2025 STEEM Price Prediction: Analyzing Potential Growth Factors and Market Trends

Introduction: STEEM's Market Position and Investment Value

Steem (STEEM), as an open-source blockchain protocol for storing social information and distributing tokens, has achieved significant milestones since its inception in 2016. As of 2025, Steem's market capitalization has reached $47,755,298, with a circulating supply of approximately 529,966,691 tokens, and a price hovering around $0.09011. This asset, often referred to as the "social blockchain pioneer," is playing an increasingly crucial role in decentralized content creation and distribution platforms.

This article will provide a comprehensive analysis of Steem's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. STEEM Price History Review and Current Market Status

STEEM Historical Price Evolution

- 2017: Launch of Steem blockchain, price reached all-time low of $0.07199 on March 11

- 2018: Bull market peak, STEEM hit all-time high of $8.19 on January 3

- 2025: Prolonged bear market, price dropped to $0.09011 as of October 24

STEEM Current Market Situation

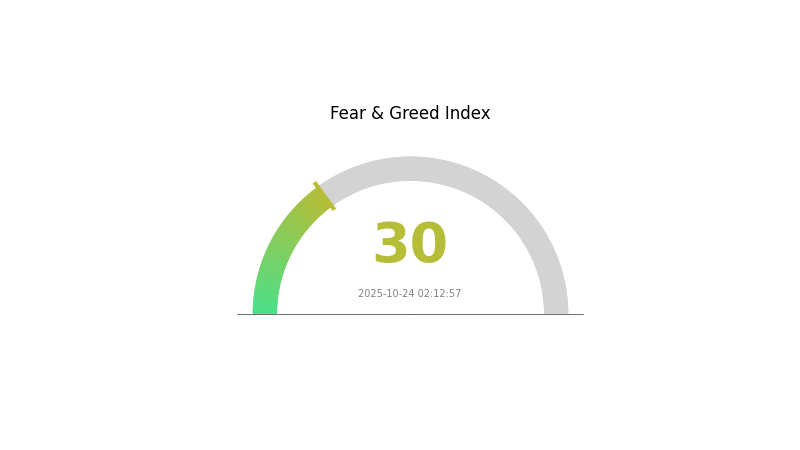

As of October 24, 2025, STEEM is trading at $0.09011, with a 24-hour trading volume of $6,829.45. The token has experienced a slight decrease of 0.62% in the past 24 hours. STEEM's market cap currently stands at $47,755,298, ranking it 640th in the cryptocurrency market. The circulating supply is 529,966,691.802 STEEM tokens, with no maximum supply limit. Over the past year, STEEM has seen a significant decline of 48.22%, reflecting the overall bearish sentiment in the crypto market. The current market emotion index indicates a "Fear" level of 30, suggesting cautious investor sentiment.

Click to view the current STEEM market price

STEEM Market Sentiment Indicator

2025-10-24 Fear and Greed Index: 30 (Fear)

Click to view the current Fear & Greed Index

The crypto market sentiment remains cautious as the Fear and Greed Index hovers at 30, indicating a state of fear. This suggests investors are becoming increasingly wary, potentially creating buying opportunities for contrarian traders. However, it's crucial to exercise caution and conduct thorough research before making any investment decisions. Remember, market sentiment can shift rapidly, and past performance doesn't guarantee future results. Stay informed and consider diversifying your portfolio to manage risk effectively.

STEEM Holdings Distribution

The address holdings distribution data for STEEM is currently unavailable, which limits our ability to conduct a comprehensive analysis of its concentration and market structure. This lack of data could be due to various factors, including potential changes in the blockchain's transparency mechanisms or temporary issues with data collection.

In the absence of specific holding data, we can only make general observations about STEEM's market characteristics. Typically, a healthy distribution would show a balance between large holders (often referred to as "whales") and a diverse base of smaller holders. This balance is crucial for maintaining market stability and reducing the risk of price manipulation.

Without concrete data, it's challenging to assess STEEM's current level of decentralization or the potential impact of large holders on price volatility. Investors and analysts should seek additional information from reliable sources to gain a clearer picture of STEEM's on-chain structure and market dynamics.

Click to view the current STEEM holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Key Factors Affecting STEEM's Future Price

Macroeconomic Environment

- Monetary Policy Impact: Central bank policies and overall economic conditions may influence STEEM's price as part of the broader cryptocurrency market.

- Inflation Hedging Properties: As a cryptocurrency, STEEM may be viewed as a potential hedge against inflation in certain economic scenarios.

- Geopolitical Factors: International political events and tensions can impact the global cryptocurrency market, including STEEM.

Technological Development and Ecosystem Building

- Blockchain Technology Advancements: Improvements in the Steem blockchain technology could positively affect STEEM's value and adoption.

- Ecosystem Applications: The continued development of DApps and projects within the Steem ecosystem, particularly the Steemit platform, may drive increased usage and potentially impact STEEM's price.

III. STEEM Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $0.07289 - $0.08999

- Neutral forecast: $0.08999 - $0.09809

- Optimistic forecast: $0.09809 - $0.10619 (requires positive market sentiment and increased adoption)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increased volatility

- Price range forecast:

- 2027: $0.07698 - $0.10966

- 2028: $0.07636 - $0.16026

- Key catalysts: Platform upgrades, ecosystem expansion, and broader crypto market trends

2029-2030 Long-term Outlook

- Base scenario: $0.13391 - $0.15533 (assuming steady growth and adoption)

- Optimistic scenario: $0.15533 - $0.1895 (with significant ecosystem developments and mainstream acceptance)

- Transformative scenario: Above $0.1895 (with revolutionary use cases and global integration)

- 2030-12-31: STEEM $0.15533 (potential for significant value appreciation)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.10619 | 0.08999 | 0.07289 | 0 |

| 2026 | 0.1128 | 0.09809 | 0.06768 | 8 |

| 2027 | 0.10966 | 0.10545 | 0.07698 | 16 |

| 2028 | 0.16026 | 0.10755 | 0.07636 | 19 |

| 2029 | 0.17676 | 0.13391 | 0.0857 | 48 |

| 2030 | 0.1895 | 0.15533 | 0.09164 | 72 |

IV. STEEM Professional Investment Strategies and Risk Management

STEEM Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Conservative investors looking for steady growth

- Operation suggestions:

- Accumulate STEEM during market dips

- Stake STEEM to earn passive income through Steem Power

- Store in secure hardware wallets for long-term holding

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Monitor short-term and long-term trends

- RSI: Identify overbought and oversold conditions

- Key points for swing trading:

- Set clear entry and exit points based on technical indicators

- Monitor Steem ecosystem developments for potential price catalysts

STEEM Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple cryptocurrencies

- Stop-loss orders: Set predetermined exit points to limit potential losses

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate Web3 Wallet

- Software wallet option: Official Steem wallet

- Security precautions: Enable two-factor authentication, use strong passwords, and regularly update software

V. Potential Risks and Challenges for STEEM

STEEM Market Risks

- High volatility: STEEM price can experience significant fluctuations

- Competition: Other social media cryptocurrencies may impact STEEM's market share

- Liquidity risk: Limited trading volume may affect price stability

STEEM Regulatory Risks

- Uncertain regulatory landscape: Potential for increased scrutiny of social media cryptocurrencies

- Cross-border compliance: Varying regulations across jurisdictions may impact adoption

- Token classification: Risk of being classified as a security in some regions

STEEM Technical Risks

- Smart contract vulnerabilities: Potential for exploits in the Steem blockchain

- Scalability challenges: Possible network congestion during high usage periods

- Centralization concerns: Delegated Proof-of-Stake consensus may lead to centralization issues

VI. Conclusion and Action Recommendations

STEEM Investment Value Assessment

STEEM offers long-term potential as a blockchain-based social media platform but faces short-term volatility and competitive pressures. Its unique features and established ecosystem provide a solid foundation for growth, but investors should be prepared for market fluctuations.

STEEM Investment Recommendations

✅ Beginners: Start with small investments, focus on learning the Steem ecosystem ✅ Experienced investors: Consider a balanced approach of staking and trading ✅ Institutional investors: Conduct thorough due diligence and consider STEEM as part of a diversified crypto portfolio

STEEM Participation Methods

- Staking: Power up STEEM to Steem Power for voting rights and rewards

- Content creation: Earn STEEM by posting and curating content on Steem-based platforms

- Trading: Participate in STEEM markets on reputable exchanges like Gate.com

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the future of STEEM?

STEEM's future looks promising, with projections indicating a price target of $0.1981. The platform's utility continues to expand, and the community remains active, suggesting potential for further growth and development in the coming years.

Will Stellar Lumens reach $10?

While possible, reaching $10 is highly speculative for Stellar Lumens. Market trends and expert analyses don't strongly support this prediction. Long-term price projections vary significantly.

Does stx have a future?

Yes, STX has a promising future. Its innovative layer-2 solutions are driving increased adoption. By 2030, STX is expected to reach $7, with continued technological advancements supporting its growth.

What will stellar lumens be worth in 2025?

Based on current market trends, Stellar Lumens (XLM) is projected to be worth approximately $0.311694 in 2025.

RTF vs SNX: Comparing Document Formats for Cross-Platform Compatibility

Bitcoin Cash Price Analysis: BCH Market Trends and Trading Strategies for 2025

Bitget Token Price 2025: Investment Analysis and Market Performance

Avalanche (AVAX) 2025 Price Analysis and Market Trends

Ethereum to AUD: What Australian Traders Need to Know in 2025

FTT Explained

Ethereum Classic vs Ethereum: Key Differences and EUR Trading Guide

How Do Exchange Net Inflows and Crypto Holdings Concentration Affect Market Capital Flow in 2025?

How to Purchase SPX6900 Cryptocurrency in UK: A Step-by-Step Guide

# What Is Token Economics Model: Distribution, Inflation & Governance Explained

Understanding the Role of Price Oracles in Lending Protocol Liquidation