2025 PIN Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: PIN's Market Position and Investment Value

PinLink (PIN) serves as a decentralized computing infrastructure asset that bridges artificial intelligence (AI), real-world assets (RWA), and DePIN by leveraging global compute power. Since its launch in November 2024, PinLink has established itself as a marketplace connecting users with tokenized GPUs, miners, and cloud storage resources. As of December 22, 2025, PIN maintains a market capitalization of approximately $8.94 million with a circulating supply of 80 million tokens, currently trading at $0.11177 per token. This innovative asset, recognized for its role in democratizing access to computational resources, is playing an increasingly crucial role in powering AI, machine learning, and intensive computational tasks across the global developer and enterprise ecosystem.

This article will provide a comprehensive analysis of PinLink's price trajectory through 2030, integrating historical price patterns, market supply-demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and actionable investment strategies for investors seeking exposure to the decentralized computing infrastructure sector.

PIN (PinLink) Market Analysis Report

I. PIN Price History Review and Market Status

PIN Historical Price Evolution Trajectory

Based on available data, PinLink (PIN) has experienced significant volatility since its launch:

- November 2024: Project launch at initial price of $0.058

- January 2025: Reached all-time high (ATH) of $3.8399 on January 6, 2025, representing approximately 6,531% gain from launch price

- December 2025: Sharp decline to current levels, with all-time low (ATL) of $0.09176 recorded on December 19, 2025

PIN Current Market Status

As of December 22, 2025, PIN is trading at $0.11177, reflecting a 1.35% increase over the past 24 hours. However, the token exhibits concerning performance across longer timeframes:

- 1-hour change: -2.15%

- 7-day change: -2.12%

- 30-day change: -11.29%

- 1-year change: -94.77%

Market Capitalization and Supply Metrics:

- Current Market Cap: $8,941,600

- Fully Diluted Valuation (FDV): $11,177,000

- Circulating Supply: 80,000,000 PIN (80% of total)

- Total/Max Supply: 100,000,000 PIN

- 24-hour Trading Volume: $65,377.73

- Market Dominance: 0.00034%

Holder Distribution:

- Total Holders: 25,153

- Listed on 5 exchanges

The token is currently traded on the Ethereum blockchain (ERC-20 standard) and is available on Gate.com, among other platforms.

Click to view current PIN market price

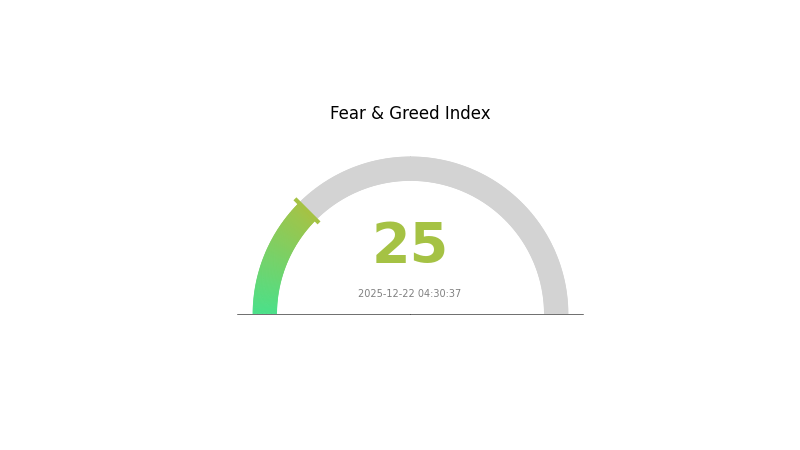

PIN Market Sentiment Index

2025-12-22 Fear and Greed Index: 25 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index plummeting to 25. This reading signals significant market pessimism and risk aversion among investors. During such periods, market volatility tends to intensify, presenting both challenges and opportunities for traders. Investors should exercise caution and avoid panic-driven decisions. Consider using this downturn as a potential entry point for long-term positions, while implementing strict risk management strategies. Monitor market developments closely on Gate.com for real-time data and insights.

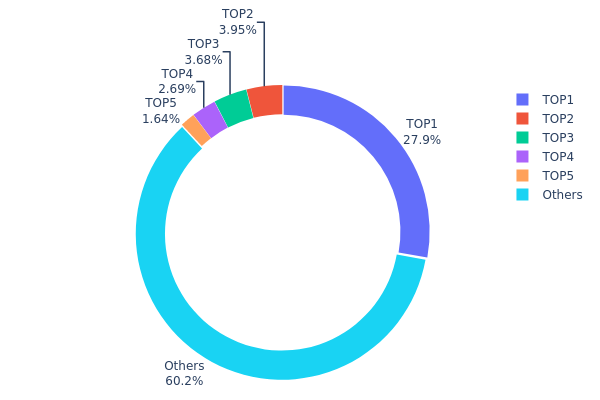

PIN Holdings Distribution

The address holdings distribution chart illustrates the concentration of token ownership across blockchain addresses, providing critical insights into the decentralization structure and potential market dynamics of PIN. By analyzing the top holders and their respective percentages, we can assess whether token supply is equitably distributed or concentrated among a limited number of entities, which directly impacts price stability, governance participation, and overall market resilience.

PIN demonstrates a moderate to significant concentration pattern in its current holdings structure. The leading address controls 27.85% of total supply, representing a substantial single-entity stake that warrants attention. The top five addresses collectively hold approximately 39.79% of circulating tokens, indicating meaningful concentration at the apex of the distribution curve. However, the remaining 60.21% dispersed among other addresses suggests that a majority of PIN tokens are distributed across numerous participants, which partially mitigates extreme centralization concerns. This distribution pattern reflects a common characteristic of maturing blockchain projects, where early investors and founding entities retain meaningful stakes while broader community participation has expanded.

The current address concentration presents a nuanced risk profile for market structure and price stability. While the dominant position of the leading address could theoretically enable significant market influence or sudden selling pressure, the substantial holdings retained by this entity may indicate long-term commitment rather than speculative positioning. The relatively balanced tail distribution among other holders reduces the likelihood of coordinated manipulation, though price volatility could be triggered by unexpected moves from top-tier addresses. Overall, PIN's holdings distribution reflects a network in transition toward greater decentralization, with sufficient community participation to maintain functional market integrity while retaining structural elements typical of projects with established institutional presence.

Click to view current PIN holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x0622...6ac68a | 27851.11K | 27.85% |

| 2 | 0x14d0...897162 | 3945.93K | 3.94% |

| 3 | 0x241f...3b81b6 | 3683.21K | 3.68% |

| 4 | 0x3cc9...aecf18 | 2689.82K | 2.68% |

| 5 | 0x9642...2f5d4e | 1642.72K | 1.64% |

| - | Others | 60187.21K | 60.21% |

II. Core Factors Influencing PI's Future Price

Supply Mechanism

-

Mining Rewards Structure: 65% of total supply (approximately 6.5 billion PI tokens) is allocated to mining rewards, employing an exponential decline model to maintain token scarcity and long-term sustainability.

-

Historical Pattern: The exponential decline mechanism is designed to prevent supply inflation in later stages, following proven models from earlier blockchain projects. This scarcity-focused approach historically supports price appreciation over extended periods.

-

Current Impact: Upon mainnet launch in February 2025, initial circulating supply is estimated at approximately 1 billion PI tokens (based on 10 million users holding an average of 100 PI each). This limited initial circulation, combined with the exponential decline in mining rewards, is expected to create supply constraints that could support price appreciation during the early adoption phase.

Institutional and Whale Dynamics

-

User Base: Pi Network claims over 19 million KYC-verified users, representing substantial organic community adoption, particularly strong in Asian markets such as South Korea where download volumes exceed 100 million.

-

Exchange Support: Following mainnet launch on February 20, 2025, PI has gained listing support on major exchanges including Gate.com, enabling enhanced trading liquidity and market confidence recovery.

Technology Development and Ecosystem Building

-

Mainnet Launch: The transition to the open network phase on February 20, 2025, marked a critical milestone. This phase removes firewall restrictions, enabling PI to achieve interoperability with external blockchains, exchanges, and commercial systems.

-

Mobile-First Architecture: Pi Network's mobile-first strategy leverages Stellar Consensus Protocol (SCP), emphasizing energy efficiency and broad accessibility. This approach has attracted millions of users previously unexposed to cryptocurrency, accumulating substantial free PI tokens through simplified mobile mining.

-

Ecosystem Applications: The project is expanding beyond payment scenarios into emerging domains including artificial intelligence (AI), asset tokenization, and blockchain gaming. The Pi Browser serves as the ecosystem's foundation, integrating applications, utility functions, and user communities to develop comprehensive blockchain solutions for global merchants.

Three、2025-2030 PIN Price Forecast

2025 Outlook

- Conservative Forecast: $0.06342 - $0.11126

- Neutral Forecast: $0.11126

- Optimistic Forecast: $0.15354 (requires sustained market momentum and positive ecosystem developments)

2026-2028 Medium-term Outlook

- Market Phase Expectation: Consolidation phase with gradual recovery, characterized by volatility normalization and increasing institutional adoption

- Price Range Forecast:

- 2026: $0.11254 - $0.14829

- 2027: $0.13613 - $0.2035

- 2028: $0.12894 - $0.24069

- Key Catalysts: Protocol upgrades, expanded use cases within the ecosystem, increased market liquidity on platforms such as Gate.com, and growing developer community engagement

2029-2030 Long-term Outlook

- Base Case Scenario: $0.16102 - $0.27834 (assuming moderate adoption acceleration and stable macroeconomic conditions)

- Optimistic Scenario: $0.25375 - $0.27834 (assuming accelerated institutional investment and breakthrough network utility milestones)

- Transformative Scenario: $0.27834+ (extreme favorable conditions including mainstream adoption, regulatory clarity, and significant technological innovations)

- Compound Annual Growth Rate (CAGR 2025-2030): Approximately 60% - 75% based on average price trajectory from $0.11126 to $0.23003

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.15354 | 0.11126 | 0.06342 | 0 |

| 2026 | 0.14829 | 0.1324 | 0.11254 | 18 |

| 2027 | 0.2035 | 0.14034 | 0.13613 | 25 |

| 2028 | 0.24069 | 0.17192 | 0.12894 | 53 |

| 2029 | 0.25375 | 0.2063 | 0.12172 | 84 |

| 2030 | 0.27834 | 0.23003 | 0.16102 | 105 |

PinLink (PIN) Professional Investment Strategy and Risk Management Report

IV. PIN Professional Investment Strategy and Risk Management

PIN Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: Institutional investors, enterprise users seeking computational resources, and long-term believers in decentralized computing infrastructure

- Operation Recommendations:

- Accumulate during market downturns when PIN trades below historical averages, taking advantage of the current 94.77% year-over-year decline

- Hold positions through market cycles, recognizing PIN's utility as a gateway to tokenized GPU, mining, and cloud storage resources

- Reinvest any staking or platform rewards to compound returns over time

- Maintain a 12-24 month holding horizon minimum to capture adoption growth in the AI and machine learning computation marketplace

(2) Active Trading Strategy

-

Technical Analysis Tools:

- Moving Average Convergence Divergence (MACD): Monitor momentum shifts when PIN crosses above/below key moving averages (20-day, 50-day, 200-day) to identify trend reversals

- Relative Strength Index (RSI): Trade entry signals when RSI falls below 30 (oversold conditions) and exit when RSI exceeds 70 (overbought conditions)

- Support and Resistance Levels: Current trading range is $0.11023 to $0.11566 (24h); watch for breakouts above $0.12 or breakdown below $0.10

-

Wave Trading Key Points:

- Execute buy orders near the 24h low ($0.11023) when volume spikes, indicating institutional accumulation

- Take partial profits at 15-20% gains to lock in short-term returns

- Use stop-loss orders 5-8% below entry positions to protect against sudden liquidations

- Monitor Gate.com's PIN trading volume trends; sustained volume above $65,000 daily indicates healthy market interest

PIN Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of portfolio allocation to PIN, focusing on dollar-cost averaging over 6-12 months

- Active Investors: 3-5% of portfolio allocation, combining long-term positions with tactical trading opportunities

- Professional/Institutional Investors: 5-10% of allocation, with dedicated computing resource procurement strategies integrated into operational models

(2) Risk Hedging Solutions

- Stablecoin Reserves: Maintain 30-40% of allocated capital in stablecoins (USDC, USDT) to capitalize on price dips and fund additional purchases during market corrections

- Diversified Compute Exposure: Reduce concentration risk by balancing PIN holdings with exposure to other decentralized physical infrastructure (DePin) assets that offer complementary computing solutions

(3) Secure Storage Solutions

- Hot Wallet Strategy: Use Gate.com's native Web3 wallet for active trading and frequent transactions, balancing convenience with security protocols

- Cold Storage Best Practices: Transfer long-term PIN holdings to secure self-custody solutions; store recovery phrases offline in multiple encrypted locations

- Security Considerations: Enable two-factor authentication (2FA) on all exchange accounts; never share private keys or seed phrases; verify smart contract addresses before token transfers; be aware that PIN operates on the Ethereum (ETH) blockchain (contract: 0x2e44f3f609ff5aa4819b323fd74690f07c3607c4) and is vulnerable to phishing scams targeting ERC-20 tokens

V. PIN Potential Risks and Challenges

PIN Market Risk

- Extreme Price Volatility: PIN experienced a devastating 94.77% decline over the past year, falling from historical highs of $3.8399 to lows of $0.09176, indicating extreme market instability and potential for further downside

- Low Trading Liquidity: Daily volume of $65,377.72 is modest for a token ranked #1,227, creating wide bid-ask spreads and potential slippage for large orders

- Concentration Risk: Only 25,153 token holders present elevated risk of whale manipulation and dramatic price swings from large holder transactions

PIN Regulatory Risk

- Uncertain Regulatory Status: Decentralized physical infrastructure (DePin) projects face evolving regulatory scrutiny globally; governments may impose restrictions on tokenized computing resources or classify PIN as a security

- Jurisdictional Challenges: Operating in multiple countries with different compliance frameworks creates legal uncertainty for enterprises integrating PIN-based computational services

- Enterprise Adoption Barriers: Regulatory concerns may slow institutional adoption of PIN by conservative enterprises, limiting market growth potential

PIN Technical Risk

- Smart Contract Vulnerabilities: As an ERC-20 token, PIN is dependent on Ethereum network security; bugs in the Pinlink protocol or connected systems could result in fund loss

- Scalability Limitations: Current Ethereum congestion may create operational inefficiencies for real-time GPU and mining resource allocation through the Pinlink marketplace

- Marketplace Viability Unproven: The success of Pinlink's RWA tokenization model remains untested at scale; platform adoption may fall short of projections, rendering PIN economically valueless

VI. Conclusion and Action Recommendations

PIN Investment Value Assessment

PinLink operates in the promising but nascent decentralized physical infrastructure (DePin) sector, positioning itself as a bridge between AI computational demands, real-world asset tokenization, and decentralized computing resources. However, PIN's extreme 94.77% year-over-year decline, modest trading liquidity ($65,377 daily volume), and unproven marketplace model create substantial short-term downside risks. The token's utility depends entirely on enterprise and developer adoption of Pinlink's GPU rental, mining, and cloud storage tokenization services—a capability still in early development stages. PIN should be considered a speculative, high-risk allocation appropriate only for investors with significant risk tolerance and long time horizons of 3+ years.

PIN Investment Recommendations

✅ Beginners: Start with micro-allocations (0.5-1% of portfolio) using dollar-cost averaging strategy over 6-12 months on Gate.com; do not deploy lump-sum capital given extreme volatility; focus on understanding Pinlink's competitive advantages before increasing exposure

✅ Experienced Investors: Combine 2-3% core holdings with tactical wave trading around identified support/resistance levels; use technical indicators (RSI, MACD) to time entries near oversold conditions; maintain strict stop-losses at 8% below entry

✅ Institutional Investors: Evaluate PIN as infrastructure investment aligned with enterprise computational needs; negotiate direct partnerships with Pinlink team to evaluate marketplace viability; conduct thorough technical audits of smart contracts; consider allocations only if integration creates operational cost savings exceeding token price volatility risks

PIN Trading Participation Methods

- Gate.com Spot Trading: Execute PIN/USDT or PIN/USDC trades directly on Gate.com's trading platform; leverage limit orders to acquire PIN during support breakdowns or market-wide cryptocurrency corrections

- Automated Dollar-Cost Averaging: Configure recurring buy orders on Gate.com for fixed USD amounts weekly or monthly, removing emotion from entry decisions and reducing timing risk

- Staking and Reward Programs: Monitor Pinlink's official website and social channels (@PinLinkAi on Twitter/X) for staking opportunities or liquidity provider incentives that generate additional PIN income

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors should make decisions based on personal risk tolerance and financial situation. Consult professional financial advisors before committing capital. Never invest funds you cannot afford to lose completely.

FAQ

What is pins price target for 2030?

PIN is projected to reach an average price target of $47.87 in 2030, with forecasts ranging from $35.18 to $60.56 based on current market analysis and trend evaluation.

Will pi reach 100 dollars?

Pi reaching $100 would require a market cap of approximately $670.8 billion. While theoretically possible with significant adoption and market growth, current conditions make this challenging. Success depends on Pi's utility expansion, network adoption, and overall cryptocurrency market development.

What factors influence PIN price prediction?

PIN price is influenced by market supply and demand dynamics, trading volume, market sentiment, and broader cryptocurrency market trends. Regulatory developments, technological advancements, and macroeconomic factors also significantly impact price movements.

What is the current market cap and price of PIN?

As of December 22, 2025, PIN has a market cap of approximately $9.93 million USD. The token maintains steady trading activity with consistent market presence in the cryptocurrency ecosystem.

How does PIN compare to other similar cryptocurrencies in terms of price potential?

PIN demonstrates strong price potential with projections to reach $25 per coin if it achieves top 5 market cap ranking(excluding Bitcoin). This growth trajectory compares favorably against established cryptocurrencies, supported by its total supply dynamics and market positioning.

2025 PIN Price Prediction: Expert Analysis and Market Forecast for the Digital Asset

2025 PINGO Price Prediction: Analyzing Market Trends and Potential Growth Factors

Is Shieldeum (SDM) a good investment?: Analyzing the potential and risks of this emerging cryptocurrency

How Does Competitor Analysis Drive Crypto Market Share Growth in 2030?

VELAAI vs BAT: The Battle for AI Dominance in the Tech Industry

Is Clore.ai (CLORE) a good investment?: Analyzing the Potential and Risks of this Emerging AI Token

Comprehensive Guide to Exploring Crypto Platforms

Exploring Secure Web3 Storage Solutions: A Complete Guide

Exploring VIC Token: Features and Benefits of the Viction Blockchain Platform

Enhancing Cryptocurrency Security with Cold Storage Solutions

Enhanced Security Solutions for Cold Storage of Cryptocurrencies