2025 CLOUDPrice Prediction: Emerging Market Trends and Investment Opportunities in the Global Cloud Computing Industry

Introduction: CLOUD's Market Position and Investment Value

Sanctum (CLOUD), as a revolutionary blockchain platform for trading Liquid Staking Tokens (LSTs) on Solana, has been making significant strides since its inception. As of 2025, CLOUD's market capitalization has reached $22,942,800, with a circulating supply of approximately 180,000,000 tokens, and a price hovering around $0.12746. This asset, hailed as the "LST trading innovator," is playing an increasingly crucial role in enhancing liquidity and yield opportunities in the decentralized finance space.

This article will provide a comprehensive analysis of CLOUD's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors, offering investors professional price predictions and practical investment strategies.

I. CLOUD Price History Review and Current Market Status

CLOUD Historical Price Evolution

- 2024: CLOUD reached its all-time high of $0.6297 on November 14, marking a significant milestone for the token.

- 2025: The token experienced a dramatic downturn, hitting its all-time low of $0.06411 on May 7.

- 2025: CLOUD has shown signs of recovery, with the price increasing by 44.57% over the past 30 days.

CLOUD Current Market Situation

As of October 4, 2025, CLOUD is trading at $0.12746, representing a 5.46% decrease in the last 24 hours. The token has a market capitalization of $22,942,800, ranking it at 1034 in the global cryptocurrency market. CLOUD's trading volume in the past 24 hours stands at $334,260.29, indicating moderate market activity. Despite the recent 24-hour decline, CLOUD has shown strong performance over the past week with a 23.07% increase, and an even more impressive 44.57% gain over the last 30 days. However, looking at the longer-term perspective, CLOUD is down 67.81% compared to its price one year ago. The current price is 79.76% below its all-time high and 98.81% above its all-time low, suggesting that the token is in a recovery phase after a significant downturn.

Click to view the current CLOUD market price

Here's the content in English as requested:

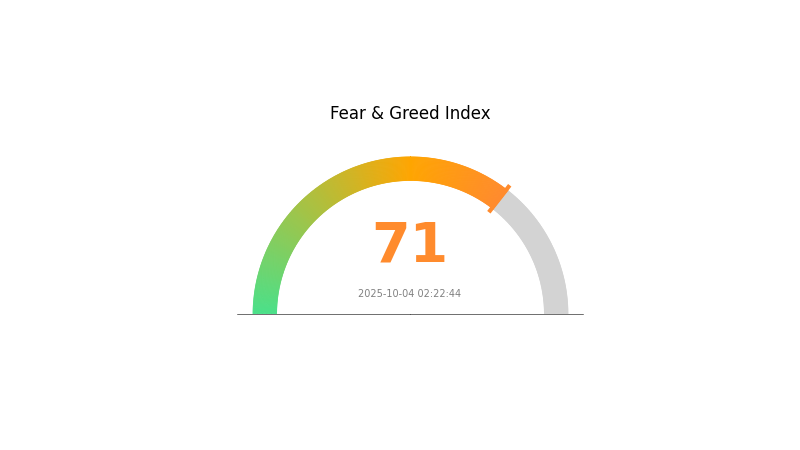

CLOUD Market Sentiment Indicator

2025-10-04 Fear and Greed Index: 71 (Greed)

Click to view the current Fear & Greed Index

The crypto market is currently experiencing a wave of greed, with the Fear and Greed Index standing at 71. This high reading suggests investors are becoming overly optimistic, potentially leading to overbought conditions. While bullish sentiment can drive prices higher in the short term, it's crucial for traders to remain cautious. Historical data shows that extreme greed often precedes market corrections. Prudent investors might consider taking some profits or rebalancing their portfolios to mitigate potential risks in this exuberant market climate.

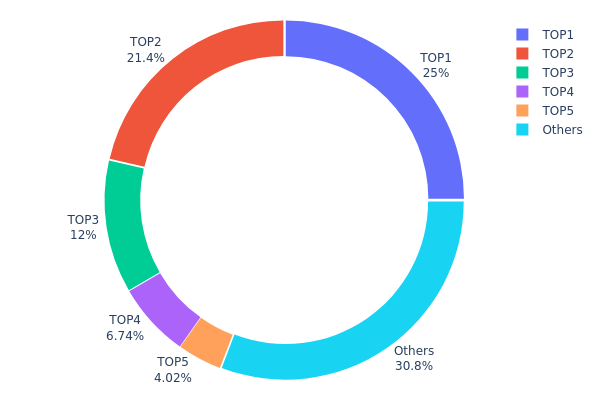

CLOUD Holdings Distribution

The address holdings distribution for CLOUD reveals a significant concentration of tokens among a few top holders. The largest address holds 25% of the total supply, with the top 5 addresses collectively controlling 69.15% of CLOUD tokens. This high concentration suggests a potential centralization of power within the CLOUD ecosystem.

Such a distribution pattern raises concerns about market stability and vulnerability to large-scale sell-offs. The top holders have substantial influence over price movements, potentially leading to increased volatility. Moreover, this concentration may impact the token's decentralization ethos, as a small number of entities could exert disproportionate control over governance decisions or market dynamics.

While some concentration is common in newer projects, CLOUD's current distribution indicates a need for broader token dissemination to enhance market resilience and reduce manipulation risks. As the project evolves, monitoring changes in this distribution will be crucial for assessing CLOUD's progress towards a more decentralized and stable token economy.

Click to view the current CLOUD Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | BdVocC...BJqvD4 | 250000.00K | 25.00% |

| 2 | How2rJ...9on8hs | 214126.13K | 21.41% |

| 3 | 8VE2uJ...h86BGk | 120051.68K | 12.00% |

| 4 | 5jbzpJ...3r14cv | 67372.28K | 6.73% |

| 5 | 7cAui6...Lx4xR8 | 40189.83K | 4.01% |

| - | Others | 308254.65K | 30.85% |

II. Key Factors Affecting CLOUD's Future Price

Supply Mechanism

- Market Competition: As new suppliers enter the market, existing market shares may change, affecting prices.

- Supply and Demand: Increased demand for certain cloud services may lead suppliers to raise prices.

Macroeconomic Environment

- Technological Advancements: Maturation of cloud computing technology and increased market competition have led to cost reductions through optimized hardware resource scheduling, elastic scaling technology, and economies of scale.

Technology Development and Ecosystem Building

- Cost Reduction: Cloud service providers are optimizing hardware resource allocation, introducing elastic scaling technologies, and leveraging large-scale procurement to reduce costs.

- Ecosystem Applications: Major industries such as e-commerce and education have already moved most of their IT workloads to the cloud. Other sectors, including labor-intensive industries like manufacturing, are expected to follow suit.

III. CLOUD Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.08379 - $0.10

- Neutral prediction: $0.12696

- Optimistic prediction: $0.1714 (requires positive market sentiment)

2027-2028 Outlook

- Market stage expectation: Potential growth phase

- Price range forecast:

- 2027: $0.15359 - $0.19374

- 2028: $0.11417 - $0.20992

- Key catalysts: Increased adoption and technological advancements

2030 Long-term Outlook

- Base scenario: $0.20983 (assuming steady market growth)

- Optimistic scenario: $0.26649 (assuming strong adoption and favorable market conditions)

- Transformative scenario: $0.30+ (assuming breakthrough innovations and widespread integration)

- 2030-12-31: CLOUD $0.26649 (potential peak price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.1714 | 0.12696 | 0.08379 | 0 |

| 2026 | 0.1999 | 0.14918 | 0.11785 | 17 |

| 2027 | 0.19374 | 0.17454 | 0.15359 | 36 |

| 2028 | 0.20992 | 0.18414 | 0.11417 | 44 |

| 2029 | 0.22264 | 0.19703 | 0.13792 | 54 |

| 2030 | 0.26649 | 0.20983 | 0.18465 | 64 |

IV. CLOUD Professional Investment Strategies and Risk Management

CLOUD Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors and believers in Solana ecosystem

- Operation suggestions:

- Accumulate CLOUD tokens during market dips

- Stake CLOUD tokens to earn additional rewards

- Store tokens in a secure non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Set clear entry and exit points based on technical indicators

- Monitor Solana ecosystem developments for potential price catalysts

CLOUD Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple LST projects

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for CLOUD

CLOUD Market Risks

- Volatility: High price fluctuations common in crypto markets

- Competition: Emergence of rival LST platforms on Solana

- Liquidity: Potential issues during market stress periods

CLOUD Regulatory Risks

- Regulatory uncertainty: Evolving global crypto regulations

- Compliance challenges: Potential issues with SEC or other regulators

- Taxation: Unclear tax implications for LST transactions

CLOUD Technical Risks

- Smart contract vulnerabilities: Potential exploits in Sanctum's code

- Scalability issues: Challenges handling increased transaction volume

- Integration problems: Difficulties in connecting with other DeFi protocols

VI. Conclusion and Action Recommendations

CLOUD Investment Value Assessment

CLOUD presents a promising investment opportunity within the Solana ecosystem, offering exposure to the growing LST market. However, investors should be aware of the high volatility and regulatory uncertainties in the short term.

CLOUD Investment Recommendations

✅ Beginners: Start with small positions, focus on education about LSTs

✅ Experienced investors: Consider allocating a portion of Solana investments to CLOUD

✅ Institutional investors: Explore CLOUD as part of a diversified crypto portfolio

CLOUD Trading Participation Methods

- Spot trading: Buy and sell CLOUD tokens on Gate.com

- Staking: Participate in CLOUD staking programs for additional yields

- DeFi integration: Use CLOUD in Solana-based DeFi protocols

Cryptocurrency investments carry extremely high risk. This article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Will cloud coin go up?

Yes, CloudCoin is projected to rise. Forecasts suggest it could reach $0.379298 by 2025, with a 9.6% increase expected in the near term.

What is cloud crypto coin?

Cloud crypto coin (CLOUD) is a meme token on the Internet Computer Protocol. It's the first cloud-themed token native to ICP's ecosystem, with a current price of $0.003519 and a circulating supply of 398,875,822 CLOUD coins.

What is the price prediction for Cro 2030?

The price prediction for Cro in 2030 is approximately $9.35, based on long-term market analysis and trends.

What is the price prediction for Constellation crypto in 2025?

Based on market analysis, Constellation (DAG) is expected to trade between $0.071 and $0.076 by the end of 2025.

2025 MNDE Price Prediction: Will the Governance Token Surge to New Heights in the Evolving DeFi Landscape?

Is Sanctum (CLOUD) a Good Investment?: Analyzing Potential Returns and Risks in the Cloud Security Token Market

2025 MNDE Price Prediction: Analyzing Market Trends and Potential Growth Factors for Marinade Finance

2025 MSOL Price Prediction: Analyzing Potential Growth and Market Trends for Marinade Staked SOL

Is Sanctum (CLOUD) a good investment?: Analyzing the potential of this cloud-based security token

2025 FRAG Price Prediction: Will This Gaming Token Reach New Heights in the Metaverse Era?

2025 SKL Price Prediction: Expert Analysis and Future Market Outlook for Skale Network Token

2025 UMA Price Prediction: Expert Analysis and Market Outlook for the Universal Market Access Token

2025 RECALL Price Prediction: Expert Analysis, Market Trends, and Investment Opportunities

2025 ANKR Price Prediction: Will the Ankr Protocol Token Reach New Highs in the Upcoming Year?

Is OVERTAKE (TAKE) a good investment?: A Comprehensive Analysis of Performance, Market Potential, and Risk Factors for 2024