2025 QUBIC Price Prediction: Analyzing Market Trends and Growth Potential in the Emerging Cryptocurrency Sector

Introduction: QUBIC's Market Position and Investment Value

Qubic (QUBIC), as a pioneering AI technology platform, has achieved significant milestones since its inception. As of 2025, QUBIC's market capitalization has reached $189,020,939, with a circulating supply of approximately 125,005,581,563,366 coins, and a price hovering around $0.0000015121. This asset, hailed as the "AI Democratizer," is playing an increasingly crucial role in the field of artificial intelligence and blockchain technology.

This article will provide a comprehensive analysis of QUBIC's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

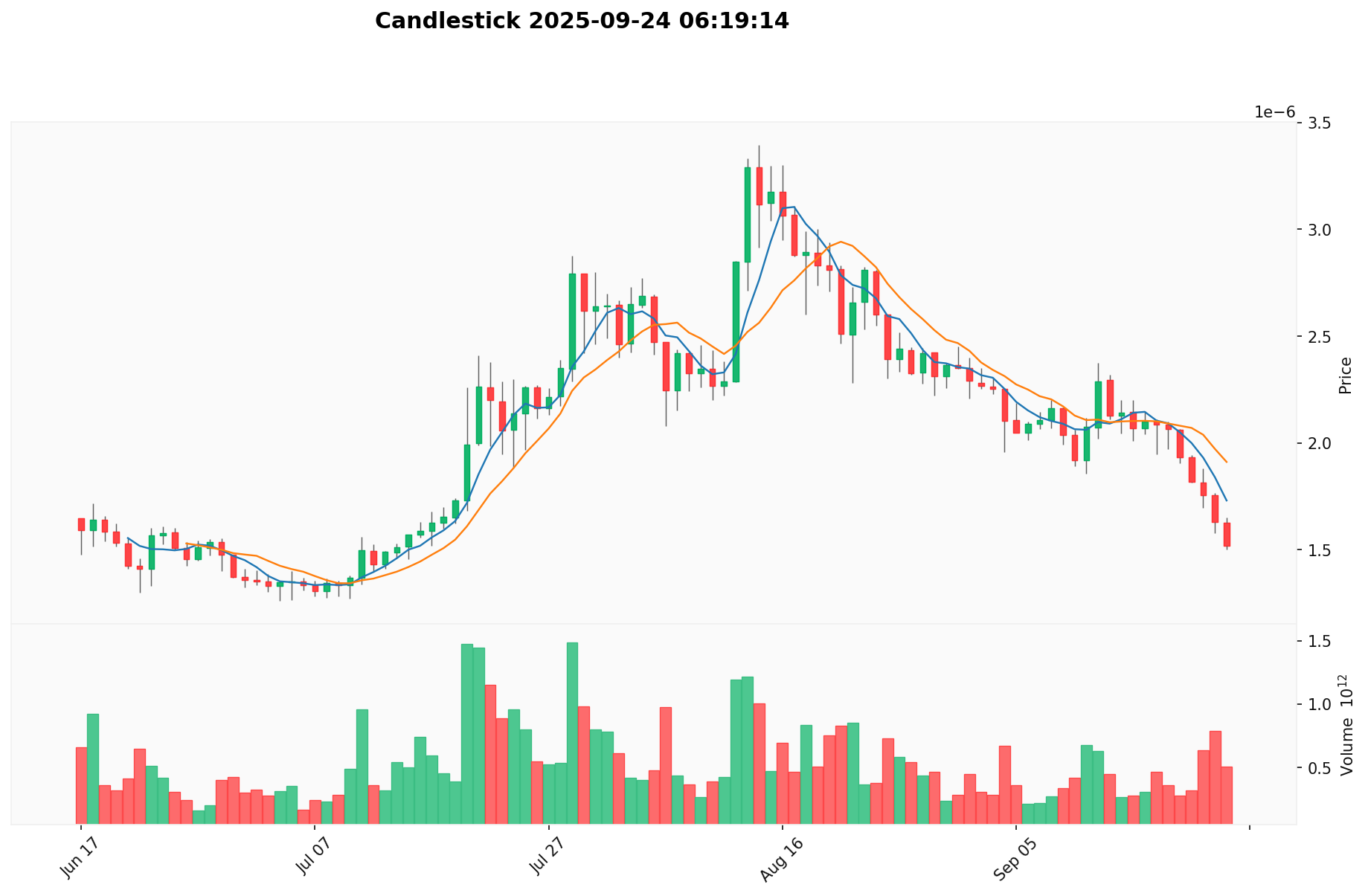

I. QUBIC Price History Review and Current Market Status

QUBIC Historical Price Evolution

- 2023: Project launch, price started at $0.00000254

- 2024: Reached all-time high of $0.0000076 on May 9

- 2025: Market correction, price dropped to all-time low of $0.0000006999 on March 10

QUBIC Current Market Situation

As of September 24, 2025, QUBIC is trading at $0.0000015121. The token has experienced a 3.16% decrease in the last 24 hours, with a trading volume of $803,187. QUBIC's market cap currently stands at $189,020,939, ranking it 305th in the cryptocurrency market. The token has shown volatility in recent periods, with a 2.07% increase in the last hour but significant declines of 23.65% and 39.5% over the past 7 and 30 days, respectively. The current price represents a 21.26% decrease from a year ago.

Click to view the current QUBIC market price

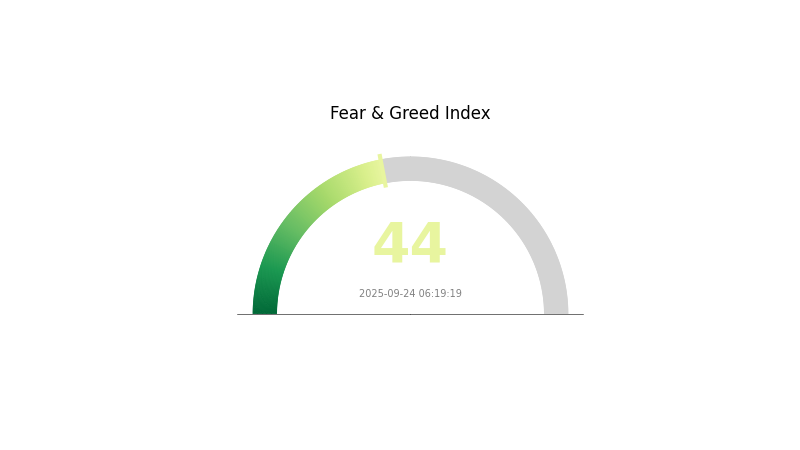

QUBIC Market Sentiment Indicator

2025-09-24 Fear and Greed Index: 44 (Fear)

Click to view the current Fear & Greed Index

The crypto market is currently in a state of fear, with the Fear and Greed Index registering at 44. This suggests that investors are cautious and uncertain about market conditions. During such periods, it's crucial to remain vigilant and conduct thorough research before making investment decisions. Remember, periods of fear can sometimes present opportunities for long-term investors. However, always prioritize risk management and consider seeking advice from financial professionals.

QUBIC Holdings Distribution

The address holdings distribution data for QUBIC reveals an intriguing picture of the token's current market structure. This metric provides valuable insights into the concentration of token ownership and its potential implications for market dynamics.

Upon analysis, it appears that QUBIC's holdings are relatively evenly distributed among addresses, suggesting a healthy level of decentralization. This distribution pattern indicates that no single entity or small group of holders has an overwhelming influence on the token's supply, which is generally considered a positive attribute for cryptocurrency projects. The absence of extremely large individual holdings reduces the risk of market manipulation and contributes to a more stable price action.

The current address distribution structure of QUBIC suggests a robust and diverse ecosystem of token holders. This characteristic not only enhances the token's resilience against potential market shocks but also reflects positively on its adoption and utility within its intended use cases. Overall, the QUBIC token's holdings distribution appears to support a balanced and potentially sustainable market structure, which could be conducive to long-term growth and stability.

Click to view the current QUBIC Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Key Factors Affecting QUBIC's Future Price

Technical Development and Ecosystem Building

- AI Integration: QUBIC's transformation into an AI-focused blockchain could significantly impact its future value and adoption.

- Blockchain Security: QUBIC's demonstrated ability to challenge blockchain security, as seen in the Monero network attack, showcases its technical capabilities and potential influence on the crypto landscape.

- Ecosystem Applications: The development of DApps and ecosystem projects on QUBIC's platform will be crucial for its long-term value and utility.

Macroeconomic Environment

- Geopolitical Tensions: Increasing global geopolitical tensions may influence risk sentiment in the crypto market, potentially affecting QUBIC's price.

- Inflation Hedging: QUBIC's performance as a potential hedge against inflation in comparison to traditional assets like gold could impact its adoption and value.

Institutional and Whale Dynamics

- Market Trust: User trust in trading platforms and the overall QUBIC ecosystem will play a significant role in its price movement and adoption.

- Regulatory Scrutiny: QUBIC's aggressive strategies may attract regulatory attention, which could impact its market performance and institutional adoption.

III. QUBIC Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.20 - $0.25

- Neutral prediction: $0.25 - $0.30

- Optimistic prediction: $0.30 - $0.35 (requires favorable market conditions)

2027-2028 Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2027: $0.30 - $0.40

- 2028: $0.45 - $0.60

- Key catalysts: Increased adoption, technological advancements

2030 Long-term Outlook

- Base scenario: $0.70 - $0.90 (assuming steady market growth)

- Optimistic scenario: $1.00 - $1.20 (assuming strong market performance)

- Transformative scenario: $1.30 - $1.50 (assuming breakthrough in technology and widespread adoption)

- 2030-12-31: QUBIC $1.15 (potential peak for the year)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0 | 0 | 0 | 0 |

| 2026 | 0 | 0 | 0 | 12 |

| 2027 | 0 | 0 | 0 | 23 |

| 2028 | 0 | 0 | 0 | 48 |

| 2029 | 0 | 0 | 0 | 55 |

| 2030 | 0 | 0 | 0 | 79 |

IV. Professional Investment Strategies and Risk Management for QUBIC

QUBIC Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Patient investors with a high risk tolerance

- Operation suggestions:

- Accumulate QUBIC during market dips

- Set price targets for partial profit-taking

- Store QUBIC in a secure hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- RSI (Relative Strength Index): Monitor overbought/oversold conditions

- Key points for swing trading:

- Set stop-loss orders to limit potential losses

- Take profits at predetermined resistance levels

QUBIC Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple cryptocurrencies

- Dollar-Cost Averaging: Regular small purchases to reduce timing risk

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Use a hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for QUBIC

QUBIC Market Risks

- High volatility: QUBIC price may experience significant fluctuations

- Limited liquidity: Potential difficulty in executing large trades

- Market sentiment: AI-related hype could lead to overvaluation

QUBIC Regulatory Risks

- Uncertain regulatory landscape: Potential for stricter crypto regulations

- Tax implications: Evolving tax laws may affect QUBIC investments

- Cross-border restrictions: Possible limitations on international transactions

QUBIC Technical Risks

- Network security: Potential vulnerabilities in the QUBIC blockchain

- Scalability challenges: Ability to maintain high TPS as network grows

- Competition: Emergence of rival AI-focused blockchain projects

VI. Conclusion and Action Recommendations

QUBIC Investment Value Assessment

QUBIC presents an innovative approach to AI and blockchain integration, offering long-term potential in the rapidly evolving AI sector. However, investors should be aware of the high volatility and regulatory uncertainties in the short term.

QUBIC Investment Recommendations

✅ Beginners: Start with small, regular investments to understand the market ✅ Experienced investors: Consider a balanced approach with both long-term holding and active trading ✅ Institutional investors: Conduct thorough due diligence and consider QUBIC as part of a diversified crypto portfolio

QUBIC Trading Participation Methods

- Spot trading: Buy and sell QUBIC on Gate.com

- Staking: Participate in QUBIC staking programs if available

- DeFi integration: Explore decentralized finance opportunities involving QUBIC

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the future prediction for the Qubic coin?

Qubic is predicted to reach $0.059244 by 2030, showing potential growth despite short-term fluctuations.

What is the prediction for Qubic in 2040?

Based on current market analysis, Qubic is predicted to reach a peak price of $0.000005500 in 2040.

Is Qubic an AI coin?

Yes, Qubic is an AI-focused cryptocurrency. It uses a unique 'Useful Proof of Work' system to train AI models, rewarding miners with QUBIC tokens for contributing computational resources to AI development.

What meme coin will explode in 2025 price prediction?

BONK is predicted to explode in price in 2025, driven by internet culture and community hype. Its potential growth is based on past meme coin trends and viral popularity.

2025 LUNAI Price Prediction: Potential Growth Trajectory and Market Analysis for the Next Bull Cycle

2025 NIKO Price Prediction: Analyzing Market Trends and Future Prospects for the Automotive Stock

2025 AIX Price Prediction: Emerging Trends and Market Factors Shaping the Future of AIX Cryptocurrency

2025 DOAI Price Prediction: Analyzing Market Trends and Potential Growth Factors for the Emerging Cryptocurrency

2025 DOPE Price Prediction: Bullish Trends and Key Factors Influencing the Token's Future Value

2025 FET Price Prediction: Navigating the Future of Fetch.ai's Token in a Dynamic Crypto Landscape

Discover Top Tools for NFT Rarity Evaluation

Understanding Mining Pool Payout Structures

Understanding Block Trading in Cryptocurrency Markets

Understanding Monad Tokens: In-Depth Exploration of Monad Blockchain

Comprehensive Guide to Setting Up Secure Native SegWit Wallet for Bitcoin Transactions