Previsão do preço da KAVA em 2025: análise das tendências de mercado, indicadores técnicos e potencial de crescimento no setor DeFi

Introdução: Posição de Mercado da KAVA e Valor de Investimento

A Kava (KAVA), enquanto plataforma descentralizada de finanças cross-chain, consolidou importantes conquistas desde o seu lançamento. Em 2025, a capitalização de mercado da Kava ascende a 364 163 486 $, com uma oferta circulante de cerca de 1 082 853 067 tokens e um preço aproximado de 0,3363 $. Este ativo, frequentemente designado como o “hub DeFi”, assume um papel cada vez mais relevante ao viabilizar aplicações e serviços DeFi cross-chain.

Este artigo apresenta uma análise detalhada da evolução do preço da Kava entre 2025 e 2030, tendo em conta padrões históricos, oferta e procura, desenvolvimento do ecossistema e fatores macroeconómicos, com o objetivo de fornecer aos investidores previsões de preço credíveis e estratégias de investimento eficazes.

I. Revisão Histórica do Preço da KAVA e Estado Atual do Mercado

Evolução Histórica do Preço KAVA

- 2021: A KAVA atingiu o seu máximo histórico de 9,12 $ a 30 de agosto de 2021, assinalando um marco significativo na sua história de preço.

- 2024: O token registou uma descida acentuada, atingindo o mínimo histórico de 0,247359 $ em 5 de agosto de 2024.

- 2025: Observa-se uma recuperação da KAVA, com o preço estabilizado em torno dos 0,3363 $.

Situação Atual de Mercado da KAVA

Em 21 de setembro de 2025, a KAVA negocia a 0,3363 $, com uma capitalização de mercado de 364 163 486 $. O token registou uma ligeira queda de 0,26 % nas últimas 24 horas, revelando estabilidade a curto prazo. Contudo, em horizontes temporais mais extensos, a KAVA enfrentou maior pressão descendente, com uma desvalorização de 7,23 % nos últimos sete dias e uma queda de 9,45 % nos últimos trinta dias.

A oferta circulante da KAVA fixa-se em 1 082 853 067 tokens, correspondendo à sua oferta total. O volume de transações nas últimas 24 horas é de 104 785 $, o que indica uma atividade de mercado moderada. O domínio de mercado da KAVA situa-se atualmente em 0,0084 %, refletindo o seu estatuto de criptomoeda de capitalização intermédia.

Consulte o preço de mercado atual da KAVA

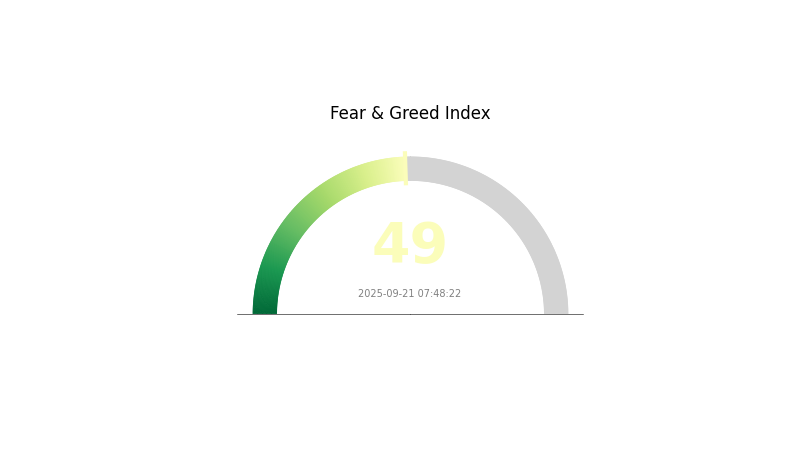

Indicador de Sentimento de Mercado da KAVA

2025-09-21 Índice de Medo e Ganância: 49 (Neutro)

Consulte o atual Índice de Medo & Ganância

O sentimento do mercado para a KAVA permanece equilibrado, com o Índice de Medo e Ganância fixado em 49, o que traduz uma posição neutra. Esta circunstância indica que os investidores evitam tanto o excesso de cautela quanto de ganância. Este equilíbrio favorece decisões de investimento racionais. Todavia, é indispensável manter vigilância, dado que as condições de mercado podem sofrer alterações rápidas. Recomenda-se a realização de análises aprofundadas e a diversificação do portefólio como estratégias-chave para gerir a volatilidade do setor das criptomoedas.

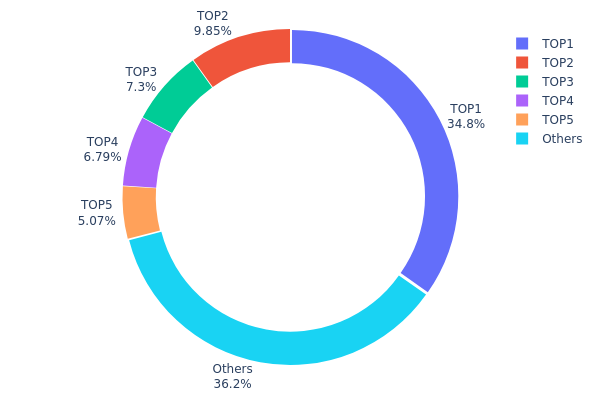

Distribuição de Detenções de KAVA

A análise da distribuição de endereços detentores de KAVA evidencia uma forte concentração de tokens em poucos endereços. O principal endereço detém 34,78 % da oferta total, ao passo que os cinco maiores concentram no total 63,78 % dos tokens KAVA. Esta configuração aponta para uma distribuição marcadamente centralizada, com potencial impacto nas dinâmicas de mercado.

Tal concentração suscita preocupações sobre a estabilidade do mercado e a vulnerabilidade à manipulação de preços. Os grandes detentores (“whales”) dispõem de capacidade para influenciar o preço do token através das suas transações. Esta distribuição implica também que a governação on-chain e os processos decisórios da KAVA podem ser dominados por um restrito grupo de titulares.

Apesar de alguma concentração ser comum em grande parte das criptomoedas, a distribuição da KAVA distingue-se pela sua assimetria. Isso pode dificultar o alcance de verdadeira descentralização e acentuar o risco de volatilidade. Ainda assim, 36,22 % dos tokens encontram-se distribuídos por endereços de menor dimensão, indicando certa dispersão comunitária.

Consulte a Distribuição de Detenções de KAVA atual

| Top | Endereço | Quantidade Detida | Quota (%) |

|---|---|---|---|

| 1 | 0xf354...4EbC35 | 376 712,51K | 34,78 % |

| 2 | 0x4feA...D39391 | 106 676,61K | 9,85 % |

| 3 | 0x0c79...35b5Bd | 79 089,65K | 7,30 % |

| 4 | 0x8021...Bb8b45 | 73 541,05K | 6,79 % |

| 5 | 0xed54...bD9D37 | 54 892,86K | 5,06 % |

| - | Outros | 391 940,40K | 36,22 % |

II. Fatores-chave que Influenciam o Preço Futuro da KAVA

Mecanismo de Oferta

- Oferta circulante: Atualmente, circulam 1 082 853 067 tokens KAVA.

- Oferta total: A oferta total corresponde igualmente a 1 082 853 067 tokens.

- Impacto atual: Com um modelo de oferta ilimitada, o aumento constante de tokens pode pressionar o preço em baixa, caso a procura não acompanhe o ritmo.

Dinâmica Institucional e de Grandes Detentores

- Adoção empresarial: A Kava aposta na expansão do seu ecossistema, atraindo developers e projetos para a plataforma.

Contexto Macroeconómico

- Caráter protetivo contra inflação: Enquanto ativo digital, a KAVA pode funcionar como proteção contra inflação, à semelhança de outras criptomoedas.

Desenvolvimento Tecnológico e Expansão do Ecossistema

- Interoperabilidade cross-chain: A Kava opera com Cosmos SDK, conectando mais de 30 blockchains via IBC e facilitando transferências superiores a 6,25 mil milhões $ em ativos on-chain.

- Aplicações do ecossistema: A Kava investe na expansão do ecossistema de DApps e na melhoria da plataforma para developers e utilizadores.

III. Previsão de Preço da KAVA para 2025-2030

Perspetiva 2025

- Previsão conservadora: 0,31276 $ – 0,3363 $

- Previsão neutra: 0,3363 $ – 0,39515 $

- Previsão otimista: 0,39515 $ – 0,45401 $ (dependente de condições favoráveis e maior adoção)

Perspetiva 2027-2028

- Fase de mercado expectável: Crescimento potencial com adoção crescente

- Intervalos previstos de preço:

- 2027: 0,31207 $ – 0,55693 $

- 2028: 0,37333 $ – 0,60667 $

- Catalisadores principais: Expansão do ecossistema, evolução tecnológica e recuperação do mercado

Perspetiva 2029-2030 longo prazo

- Cenário base: 0,56259 $ – 0,60479 $ (com crescimento sustentado e desenvolvimento contínuo)

- Cenário otimista: 0,60479 $ – 0,66527 $ (com desempenho robusto e expansão significativa do ecossistema)

- Cenário transformador: 0,66527 $ – 0,70000 $ (com inovações disruptivas e adoção massiva)

- 2030-12-31: KAVA 0,60479 $ (potencial valorização de 79 % face ao valor de 2025)

| Ano | Preço Máximo Previsto | Preço Médio Previsto | Preço Mínimo Previsto | Variação (%) |

|---|---|---|---|---|

| 2025 | 0,45401 | 0,3363 | 0,31276 | 0 |

| 2026 | 0,56507 | 0,39515 | 0,32403 | 17 |

| 2027 | 0,55693 | 0,48011 | 0,31207 | 42 |

| 2028 | 0,60667 | 0,51852 | 0,37333 | 54 |

| 2029 | 0,64698 | 0,56259 | 0,38256 | 67 |

| 2030 | 0,66527 | 0,60479 | 0,38706 | 79 |

IV. Estratégia Profissional de Investimento e Gestão de Risco KAVA

Metodologia de Investimento KAVA

(1) Estratégia de Holding a Longo Prazo

- Indicado para: Investidores com perfil de risco elevado e orientação de longo prazo

- Sugestões:

- Aumentar posição KAVA em períodos de correção

- Acompanhar atualizações de projeto e crescimento do ecossistema

- Armazenar tokens em wallets não custodiais seguras

(2) Estratégia de Trading Ativo

- Ferramentas de análise técnica:

- Médias móveis: Identificação de tendências e potenciais reversões

- RSI: Deteção de condições de sobrecompra e sobrevenda

- Pontos críticos para swing trading:

- Definir pontos de entrada e saída com rigor

- Utilizar ordens stop-loss para limitação de risco

Estrutura de Gestão de Risco KAVA

(1) Princípios de Alocação de Ativos

- Investidores conservadores: 1 a 3 % da carteira cripto

- Investidores agressivos: 5 a 10 % da carteira cripto

- Investidores profissionais: até 15 % da exposição cripto

(2) Soluções de cobertura de risco

- Diversificação: Distribuir investimento por múltiplos ativos cripto

- Stop-loss: Implementar limites automáticos para controlo de perdas

(3) Soluções de armazenamento seguro

- Hot wallet recomendada: Gate Web3 Wallet

- Solução cold storage: Carteiras hardware para holding a longo prazo

- Precauções de segurança: Ativar autenticação dois fatores, utilizar palavras-passe robustas

V. Riscos e Desafios Potenciais KAVA

Riscos de Mercado KAVA

- Altíssima volatilidade típica do segmento cripto

- Competição crescente no espaço DeFi

- Dependência de tendência do mercado geral cripto

Riscos Regulatórios KAVA

- Incerteza jurídica: Mudanças regulatórias podem afetar plataformas DeFi

- Desafios para cumprimento normativo emergente

- Dificuldades em operações internacionais devido à disparidade de enquadramentos legais

Riscos Técnicos KAVA

- Pontos vulneráveis em smart contracts: Possibilidade de exploração de bugs

- Problemas de escalabilidade: Limitações diante do aumento da utilização de rede

- Interoperabilidade cross-chain: Riscos inerentes à integração entre redes

VI. Conclusão e Recomendações de Ação

Avaliação do Valor de Investimento KAVA

A KAVA demonstra valor de longo prazo no setor DeFi, embora seja suscetível a volatilidade e forte concorrência no curto prazo. O êxito do projeto dependerá da contínua expansão do ecossistema e da adesão sustentada aos seus serviços financeiros.

Recomendações de Investimento KAVA

✅ Iniciantes: Adotar posições reduzidas e investir em conhecimento DeFi

✅ Investidores experientes: Integrar KAVA numa carteira DeFi diversificada

✅ Investidores institucionais: Realizar diligência detalhada e monitorizar temas regulatórios

Formas de Participação nas Negociações KAVA

- Negociação spot: Compra e venda de KAVA em exchanges

- Staking: Participação na segurança da rede e obtenção de recompensas

- Integração DeFi: Utilização da KAVA em aplicações DeFi do seu ecossistema

Os investimentos em criptomoedas implicam riscos muito elevados. Este conteúdo não constitui recomendação de investimento. Cada investidor deve decidir de acordo com a sua tolerância ao risco e consultar aconselhamento profissional. Nunca invista mais do que pode suportar perder.

FAQ

Até onde pode subir a KAVA?

A KAVA poderá atingir 0,99 $ em 2025, podendo superar os 4,60 $ futuramente, conforme prognósticos atuais. O preço corrente é 0,33665578 $.

Qual será o preço da KNC em 2030?

Segundo análise de mercado, a KNC pode atingir um máximo de 0,440482 $ e um mínimo de 0,344361 $ em 2030.

Qual é o preço da KAVA?

O valor da KAVA é de 0,34 $, com um volume de negociação de 24 horas de 7,6 milhões $. Representa uma ligeira desvalorização nas últimas sessões.

O que é a KAVA crypto?

A KAVA é a criptomoeda utilitária da plataforma Kava, permitindo a obtenção de USDX mediante o bloqueio de outras criptomoedas como garantia. Os utilizadores recebem recompensas KAVA segundo o tipo de colateral e USDX gerado. O USDX possui sobrecolateralização para garantir a segurança dos mutuários.

Previsão do Preço LON em 2025: análise das tendências de mercado e dos fatores potenciais de crescimento para o Tokenlon Network Token

Previsão do preço da IDEX em 2025: análise das tendências de mercado e do potencial de crescimento futuro para o token de exchange descentralizada

O BitShares (BTS) é um bom investimento?: Análise do Potencial e dos Riscos deste Token de Plataforma de Exchange Descentralizada

RADAR vs DYDX: Comparação entre Duas Plataformas Líderes de Negociação Descentralizada

Synthetix (SNX) será um bom investimento?: Análise do potencial e dos riscos deste protocolo DeFi

Previsão do Preço DRV em 2025: Análise das Tendências de Mercado e Potencial de Crescimento para Investidores

Guia para Iniciantes: Criação e Gestão de Conta Simplificada

Principais Lançamentos de NFT Esperados em 2024

Compreender a Criptografia: Conceitos Fundamentais para a Segurança da Blockchain

Introdução à Criptografia: Guia Introdutório para Iniciantes

Como adicionar a rede Avalanche à sua carteira MetaMask