Prediksi Harga AMP 2025: Analisis Strategis serta Outlook Pasar bagi Investor Cryptocurrency

Pendahuluan: Posisi Pasar dan Nilai Investasi AMP

Amp (AMP) merupakan token jaminan utama dari jaringan pembayaran Flexa yang telah berkembang pesat sejak peluncurannya. Pada tahun 2025, kapitalisasi pasar Amp tercatat sebesar $266.171.055 dengan suplai beredar sekitar 84.231.346.590 token dan harga berada di sekitar $0,00316. Dikenal sebagai “inovator jaminan pembayaran”, aset ini semakin penting dalam mendukung transaksi kripto yang aman dan cepat.

Artikel berikut menghadirkan analisis menyeluruh atas tren harga Amp dari 2025 hingga 2030, membahas data historis, suplai dan permintaan pasar, perkembangan ekosistem, serta faktor makroekonomi sebagai dasar prediksi harga profesional dan strategi investasi bagi investor.

I. Tinjauan Sejarah Harga AMP dan Status Pasar Saat Ini

Perkembangan Harga AMP secara Historis

- 2020: Token AMP diluncurkan, harga awal $0,00167

- 2021: Mencapai rekor tertinggi $0,120813 pada 17 Juni

- 2023: Periode penurunan pasar, harga minimum $0,00140933 pada 13 Oktober

Situasi Pasar AMP Terkini

Per 23 September 2025, AMP diperdagangkan di harga $0,00316 dengan volume perdagangan 24 jam sebesar $13.333,35. Harga mengalami penurunan tipis 0,22% dalam 24 jam terakhir. Kapitalisasi pasar AMP sebesar $266.171.055, menduduki peringkat ke-252 di pasar kripto. Suplai beredar tercatat 84.231.346.590 token AMP (84,51% dari total suplai sebesar 99.669.205.040 AMP). Saat ini, AMP diperdagangkan 97,38% di bawah harga tertinggi sepanjang masa dan 124,22% di atas harga terendahnya.

Lihat harga pasar AMP terkini

Indikator Sentimen Pasar AMP

23-09-2025 Indeks Ketakutan dan Keserakahan: 43 (Ketakutan)

Lihat Indeks Ketakutan & Keserakahan saat ini

Sentimen pasar kripto cenderung hati-hati dengan Indeks Ketakutan dan Keserakahan bertahan di angka 43, menandakan kondisi ketakutan. Investor cenderung waspada dan mencari peluang beli. Ingatlah bahwa sentimen pasar dapat berubah dengan cepat. Kondisi ketakutan dapat menjadi momen masuk bagi investor jangka panjang, namun keputusan investasi di pasar kripto harus diambil dengan riset cermat dan pengelolaan risiko yang disiplin.

Distribusi Kepemilikan AMP

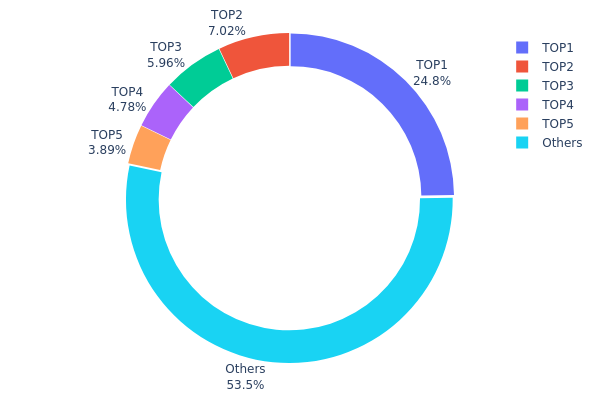

Distribusi kepemilikan AMP menunjukkan tingkat konsentrasi moderat di antara pemegang teratas. Alamat terbesar menguasai 24,82% dari total suplai, menandakan dampak signifikan satu entitas. Lima alamat teratas mengendalikan 46,44% token AMP, sedangkan 53,56% sisanya terdistribusi ke pemegang kecil.

Distribusi ini mencerminkan struktur semi-terpusat yang dapat mempengaruhi volatilitas pasar, terutama jika pemegang besar melakukan transaksi signifikan. Lebih dari setengah token dipegang oleh pemegang kecil sehingga tata kelola pasar tetap desentralisasi dan menjaga stabilitas AMP.

Kondisi distribusi saat ini menampilkan keseimbangan antara sentralisasi dan desentralisasi di pasar AMP. Pengawasan terus-menerus terhadap pola distribusi sangat penting untuk menilai kesehatan pasar jangka panjang dan risiko yang mungkin muncul.

Lihat Distribusi Kepemilikan AMP terkini

| Top | Alamat | Jumlah Kepemilikan | Kepemilikan (%) |

|---|---|---|---|

| 1 | 0x5d27...1d675f | 24.754.917,16K | 24,82% |

| 2 | 0x9eda...69fd62 | 7.000.000,00K | 7,01% |

| 3 | 0x0c3a...60c7bd | 5.938.990,20K | 5,95% |

| 4 | 0x706d...e7c578 | 4.767.234,15K | 4,78% |

| 5 | 0xafcd...45c5da | 3.874.174,72K | 3,88% |

| - | Lainnya | 53.384.651,04K | 53,56% |

II. Faktor Utama yang Mempengaruhi Harga AMP ke Depan

Mekanisme Suplai

- Suplai Tetap: AMP memiliki maksimum suplai 100 miliar token.

- Polanya Secara Historis: Suplai tetap membantu mempertahankan stabilitas harga dan nilai kelangkaan.

- Dampak Saat Ini: Mendekati batas maksimum suplai dapat mendorong tekanan kenaikan harga seiring kelangkaan meningkat.

Pengembangan Teknis dan Ekosistem

- Manajer Jaminan: Implementasi manajer jaminan baru mendukung utilitas AMP pada aplikasi DeFi.

- Kompatibilitas lintas rantai: Pengembangan jembatan lintas blockchain memperluas kegunaan AMP di berbagai jaringan.

- Aplikasi Ekosistem: Integrasi ke platform pembayaran utama dan e-commerce untuk transaksi instan tanpa penipuan.

III. Prediksi Harga AMP 2025-2030

Proyeksi Tahun 2025

- Prakiraan konservatif: $0,00231 - $0,00317

- Prakiraan netral: $0,00317 - $0,00377

- Prakiraan optimistis: $0,00377 - $0,00437 (jika sentimen pasar positif)

Proyeksi 2027-2028

- Fase pasar yang diprediksi: Potensi fase pertumbuhan

- Prakiraan rentang harga:

- 2027: $0,00413 - $0,00465

- 2028: $0,00266 - $0,00671

- Pemicu utama: Adopsi AMP yang semakin masif pada jaringan pembayaran

Proyeksi Jangka Panjang 2029-2030

- Skenario dasar: $0,00561 - $0,00659 (asumsi pertumbuhan pasar stabil)

- Skenario optimistis: $0,00659 - $0,00810 (asumsi adopsi masif)

- Skenario transformatif: $0,00810+ (kondisi sangat menguntungkan pasar crypto pembayaran)

- 31-12-2030: AMP berpotensi mencapai $0,00810

| Tahun | Harga Tertinggi | Harga Rata-Rata | Harga Terendah | Persentase Perubahan |

|---|---|---|---|---|

| 2025 | 0,00437 | 0,00317 | 0,00231 | 0 |

| 2026 | 0,00493 | 0,00377 | 0,0035 | 18 |

| 2027 | 0,00465 | 0,00435 | 0,00413 | 37 |

| 2028 | 0,00671 | 0,0045 | 0,00266 | 41 |

| 2029 | 0,00757 | 0,00561 | 0,00499 | 76 |

| 2030 | 0,0081 | 0,00659 | 0,00454 | 107 |

IV. Strategi Investasi AMP Profesional dan Manajemen Risiko

Metodologi Investasi AMP

(1) Strategi Penahanan Jangka Panjang

- Cocok untuk: Investor dengan toleransi risiko dan fokus jangka panjang

- Saran operasional:

- Lakukan akumulasi AMP saat terjadi koreksi pasar

- Tetapkan target harga untuk pengambilan profit parsial

- Simpan token AMP di dompet perangkat keras yang aman

(2) Strategi Trading Aktif

- Alat analisis teknikal:

- Moving Averages: Untuk identifikasi tren dan potensi pembalikan

- RSI (Relative Strength Index): Untuk deteksi kondisi overbought/oversold

- Poin penting perdagangan ayunan:

- Amati korelasi AMP terhadap tren pasar kripto secara luas

- Terapkan stop-loss guna mengontrol risiko penurunan harga

Kerangka Manajemen Risiko AMP

(1) Prinsip Alokasi Aset

- Investor konservatif: 1-3% portofolio kripto

- Investor agresif: 5-8% portofolio kripto

- Investor profesional: Maksimal 10% portofolio kripto

(2) Solusi Lindung Risiko

- Diversifikasi: Seimbangkan kepemilikan AMP dengan aset kripto maupun investasi tradisional lainnya

- Strategi opsi: Pertimbangkan opsi untuk melindungi dari risiko penurunan harga

(3) Solusi Penyimpanan Aman

- Rekomendasi dompet perangkat keras: Gate Web3 Wallet

- Pilihan dompet perangkat lunak: Dompet resmi AMP (jika tersedia)

- Langkah keamanan: Aktifkan autentikasi dua faktor, gunakan password kuat, lakukan update software berkala

V. Risiko dan Tantangan AMP

Risiko Pasar AMP

- Volatilitas: Fluktuasi harga sangat tinggi di pasar kripto

- Likuiditas: Tantangan dalam transaksi volume besar

- Kompetisi: Kripto pembayaran lain dapat mengurangi pangsa pasar AMP

Risiko Regulasi AMP

- Ketidakpastian regulasi: Kebijakan pemerintah yang dinamis dapat berdampak pada adopsi AMP

- Tantangan kepatuhan: Potensi kendala dalam integrasi dengan sistem pembayaran tradisional

- Dampak pajak: Perkembangan aturan pajak dapat memengaruhi pemilik AMP

Risiko Teknis AMP

- Celah smart contract: Risiko eksploitasi pada kontrak token AMP

- Masalah skalabilitas: Penanganan volume transaksi tinggi jadi tantangan

- Kemacetan jaringan: Masalah jaringan Ethereum dapat memengaruhi transaksi AMP

VI. Kesimpulan dan Rekomendasi

Penilaian Nilai Investasi AMP

AMP menawarkan proposisi nilai berbeda di sektor pembayaran kripto, dengan prospek pertumbuhan jangka panjang. Namun, volatilitas jangka pendek dan ketidakpastian regulasi perlu diwaspadai sebagai risiko utama.

Rekomendasi Investasi AMP

✅ Pemula: Mulai dengan nominal kecil dan rutin untuk memahami pasar ✅ Investor berpengalaman: Terapkan strategi seimbang antara penahanan jangka panjang dan trading terukur ✅ Investor institusional: Teliti peluang kemitraan dengan jaringan Flexa serta lakukan penelitian mendalam

Metode Partisipasi Trading AMP

- Perdagangan spot: Membeli dan menjual AMP di Gate.com

- Penyetakan: Ikut program penyetakan AMP untuk potensi pendapatan pasif

- Integrasi DeFi: Jelajahi protokol DeFi yang mendukung AMP

Investasi kripto memiliki risiko sangat tinggi dan artikel ini bukan saran investasi. Setiap investor harus mengambil keputusan sesuai toleransi risiko pribadi dan disarankan berkonsultasi dengan penasihat keuangan profesional. Jangan investasi melebihi kemampuan Anda.

FAQ

Apakah AMP dapat mencapai $1?

Meskipun target ini ambisius, AMP berpotensi mencapai $1 dalam jangka panjang apabila adopsi dan pertumbuhan pasar berlangsung pesat, didukung ekspansi ekosistem kripto dan jaringan Flexa.

Apakah AMP punya masa depan?

AMP sangat prospektif. Sebagai token jaminan jaringan Flexa, AMP berpotensi berkembang di pembayaran digital dan DeFi. Utilitas dan kemitraan AMP mendukung potensi apresiasi nilai dalam jangka panjang.

Berapa prediksi harga AMP tahun 2025?

Berdasarkan tren pasar dan analisis ahli, AMP diperkirakan mencapai $0,15 hingga $0,20 per token pada tahun 2025, menawarkan peluang pertumbuhan signifikan dari harga saat ini.

Berapa prediksi harga AMP di 2025?

Berdasarkan analisis pasar dan tren terbaru, harga AMP diproyeksikan mencapai sekitar $0,15 hingga $0,20 pada tahun 2025, menunjukkan potensi pertumbuhan besar di tahun-tahun mendatang.

Prediksi Harga REQ 2025: Analisis Tren Pasar dan Faktor-Faktor Pertumbuhan Potensial Request Network

Prediksi Harga WPAY Tahun 2025: Analisis Potensi Pertumbuhan dan Tren Pasar Masa Depan untuk Token Pembayaran Digital

Prediksi Harga UTK 2025: Analisis Potensi Pertumbuhan dan Tren Pasar Token UTRUST di Ekosistem Pembayaran Digital yang Terus Berkembang

P vs XLM: Analisis Mendalam Kinerja Investasi di Pasar Berkembang

UNA vs XLM: Perbandingan Dua Protokol Blockchain Inovatif untuk Transaksi Internasional

MOVE vs XLM: Perbandingan Dua Bahasa Pemrograman Blockchain Inovatif

Jelajahi Masa Depan Blockchain dalam Konferensi Tech Insights 2024

Pemahaman Cold Wallet: 3 Opsi Terbaik untuk Penyimpanan Crypto yang Aman

Prediksi Harga SCOR 2025: Analisis Pakar dan Outlook Pasar untuk Saham SCOR di Tahun Depan