2025 MORPHO Price Prediction: Analyzing Market Trends and Growth Potential for the DeFi Token

Introduction: MORPHO's Market Position and Investment Value

Morpho Labs (MORPHO), as a lending protocol on the Ethereum blockchain, has achieved significant milestones since its inception. As of 2025, MORPHO's market capitalization has reached $1.01 billion, with a circulating supply of approximately 522.48 million tokens, and a price hovering around $1.93. This asset, hailed as a "lending pool optimizer," is playing an increasingly crucial role in the decentralized finance (DeFi) lending sector.

This article will comprehensively analyze MORPHO's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. MORPHO Price History Review and Current Market Status

MORPHO Historical Price Evolution

- 2025: MORPHO reached its all-time high of $4.1905 on January 17

- 2025: The token hit its all-time low of $0.5291 on October 10

- 2025: MORPHO was initially listed at $0.75 on July 21

MORPHO Current Market Situation

As of October 16, 2025, MORPHO is trading at $1.9348. The token has experienced a 24-hour price decrease of 2.95%, with a trading volume of $4,325,079.29. MORPHO's market capitalization stands at $1,010,885,763, ranking it 98th in the overall cryptocurrency market. The circulating supply is 522,475,585.70 MORPHO, which represents 52.25% of the total supply of 1,000,000,000 tokens.

Over the past week, MORPHO has shown positive momentum with a 9.15% increase. However, the 30-day performance indicates a slight decline of 0.91%. The year-to-date performance remains strong, with MORPHO up 56.73% compared to the previous year.

The current market sentiment for MORPHO appears neutral, with the price fluctuating between the 24-hour high of $2.0757 and the low of $1.852. The token is currently trading above its initial listing price, suggesting overall positive growth since its launch.

Click to view the current MORPHO market price

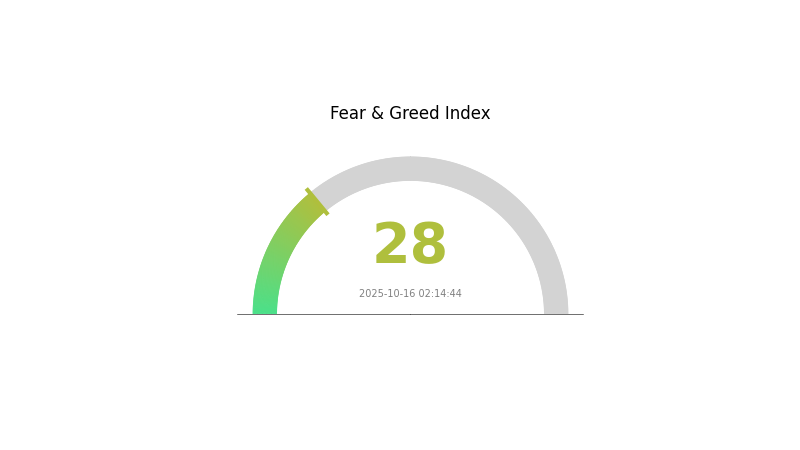

MORPHO Market Sentiment Indicator

2025-10-16 Fear and Greed Index: 28 (Fear)

Click to view the current Fear & Greed Index

The crypto market sentiment remains cautious as the Fear and Greed Index stands at 28, indicating a state of fear. This suggests investors are hesitant and potentially looking for buying opportunities. During such periods, it's crucial to stay informed and make well-researched decisions. Remember, market cycles are natural, and fear often precedes recovery. Consider diversifying your portfolio and focusing on projects with strong fundamentals. As always, conduct thorough research and manage your risk appropriately in this volatile market.

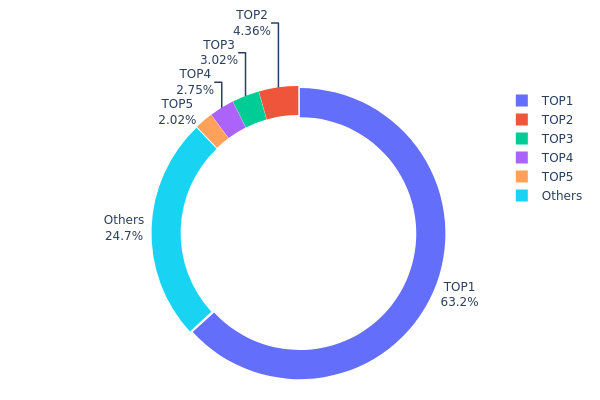

MORPHO Holdings Distribution

The address holdings distribution of MORPHO reveals a highly concentrated ownership structure. The top address holds an overwhelming 63.16% of the total supply, indicating significant centralization. The subsequent four largest holders collectively account for an additional 12.14%, while the remaining addresses control 24.7% of MORPHO tokens.

This extreme concentration poses potential risks to the market structure and price stability of MORPHO. With a single address controlling nearly two-thirds of the supply, there's an increased vulnerability to large-scale market movements or potential manipulation. Such concentration could lead to heightened volatility, as any significant action by the top holder could dramatically impact the token's liquidity and price.

The current distribution reflects a low degree of decentralization for MORPHO, which may raise concerns about its on-chain structural stability. This concentration of power in few hands could potentially influence governance decisions and overall token utility, warranting close monitoring by market participants and potential investors.

Click to view the current MORPHO Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x9d03...0e5123 | 631657.36K | 63.16% |

| 2 | 0x5305...79b281 | 43609.60K | 4.36% |

| 3 | 0x3154...0f2c35 | 30158.58K | 3.01% |

| 4 | 0x72b2...696fae | 27503.39K | 2.75% |

| 5 | 0x2419...925dfe | 20205.02K | 2.02% |

| - | Others | 246866.05K | 24.7% |

II. Key Factors Influencing MORPHO's Future Price

Supply Mechanism

- Historical Pattern: Past supply changes have shown a direct impact on MORPHO's price movements.

- Current Impact: The expected supply changes are likely to influence MORPHO's market performance in the near future.

Institutional and Whale Dynamics

- Enterprise Adoption: MORPHO, as the native token of a decentralized lending platform, is gaining traction among enterprises in the DeFi space.

Macroeconomic Environment

- Inflation Hedging Properties: MORPHO's performance in inflationary environments is being closely watched by investors.

Technical Development and Ecosystem Building

- Lending Network Expansion: The continuous expansion of MORPHO's lending network is crucial for its long-term price growth.

- User Base Growth: Increasing the user base is a key factor that could drive MORPHO's price upwards.

- Ecosystem Applications: The development of DApps and ecosystem projects on the MORPHO platform is expected to boost its value proposition.

Note: Long-term projections suggest that if MORPHO continues its development trajectory, it could potentially reach $5-$8 by 2030.

III. MORPHO Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $1.10 - $1.50

- Neutral forecast: $1.50 - $1.93

- Optimistic forecast: $1.93 - $2.11 (requires favorable market conditions)

2026-2027 Outlook

- Market phase expectation: Potential growth phase

- Price range prediction:

- 2026: $1.94 - $2.81

- 2027: $2.25 - $3.46

- Key catalysts: Increased adoption of DeFi platforms, overall cryptocurrency market recovery

2028-2030 Long-term Outlook

- Base scenario: $2.94 - $3.37 (assuming steady market growth)

- Optimistic scenario: $3.37 - $4.62 (assuming strong DeFi sector expansion)

- Transformative scenario: $4.62+ (extremely favorable conditions in crypto and DeFi markets)

- 2030-12-31: MORPHO $3.37 (projected average price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 2.11286 | 1.9384 | 1.10489 | 0 |

| 2026 | 2.81562 | 2.02563 | 1.9446 | 4 |

| 2027 | 3.46149 | 2.42063 | 2.25118 | 25 |

| 2028 | 3.70574 | 2.94106 | 2.67636 | 52 |

| 2029 | 3.4231 | 3.3234 | 2.29314 | 71 |

| 2030 | 4.62135 | 3.37325 | 3.00219 | 74 |

IV. MORPHO Professional Investment Strategies and Risk Management

MORPHO Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term value investors and DeFi enthusiasts

- Operation suggestions:

- Accumulate MORPHO tokens during market dips

- Participate in the Morpho protocol to earn yield

- Store tokens in a secure non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Set clear entry and exit points based on technical indicators

- Monitor DeFi market sentiment and Morpho protocol updates

MORPHO Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of DeFi-focused portfolio

(2) Risk Hedging Solutions

- Diversification: Balance MORPHO with other DeFi assets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for MORPHO

MORPHO Market Risks

- Volatility: DeFi tokens can experience significant price swings

- Competition: Emerging DeFi protocols may impact Morpho's market share

- Liquidity: Potential for reduced liquidity during market stress

MORPHO Regulatory Risks

- Uncertain regulations: Evolving DeFi regulations may impact operations

- Compliance requirements: Potential need for KYC/AML integration

- Cross-border restrictions: Varying international regulatory stances on DeFi

MORPHO Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs

- Scalability challenges: Ethereum network congestion may affect performance

- Oracle dependencies: Risks associated with external data feeds

VI. Conclusion and Action Recommendations

MORPHO Investment Value Assessment

MORPHO presents a compelling long-term value proposition in the DeFi lending space, with innovative optimization of existing protocols. However, short-term risks include market volatility and regulatory uncertainties.

MORPHO Investment Recommendations

✅ Beginners: Start with small positions, focus on learning about DeFi and Morpho's technology

✅ Experienced investors: Consider a moderate allocation within a diversified DeFi portfolio

✅ Institutional investors: Explore strategic partnerships and larger positions with thorough risk assessment

MORPHO Participation Methods

- Token purchase: Acquire MORPHO tokens on Gate.com

- Protocol engagement: Deposit assets into Morpho-optimized lending pools

- Governance participation: Stake MORPHO tokens to participate in protocol decisions

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the price prediction for Morpho?

Morpho's price is predicted to reach a minimum of $1.79 and a maximum of $2.06 by 2027, based on long-term market forecasts.

Which crypto boom in 2025 prediction?

Bitcoin, Ethereum, Solana, XRP, and Binance Coin are predicted to boom in 2025, with significant price increases expected in a bullish market trend.

How much is Melania Trump coin worth today?

As of today, the Melania Trump coin is worth $0.12. Its value has declined by 1.7% in the past hour.

Can holo coin reach $1?

Holo coin reaching $1 is possible but uncertain. Predictions suggest it may reach $0.20 to $0.73 by year-end, with long-term speculation for a $1 price in the future.

2025 EULPrice Prediction: Market Analysis and Future Trends for Euler Finance Token in the DeFi Ecosystem

2025 EDGEPrice Prediction: Analysis of Growth Potential and Market Factors Influencing the Future Value

2025 BENQI Price Prediction: Analyzing Market Trends and Future Valuation for the DeFi Protocol

2025 ASTER Price Prediction: Analyzing Market Trends and Growth Potential for the Emerging Cryptocurrency

2025 OMG Price Prediction: Analyzing Market Trends and Future Potential of the Token in a Maturing Crypto Ecosystem

2025 TOKEN Price Prediction: Analyzing Market Trends and Growth Potential for the Coming Bull Run

Is Vana (VANA) a good investment?: A Comprehensive Analysis of the Emerging Data Economy Token

Is VVS Finance (VVS) a good investment?: A Comprehensive Analysis of Tokenomics, Risk Factors, and Potential Returns in 2024

Is Sushiswap (SUSHI) a good investment?: A Comprehensive Analysis of Risk, Potential Returns, and Market Position in 2024

ROSE vs ICP: Comparing Two Leading Blockchain Ecosystems for Enterprise and Developer Solutions

Is GMX (GMX) a good investment?: A Comprehensive Analysis of Tokenomics, Risk Factors, and Market Potential for 2024