2025 P00LS Price Prediction: Analyzing Market Trends and Future Prospects for the Digital Asset

Introduction: P00LS Market Position and Investment Value

P00LS (P00LS), as the leading decentralized protocol for fan tokens and creator cryptocurrencies, has enabled top artists, creators, and brands to launch their own tokens since its inception. As of 2025, P00LS has a market capitalization of $1,603,689, with a circulating supply of approximately 232,688,484 tokens, and a price hovering around $0.006892. This asset, often referred to as the "creator economy token," is playing an increasingly crucial role in the fan engagement and digital content monetization sectors.

This article will provide a comprehensive analysis of P00LS's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. P00LS Price History Review and Current Market Status

P00LS Historical Price Evolution

- 2022: All-time high reached, price peaked at $0.980104 on October 13

- 2023: Market fluctuations, price experienced significant volatility

- 2024: Bearish trend, price declined from previous highs

- 2025: New all-time low recorded, price dropped to $0.00625353 on November 21

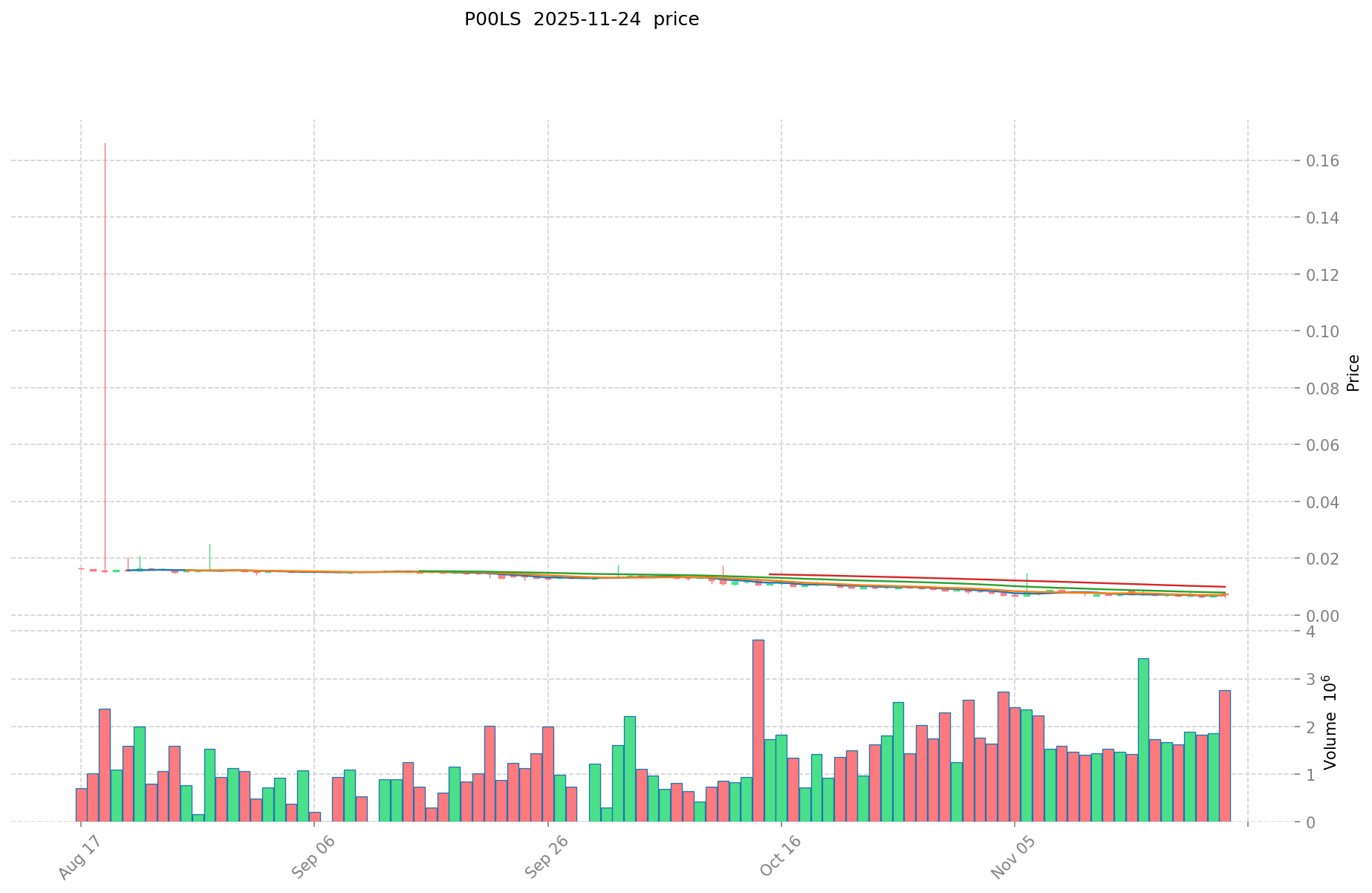

P00LS Current Market Situation

As of November 25, 2025, P00LS is trading at $0.006892, with a 24-hour trading volume of $13,878.45. The token has shown a 2.33% increase in the last 24 hours, but it's down 1.55% over the past week and 30.79% over the last month. The current price represents a substantial 82.84% decrease from a year ago.

P00LS has a market capitalization of $1,603,689, ranking it at 2295th position in the cryptocurrency market. The token's circulating supply is 232,688,484.59 P00LS, which is 23.27% of its total supply of 1,000,000,000 tokens.

The token is currently trading significantly below its all-time high, suggesting a bearish long-term trend. However, the recent 24-hour uptick might indicate some short-term bullish momentum.

Click to view the current P00LS market price

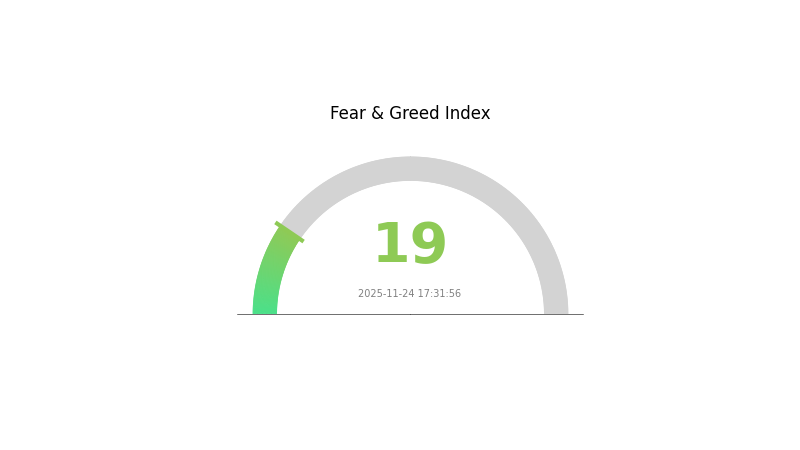

P00LS Market Sentiment Indicator

2025-11-24 Fear and Greed Index: 19 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is gripped by extreme fear, with the Fear and Greed Index plummeting to 19. This level of pessimism often signals a potential buying opportunity for contrarian investors. However, caution is advised as market volatility may persist. Traders should consider dollar-cost averaging and thorough research before making any decisions. Remember, market sentiment can shift rapidly, and it's crucial to maintain a balanced perspective amidst the current bearish atmosphere.

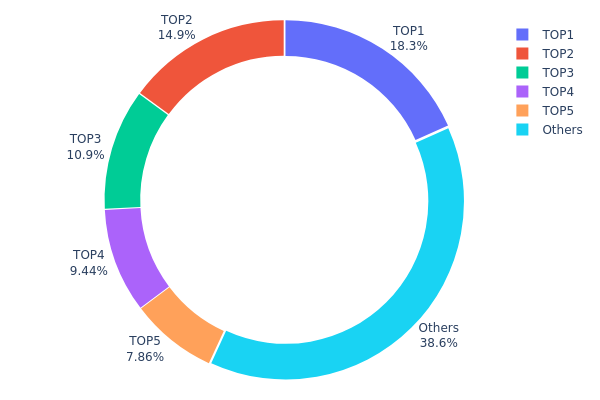

P00LS Holdings Distribution

The address holdings distribution data provides crucial insights into the concentration of P00LS tokens among various wallet addresses. Analysis of this data reveals a significant level of centralization within the P00LS ecosystem. The top five addresses collectively hold 61.39% of the total supply, with the largest holder commanding 18.27% of all tokens.

This concentration raises concerns about potential market manipulation and price volatility. With such a substantial portion of tokens controlled by a small number of addresses, there's an increased risk of large-scale sell-offs or coordinated actions that could dramatically impact token value. Moreover, this centralization contradicts the principles of decentralization often associated with blockchain projects.

The current distribution structure suggests a nascent market with limited circulation among retail investors. This concentration may hinder organic price discovery and could potentially deter new investors concerned about whale dominance. As the project evolves, a more equitable distribution would be beneficial for long-term stability and broader market participation.

Click to view the current P00LS Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x982f...4db3db | 182770.58K | 18.27% |

| 2 | 0xc84e...6246f7 | 149212.31K | 14.92% |

| 3 | 0x17f7...e60329 | 109105.41K | 10.91% |

| 4 | 0x7751...238da7 | 94439.57K | 9.44% |

| 5 | 0x35e9...5e9c8a | 78590.86K | 7.85% |

| - | Others | 385881.26K | 38.61% |

II. Key Factors Affecting P00LS Future Price

Supply Mechanism

- Social Token Creation: P00LS allows creators to launch their own social tokens, which can impact the overall supply and demand dynamics.

- Current Impact: The continuous creation of new social tokens on the platform may influence P00LS token value and market dynamics.

Institutional and Whale Activities

- Corporate Adoption: Platforms like Coinvise, P00LS, Rally, and Strata Protocol are simplifying the process of establishing social economies, potentially attracting more institutional interest.

Macroeconomic Environment

- Inflation Hedging Properties: As seen in historical examples like Germany in 1919, where bread prices rose from 1 mark to 100 billion in four years, social tokens might be viewed as potential hedges against extreme inflation scenarios.

Technological Development and Ecosystem Building

- Platform Enhancements: Ongoing improvements to the P00LS platform and its features could drive user adoption and token value.

- Ecosystem Applications: The growth of DApps and projects within the P00LS ecosystem may significantly impact the token's utility and demand.

III. P00LS Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.00407 - $0.00689

- Neutral prediction: $0.00689 - $0.00796

- Optimistic prediction: $0.00796 - $0.00903 (requires positive market sentiment)

2027-2028 Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2027: $0.00563 - $0.01093

- 2028: $0.00730 - $0.01085

- Key catalysts: Increased adoption, market expansion, technological advancements

2029-2030 Long-term Outlook

- Base scenario: $0.01023 - $0.01268 (assuming steady market growth)

- Optimistic scenario: $0.01268 - $0.01514 (with strong market performance)

- Transformative scenario: $0.01514 - $0.01864 (with exceptional market conditions and widespread adoption)

- 2030-12-31: P00LS $0.01864 (potential peak price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00903 | 0.00689 | 0.00407 | 0 |

| 2026 | 0.0086 | 0.00796 | 0.00629 | 15 |

| 2027 | 0.01093 | 0.00828 | 0.00563 | 20 |

| 2028 | 0.01085 | 0.0096 | 0.0073 | 39 |

| 2029 | 0.01514 | 0.01023 | 0.00675 | 48 |

| 2030 | 0.01864 | 0.01268 | 0.01205 | 84 |

IV. Professional Investment Strategies and Risk Management for P00LS

P00LS Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a long-term perspective

- Operational suggestions:

- Accumulate P00LS tokens during market dips

- Set price targets for partial profit-taking

- Store tokens in a secure non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trend directions and potential reversals

- Relative Strength Index (RSI): Gauge overbought/oversold conditions

- Key points for swing trading:

- Monitor trading volume for confirmation of price movements

- Set strict stop-loss orders to manage downside risk

P00LS Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple crypto assets

- Options strategies: Consider using options to protect against downside risk

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate Web3 Wallet

- Software wallet option: Official P00LS wallet (if available)

- Security precautions: Enable two-factor authentication, use strong passwords, and regularly update software

V. Potential Risks and Challenges for P00LS

P00LS Market Risks

- Volatility: Extreme price fluctuations common in small-cap tokens

- Liquidity: Limited trading volume may lead to slippage

- Market sentiment: Susceptible to rapid shifts in investor sentiment

P00LS Regulatory Risks

- Uncertain regulations: Potential for new laws affecting creator tokens

- Cross-border compliance: Varying legal status in different jurisdictions

- Tax implications: Evolving tax treatment of creator tokens

P00LS Technical Risks

- Smart contract vulnerabilities: Potential for code exploits

- Network congestion: High gas fees on Ethereum during peak times

- Scalability challenges: Limitations of current blockchain infrastructure

VI. Conclusion and Action Recommendations

P00LS Investment Value Assessment

P00LS presents a unique opportunity in the creator economy token space, but carries significant short-term volatility and adoption risks. Long-term potential is tied to the growth of the creator economy and P00LS' ability to attract high-profile artists and brands.

P00LS Investment Recommendations

✅ Beginners: Start with small, regular investments to understand market dynamics ✅ Experienced investors: Consider allocating a portion of high-risk portfolio to P00LS ✅ Institutional investors: Evaluate P00LS as part of a diversified crypto portfolio focusing on Web3 and creator economy tokens

P00LS Trading Participation Methods

- Spot trading: Available on select cryptocurrency exchanges

- Liquidity provision: Participate in liquidity pools if available

- Earning opportunities: Explore staking or yield farming options within the P00LS ecosystem

Cryptocurrency investments carry extremely high risk. This article does not constitute investment advice. Investors should make decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

How high can a pol coin go?

Based on market trends and analyst predictions, POL could potentially reach $1.20 by 2025, assuming continued growth in the blockchain sector.

Can pond reach $1?

Yes, POND could potentially reach $1 by the end of 2025 if the current bullish trend continues. Market projections suggest this is a realistic target given the token's momentum.

Does Polkastarter have a future?

Yes, Polkastarter has a future, but it may face challenges. Forecasts suggest a potential price decrease to around $0.07664 in the next decade, influenced by market trends and investor sentiment.

Will Clearpool go up?

Clearpool is expected to rise by 10.42%, reaching $0.05023 by December 2025. However, the market outlook remains bearish.

Is Cygnus (CGN) a good investment?: Analyzing the potential and risks of this emerging cryptocurrency

DESO vs CHZ: Comparing Two Social Tokens in the Web3 Era

Is LimeWire (LMWR) a good investment?: A Comprehensive Analysis of the Token's Potential, Risks, and Market Position in 2024

Is RSS3 (RSS3) a good investment?: A comprehensive analysis of opportunities and risks in the decentralized information network

Is RSS3 (RSS3) a good investment?: A Comprehensive Analysis of the Web3 Content Distribution Protocol

GT Token in 2025: Buying, Staking, and Use Cases for Investors

Galaxy Digital's Alex Thorn on Bitcoin Price Prediction and 2026 Market Outlook

A Beginner's Guide to Using Probable Prediction Markets on Web3

Exploring B2 Squared Network: An In-Depth Guide to Blockchain Technology

Altcoin Season 2026: Trading Opportunities and Profit Strategies

Exploring Effective Revenue Strategies for DApps