockchain network performance, congestion pricing, and protocol upgrades beyond the project team's direct control.

User Retention and Network Effects: Gaming tokens depend critically on sustained player engagement and active user growth. Declining Daily Active Users (DAU) or Monthly Active Users (MAU) metrics indicate eroding network value, directly threatening token economics.

VI. Conclusions and Action Recommendations

TLM Investment Value Assessment

Alien Worlds represents a speculative investment in decentralized gaming infrastructure with established but challenged market positioning. The project demonstrates genuine technical implementation of NFT-based gameplay mechanics and DAO governance, distinguishing it from purely theoretical blockchain game concepts. However, the 85.15% annual decline, significant distance from ICO pricing, and capital market erosion reflect deteriorating investor confidence and potential sustainability challenges. The token's current valuation appears discounted relative to development stage and active user base, but this discount may reflect legitimate concerns about long-term economic viability rather than temporary market mispricings.

TLM Investment Recommendations

✅ Beginners: Limit exposure to 0.5%-1% of speculative portfolio allocation. Allocate capital only to funds available for near-total loss scenarios. Prioritize understanding Planet DAO governance mechanics and NFT mining functionality before capital deployment. Use Gate.com as primary trading venue and secure wallet provider.

✅ Experienced Investors: Consider 2%-5% allocation contingent upon fundamental analysis of monthly active user trends and DAO participation metrics. Employ DCA strategies across 6-12 month accumulation periods to reduce average entry costs. Utilize staking mechanisms to generate yield while maintaining conviction thesis.

✅ Institutional Investors: Conduct extensive on-chain analytics regarding transaction volumes, wallet concentration, and governance participation effectiveness. Establish hedging positions through token derivatives or alternative metaverse gaming tokens. Engage directly with project governance to understand development roadmap and user acquisition strategies.

TLM Trading Participation Methods

Method 1 - Spot Trading via Gate.com: Execute buy and sell orders directly on Gate.com's exchange platform using market or limit order functionality. This method provides optimal execution pricing and access to the 27-exchange liquidity network through consolidated order flow.

Method 2 - Staking on Planet DAOs: Lock TLM tokens on designated planets to participate in protocol governance rewards and NFT mining incentives. This mechanism generates passive yield while maintaining governance rights within the Alien Worlds ecosystem.

Method 3 - NFT Mining and Gameplay: Acquire in-game NFTs using TLM to participate in active mining and competitive gameplay elements. This approach transforms passive holdings into active ecosystem participation, though requires substantial time investment and gameplay commitment.

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions aligned with individual risk tolerance and financial circumstances. Professional financial consultation is strongly recommended. Never invest funds you cannot afford to lose completely.

FAQ

Is TLM crypto a good investment?

TLM offers strong potential as a gaming and metaverse token with solid use cases in the Alien Worlds ecosystem. Its tokenomics and growing adoption make it attractive for long-term investors seeking exposure to play-to-earn gaming trends.

What is the expected price of TLM?

The expected price of TLM is $0.00239 for the next 24 hours, based on recent market analysis and trading volume trends. Price may range between $0.00239 and $0.00233.

What is the max supply of TLM coin?

The maximum supply of TLM coin is 10 billion tokens. The circulating supply is currently 6.24 billion TLM. This fixed maximum supply helps control inflation and maintain scarcity of the token.

Is YieldGuildGames (YGG) a good investment?: Analyzing the potential and risks of the play-to-earn gaming token

What is TLM: Unlocking the Power of Transfer Learning in Machine Translation

What is YGG: A Comprehensive Guide to Yield Guild Games and Its Impact on Gaming Economy

What is YGG: A Comprehensive Guide to Yield Guild Games and Its Role in the Metaverse Economy

What is TLM: A Comprehensive Guide to Token-based Language Models and Their Applications in Modern AI

Open Loot Explained: Core Whitepaper Logic and Gaming Applications

Is KernelDao (KERNEL) a good investment?: A Comprehensive Analysis of Token Value, Market Potential, and Risk Factors

Is Orbiter Finance (OBT) a good investment?: Analyzing Risk, Potential Returns, and Market Positioning in 2024

NIZA vs ARB: Comparing Two Emerging Blockchain Networks for DeFi and Web3 Applications

Tìm Hiểu Về Tiềm Năng Của DRV Token Trong Không Gian Web3

Promising Crypto Tokens for December 2024 Investments