2025 POLISPrice Prediction: Analyzing Key Factors and Market Trends for Star Atlas Governance Token

Introduction: POLIS Market Position and Investment Value

Star Atlas DAO (POLIS), as a key player in the gaming metaverse sector, has made significant strides since its inception in 2021. As of 2025, POLIS has achieved a market capitalization of $20,471,880, with a circulating supply of approximately 310,086,044 tokens, and a price hovering around $0.06602. This asset, often hailed as the "Metaverse Gaming Pioneer," is playing an increasingly crucial role in the intersection of blockchain technology and immersive gaming experiences.

This article will provide a comprehensive analysis of POLIS's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. POLIS Price History Review and Current Market Status

POLIS Historical Price Evolution

- 2021: POLIS launched, reaching an all-time high of $18.55 on September 4th

- 2022-2024: Gradual decline during the bear market

- 2025: Price hit an all-time low of $0.04278831 on June 23rd

POLIS Current Market Situation

As of October 5, 2025, POLIS is trading at $0.06602. The token has experienced a 6.1% decrease in the last 24 hours, with a trading volume of $27,935.24. Despite the recent dip, POLIS has shown some resilience over the past week, with a 4.76% increase. However, the token is still down 4.54% over the last 30 days and has seen a significant 67.33% decrease over the past year.

The current market capitalization of POLIS stands at $20,471,880.64, ranking it 1088th in the overall cryptocurrency market. With a circulating supply of 310,086,044.3635 POLIS and a total supply of 360,000,000, the token has a circulation ratio of 86.14%.

The market sentiment for POLIS is currently showing signs of greed, with a VIX index of 74. This indicates that investors may be overly optimistic about the token's short-term prospects.

Click to view the current POLIS market price

POLIS Market Sentiment Indicator

2025-10-05 Fear and Greed Index: 74 (Greed)

Click to view the current Fear & Greed Index

The crypto market is currently in a state of high greed, with the Fear and Greed Index reaching 74. This indicates strong investor optimism and potentially overheated market conditions. While positive sentiment can drive prices up, it's crucial to exercise caution. Traders should be wary of FOMO and consider taking profits or hedging positions. Remember, extreme greed often precedes market corrections. Stay informed and trade responsibly on Gate.com.

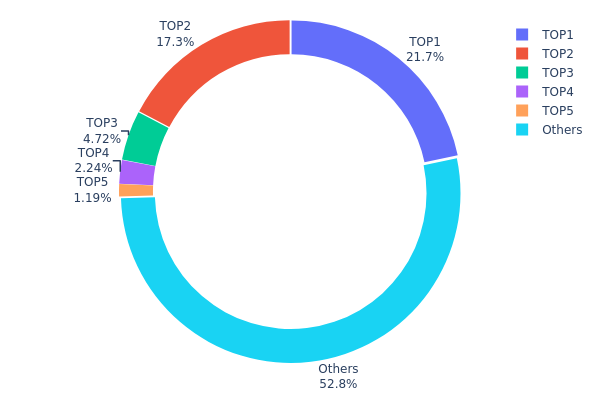

POLIS Holdings Distribution

The address holdings distribution data for POLIS reveals a relatively concentrated ownership structure. The top address holds 21.69% of the total supply, while the second-largest holder controls 17.32%. Together, these two addresses account for nearly 40% of all POLIS tokens. The top five addresses collectively hold 47.15% of the supply, with the remaining 52.85% distributed among other holders.

This concentration of holdings suggests a potential vulnerability in the POLIS market structure. With such a significant portion of tokens controlled by a small number of addresses, there is an increased risk of market manipulation and price volatility. Large holders could potentially exert substantial influence over the token's price through coordinated buying or selling actions.

The current distribution indicates a moderate level of centralization, which may impact the overall stability and decentralization goals of the POLIS ecosystem. While a majority of tokens are held by smaller holders, the outsized influence of the top addresses could pose challenges for governance and decision-making processes within the network.

Click to view the current POLIS Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 5MPLVo...6TfjDu | 78093.46K | 21.69% |

| 2 | 2cg6Sb...KdKvZT | 62368.19K | 17.32% |

| 3 | 3ENn1U...cdAzmP | 17000.00K | 4.72% |

| 4 | u6PJ8D...ynXq2w | 8078.73K | 2.24% |

| 5 | 6LY1Jz...kZzkzF | 4275.18K | 1.18% |

| - | Others | 190182.26K | 52.85% |

II. Key Factors Affecting POLIS's Future Price

Market Sentiment

- Investor Confidence: Investor sentiment and confidence have a direct impact on POLIS price trends.

- Historical Pattern: POLIS price has shown high volatility, typical of emerging cryptocurrencies.

- Current Impact: Market sentiment remains a significant driver of POLIS price fluctuations.

Technical Development and Ecosystem Building

- Governance Proposals: The release of major governance proposals significantly increases POLIS holder activity.

- Ecosystem Growth: POLIS price trends are closely related to the growth of its ecosystem, particularly in the GameFi sector.

- Technical Support: POLIS has attracted interest due to its strong technical support and application prospects.

Macroeconomic Environment

- Market Volatility: Like many emerging cryptocurrencies, POLIS price is highly susceptible to market volatility and external factors.

- Crypto Market Trends: Overall cryptocurrency market trends, including Bitcoin price movements, may influence POLIS.

III. POLIS Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.05279 - $0.06599

- Neutral prediction: $0.06599 - $0.07000

- Optimistic prediction: $0.07000 - $0.07721 (requires favorable market conditions and increased adoption)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increased volatility

- Price range forecast:

- 2027: $0.04060 - $0.09322

- 2028: $0.05726 - $0.08673

- Key catalysts: Technological advancements, wider blockchain adoption, and potential regulatory clarity

2029-2030 Long-term Outlook

- Base scenario: $0.08546 - $0.09828 (assuming steady market growth and continued project development)

- Optimistic scenario: $0.09828 - $0.11499 (with accelerated adoption and favorable market conditions)

- Transformative scenario: $0.11499 - $0.12500 (with groundbreaking technological breakthroughs and mass adoption)

- 2030-12-31: POLIS $0.11499 (potential peak, subject to market dynamics)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.07721 | 0.06599 | 0.05279 | 0 |

| 2026 | 0.07876 | 0.0716 | 0.03938 | 8 |

| 2027 | 0.09322 | 0.07518 | 0.0406 | 13 |

| 2028 | 0.08673 | 0.0842 | 0.05726 | 27 |

| 2029 | 0.1111 | 0.08546 | 0.07948 | 29 |

| 2030 | 0.11499 | 0.09828 | 0.08944 | 48 |

IV. POLIS Professional Investment Strategy and Risk Management

POLIS Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a long-term outlook

- Operation suggestions:

- Accumulate POLIS during market dips

- Set a target holding period of at least 2-3 years

- Store tokens in a secure wallet with regular backups

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Set clear entry and exit points based on technical indicators

- Use stop-loss orders to manage risk

POLIS Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of portfolio

- Aggressive investors: 5-10% of portfolio

- Professional investors: Up to 15% of portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple cryptocurrencies

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for POLIS

POLIS Market Risks

- High volatility: Significant price fluctuations common in the crypto market

- Liquidity risk: Limited trading volume may affect ability to exit positions

- Competition: Other gaming and metaverse projects may impact POLIS adoption

POLIS Regulatory Risks

- Uncertain regulatory landscape: Potential for stricter cryptocurrency regulations

- Token classification: Risk of POLIS being classified as a security

- Cross-border restrictions: Possible limitations on international trading

POLIS Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs in the underlying code

- Scalability issues: Challenges in handling increased network activity

- Interoperability concerns: Compatibility issues with other blockchain networks

VI. Conclusion and Action Recommendations

POLIS Investment Value Assessment

POLIS offers potential long-term value in the growing gaming and metaverse sector, but faces short-term risks due to market volatility and regulatory uncertainties.

POLIS Investment Recommendations

✅ Newcomers: Start with small, regular investments to build a position over time ✅ Experienced investors: Consider a balanced approach with both long-term holdings and active trading ✅ Institutional investors: Conduct thorough due diligence and consider POLIS as part of a diversified crypto portfolio

POLIS Trading Participation Methods

- Spot trading: Buy and sell POLIS on Gate.com's spot market

- Staking: Participate in POLIS staking programs if available

- DeFi integration: Explore decentralized finance options within the Star Atlas ecosystem

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

How much is Polis crypto worth?

As of 2025-10-05, Polis crypto is worth $0.004781. This price reflects the current market value of POLIS tokens.

What is the price prediction for Pols in 2030?

Based on current market analysis, the price of Pols is predicted to reach $0.290893 by 2030. However, this forecast may change as market conditions evolve.

What is Pepe's price prediction for 2025?

Pepe's price may see moderate growth by 2025, with current market sentiment being favorable. Analysts suggest potential for upward movement, but exact predictions vary.

What is polis crypto?

Polis is a community-driven cryptocurrency focused on facilitating easy and secure crypto acceptance. It operates on a smart blockchain, aiming to integrate crypto into everyday transactions.

Is Galaxy Fight Club (GCOIN) a good investment?: Analyzing the Potential and Risks of this Crypto Gaming Token

NXPC Price Trends and Web3 Application Analysis in 2025

2025 BIGTIME Price Prediction: Analysis of Growth Potential and Market Factors Influencing the Gaming Token's Future Value

2025 GAME2Price Prediction: Analyzing Market Trends and Future Valuation Potential for the Gaming Token

2025 MAVIA Price Prediction: Future Growth Analysis and Potential ROI for Investors

VIC vs SAND: Comparing Two Leading Blockchain Gaming Ecosystems for Metaverse Development

What is ICNT: A Comprehensive Guide to International Certified Nursing Technician Qualifications and Career Opportunities

What is WHITE: Understanding the Science, Psychology, and Cultural Significance of the Color White

What is PUFF: A Comprehensive Guide to Understanding the Popular Slang Term and Its Cultural Impact

What is BLUR: A Comprehensive Guide to Understanding the Revolutionary Cryptocurrency Platform

What is XVS: A Comprehensive Guide to Venus Protocol's Native Governance Token