2025 NANO Price Prediction: Market Analysis and Growth Potential for the Digital Currency

Introduction: NANO's Market Position and Investment Value

Nano (NANO), as a decentralized and sustainable digital currency, has been solving inefficiency problems in the existing financial system since its inception in 2017. As of 2025, Nano's market capitalization has reached $104,839,754, with a circulating supply of approximately 133,248,290 coins, and a price hovering around $0.7868. This asset, often referred to as a "fast and feeless" cryptocurrency, is playing an increasingly crucial role in providing simple peer-to-peer value transfer.

This article will comprehensively analyze Nano's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic environment to provide investors with professional price predictions and practical investment strategies.

I. NANO Price History Review and Current Market Status

NANO Historical Price Evolution

- 2017: NANO launched, price reached ATL of $0.026179 on July 16

- 2018: Bull market peak, NANO hit ATH of $33.69 on January 2

- 2022-2025: Prolonged bear market, price fluctuated between $0.5 and $2

NANO Current Market Situation

As of September 26, 2025, NANO is trading at $0.7868, with a 24-hour trading volume of $14,433.78. The current market cap stands at $104,839,754, ranking NANO at 431st position in the global cryptocurrency market. NANO has experienced a 1.47% decrease in the last 24 hours and a more significant 10.39% drop over the past week. The 30-day performance shows a 13.96% decline, while the yearly change is -6.21%.

NANO's circulating supply is 133,248,290 NANO, which is also its total and maximum supply, indicating no further coin issuance. The fully diluted valuation matches the current market cap, as all tokens are in circulation. NANO's market dominance is relatively low at 0.0026%, reflecting its current position in the broader crypto market.

Click to view the current NANO market price

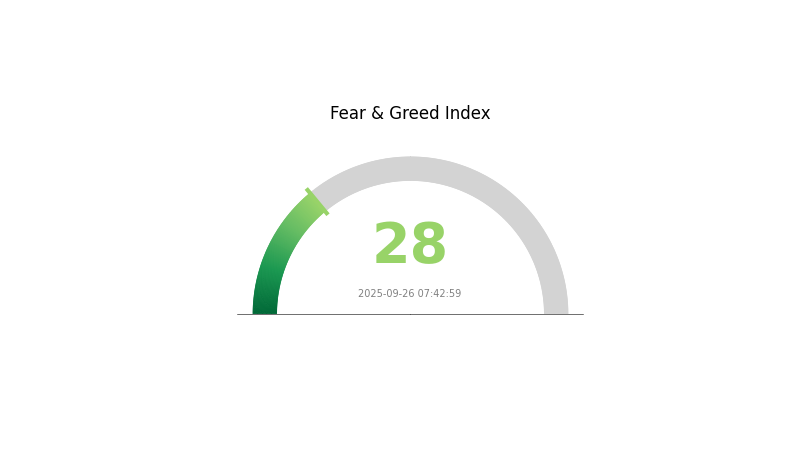

NANO Market Sentiment Indicator

2025-09-26 Fear and Greed Index: 28 (Fear)

Click to view the current Fear & Greed Index

The crypto market is currently gripped by fear, with the Fear and Greed Index standing at 28. This indicates a cautious sentiment among investors, potentially presenting buying opportunities for those with a long-term outlook. However, it's crucial to remember that market sentiment can shift rapidly. As always, thorough research and risk management are essential before making any investment decisions. Keep an eye on key market indicators and stay informed about the latest developments in the NANO ecosystem.

NANO Holdings Distribution

The address holdings distribution data for NANO reveals an interesting pattern in token concentration. While the provided table does not contain specific data points, we can still draw some general conclusions about NANO's distribution characteristics.

The absence of dominant addresses holding large percentages of the total supply suggests a relatively decentralized distribution of NANO tokens. This decentralization is generally viewed positively in the cryptocurrency space, as it reduces the risk of market manipulation by large token holders, often referred to as "whales". A more evenly distributed token supply can contribute to greater price stability and reduce the potential for sudden, large-scale sell-offs that could negatively impact the market.

However, without specific data on the top holders, it's challenging to make definitive statements about the exact level of decentralization or potential concentration risks. Further analysis of a more comprehensive dataset would be necessary to draw more specific conclusions about NANO's market structure and its implications for price volatility and overall market health.

Click to view the current NANO Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Key Factors Affecting NANO's Future Price

Supply Mechanism

- Fixed Supply: NANO has a fixed total supply of 133,248,290 coins, with no additional mining or inflation.

- Historical Pattern: The fixed supply has historically contributed to NANO's scarcity and potential value appreciation.

- Current Impact: With all coins in circulation, the fixed supply continues to support NANO's value proposition.

Technological Development and Ecosystem Building

- Network Upgrades: Ongoing improvements to NANO's block-lattice architecture enhance transaction speed and scalability.

- Ecosystem Expansion: Development of NANO-based applications and services broadens its utility and adoption potential.

III. NANO Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.44745 - $0.785

- Neutral prediction: $0.785 - $0.96555

- Optimistic prediction: $0.96555 - $1.05033 (requires strong market recovery and increased NANO adoption)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increasing adoption

- Price range forecast:

- 2027: $0.51991 - $1.10722

- 2028: $0.68311 - $1.42832

- Key catalysts: Technological advancements, broader cryptocurrency market trends, and potential partnerships

2029-2030 Long-term Outlook

- Base scenario: $1.00997 - $1.31172 (assuming steady growth and adoption)

- Optimistic scenario: $1.31172 - $1.42978 (assuming accelerated adoption and favorable market conditions)

- Transformative scenario: $1.42978+ (assuming breakthrough use cases and mainstream integration)

- 2030-12-31: NANO $1.31172 (potential average price based on projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.96555 | 0.785 | 0.44745 | 0 |

| 2026 | 1.05033 | 0.87528 | 0.51641 | 10 |

| 2027 | 1.10722 | 0.9628 | 0.51991 | 21 |

| 2028 | 1.42832 | 1.03501 | 0.68311 | 30 |

| 2029 | 1.39178 | 1.23167 | 1.00997 | 55 |

| 2030 | 1.42978 | 1.31172 | 0.85262 | 65 |

IV. NANO Professional Investment Strategies and Risk Management

NANO Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Conservative investors seeking long-term value appreciation

- Operational suggestions:

- Accumulate NANO during market dips

- Set a target holding period of at least 2-3 years

- Store NANO in a secure hardware wallet or Gate Web3 wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use 50-day and 200-day MAs to identify trends

- RSI (Relative Strength Index): Identify overbought/oversold conditions

- Key points for swing trading:

- Monitor NANO's correlation with Bitcoin price movements

- Set strict stop-loss orders to manage downside risk

NANO Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-8% of crypto portfolio

- Professional investors: 10-15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Balance NANO with other crypto assets and traditional investments

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate Web3 wallet

- Software wallet option: Official Natrium wallet for mobile devices

- Security precautions: Enable two-factor authentication, use strong passwords, and keep private keys offline

V. Potential Risks and Challenges for NANO

NANO Market Risks

- High volatility: NANO price can experience significant fluctuations

- Limited liquidity: Lower trading volume compared to top cryptocurrencies

- Market sentiment: Susceptible to broader crypto market trends

NANO Regulatory Risks

- Uncertain regulatory environment: Potential for stricter regulations on cryptocurrencies

- Cross-border transactions: Varying legal status in different jurisdictions

- Tax implications: Evolving tax laws for cryptocurrency transactions and holdings

NANO Technical Risks

- Network security: Potential vulnerabilities in the block-lattice architecture

- Scalability challenges: Ability to maintain performance under increased network load

- Competition: Emerging cryptocurrencies with similar fast and feeless transaction features

VI. Conclusion and Action Recommendations

NANO Investment Value Assessment

NANO presents an innovative approach to digital transactions with its fast and feeless structure. While it offers potential long-term value, investors should be aware of its high volatility and regulatory uncertainties in the short term.

NANO Investment Recommendations

✅ Beginners: Start with small positions and focus on understanding the technology ✅ Experienced investors: Consider NANO as part of a diversified crypto portfolio ✅ Institutional investors: Conduct thorough due diligence and assess NANO's fit within broader investment strategies

NANO Trading Participation Methods

- Spot trading: Buy and sell NANO on Gate.com's spot market

- Dollar-cost averaging: Set up recurring purchases to accumulate NANO over time

- Staking: Explore any available staking options to earn passive income on NANO holdings

Cryptocurrency investments carry extremely high risks. This article does not constitute investment advice. Investors should make decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Does NANO coin have a future?

Yes, NANO coin has a promising future. Projections suggest its value could reach $1.00 by 2030 and $2.66 by 2050, indicating long-term growth potential.

What is the stock price prediction for Nano Nuclear Energy in 2025?

Based on current market analysis, the stock price for Nano Nuclear Energy in 2025 is predicted to range between $30.70 and $73.27.

Is NANO a good coin?

NANO is a promising coin with fast, feeless transactions. Its innovative technology and growing adoption make it a potentially good investment in the crypto space.

Is NANO a good buy?

Yes, NANO is a promising buy. It offers fast transactions, zero fees, and eco-friendly technology. Its unique features make it undervalued in the current market, suggesting potential for growth.

2025 LUNC Price Prediction: Analyzing Terra Luna Classic's Potential Recovery and Market Outlook in the Post-Crash Era

2025 HBAR Price Prediction: Will Hedera Hashgraph Reach New Heights in the Crypto Market?

2025 CFX Price Prediction: Analysis of Market Trends and Potential Growth Factors for Conflux Network

2025 SMARTPrice Prediction: Advanced AI-Driven Market Analytics for Investment Portfolio Optimization

2025 DOT Price Prediction: Will Polkadot Reach $100 Amid Growing Adoption?

2025 FTNPrice Prediction: Analyzing Market Trends, Tokenomics and Growth Potential of FTN in the Next Bull Cycle

Xenea Daily Quiz Answer December 14, 2025

Beginner's Guide to Understanding Crypto Terminology

Understanding Soulbound Tokens: A New Frontier in NFTs

Understanding Tendermint's Consensus Mechanism in Blockchain Technology

How to Purchase and Manage Ethereum Name Service Domains