2025 1INCH Price Prediction: Analyzing Growth Potential and Market Trends for the DeFi Aggregator Token

Introduction: 1INCH's Market Position and Investment Value

1INCH (1INCH), as a functional token of the 1inch trading platform, has achieved significant milestones since its inception in 2020. As of 2025, 1INCH's market capitalization has reached $366,321,212, with a circulating supply of approximately 1,397,639,117 tokens, and a price hovering around $0.2621. This asset, known as a "decentralized exchange aggregator tool," is playing an increasingly crucial role in DeFi and decentralized trading.

This article will provide a comprehensive analysis of 1INCH's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. Historical Review and Current Market Status of 1INCH

1INCH Historical Price Evolution

- 2020: 1INCH token launched, initial price around $0.70

- 2021: Reached all-time high of $8.65 on October 27

- 2025: Hit all-time low of $0.149574 on April 7

Current Market Situation of 1INCH

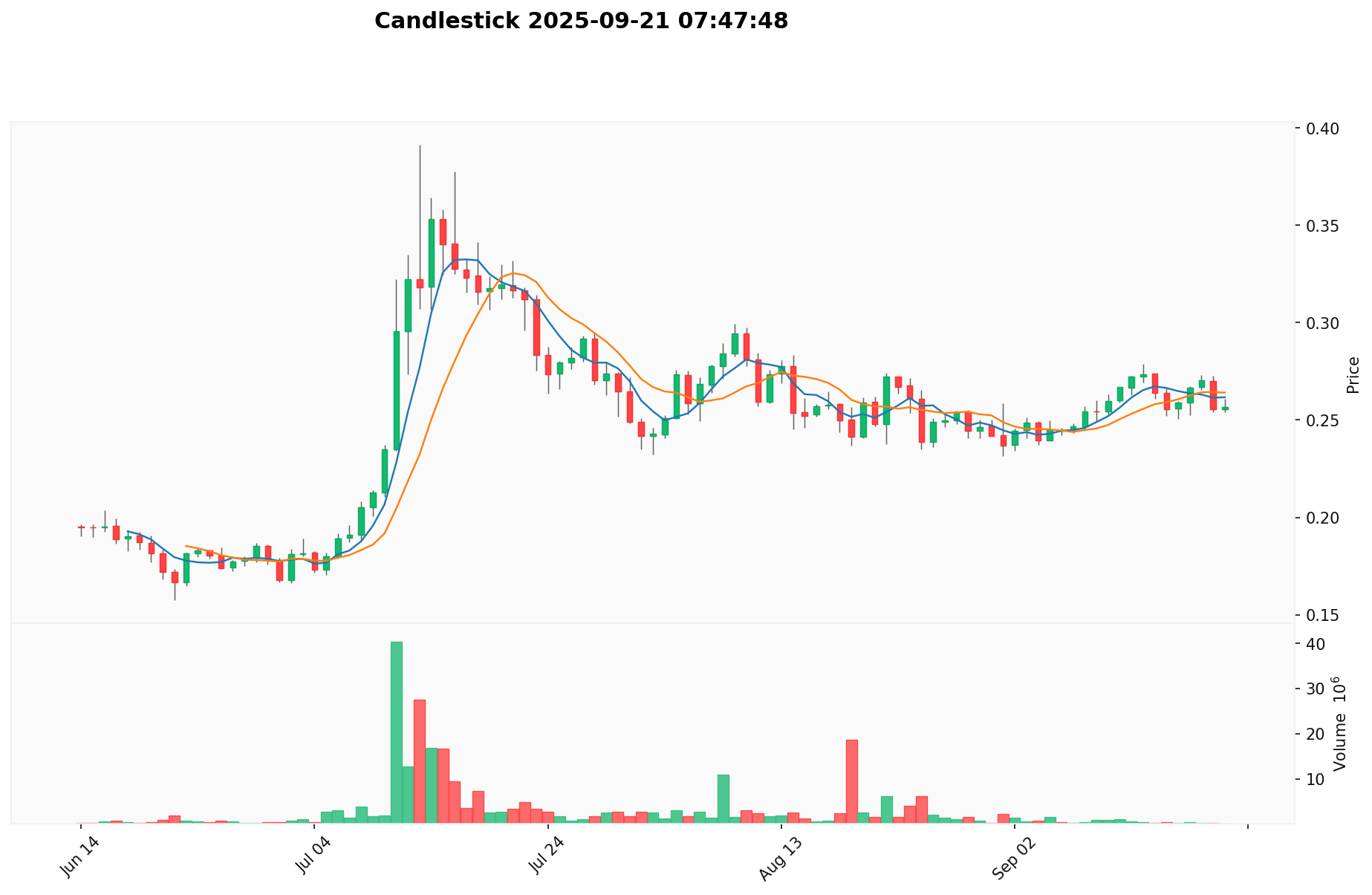

As of September 21, 2025, 1INCH is trading at $0.2621, with a 24-hour trading volume of $33,953.94. The token has seen a 2.18% increase in the last 24 hours. 1INCH currently ranks 217th in the cryptocurrency market with a market capitalization of $366,321,212.67.

The circulating supply of 1INCH stands at 1,397,639,117.39 tokens, which is 93.18% of the total supply of 1,499,999,999.997 tokens. The fully diluted market cap is $393,149,999.99.

In terms of recent price trends, 1INCH has shown mixed performance across different timeframes:

- 1 hour: +0.58%

- 24 hours: +2.18%

- 7 days: -2.81%

- 30 days: +6.75%

- 1 year: -5.79%

The token is currently trading 96.97% below its all-time high and 75.23% above its all-time low, indicating a potential for recovery but also highlighting the volatility in the crypto market.

Click to view the current 1INCH market price

1INCH Market Sentiment Indicator

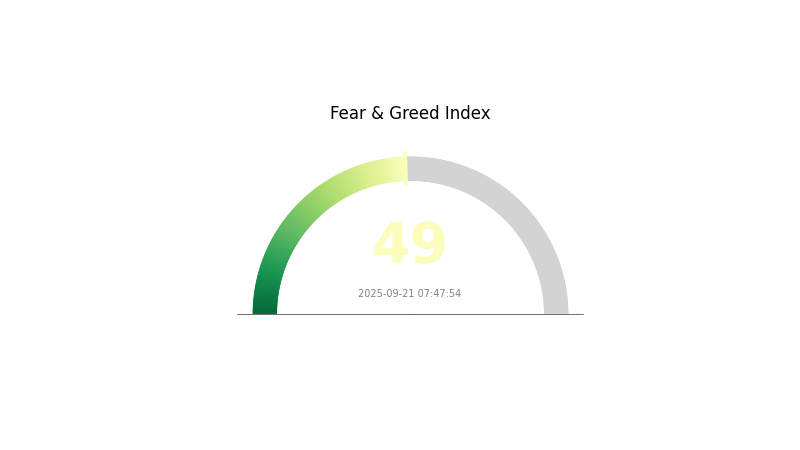

2025-09-21 Fear and Greed Index: 49 (Neutral)

Click to view the current Fear & Greed Index

The crypto market sentiment for 1INCH remains balanced today, with the Fear and Greed Index at 49, indicating a neutral outlook. This equilibrium suggests that investors are neither overly fearful nor excessively greedy. As the market stabilizes, it's an opportune time for traders to reassess their strategies and positions. Remember to stay informed and manage risks wisely. Gate.com offers comprehensive tools and analysis to help you navigate the crypto landscape effectively.

1INCH Holdings Distribution

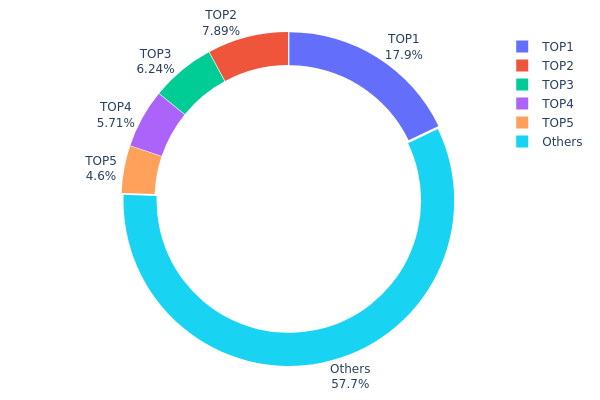

The address holdings distribution data reveals a significant concentration of 1INCH tokens among top holders. The largest address holds 17.87% of the total supply, with the top 5 addresses collectively controlling 42.29% of all tokens. This concentration level indicates a relatively centralized distribution, which could potentially impact market dynamics.

Such a concentrated holding structure may lead to increased volatility in the 1INCH market. Large holders have the capacity to influence price movements significantly through substantial buy or sell orders. Moreover, this concentration raises concerns about potential market manipulation risks, as coordinated actions by top holders could sway token valuations.

Despite these concerns, it's noteworthy that 57.71% of tokens are distributed among other addresses, suggesting a degree of broader market participation. This distribution pattern reflects a balance between major stakeholders and smaller holders, which is crucial for maintaining some level of decentralization and market stability in the 1INCH ecosystem.

Click to view the current 1INCH holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x9a0c...7501d7 | 268136.78K | 17.87% |

| 2 | 0x6630...d5a7ba | 118336.98K | 7.88% |

| 3 | 0x5e89...7cd7d1 | 93589.26K | 6.23% |

| 4 | 0x225d...32086e | 85704.79K | 5.71% |

| 5 | 0x4942...52dfd0 | 69000.00K | 4.60% |

| - | Others | 865232.18K | 57.71% |

II. Key Factors Affecting 1INCH's Future Price

Supply Mechanism

- Total Supply: The total supply of 1INCH tokens is capped at 1,500,000,000.

- Current Impact: With a circulating supply of 1,397,639,117.3990636 tokens, the limited supply could potentially create scarcity and impact price as demand changes.

Institutional and Whale Dynamics

- Enterprise Adoption: 1inch has partnerships and integrations with various DeFi projects, which could influence its adoption and value.

- Government Policies: Regulatory changes in the crypto space, particularly around DeFi and DEXs, could significantly impact 1INCH's price and adoption.

Macroeconomic Environment

- Inflation Hedging Properties: As a DeFi token, 1INCH may be viewed as a potential hedge against inflation, influencing its demand during periods of economic uncertainty.

Technical Development and Ecosystem Building

- DEX Aggregator Improvements: Continuous improvements to the 1inch DEX aggregator could enhance its market position and user adoption.

- Cross-Chain Functionality: The expansion of 1inch to multiple blockchains, including Ethereum, BNB Smart Chain, Avalanche, and Solana, broadens its utility and potential user base.

- Ecosystem Applications: 1inch's ecosystem includes various DeFi applications and tools, which could drive demand for the 1INCH token.

III. 1INCH Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.20143 - $0.25

- Neutral prediction: $0.25 - $0.30

- Optimistic prediction: $0.30 - $0.34008 (requires positive market sentiment and project developments)

2027-2028 Outlook

- Market stage expectation: Potential growth phase with increased adoption

- Price range forecast:

- 2027: $0.34867 - $0.45878

- 2028: $0.23123 - $0.58219

- Key catalysts: DeFi sector expansion, technological improvements, and broader crypto market trends

2029-2030 Long-term Outlook

- Base scenario: $0.49755 - $0.59208 (assuming steady growth and adoption)

- Optimistic scenario: $0.68662 - $0.82299 (assuming strong market performance and project success)

- Transformative scenario: $0.90 - $1.00 (assuming breakthrough innovations and mass adoption)

- 2030-09-21: 1INCH $0.59208 (potential stabilization point after significant growth)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.34008 | 0.2616 | 0.20143 | 0 |

| 2026 | 0.43321 | 0.30084 | 0.23165 | 14 |

| 2027 | 0.45878 | 0.36702 | 0.34867 | 39 |

| 2028 | 0.58219 | 0.4129 | 0.23123 | 57 |

| 2029 | 0.68662 | 0.49755 | 0.44282 | 89 |

| 2030 | 0.82299 | 0.59208 | 0.38485 | 125 |

IV. Professional Investment Strategies and Risk Management for 1INCH

1INCH Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors with high risk tolerance

- Operation suggestions:

- Accumulate 1INCH during market dips

- Set price targets and rebalance portfolio periodically

- Store tokens in a secure non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- Relative Strength Index (RSI): Helps determine overbought or oversold conditions

- Key points for swing trading:

- Monitor 1INCH's correlation with major cryptocurrencies

- Pay attention to 1inch protocol upgrades and partnerships

1INCH Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple DeFi tokens

- Stop-loss orders: Set automated sell orders to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Use two-factor authentication, never share private keys

V. Potential Risks and Challenges for 1INCH

1INCH Market Risks

- Volatility: DeFi tokens can experience significant price swings

- Competition: Increasing number of DEX aggregators may impact market share

- Liquidity: Potential for reduced liquidity during market stress

1INCH Regulatory Risks

- Unclear regulations: DeFi protocols may face regulatory scrutiny

- Cross-border compliance: Varying regulations across jurisdictions

- KYC/AML requirements: Potential implementation may affect user adoption

1INCH Technical Risks

- Smart contract vulnerabilities: Potential for exploits or hacks

- Scalability issues: Network congestion may impact transaction speeds

- Interoperability challenges: Integration with new blockchains or protocols

VI. Conclusion and Action Recommendations

1INCH Investment Value Assessment

1INCH presents a unique value proposition in the DeFi space with its DEX aggregator technology. Long-term potential exists, but short-term volatility and regulatory uncertainties pose risks.

1INCH Investment Recommendations

✅ Beginners: Start with small positions, focus on learning DeFi concepts ✅ Experienced investors: Consider allocating as part of a diversified DeFi portfolio ✅ Institutional investors: Evaluate 1inch protocol's technology and growth potential

Ways to Participate in 1INCH Trading

- Spot trading: Buy and hold 1INCH tokens on Gate.com

- DeFi staking: Participate in liquidity provision on the 1inch platform

- Governance: Engage in protocol governance by holding and voting with 1INCH tokens

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions cautiously based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Will 1inch reach $10?

Based on current forecasts, 1inch is not expected to reach $10 by 2025. Analysts predict it will likely trade around $0.28 in October 2025.

Is 1 inch coin a good investment?

Yes, 1inch coin is a promising investment. It supports multiple liquidity sources and shows potential for future growth in the DeFi space.

Will 1inch recover?

Yes, 1inch is expected to recover. Experts predict a strong resurgence based on positive market trends and signals for its future growth.

What is the PI coin expected launch price prediction 2025?

The expected launch price for PI coin in 2025 is predicted to be between $0.270357 and $0.291518, based on recent market trends.

2025 MLNPrice Prediction: Analyzing Key Factors That Will Drive MLN Valuation in the Coming Market Cycle

2025 UNCX Price Prediction: Analyzing Market Trends and Potential Growth Factors

2025 CHESSPrice Prediction: Market Analysis and Future Trends for the CHESS Token Ecosystem

2025 EDGE Price Prediction: Will This Crypto Asset Reach New Heights or Face a Downturn?

2025 ITHACA Price Prediction: Analyzing Market Trends and Potential Growth Factors

2025 HFT Price Prediction: Analyzing Market Trends and Future Potential for Hashflow Token

Is RaveDAO (RAVE) a good investment?: A Comprehensive Analysis of Token Fundamentals, Market Performance, and Future Potential

Is ZetaChain (ZETA) a good investment?: A Comprehensive Analysis of Features, Market Potential, and Risk Factors in 2024

Is Non-Playable Coin (NPC) a good investment?: A Comprehensive Analysis of Market Potential, Risks, and Future Prospects

Is Popcat (POPCAT) a good investment?: A Comprehensive Analysis of Price Trends, Market Potential, and Risk Factors for 2024

What Is a Ponzi Scheme? How Ponzi Scams Work and How to Identify Them