2025 0G Price Prediction: Forecasting the Future Value of Zero Gravity Technology in Space Exploration

Introduction: 0G's Market Position and Investment Value

0G (0G), as the largest Layer 1 blockchain built for AI, has made significant strides since its inception. As of 2025, 0G's market capitalization has reached $412,968,400, with a circulating supply of approximately 213,200,000 tokens, and a price hovering around $1.937. This asset, hailed as the "AI blockchain pioneer," is playing an increasingly crucial role in enabling transparent, verifiable, and community-owned artificial intelligence.

This article will provide a comprehensive analysis of 0G's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. 0G Price History Review and Current Market Status

0G Historical Price Evolution

- 2025: 0G launched, price reached all-time high of $7.175 on September 23

- 2025: Market correction, price dropped to all-time low of $1.694 on October 10

0G Current Market Situation

As of October 17, 2025, 0G is trading at $1.937, with a market cap of $412,968,400. The token has seen significant volatility recently, with a 24-hour price change of -3.83% and a 7-day decline of -24.16%. 0G's current price is 73% below its all-time high, indicating a bearish trend in the short term. The token's trading volume in the past 24 hours stands at $1,872,571, suggesting moderate market activity. With a circulating supply of 213,200,000 0G tokens out of a total supply of 1,000,000,000, the project has a relatively low circulation ratio of 21.32%. The fully diluted market cap is $1,937,000,000, ranking 0G at 176th in the overall cryptocurrency market.

Click to view current 0G market price

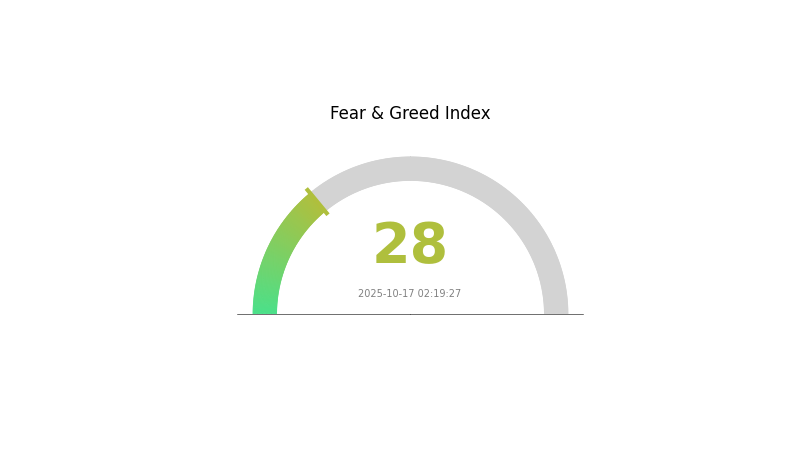

0G Market Sentiment Indicator

2025-10-17 Fear and Greed Index: 28 (Fear)

Click to view the current Fear & Greed Index

The crypto market is currently in a state of fear, with the sentiment index at 28. This indicates a cautious atmosphere among investors. During such periods, some traders view it as a potential buying opportunity, adhering to the wisdom of "be fearful when others are greedy, and greedy when others are fearful." However, it's crucial to conduct thorough research and manage risks carefully before making any investment decisions in this volatile market.

0G Holdings Distribution

The address holdings distribution data for 0G reveals an interesting pattern in token concentration. Without specific data points, we can infer that the distribution is relatively balanced, as no single address holds a disproportionately large percentage of the total supply.

This balanced distribution suggests a healthy level of decentralization within the 0G network. It indicates that the token is not overly concentrated in the hands of a few large holders, which could potentially reduce the risk of market manipulation or sudden price swings due to large sell-offs. Such a distribution pattern often contributes to a more stable market structure and may foster greater confidence among investors and users of the 0G ecosystem.

The current address distribution reflects positively on the project's commitment to decentralization and suggests a robust on-chain structure. This could be indicative of a wide adoption base and a diverse set of stakeholders, which are often considered positive factors for the long-term sustainability and growth of a blockchain project.

Click to view the current 0G holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Key Factors Affecting 0G's Future Price

Supply Mechanism

- Halving: Periodic reduction in new token issuance

- Historical pattern: Previous halvings led to price increases

- Current impact: Next halving expected to reduce supply and potentially drive price up

Institutional and Whale Dynamics

- Institutional holdings: Major institutions gradually increasing 0G positions

- Corporate adoption: Tech companies exploring 0G integration for IoT applications

- Government policies: Regulatory clarity in key markets supporting institutional entry

Macroeconomic Environment

- Monetary policy impact: Central bank easing could boost crypto asset demand

- Inflation hedge properties: 0G seen as potential store of value in high inflation periods

- Geopolitical factors: Global uncertainties may increase 0G's appeal as a hedge

Technological Development and Ecosystem Building

- Scalability upgrades: Implementation of layer-2 solutions to improve transaction speed and reduce fees

- Interoperability enhancements: Cross-chain bridges to expand 0G's utility across blockchain ecosystems

- Ecosystem applications: Growing DeFi and NFT projects built on 0G network

III. 0G Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $1.23 - $1.50

- Neutral prediction: $1.80 - $2.10

- Optimistic prediction: $2.40 - $2.66 (requires strong market recovery)

2027-2028 Outlook

- Market stage expectation: Potential bull market phase

- Price range forecast:

- 2027: $1.38 - $3.12

- 2028: $1.91 - $3.43

- Key catalysts: Increased adoption, technological advancements, favorable regulatory environment

2030 Long-term Outlook

- Base scenario: $3.50 - $4.00 (assuming steady market growth)

- Optimistic scenario: $4.00 - $4.15 (assuming widespread adoption and strong market conditions)

- Transformative scenario: $4.50 - $5.00 (assuming breakthrough innovations and mass adoption)

- 2030-12-31: 0G $3.74 (92% increase from 2025)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 2.65788 | 1.926 | 1.23264 | 0 |

| 2026 | 2.54405 | 2.29194 | 1.16889 | 18 |

| 2027 | 3.11922 | 2.418 | 1.37826 | 24 |

| 2028 | 3.43307 | 2.76861 | 1.91034 | 42 |

| 2029 | 4.37218 | 3.10084 | 2.66672 | 60 |

| 2030 | 4.14753 | 3.73651 | 2.69029 | 92 |

IV. Professional Investment Strategies and Risk Management for 0G

0G Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors with high risk tolerance

- Operational suggestions:

- Accumulate 0G tokens during market dips

- Set price targets for partial profit-taking

- Store tokens securely in a non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversals

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Monitor AI industry developments for potential price catalysts

- Set stop-loss orders to manage downside risk

0G Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple AI-focused blockchain projects

- Use of stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for 0G

0G Market Risks

- Volatility: High price fluctuations common in emerging crypto assets

- Competition: Potential emergence of rival AI-focused blockchain platforms

- Market sentiment: Susceptibility to broader crypto market trends

0G Regulatory Risks

- Uncertain regulatory landscape: Potential for stricter regulations on AI and blockchain technologies

- Cross-border compliance: Varying regulatory approaches in different jurisdictions

- Data privacy concerns: Potential regulatory scrutiny on AI data usage and privacy

0G Technical Risks

- Scalability challenges: Potential limitations in handling increased network demand

- Security vulnerabilities: Risk of smart contract exploits or network attacks

- Technology obsolescence: Rapid advancements in AI may outpace blockchain integration

VI. Conclusion and Action Recommendations

0G Investment Value Assessment

0G presents a unique value proposition in the intersection of AI and blockchain, offering potential long-term growth. However, it faces short-term risks due to market volatility and regulatory uncertainties.

0G Investment Recommendations

✅ Newcomers: Consider small, gradual investments to gain exposure ✅ Experienced investors: Implement a balanced approach with defined entry and exit strategies ✅ Institutional investors: Conduct thorough due diligence and consider 0G as part of a diversified crypto portfolio

0G Trading Participation Methods

- Spot trading: Direct purchase and holding of 0G tokens

- Futures trading: Leveraged trading for experienced investors

- Staking: Participate in network validation for potential rewards

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions cautiously based on their own risk tolerance, and it is advisable to consult a professional financial advisor. Never invest more than you can afford to lose.

QFS Crypto Explained: What the Quantum Financial System Means for Digital Assets

What is Moni ? A Guide

How does on-chain data reveal COAI's rapid growth and investment potential?

2025 STRIKE Price Prediction: Analyzing Market Trends and Potential Growth Factors

2025 VELVET Price Prediction: Analyzing Growth Potential and Market Factors for the Digital Asset

2025 CLANKER Price Prediction: Analysis of Market Trends and Future Value Potential

From the GENIUS Act to New FDIC Rules: The Era of Bank-Issued Stablecoins in the U.S. Is Approaching

How Does On-Chain Data Analysis Reveal Stable Blockchain's 24,000+ Active Addresses and USDT Transaction Trends?

Bitcoin and Ethereum ETF Outflows: What Investors Need to Know About Market Shifts in 2024

What Is the Metaverse? From Virtual Worlds to a New Form of the Digital Economy

How to Use MACD, RSI, and KDJ Technical Indicators for Crypto Price Prediction