2025 PNUT Price Prediction: Navigating Growth Potential and Market Dynamics in the Evolving Digital Asset Landscape

Introduction: PNUT's Market Position and Investment Value

Peanut the Squirrel (PNUT) has emerged as a unique digital asset that combines social media appeal with blockchain technology. Since its inception, PNUT has captured the hearts of millions and sparked a movement for governmental reform. As of 2025, PNUT's market cap has reached $213,269,905, with a circulating supply of approximately 999,858,912 tokens, and a price hovering around $0.2133. This asset, often referred to as the "Immortal Squirrel," is playing an increasingly crucial role in raising awareness about governmental overreach and animal rights.

This article will provide a comprehensive analysis of PNUT's price trends from 2025 to 2030, taking into account historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. PNUT Price History Review and Current Market Status

PNUT Historical Price Evolution

- 2024: PNUT launched, price reached an all-time low of $0.048 on November 5

- 2024: Significant growth, hitting an all-time high of $2.50119 on November 14

- 2025: Market consolidation, price fluctuating between $0.2043 and $0.2167 in the past 24 hours

PNUT Current Market Situation

As of September 24, 2025, PNUT is trading at $0.2133, with a 24-hour trading volume of $992,731.15549. The token has shown a slight increase of 0.04% in the last 24 hours. PNUT's market capitalization stands at $213,269,905.944531, ranking it at 285th in the overall cryptocurrency market.

The circulating supply of PNUT is 999,858,912.07 tokens, which is 99.99% of its total supply of 1,000,000,000 tokens. This indicates that almost all PNUT tokens are in circulation.

In terms of recent price trends, PNUT has experienced mixed performance across different timeframes:

- 1 hour: +1.32%

- 24 hours: +0.04%

- 7 days: -13.4%

- 30 days: -4.22%

- 1 year: +340,872.99%

The token's price is currently significantly below its all-time high of $2.50119, achieved on November 14, 2024. However, it remains well above its all-time low of $0.048, recorded on November 5, 2024.

Click to view the current PNUT market price

PNUT Market Sentiment Indicator

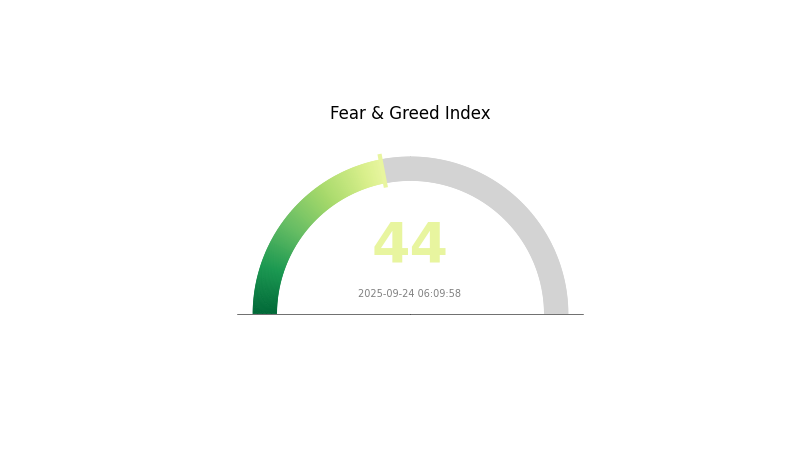

2025-09-24 Fear and Greed Index: 44 (Fear)

Click to view the current Fear & Greed Index

The crypto market is currently experiencing a sense of fear, with the Fear and Greed Index standing at 44. This indicates a cautious sentiment among investors, who may be hesitant to make bold moves. During such periods, it's crucial to remain vigilant and conduct thorough research before making any investment decisions. Remember, market fear can sometimes present opportunities for those with a long-term perspective. Stay informed and consider diversifying your portfolio to mitigate risks in this uncertain climate.

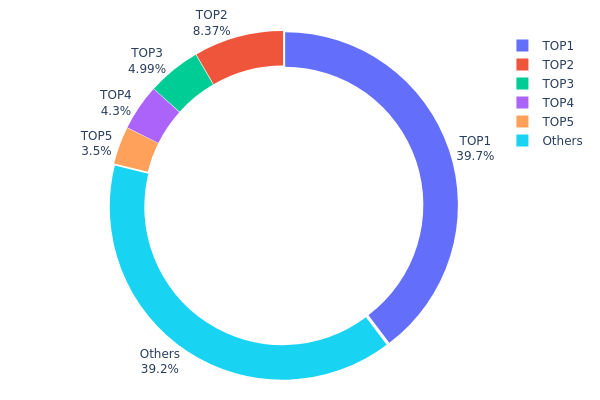

PNUT Holdings Distribution

The address holdings distribution data for PNUT reveals a significant concentration of tokens among a few top addresses. The top address holds 39.69% of the total supply, while the top 5 addresses collectively control 60.81% of PNUT tokens. This level of concentration indicates a highly centralized distribution, which could have substantial implications for the token's market dynamics.

Such a concentrated holding pattern raises concerns about potential market manipulation and price volatility. With a single address controlling nearly 40% of the supply, there is a risk of large-scale sell-offs or buying pressure that could dramatically impact PNUT's price. Furthermore, the top 5 addresses having the ability to influence over 60% of the token supply suggests that PNUT's on-chain governance and decision-making processes may be dominated by a small group of stakeholders.

This concentration also reflects a low level of decentralization in PNUT's ecosystem, which may be perceived negatively by investors seeking more distributed token economies. However, it's worth noting that 39.19% of the tokens are held by other addresses, indicating some degree of wider distribution among smaller holders.

Click to view the current PNUT Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 9WzDXw...YtAWWM | 396931.66K | 39.69% |

| 2 | CBEADk...sebkVG | 83651.72K | 8.36% |

| 3 | 4xLpwx...k99Qdg | 49855.66K | 4.98% |

| 4 | 3B7XAQ...hhei9z | 42973.05K | 4.29% |

| 5 | 5LZkAT...mtboT2 | 34960.43K | 3.49% |

| - | Others | 391479.32K | 39.19% |

II. Key Factors Influencing PNUT's Future Price

Market Sentiment

- Social Media Impact: PNUT's price is highly sensitive to social media trends and public figures' comments.

- Historical Pattern: Elon Musk's remarks have previously caused significant price fluctuations.

- Current Impact: Recent social media buzz and celebrity endorsements continue to drive short-term price movements.

Macroeconomic Environment

- Inflation Hedge Potential: PNUT's performance in inflationary environments remains to be fully tested.

- Geopolitical Factors: International tensions and regulatory changes can impact PNUT's global adoption and value.

Technological Development and Ecosystem Building

- Solana-Based Infrastructure: PNUT benefits from Solana's high-speed, low-cost transaction capabilities.

- Ecosystem Applications: Platforms like Pump.fun facilitate easy creation and trading of meme coins, including PNUT.

III. PNUT Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.19197 - $0.2133

- Neutral prediction: $0.2133 - $0.2165

- Optimistic prediction: $0.2165 - $0.2197 (requires positive market sentiment)

2026-2027 Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2026: $0.14072 - $0.30526

- 2027: $0.18523 - $0.31828

- Key catalysts: Increasing adoption and potential technological advancements

2028-2030 Long-term Outlook

- Base scenario: $0.28958 - $0.31616 (assuming steady market growth)

- Optimistic scenario: $0.31616 - $0.39204 (with favorable market conditions)

- Transformative scenario: Above $0.39204 (with exceptional project developments and market adoption)

- 2030-12-31: PNUT $0.39204 (potential peak based on optimistic projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.2197 | 0.2133 | 0.19197 | 0 |

| 2026 | 0.30526 | 0.2165 | 0.14072 | 1 |

| 2027 | 0.31828 | 0.26088 | 0.18523 | 22 |

| 2028 | 0.32433 | 0.28958 | 0.20271 | 35 |

| 2029 | 0.32537 | 0.30695 | 0.2517 | 43 |

| 2030 | 0.39204 | 0.31616 | 0.27506 | 48 |

IV. Professional Investment Strategies and Risk Management for PNUT

PNUT Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term value investors and supporters of the PNUT project

- Operation suggestions:

- Accumulate PNUT tokens during market dips

- Hold for at least 1-2 years to ride out short-term volatility

- Store tokens in a secure Gate Web3 wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential support/resistance levels

- RSI (Relative Strength Index): Monitor overbought/oversold conditions

- Key points for swing trading:

- Set clear entry and exit points based on technical indicators

- Use stop-loss orders to manage downside risk

PNUT Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple crypto assets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords, and regularly update software

V. Potential Risks and Challenges for PNUT

PNUT Market Risks

- High volatility: PNUT price may experience significant fluctuations

- Limited liquidity: Potential difficulty in executing large trades without impacting price

- Market sentiment: Susceptible to changes in overall crypto market trends

PNUT Regulatory Risks

- Uncertain regulatory landscape: Potential for new regulations affecting meme coins

- Legal challenges: Possible issues related to the use of a real-world story for the project

- Cross-border restrictions: Varying regulations in different jurisdictions

PNUT Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs in the token contract

- Blockchain network congestion: Possible delays or high fees on the Solana network

- Wallet security: Risk of hacks or user errors leading to loss of funds

VI. Conclusion and Action Recommendations

PNUT Investment Value Assessment

PNUT presents a unique investment opportunity based on its viral social media story and community support. However, it carries significant risks due to its meme coin nature and regulatory uncertainties. Long-term potential exists if the project successfully leverages its narrative for sustained growth.

PNUT Investment Recommendations

✅ Beginners: Consider small, experimental investments to learn about meme coins ✅ Experienced investors: Allocate a small portion of portfolio, closely monitor project developments ✅ Institutional investors: Approach with caution, conduct thorough due diligence before any significant investment

PNUT Trading Participation Methods

- Spot trading: Buy and sell PNUT tokens on Gate.com

- Staking: Participate in staking programs if offered by the project

- Community engagement: Follow official social media channels for updates and potential airdrops

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Will pnut coin go up?

Yes, PNUT coin is expected to rise. Forecasts predict it could reach above $0.2996 by December 2025, based on current market trends and analysis.

Can Pnut hit $10?

While possible, hitting $10 would require massive adoption and significant market shifts for PNUT. Current trends make this target speculative.

How high can PNUT go in 2025?

Based on forecasts, PNUT could reach above $0.2996 by December 2025. However, the exact peak is uncertain due to market volatility.

Is PNUT bullish or bearish?

PNUT is currently bearish. The sentiment is negative, and the Fear & Greed Index shows fear.

2025 POPCAT Price Prediction: Exploring Future Market Trends and Investment Potential in the Digital Feline Economy

2025 BOMEPrice Prediction: Navigating Market Trends and Investment Opportunities in a Volatile Economy

2025 MYRO Price Prediction: Evaluating Growth Potential and Market Trends in the Evolving Cryptocurrency Landscape

Is XAI gork (GORK) a good investment?: Analyzing the Potential and Risks of GORK Tokens in the Explainable AI Market

2025 PUNDU Price Prediction: Analyzing Market Trends and Potential Growth Factors

Is dogwifhat (WIF) a good investment?: Evaluating the potential and risks of the latest meme coin craze

What is ANON token: whitepaper logic, use cases, and technical innovation explained

How to Use MACD, RSI, and KDJ Indicators for Crypto Trading: A Complete Technical Analysis Guide

How does exchange net flow and holding concentration affect crypto capital flow?

What is VSN price volatility and how does it correlate with Bitcoin and Ethereum movements?

How to Analyze On-Chain Data: Active Addresses, Transaction Volume, Whale Distribution & Fee Trends